PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1850257

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1850257

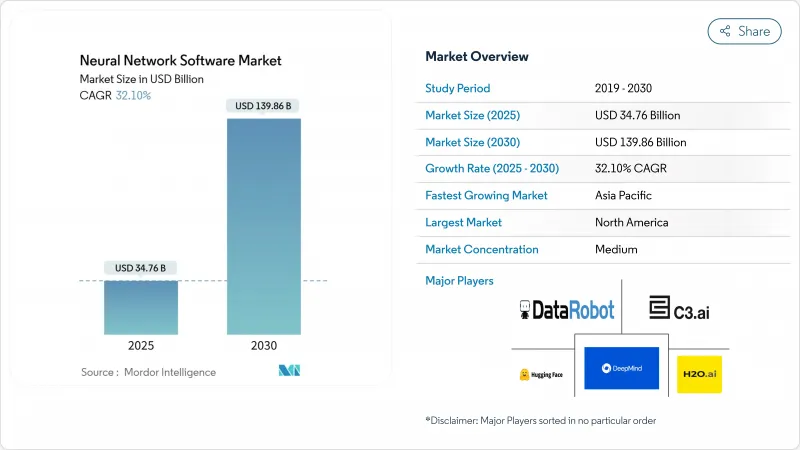

Neural Network Software - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Neural Network Software Market size is estimated at USD 34.76 billion in 2025, and is expected to reach USD 139.86 billion by 2030, at a CAGR of 32.10% during the forecast period (2025-2030).

Expansion is accelerating as enterprises move from proofs of concept to full-scale rollouts, supported by sovereign-AI programs, foundation-model ecosystems, and cloud platforms that lower adoption barriers. OpenAI's revenue jump from USD 5.5 billion in December 2024 to USD 10 billion in June 2025, illustrating rising commercial demand for large-scale neural network deployments. Asia-Pacific is the fastest-growing geography because China, Japan, India, and South Korea are localizing large language models and building national AI clouds. Component trends show software tools retaining the majority share, yet services are expanding faster as enterprises seek integration and optimization expertise. Competition continues to intensify, with cloud hyperscalers, enterprise software vendors, and specialist AI firms racing to differentiate on model efficiency, governance, and vertical solutions.

Global Neural Network Software Market Trends and Insights

Cloud-based AI Platforms Democratize Access

Enterprise generative-AI spending is rising 30% in 2025 as mid-market firms adopt managed platforms that remove capital barriers. Red Hat's purchase of Neural Magic adds optimized inference libraries to its hybrid cloud suite, enabling efficient deployments within private clusters. Rackspace's AI Anywhere service packages pre-built models with predictable subscription pricing, making complex neural network architectures attainable for firms lacking in-house expertise. Google's Gemini family extends democratization by embedding text-to-image and video generation APIs inside standard cloud consoles, letting developers test multimodal inference without bespoke infrastructure. These platform moves reduce time-to-value and expand the neural network software market across new corporate adopters.

Rising Enterprise Demand for Predictive Analytics

Manufacturers are shifting from reactive to proactive maintenance as neural networks reach 94% accuracy in fault prediction. BMW's Regensburg plant prevents over 500 minutes of annual assembly disruption by analyzing existing component data, confirming strong ROI in industrial contexts. General Motors cut unexpected downtime by 15% and saved USD 20 million yearly after linking IoT sensors with AI-driven scheduling engines. Financial institutions see parallel benefits, with hybrid deep-learning models catching 98.7% of fraudulent payments. Such clear economic gains accelerate software procurement cycles and raise expectations for rapid deployment support from vendors.

Shortage of Deep-Learning MLOps Talent

Only 28% of AI adopters employ dedicated MLOps engineers, and 75% of European employers struggled to fill AI roles in 2024, spotlighting a persistent skills gap. Tech giants now deliver certification curricula to accelerate reskilling, yet curricula cannot match rapid framework changes. Without sufficient practitioners to operationalize models, deployment timelines lengthen and service revenues climb, capping short-term neural network software market gains even as demand grows.

Other drivers and restraints analyzed in the detailed report include:

- Growing Availability of Big Data and GPUs

- Foundation Models Create New Toolchain Demand

- Data-Privacy and Governance Burdens

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Software frameworks, libraries, and AutoML suites delivered 54.4% of 2024 revenue, underscoring their role as the structural backbone of the neural network software market. Core development kits such as TensorFlow, PyTorch, and JAX remain essential, yet buyers increasingly demand turnkey modules that shorten experimentation cycles. Services, including professional consulting and managed operations, are rising at 35.4% CAGR as firms outsource integration, tuning, and lifecycle management.

Managed services captured incremental gains equal to 35.4% of the neural network software market size in 2024 as cloud providers embedded AI specialists within subscription packages to accelerate time-to-production. Professional service teams respond to sector-specific needs-e.g., healthcare imaging compliance-further boosting service share. Over the forecast window, vendor differentiation will hinge on domain depth and outcome-based pricing rather than licensing alone.

Public cloud retained 61.3% of the neural network software market share in 2024 because hyperscalers offer elastic compute for training and inference. Enterprises leverage GPU clusters on demand, avoiding up-front capital outlays. Yet sovereignty, latency, and regulatory requirements are shifting growth toward hybrid deployments, forecast at 34.8% CAGR to 2030.

Hybrid architectures let data reside on-premise or in private clouds while model training happens in scalable public environments. Financial services and healthcare operators adopt this topology to protect sensitive data while exploiting cloud scale. The growing use of confidential computing and federated learning will amplify hybrid demand, reshaping resource planning for vendors.

Neural Network Software Market is Segmented by Component (Software Tools, Platform, and Services), Deployment Mode (Cloud, On-Premise, and Hybrid), Type (Data Mining and Archiving, Analytical Software, and More), Application (Fraud Detection, Hardware Diagnostics, Financial Forecasting, and More), End-User Vertical (BFSI, Healthcare, and More), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America held 38.06% revenue in 2024 due to an established venture-capital ecosystem, advanced cloud infrastructure, and dense talent pools. OpenAI doubling annual recurring revenue to USD 10 billion highlights commercial maturity, while hyperscalers continually widen managed-AI portfolios. Canada leverages academic clusters in Montreal and Toronto, yet chip fabrication dependence on Asia limits sovereign compute ambitions. Mexico leverages nearshoring to integrate neural network solutions in logistics and automotive production, strengthening regional supply chains.

Asia-Pacific is forecast to grow at 35.7% CAGR, with the neural network software market size jumping to USD 300 billion by 2030 as China, Japan, India, and South Korea implement national AI clouds. China leads 37 of 44 critical R&D disciplines, channelling state financing toward industrial AI upgrades. Japan hosts OpenAI's first Indo-Pacific office, confirming local demand for enterprise GPT solutions that respect linguistic nuance and data-residency laws. India nurtures start-ups through government sandboxes, while Australia and Singapore invest in safety and governance research, creating diversified regional opportunities.

Europe pursues technological autonomy through sovereign-AI projects. NVIDIA is supplying over 3,000 exaflops of Blackwell clusters to European data-center partners, forming a continental spine for regulated AI workloads. Germany's industrial AI cloud and France's telco-led model-hosting hubs add depth. However, talent shortages persist, with 75% of employers unable to staff AI roles, driving wage inflation and cross-border migration. Strict GDPR and forthcoming AI-Act requirements favor vendors offering governance tooling, shaping procurement priorities.

- DataRobot Inc.

- H2O.ai Inc.

- C3.ai Inc.

- Hugging Face Inc.

- DeepMind Technologies Ltd.

- OpenAI Inc.

- Clarifai Inc.

- GMDH LLC

- Neural Designer (Artelnics S.L.)

- Alyuda Research LLC

- Neural Technologies Ltd.

- Neuralware LLC

- AND Corporation

- Abacus.ai

- OctoML Inc.

- Databricks Inc.

- Seldon Technologies Ltd.

- Weights and Biases Inc.

- Comet ML Inc.

- Run:AI Labs Ltd.

- Lightning AI Inc.

- KNIME AG

- RapidMiner Inc.

- LatticeFlow AG

- Pachyderm Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Cloud-based AI platforms democratize neural networks

- 4.2.2 Rising enterprise demand for predictive analytics

- 4.2.3 Growing availability of big-data and GPUs

- 4.2.4 Foundation models create new toolchain demand

- 4.2.5 Open-source model marketplaces accelerate adoption

- 4.2.6 Sovereign-AI initiatives need local NN stacks

- 4.3 Market Restraints

- 4.3.1 Shortage of deep-learning MLOps talent

- 4.3.2 Data-privacy and governance burdens

- 4.3.3 GPU supply-chain volatility inflates costs

- 4.3.4 Energy and ESG scrutiny of training workloads

- 4.4 Industry Value Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Industry Attractiveness - Porter's Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Impact of Macroeconomic Factors on the Market

5 MARKET SIZE AND GROWTH FORECASTS (VALUES)

- 5.1 By Component

- 5.1.1 Software Tools

- 5.1.1.1 Frameworks and Libraries

- 5.1.1.2 AutoML Platforms

- 5.1.2 Platform (PaaS)

- 5.1.3 Services

- 5.1.3.1 Managed Services

- 5.1.3.2 Professional Services

- 5.1.1 Software Tools

- 5.2 By Deployment Mode

- 5.2.1 Cloud

- 5.2.2 On-premise

- 5.2.3 Hybrid

- 5.3 By Type

- 5.3.1 Data Mining and Archiving

- 5.3.2 Analytical Software

- 5.3.3 Optimization Software

- 5.3.4 Visualization Software

- 5.4 By Application

- 5.4.1 Fraud Detection

- 5.4.2 Hardware Diagnostics

- 5.4.3 Financial Forecasting

- 5.4.4 Image Optimization

- 5.4.5 Predictive Maintenance

- 5.4.6 Natural Language Processing

- 5.4.7 Speech Recognition

- 5.4.8 Others

- 5.5 By End-user Vertical

- 5.5.1 BFSI

- 5.5.2 Healthcare

- 5.5.3 Retail and E-Commerce

- 5.5.4 Defense and Government

- 5.5.5 Media and Entertainment

- 5.5.6 Logistics and Transportation

- 5.5.7 Energy and Utilities

- 5.5.8 Manufacturing

- 5.5.9 Other End-user Verticals

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Mexico

- 5.6.2 South America

- 5.6.2.1 Brazil

- 5.6.2.2 Argentina

- 5.6.2.3 Chile

- 5.6.2.4 Rest of South America

- 5.6.3 Europe

- 5.6.3.1 Germany

- 5.6.3.2 United Kingdom

- 5.6.3.3 France

- 5.6.3.4 Italy

- 5.6.3.5 Spain

- 5.6.3.6 Russia

- 5.6.3.7 Rest of Europe

- 5.6.4 Asia-Pacific

- 5.6.4.1 China

- 5.6.4.2 India

- 5.6.4.3 Japan

- 5.6.4.4 South Korea

- 5.6.4.5 Malaysia

- 5.6.4.6 Singapore

- 5.6.4.7 Australia

- 5.6.4.8 Rest of Asia-Pacific

- 5.6.5 Middle East and Africa

- 5.6.5.1 Middle East

- 5.6.5.1.1 United Arab Emirates

- 5.6.5.1.2 Saudi Arabia

- 5.6.5.1.3 Turkey

- 5.6.5.1.4 Rest of Middle East

- 5.6.5.2 Africa

- 5.6.5.2.1 South Africa

- 5.6.5.2.2 Nigeria

- 5.6.5.2.3 Rest of Africa

- 5.6.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 DataRobot Inc.

- 6.4.2 H2O.ai Inc.

- 6.4.3 C3.ai Inc.

- 6.4.4 Hugging Face Inc.

- 6.4.5 DeepMind Technologies Ltd.

- 6.4.6 OpenAI Inc.

- 6.4.7 Clarifai Inc.

- 6.4.8 GMDH LLC

- 6.4.9 Neural Designer (Artelnics S.L.)

- 6.4.10 Alyuda Research LLC

- 6.4.11 Neural Technologies Ltd.

- 6.4.12 Neuralware LLC

- 6.4.13 AND Corporation

- 6.4.14 Abacus.ai

- 6.4.15 OctoML Inc.

- 6.4.16 Databricks Inc.

- 6.4.17 Seldon Technologies Ltd.

- 6.4.18 Weights and Biases Inc.

- 6.4.19 Comet ML Inc.

- 6.4.20 Run:AI Labs Ltd.

- 6.4.21 Lightning AI Inc.

- 6.4.22 KNIME AG

- 6.4.23 RapidMiner Inc.

- 6.4.24 LatticeFlow AG

- 6.4.25 Pachyderm Inc.

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 White-Space and Unmet-Need Assessment