PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1907353

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1907353

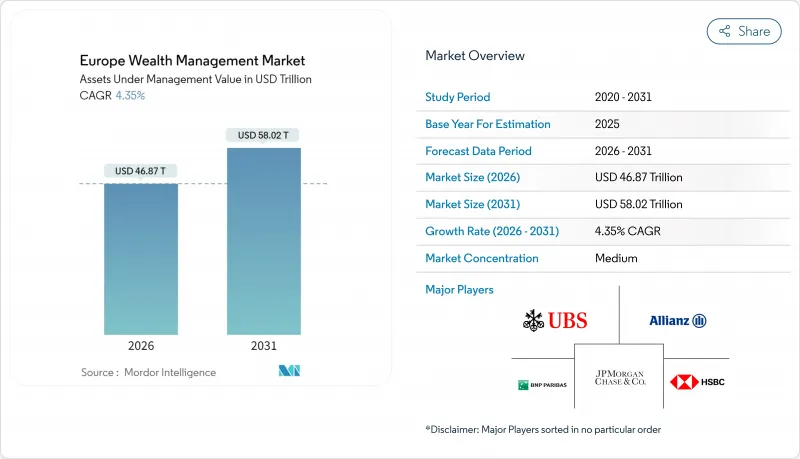

Europe Wealth Management - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The Europe wealth management market is expected to grow from USD 44.92 trillion in 2025 to USD 46.87 trillion in 2026 and is forecast to reach USD 58.02 trillion by 2031 at 4.35% CAGR over 2026-2031.

This growth path positions the European wealth management market as the financial backbone of the continent's push toward a deeper Capital Markets Union, with wealth managers increasingly functioning as conduits that redirect household savings into long-term capital-market instruments . Strong demand for ESG-aligned portfolios, accelerated shifts into technology-enabled advisory models, and the full rollout of the Markets in Crypto-Assets (MiCA) framework are reshaping product suites, operating cost structures, and competitive dynamics. Regulatory harmonization, especially under the Sustainable Finance Disclosure Regulation (SFDR) and the Distributed Ledger Technology (DLT) pilot, is encouraging product innovation while simultaneously pushing smaller players toward consolidation as compliance costs rise. Household cash deposits of EUR 13.9 trillion remain a vast pool of under-allocated capital that wealth managers aim to migrate into investment products through open-finance capabilities. Operating margins, however, face pressure from MiFID II fee transparency, an aging advisor workforce, and higher cybersecurity spending tied to the Digital Operational Resilience Act (DORA).

Europe Wealth Management Market Trends and Insights

Rebound in European HNWI AUM post-2024

Net new money inflows rebounded in 2024 as improving fixed-income yields and stabilizing equity markets restored client confidence, lifting fee income and freeing capital for technology upgrades. Higher asset values particularly benefit private banks and family offices because concentrated portfolios naturally carry higher advisory margins. This momentum is allowing firms to accelerate hiring in tax planning, succession, and alternative-investment teams, thereby strengthening client retention. Active management regained traction after underperformance in 2022-2023, reversing fee compression caused by passive funds. The durability of this rebound will depend on moderate inflation, stable interest-rate expectations, and disciplined cost control across front-office and compliance functions.

EUR 1.6 trillion Great Wealth Transfer to Millennials & Women by 2030

Europe's intergenerational transfer is reshaping service models as beneficiaries demand digital-first engagement, ESG integration, and direct investment opportunities. Wealth managers who deploy educational content and transparent fee frameworks are already improving the retention of next-generation heirs. Female inheritors, who receive a rising share of the transferred assets, are placing a higher value on planning clarity, catalyzing the launch of women-led advisory teams. Incumbent firms face elevated churn risk-millennials switch providers more readily-yet that risk unlocks acquisition opportunities for agile competitors offering personalized impact-oriented portfolios. To capture the flow, providers are widening their multi-family-office offerings and deepening digital engagement so that heirs can toggle between human advice and self-directed tools without friction.

Fee-Compression from MiFID II & Passives

MiFID II's granular cost disclosures have heightened client sensitivity to advisory charges, while the surge in low-cost ETFs has eroded active-management fee headroom. Research-bundling prohibitions force wealth managers to fund analyst coverage independently, squeezing margins. Private banks counter by spotlighting tax optimization, succession planning, and access to private-market deals that ETFs cannot replicate, but these services demand higher advisor skill sets and digital tooling. Price transparency also limits cross-selling of non-portfolio banking products, tightening overall wallet share. Consequently, firms are migrating from traditional asset-based fees toward blended retainers linked to planning complexity and outcome metrics.

Other drivers and restraints analyzed in the detailed report include:

- Hybrid & Robo-Advisory Adoption Cuts Advice Costs 30-50%

- EU DLT-Pilot Regime Spurs Tokenized Private-Market Access

- Relationship-Manager Talent Shortage & Ageing Advisor Base

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

In 2025, high-net-worth individuals captured 58.42% of Europe's wealth management market share, reflecting a broad base of professionals and entrepreneurs benefiting from the post-pandemic recovery. The ultra-high-net-worth segment holds the fastest trajectory at a 6.98% CAGR, propelled by liquidity events in technology, healthcare, and renewable infrastructure ventures. The European wealth management market size linked to UHNWI clients is expected to climb steadily as their demand for bespoke direct investments and philanthropy structures boosts advisory revenue density. Wealth concentration favors private banks and multi-family offices that supply customized lending and co-investment opportunities.

UHNWI clients exhibit a higher willingness to pay for multi-jurisdictional estate plans, impact investing vehicles, and private-equity co-investment gates unavailable to retail investors. Family offices are leveraging that demand by extending in-house deal origination desks. Mass-affluent households, by contrast, remain price sensitive and gravitate toward robo platforms that parcel diversified model portfolios at sub-50-basis-point fees. Successful providers, therefore, tier their service stack: algorithmic allocation for mass-affluent clients, hybrid advice for the upper affluent, and specialist verticals for UHNWI families.

Human advisers still commanded 85.47% of the European wealth management market size in 2025, but robo engines are amplifying reach among younger investors who favor transparent fee grids and mobile engagement. The segment's 15.42% CAGR underscores persistent demand for low-cost automation complemented by selective human touchpoints. The European wealth management market continues to integrate hybrid models that embed automated tax-loss harvesting and ESG scoring while reserving relationship managers for complex credit, philanthropy, and inheritance tasks.

Pure robo players struggle with client acquisition costs, pushing them toward B2B partnerships with incumbent banks that white-label portfolios. Meanwhile, incumbent private banks retrofit legacy architectures with open-API layers, enabling advisors to generate on-demand proposals during virtual sessions. The migration toward hybrid advice lowers operating costs by trimming routine portfolio rebalancing workflows and reallocating human capital toward higher-margin strategic conversations.

The Europe Wealth Management Market is Segmented by Client Wealth Tier (UHNWI, HNWI, and More), Mode of Advisory (Human Advisory, and Robo-Advisory), Firm Type (Private Banks, Family Offices, and More), Product Type (Fixed Income, Equities, and More), Management Source (Offshore, and Onshore), and Country (United Kingdom, Germany and More). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- UBS Group AG

- JPMorgan Chase & Co.

- BNP Paribas Wealth Management

- HSBC Holdings

- Allianz SE

- AXA Group

- Amundi SA

- Barclays PLC

- Julius Baer Group

- Deutsche Bank Wealth Management

- Pictet Group

- Schroders PLC

- Legal & General Group

- Aegon N.V.

- ING Group

- Santander Private Banking

- Intesa Sanpaolo (Fideuram ISPB)

- Nordea Bank

- ABN AMRO Private Banking

- Societe Generale Private Banking

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rebound in European HNWI AUM post-2023

- 4.2.2 EUR 1.6 tn Great Wealth Transfer to Millennials & Women by 2030

- 4.2.3 Hybrid & Robo-Advisory Adoption Cuts Advice Costs 30-50 %

- 4.2.4 EU DLT-Pilot Regime Spurs Tokenized Private-Market Access

- 4.2.5 SFDR Level-2 Creates Premium ESG-Mandate Fee Pools

- 4.2.6 EUR 14 tn Euro-area Cash Deposits Migrating to Investments via Open-Finance

- 4.3 Market Restraints

- 4.3.1 Fee-compression from MiFID II & passives

- 4.3.2 Relationship-manager talent shortage & ageing advisor base

- 4.3.3 Regulatory grey zones for crypto-assets under MiCA

- 4.3.4 Escalating cyber & AI-model risk compliance costs

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Bargaining Power of Buyers

- 4.7.2 Bargaining Power of Suppliers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value)

- 5.1 By Client Wealth Tier

- 5.1.1 UHNWI (More than USD 30 Million)

- 5.1.2 HNWI (USD 1 Million to USD 30 Million)

- 5.1.3 Mass Affluent (Less than USD 1 Million)

- 5.2 By Mode of Advisory

- 5.2.1 Human Advisory

- 5.2.2 Robo-Advisory

- 5.3 By Firm Type

- 5.3.1 Private Banks

- 5.3.2 Family Offices

- 5.3.3 Others (Independent/External Asset Managers)

- 5.4 By Product Type

- 5.4.1 Fixed Income

- 5.4.2 Equities

- 5.4.3 Alternatives

- 5.4.4 Cash and Deposits

- 5.4.5 Others

- 5.5 By Management Source

- 5.5.1 Offshore

- 5.5.2 Onshore

- 5.6 By Country

- 5.6.1 United Kingdom

- 5.6.2 Germany

- 5.6.3 France

- 5.6.4 Spain

- 5.6.5 Italy

- 5.6.6 Benelux (Belgium, Netherlands, and Luxembourg)

- 5.6.7 Nordics (Sweden, Norway, Denmark, Finland, and Iceland)

- 5.6.8 Rest of Europe

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global Level Overview, Market Level Overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for Key Companies, Products & Services, and Recent Developments)

- 6.4.1 UBS Group AG

- 6.4.2 JPMorgan Chase & Co.

- 6.4.3 BNP Paribas Wealth Management

- 6.4.4 HSBC Holdings

- 6.4.5 Allianz SE

- 6.4.6 AXA Group

- 6.4.7 Amundi SA

- 6.4.8 Barclays PLC

- 6.4.9 Julius Baer Group

- 6.4.10 Deutsche Bank Wealth Management

- 6.4.11 Pictet Group

- 6.4.12 Schroders PLC

- 6.4.13 Legal & General Group

- 6.4.14 Aegon N.V.

- 6.4.15 ING Group

- 6.4.16 Santander Private Banking

- 6.4.17 Intesa Sanpaolo (Fideuram ISPB)

- 6.4.18 Nordea Bank

- 6.4.19 ABN AMRO Private Banking

- 6.4.20 Societe Generale Private Banking

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-need Assessment