PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1850248

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1850248

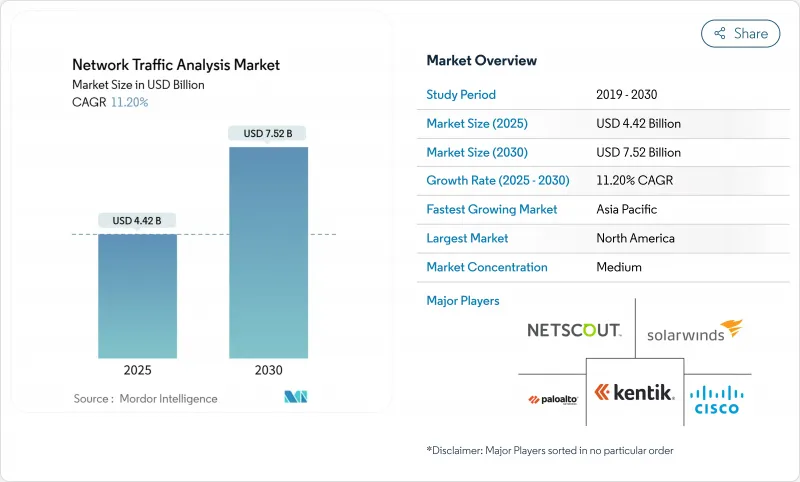

Network Traffic Analysis - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Network Traffic Analysis Market size is estimated at USD 4.42 billion in 2025, and is expected to reach USD 7.52 billion by 2030, at a CAGR of 11.20% during the forecast period (2025-2030).

Growth reflects the security community's pivot from perimeter defenses to deep traffic visibility as zero-trust programs, 5G rollouts, and cloud-native workloads muddy traditional boundaries. Enterprises see network telemetry as the single source of truth that can uncover lateral movement, encrypted threats, and performance bottlenecks in a hybrid world. Vendors that marry AI-driven analytics with continuous packet capture are winning mindshare as security teams consolidate point tools, while managed detection and response (MDR) services temper the skills gap in small IT shops. At the same time, platform providers are racing to embed encrypted traffic analytics and east-west inspection to keep pace with TLS 1.3 adoption and microservices proliferation.

Global Network Traffic Analysis Market Trends and Insights

Emergence of NTA as Cornerstone in Modern Security Stacks

Seventy percent of advanced persistent threats rely on lateral movement, detectable primarily through granular traffic analytics, prompting security teams to elevate NTA from a nice-to-have tool to a foundational control. Tightly coupling packet analytics with SIEM and XDR cuts mean time to detect by up to 30% relative to siloed tools. Unified telemetry also trims correlation workloads 40-50%, freeing scarce analysts to focus on triage rather than data wrangling. Vendors that deliver open APIs and cloud-scale data lakes now underpin many zero-trust programs, positioning NTA as the fabric that underlies endpoint, identity, and cloud defenses. As a result, platform-first buying behavior is shifting budget from stand-alone probes toward integrated SaaS analytics.

Expanding Network Bandwidth and 5G Rollouts Create Visibility Gaps

The jump to 5G introduces ultra-dense cells, distributed user-plane functions, and multi-access edge computing that overwhelm classic taps and span ports. Private 5G outlays in the United States alone are expected to hit USD 3.7 billion by 2027, yet most existing monitoring stacks cannot ingest containerized traffic or detect millisecond-scale anomalies. Service providers partner with security specialists-T-Mobile's Prisma SASE bundle is a notable example-to pair network slicing with inline threat detection. IoT proliferation further stresses analytics engines because signature-based tools falter against diverse device behaviors, fueling demand for behavior and ML-centric models.

Rapid Evolution of Threats and Encryption Outpacing Tooling

TLS 1.3 encrypts 95% of web traffic and conceals handshake metadata, thwarting legacy DPI. Features such as Encrypted ClientHello and 0-RTT resumption force vendors to pivot toward side-channel inference that relies on timing, sequence lengths, and traffic morphologies. Research prototypes like multi-instance encrypted traffic transformers hit 99% classification accuracy but demand GPU-class horsepower and data science talent that most IT teams lack. Smaller suppliers struggle with R&D costs, creating potential attrition or acquisition.

Other drivers and restraints analyzed in the detailed report include:

- Migration to Cloud and Hybrid Architectures Boosts Demand for Cloud-Native NTA

- Zero-Trust East-West Traffic Proliferation

- Shortage of Skilled Analysts and High Solution Complexity

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Cloud deployments controlled 51.2% of 2024 revenue, underscoring preference for elastic SaaS analytics that shift capex to opex. The hybrid model is the growth pacesetter, registering a 13.7% CAGR through 2030 as enterprises knit legacy data centers with AWS, Azure, or GCP estates. That blend ensures compliance with data-residency rules while sustaining cloud agility. Zscaler's Traffic Capture service showcases how cloud platforms can export raw traffic to analytics pipelines without saturating on-premises capture appliances.

Enterprises adopting hybrid architectures report lower hardware refresh spend and faster rollout of new inspection features because upgrades are deployed centrally. On-premises probes persist in air-gapped or highly regulated verticals, yet their share of the network traffic analysis market steadily recedes as regulations embrace cloud certification frameworks. Hybrid adoption consequently propels overall network traffic analysis market expansion into greenfield midsize companies that lacked enterprise-class tooling.

Solutions-appliances, virtual sensors, and SaaS consoles-represented 62.4% of the network traffic analysis market size in 2024. However, services are scaling at 14.5% CAGR as organizations offload monitoring and incident response. OPSWAT's buyout of InQuest illustrates how vendors bundle Deep File Inspection and threat intel with managed offerings to address federal-sector needs.

Managed service uptake is a pragmatic response to analyst scarcity and product complexity. Providers supply 24/7 coverage, curated threat feeds, and automated containment, boosting adoption among resource-constrained firms. Hardware sensors retain relevance in 100 Gbps-plus backbones where FPGA acceleration still outperforms virtual appliances. Even so, vendors increasingly position those sensors as data forwarders feeding cloud analytics.

Network Traffic Analysis Market is Segmented by Deployment (On-Premise, Cloud-Based, and Hybrid), Component (Solutions and Services), Organization Size (Large Enterprises and Small and Medium Enterprises), End-User Industry (BFSI, IT and Telecom, and More), and Geography. The Market Sizes and Forecasts are Provided in Value (in USD Million) for all the Above Segments.

Geography Analysis

North America contributed 34.06% of 2024 revenue thanks to strict privacy statutes, early zero-trust adoption, and high cybersecurity budgets. JPMorgan's AI-infused fraud system illustrates regional appetite for packet-driven analytics that accelerate threat identification 300-fold and save USD 200 million annually. State governments likewise embrace observability; Indiana improved citizen services after deploying traffic analytics across multi-cloud infrastructure.

Asia-Pacific is the high-growth engine with a 14.3% CAGR. Massive 5G rollouts in China, India, and South Korea, combined with smart-city investments and rising ransomware incidents, spur NTA adoption. Local regulations such as China's Cybersecurity Law and Australia's Critical Infrastructure Act compel traffic logging and anomaly detection. Manufacturers digitizing shop floors with private cellular networks need granular monitoring to secure OT and IT convergence.

Europe maintains robust demand owing to GDPR's breach notification requirements and emerging AI legislation that mandates algorithmic transparency. Sovereign-cloud initiatives push hybrid deployments so packets stay in-region, benefitting vendors that provide fine-grained data-residency controls. Latin America and the Middle East and Africa remain nascent but promising: Brazilian banks, Saudi smart-city projects, and South African telcos are piloting AI-fueled NTA in anticipation of stricter cyber mandates.

- NETSCOUT Systems Inc.

- Cisco Systems Inc.

- Palo Alto Networks Inc.

- SolarWinds Corporation

- Kentik Technologies Inc.

- Dynatrace LLC

- ExtraHop Networks Inc.

- Flowmon Networks A.S. (Progress)

- GreyCortex s.r.o.

- Genie Networks Ltd.

- ManageEngine (Zoho Corp.)

- Plixer LLC

- Nagios Enterprises LLC

- Gigamon Inc.

- Corelight Inc.

- Vectra AI Inc.

- Ixia (Keysight Technologies Inc.)

- Riverbed Technology LLC

- Nozomi Networks Inc.

- Nokia Corporation

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Emergence of NTA as cornerstone in modern security stacks

- 4.2.2 Expanding network bandwidth and 5G rollouts create visibility gaps

- 4.2.3 Migration to cloud and hybrid architectures boosts demand for cloud-native NTA

- 4.2.4 Encrypted traffic ML-based inspection requirements

- 4.2.5 Zero-trust east-west traffic proliferation

- 4.2.6 SOC consolidation pushing NTA/NDR convergence

- 4.3 Market Restraints

- 4.3.1 Rapid evolution of threats and encryption outpacing tooling

- 4.3.2 Shortage of skilled analysts and high solution complexity

- 4.3.3 Data-privacy regulations restricting deep packet inspection

- 4.3.4 Budget reallocation toward endpoint/XDR tools

- 4.4 Industry Value Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Industry Attractiveness - Porter's Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Impact of Macroeconomic Factors on the Market

5 MARKET SIZE AND GROWTH FORECASTS (VALUES)

- 5.1 By Deployment

- 5.1.1 On-premise

- 5.1.2 Cloud-based

- 5.1.3 Hybrid

- 5.2 By Component

- 5.2.1 Solutions

- 5.2.1.1 Hardware Appliances

- 5.2.1.2 Virtual Appliances

- 5.2.1.3 SaaS Platform

- 5.2.2 Services

- 5.2.2.1 Professional Services

- 5.2.2.2 Managed Services

- 5.2.1 Solutions

- 5.3 By Organization Size

- 5.3.1 Large Enterprises

- 5.3.2 Small and Medium Enterprises (SMEs)

- 5.4 By End-user Industry

- 5.4.1 BFSI

- 5.4.2 IT and Telecom

- 5.4.3 Government and Defense

- 5.4.4 Energy and Utilities

- 5.4.5 Retail and E-commerce

- 5.4.6 Healthcare and Life Sciences

- 5.4.7 Manufacturing

- 5.4.8 Other End-user Industries

- 5.5 By Application

- 5.5.1 Security and Threat Detection

- 5.5.2 Performance Monitoring and Optimization

- 5.5.3 Compliance and Policy Enforcement

- 5.5.4 Capacity Planning and Forecasting

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Mexico

- 5.6.2 South America

- 5.6.2.1 Brazil

- 5.6.2.2 Argentina

- 5.6.2.3 Chile

- 5.6.2.4 Rest of South America

- 5.6.3 Europe

- 5.6.3.1 Germany

- 5.6.3.2 United Kingdom

- 5.6.3.3 France

- 5.6.3.4 Italy

- 5.6.3.5 Spain

- 5.6.3.6 Russia

- 5.6.3.7 Rest of Europe

- 5.6.4 Asia-Pacific

- 5.6.4.1 China

- 5.6.4.2 India

- 5.6.4.3 Japan

- 5.6.4.4 South Korea

- 5.6.4.5 Malaysia

- 5.6.4.6 Singapore

- 5.6.4.7 Australia

- 5.6.4.8 Rest of Asia-Pacific

- 5.6.5 Middle East and Africa

- 5.6.5.1 Middle East

- 5.6.5.1.1 United Arab Emirates

- 5.6.5.1.2 Saudi Arabia

- 5.6.5.1.3 Turkey

- 5.6.5.1.4 Rest of Middle East

- 5.6.5.2 Africa

- 5.6.5.2.1 South Africa

- 5.6.5.2.2 Nigeria

- 5.6.5.2.3 Rest of Africa

- 5.6.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 NETSCOUT Systems Inc.

- 6.4.2 Cisco Systems Inc.

- 6.4.3 Palo Alto Networks Inc.

- 6.4.4 SolarWinds Corporation

- 6.4.5 Kentik Technologies Inc.

- 6.4.6 Dynatrace LLC

- 6.4.7 ExtraHop Networks Inc.

- 6.4.8 Flowmon Networks A.S. (Progress)

- 6.4.9 GreyCortex s.r.o.

- 6.4.10 Genie Networks Ltd.

- 6.4.11 ManageEngine (Zoho Corp.)

- 6.4.12 Plixer LLC

- 6.4.13 Nagios Enterprises LLC

- 6.4.14 Gigamon Inc.

- 6.4.15 Corelight Inc.

- 6.4.16 Vectra AI Inc.

- 6.4.17 Ixia (Keysight Technologies Inc.)

- 6.4.18 Riverbed Technology LLC

- 6.4.19 Nozomi Networks Inc.

- 6.4.20 Nokia Corporation

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 White-Space and Unmet-Need Assessment