PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1850247

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1850247

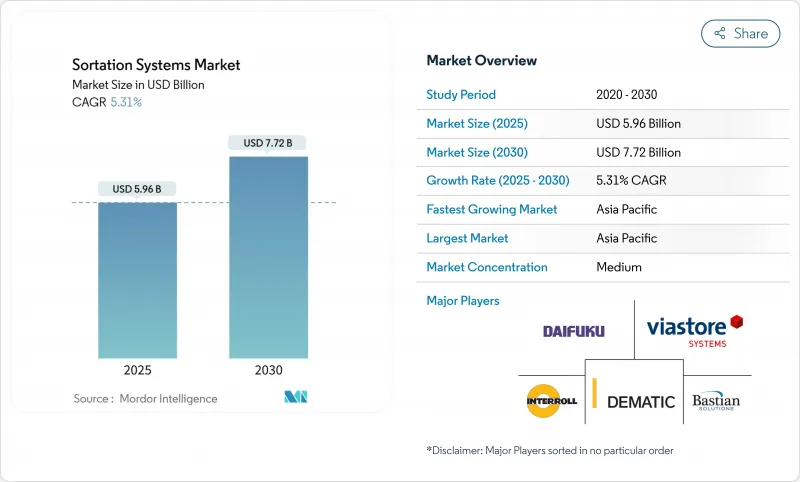

Sortation Systems - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The sortation systems market reached USD 5.96 billion in 2025 and is projected to advance to USD 7.72 billion by 2030 at a 5.31% CAGR.

Moderate but steady expansion shows the field is transitioning from novel automation toward core infrastructure. Cross-belt equipment is also the fastest-expanding sorter platform, confirming a shift from premium niche toward de-facto standard. The convergence of dominant position and accelerated expansion signals cross-belt technology's evolution from premium solution to industry standard, driven by its superior handling of diverse package geometries and weights. E-commerce and omnichannel operators dominate demand, illustrating that parcel automation remains in a long runway. Hardware continues to account for majority of sales, yet the shift toward software-centric value creation reflects industry recognition that competitive differentiation increasingly depends on algorithmic efficiency rather than mechanical speed alone. Geographically, APAC leads highest share in 2024, fuelled by Chinese cross-border e-commerce and Indian automation investments exemplified by Daifuku's 2025 plant launch

Global Sortation Systems Market Trends and Insights

E-commerce parcel surge

Parcel growth reshapes capacity planning. United States annual parcel flow is forecast to hit 28 billion by 2028, a 5% yearly increase. Chinese cross-border sellers accelerate digitalisation and employ generative AI to improve demand forecasting, allowing facilities to move from reactive peaks to predictive load balancing.Sorters that self-adjust to volume spikes and shift routing rules on the fly now underpin peak-season resilience.

Labor-cost escalation & scarcity

Warehouse payroll inflation and technician shortages compress deployment timelines. A 63% majority of operators cite skilled labour gaps as the top obstacle, while 770,000 supply-chain technician vacancies are expected by mid-decade. Procurement criteria now weigh remote diagnostics and simplified maintenance as heavily as nominal throughput.

High capex & ROI uncertainty

Full-scale sorters require multimillion-dollar outlays plus facility remodelling. Operators demanding 18-24-month payback often delay adoption, favouring modular add-ons that can stretch ROI but impair long-term efficiency. Quantifying soft returns such as reduced churn and customer loyalty remains challenging.

Other drivers and restraints analyzed in the detailed report include:

- SKU proliferation demands accuracy

- Airport baggage-handling upgrades

- AI-vision powered dynamic sorters

- Sustainability-driven energy savings

- Skilled-technician shortage

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Cross-belt units generated 38% revenue in 2024 and are set to rise 7.8% annually, giving the sorter class the largest and fastest path within the sortation systems market. Facilities prefer its capability to handle irregular packages without speed loss. Tilt-tray and sliding-shoe equipment stay relevant where either fragile goods or uniform cartons dominate. Narrow-belt installations persist in legacy buildings with limited floor plates. Pop-up wheel and diverter systems continue to fade as operators pursue higher flexibility and uptime.

The sortation systems market size for cross-belt platforms is projected to exceed USD 3 billion by 2030, reflecting entrenched migration from niche to mainstream. Meanwhile, sliding-shoe products hold a mid-single-digit sortation systems market share and show low-single-digit expansion as they retain fit in apparel and parcel hubs demanding gentle flow control.

E-commerce and omnichannel retailers captured 41.2% of 2024 turnover and are increasing 7.4% annually. Post-and-parcel operators remain the second-largest cohort, yet margin pressure converts automation into a cost-containment lever rather than growth catalyst. Airports contribute stable, project-based opportunities as hubs modernise baggage loops. Food, beverage and pharma lines embrace high-accuracy sorting to honour compliance, fuelling adoption of sensor-laden cross-belt and high-speed tray units.

By 2030, the e-commerce segment is expected to command more than USD 3 billion of the sortation systems market size. Airport programmes, though lumpy, could achieve mid-single-digit CAGR on the back of combined passenger and cargo investments.

Global Sortation System Market is Segmented by Sorter Type (Cross-Belt Sorters, Tilt-Tray Sorters, Sliding-Shoe Sorters, and More), by End-User Industry (Post and Parcel, E-Commerce and Omnichannel Retail, Airport, and More), by Offering (Hardware, and Software), by Throughput Rate (Low-Speed, Medium-Speed, and More), and by Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

APAC dominated the sortation systems market with 36.5% 2024 share and is expanding at 8.6% CAGR. China's logistics sector uses AI to lift collection efficiency 30% and delivery 35%, spurring further adoption of intelligent sorters. India's automation drive is illustrated by Daifuku's 2025 manufacturing complex designed to localise production and lower lead times. Southeast Asian e-commerce growth also channels investment into flexible sorting in urban micro-fulfilment nodes.

North America remains a core revenue pillar through airport baggage rebuilds and ongoing parcel-centre upgrades. Growth moderates to a mid-4% rate as many first-wave facilities are already automated, causing spend to pivot towards retrofits, software, and sustainability upgrades. Europe balances green mandates with performance. Operators favour energy-efficient motors and recyclable belt materials to align with EU circularity targets.

Middle East and Africa present nascent but rising demand as Gulf airports invest in hub capability and African e-commerce leapfrogs conventional retail. South America exhibits selective uptake in metropolitan corridors where parcel volumes and labour inflation justify capital outlays. Policymakers in Brazil and Chile have signalled intent to streamline customs processes, indirectly supporting sorter adoption in export-oriented logistics parks.

- Daifuku Co., Ltd.

- Vanderlande Industries

- Honeywell Intelligrated

- Siemens Logistics

- Beumer Group GmbH

- Interroll Holding AG

- Dematic Corporation (KION Group)

- Murata Machinery Ltd.

- KNAPP AG

- Bastian Solutions

- Viastore Systems Gmbh

- SSI Schaefer

- TGW Logistics

- Fives Intralogistics

- BOWE SYSTEC

- Pitney Bowes

- Equinox MHE

- Falcon Autotech

- GBI Intralogistics

- OPEX Corporation

- Okura Yusoki

- Zebra Technologies (Fetch Robotics)

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 E-commerce parcel surge

- 4.2.2 Labor-cost escalation & scarcity

- 4.2.3 SKU proliferation demands accuracy

- 4.2.4 Airport baggage-handling upgrades

- 4.2.5 AI-vision powered dynamic sorters

- 4.2.6 Sustainability-driven energy savings

- 4.3 Market Restraints

- 4.3.1 High capex & ROI uncertainty

- 4.3.2 Skilled-technician shortage

- 4.3.3 Software-layer interoperability gaps

- 4.3.4 Urban-noise compliance limits

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Sorter Type

- 5.1.1 Cross-belt Sorters

- 5.1.2 Tilt-tray Sorters

- 5.1.3 Sliding-shoe Sorters

- 5.1.4 Narrow-belt Sorters

- 5.1.5 Push-tray / Split-tray Sorters

- 5.1.6 Pop-up Wheel & Diverter Sorters

- 5.2 By End-user Industry

- 5.2.1 Post & Parcel Operators

- 5.2.2 E-commerce & Omnichannel Retail

- 5.2.3 Airports (Baggage Handling)

- 5.2.4 Food & Beverages

- 5.2.5 Pharmaceuticals & Healthcare

- 5.2.6 3PL & Contract Logistics

- 5.2.7 Automotive & Industrial Manufacturing

- 5.3 By Offering

- 5.3.1 Hardware

- 5.3.2 Software

- 5.3.3 Services (Installation, MRO)

- 5.4 By Throughput Rate

- 5.4.1 Low-speed (<3k)

- 5.4.2 Medium-speed (3k-10k)

- 5.4.3 High-speed (10k-25k)

- 5.4.4 Ultra High-speed (>25k)

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Argentina

- 5.5.2.3 Rest of South America

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 France

- 5.5.3.4 Italy

- 5.5.3.5 Spain

- 5.5.3.6 Netherlands

- 5.5.3.7 Rest of Europe

- 5.5.4 APAC

- 5.5.4.1 China

- 5.5.4.2 Japan

- 5.5.4.3 India

- 5.5.4.4 South Korea

- 5.5.4.5 Australia & New Zealand

- 5.5.4.6 Southeast Asia

- 5.5.4.7 Rest of APAC

- 5.5.5 Middle East & Africa

- 5.5.5.1 GCC (ex-Saudi)

- 5.5.5.2 Saudi Arabia

- 5.5.5.3 Turkey

- 5.5.5.4 South Africa

- 5.5.5.5 Israel

- 5.5.5.6 Rest of Middle East & Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products & Services, Recent Developments)

- 6.4.1 Daifuku Co., Ltd.

- 6.4.2 Vanderlande Industries

- 6.4.3 Honeywell Intelligrated

- 6.4.4 Siemens Logistics

- 6.4.5 Beumer Group GmbH

- 6.4.6 Interroll Holding AG

- 6.4.7 Dematic Corporation (KION Group)

- 6.4.8 Murata Machinery Ltd.

- 6.4.9 KNAPP AG

- 6.4.10 Bastian Solutions

- 6.4.11 Viastore Systems Gmbh

- 6.4.12 SSI Schaefer

- 6.4.13 TGW Logistics

- 6.4.14 Fives Intralogistics

- 6.4.15 BOWE SYSTEC

- 6.4.16 Pitney Bowes

- 6.4.17 Equinox MHE

- 6.4.18 Falcon Autotech

- 6.4.19 GBI Intralogistics

- 6.4.20 OPEX Corporation

- 6.4.21 Okura Yusoki

- 6.4.22 Zebra Technologies (Fetch Robotics)

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space & Unmet-need Assessment