PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1850244

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1850244

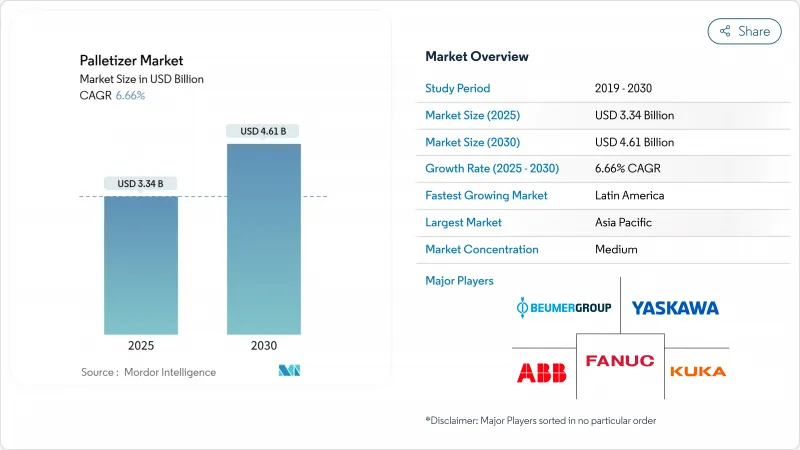

Palletizer - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The global palletizer market stands at USD 3.34 billion in 2025 and is projected to reach USD 4.61 billion by 2030, reflecting a 6.66% CAGR over the forecast period.

Momentum comes from the sustained shift away from manual pallet building toward automated, software-driven systems that resolve labor shortages, optimize trailer utilization, and meet rising e-commerce throughput requirements. Growth is reinforced by the premium that mixed-SKU, AI-enabled palletizing commands, the rapid spread of rental models that lower upfront costs, and the expanding appeal of collaborative robots in space-constrained factories. Competitive intensity remains moderate: no single player holds more than 15% revenue, yet pricing pressure surfaces as regional integrators package robots with subscription or robotics-as-a-service contracts. South America registers the fastest regional expansion as reshoring and logistics upgrades intersect with government tax incentives; meanwhile APAC maintains volume leadership due to China's scale in robot production and deployme

Global Palletizer Market Trends and Insights

Growing e-commerce SKU complexity

Fulfilment centres now handle volumes that exceed 180 billion cases yearly, with single sites processing more than 50,000 SKUs-ten times the diversity typical of legacy retail hubs.Fixed-pattern equipment cannot keep up, prompting adoption of AI-powered systems such as the Lucas Warehouse Optimization Suite, which lifts palletizing efficiency 15-20% by balancing weight, fragility, and stackability in real time. Premium platforms fetch 30-40% higher margins but still lower total shipping cost as optimized loads cut empty trailer space by up to 30%.

Labor shortages accelerating warehouse automation

Critical staffing gaps across 41 factory occupations in China and 15-20% vacancy rates in North American warehouses have compressed automation payback to under 18 months. Mid-market plants now automate runs of just 100 units per hour, unlocking a broader palletizer market as collaborative systems redeploy employees to safer, higher-value roles.

High upfront CAPEX for heavy-payload robotic arms

Installations rated above 150 kg often top USD 500,000, a hurdle for manufacturers shipping fewer than 500 pallets daily. Robotics-as-a-service pioneers such as Formic counter this barrier with USD 3,975 monthly bundles, yet tradeoffs around customisation and ownership persist.

Other drivers and restraints analyzed in the detailed report include:

- Packaging-line ROI improvements from plug-and-play cobots

- Surge in FMCG sustainability mandates favouring robotic mixed-load palletizing

- Integration complexity with legacy MES/WMS

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Conventional machines retained 48% revenue in 2024 as high-speed lines exceeding 1,000 cases per hour depend on proven layer devices. Yet the palletizer market sees collaborative units outpace at 6.2% CAGR, capturing greenfield investments in small-footprint sites that crave safety-certified, fence-free operation. Robotic articulated arms occupy the mid-performance tier, balancing throughput against changeover flexibility for mixed product portfolios. Hybrid systems, blending layer formers with robotic pickers, emerge in niche beverage and personal-care cells but remain cost-intensive.

Vendors differentiate through full-stack ecosystems: Doosan's P-SERIES coupled with Rocketfarm's Pally software reduces deployment time and elevates user autonomy. As customers prioritise single-source accountability over stand-alone hardware, suppliers bundling vision, simulation, and lifecycle services widen addressable opportunities inside the palletizer market.

Medium-duty solutions dominated with 41.2% share, reflecting consumer goods' bias toward 50-150 kg boxes. However the palletizer market size for heavy-duty systems is slated to expand at a 7.4% CAGR as bulk shippers consolidate loads to curb labour and freight costs. Energy-efficient servo architectures and advanced safety scanners now let 180 kg cobots operate alongside staff, as seen in Bob's Red Mill installations. These capabilities command 40-60% price uplifts compared with mid-tier peers, yet users justify the premium through reduced forklift moves and lower workers' compensation claims.

Light-duty cells under 50 kg address pharmaceuticals and electronics, where cleanroom compliance and precision trump brute force. Vendors targeting this end of the palletizer market leverage class-10-rated enclosures and vacuum grippers to protect high-value items, maintaining a stable but slower growth profile.

The Palletizer Market is Segmented by Product (Conventional Palletizer, Robotic Palletizer), by Payload Capacity (Light-Duty, Medium-Duty, and Heavy-Duty), by End-User Vertical (Food & Beverages, Pharmaceuticals, Chemicals, E-Commerce and 3PL, and More), by Sales Channel (Direct OEM Sales, System Integrators, and More) and by Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

APAC held 38% of 2024 revenue, with China alone installing 52% of new global robots by 2022. Domestic suppliers now secure 36% of their home market, pushing price points lower and accelerating diffusion among tier-two factories. Japan built 45% of the world's robots and channelled USD 7.35 billion in 2024 orders into logistics, food, and pharma lines, backed by a USD 39.3 billion (USD 43.7 billion) government supply-chain fund . India's Production-Linked Incentive schemes spark automation across automotive and generics plants, though adoption pockets remain uneven due to skill gaps.

South America records the strongest 8.1% CAGR trajectory to 2030 as Brazil's food and auto sectors automate pallet building for export compliance. Mexico rides near-shoring trends to supply the US market with tariff-proof goods, intensifying demand for robots certified to North American safety codes. Argentina's grain processors install palletizers that stabilise 1-tonne bulk bags for long ocean voyages despite macroeconomic volatility.

North America and Europe show measured growth driven by replacement rather than capacity additions. Upcoming Regulation (EU) 2023/1230 compels vendors to harden cybersecurity, advantaging those with certified software stacks. US reshoring programs lift the palletizer market as SMB manufacturers seek flexible cobots that accommodate frequent SKU changeovers and mitigate labour constraints in ageing rural workforces.

- ABB Ltd.

- FANUC Corp.

- KUKA AG

- Yaskawa Electric Corp.

- BEUMER Group GmbH and Co. KG

- Honeywell Intelligrated

- Krones AG

- Sidel Group

- A-B-C Packaging

- Schneider Packaging

- Barry-Wehmiller (BW Packaging)

- Premier Tech Chronos

- MMCI Robotics

- Columbia Machine

- Fuji Yusoki

- Brenton Engineering

- Kawasaki Robotics

- Okura Yusoki

- Regal Rexnord Automation

- Sealed Air AUTOBAG

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Growing e-commerce SKU complexity

- 4.2.2 Labor shortages accelerating warehouse automation

- 4.2.3 Packaging-line ROI improvements from plug-and-play cobots

- 4.2.4 Surge in FMCG sustainability mandates favouring robotic mixed-load palletizing

- 4.2.5 AI-driven vision systems boosting palletizer uptime

- 4.2.6 Resilience re-shoring of supply chains in North America and EU

- 4.3 Market Restraints

- 4.3.1 High upfront CAPEX for heavy-payload robotic arms

- 4.3.2 Integration complexity with legacy MES/WMS

- 4.3.3 Safety-rating certification delays for cobots in EU

- 4.3.4 Volatile steel & servo-motor prices widening payback periods

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Pricing Analysis

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Product Type

- 5.1.1 Conventional Palletizer

- 5.1.1.1 High-Level Palletizer

- 5.1.1.2 Low-Level Palletizer

- 5.1.2 Robotic Palletizer

- 5.1.2.1 Cartesian/Gantry

- 5.1.2.2 Articulated

- 5.1.2.3 SCARA

- 5.1.2.4 Collaborative (Cobot)

- 5.1.3 Hybrid Palletizer

- 5.1.1 Conventional Palletizer

- 5.2 By Payload Capacity

- 5.2.1 Light-Duty (<50 kg)

- 5.2.2 Medium-Duty (50-150 kg)

- 5.2.3 Heavy-Duty (>150 kg)

- 5.3 By End-user Vertical

- 5.3.1 Food & Beverages

- 5.3.2 Pharmaceuticals

- 5.3.3 Personal Care and Cosmetics

- 5.3.4 Chemicals

- 5.3.5 E-commerce and 3PL

- 5.3.6 Other Verticals

- 5.4 By Sales Channel

- 5.4.1 Direct OEM Sales

- 5.4.2 System Integrators

- 5.4.3 After-market Retrofits and Upgrades

- 5.4.4 Rental / Leasing

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Argentina

- 5.5.2.3 Rest of South America

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 France

- 5.5.3.4 Italy

- 5.5.3.5 Russia

- 5.5.3.6 Rest of Europe

- 5.5.4 APAC

- 5.5.4.1 China

- 5.5.4.2 Japan

- 5.5.4.3 India

- 5.5.4.4 South Korea

- 5.5.4.5 Rest of APAC

- 5.5.5 Middle East & Africa

- 5.5.5.1 United Arab Emirates

- 5.5.5.2 Saudi Arabia

- 5.5.5.3 South Africa

- 5.5.5.4 Rest of Middle East and Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles

- 6.4.1 ABB Ltd.

- 6.4.2 FANUC Corp.

- 6.4.3 KUKA AG

- 6.4.4 Yaskawa Electric Corp.

- 6.4.5 BEUMER Group GmbH and Co. KG

- 6.4.6 Honeywell Intelligrated

- 6.4.7 Krones AG

- 6.4.8 Sidel Group

- 6.4.9 A-B-C Packaging

- 6.4.10 Schneider Packaging

- 6.4.11 Barry-Wehmiller (BW Packaging)

- 6.4.12 Premier Tech Chronos

- 6.4.13 MMCI Robotics

- 6.4.14 Columbia Machine

- 6.4.15 Fuji Yusoki

- 6.4.16 Brenton Engineering

- 6.4.17 Kawasaki Robotics

- 6.4.18 Okura Yusoki

- 6.4.19 Regal Rexnord Automation

- 6.4.20 Sealed Air AUTOBAG

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment