PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1850262

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1850262

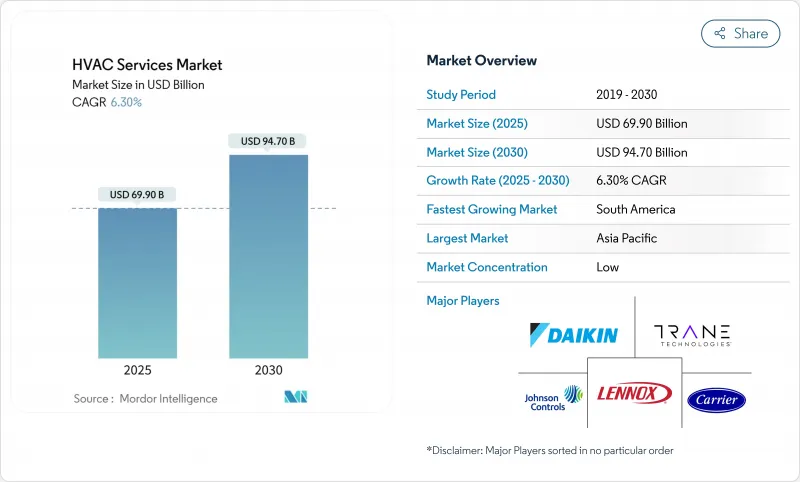

HVAC Services - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The HVAC services market size reached USD 69.90 billion in 2025 and is projected to advance to USD 94.70 billion by 2030, translating to a 6.30% CAGR-evidence that the HVAC services market remains resilient despite refrigerant phase-downs, talent shortages, and supply volatility.

Demand stems from hyperscale data-center construction, a wave of retrofits triggered by mandatory HFC reductions, and digitization that converts reactive fixes into predictive service contracts. Asia-Pacific's economic momentum, rapid urbanization, and data-center boom secure the region's leadership in revenue terms, while hyperscale operators everywhere are propelling the HVAC services market toward specialized cooling, liquid-based thermal management, and subscription pricing for uptime assurance. Established providers are monetizing their installed base through IoT-enabled analytics platforms that transform break-fix visits into continuous optimization services, yet skilled-labor scarcity and input-cost inflation threaten margins. Competitive pressure therefore favors companies that combine scale procurement with strong in-house training, allowing them to absorb wage inflation while capturing share from smaller rivals.

Global HVAC Services Market Trends and Insights

Growing Construction Activity in Emerging Economies

Accelerating urbanization across Asia-Pacific and Latin America sustains new building pipelines that automatically translate into installation and commissioning demand for the HVAC services market. Energy-efficiency codes now embedded in building permits shift lifetime spending toward preventive maintenance and performance contracts rather than emergency repairs. Government green-building incentives in India and Brazil reward early adoption of high-efficiency HVAC, nudging developers to lock in service contracts during the design phase. Providers able to embed digital monitoring at handover secure annuity-style revenue across a building's lifecycle. California's USD 1.76 million grant to Lincus for DC-powered commercial HVAC validates policymaker commitment to next-generation systems that depend on specialist service expertise

Expansion of Hyperscale Data-Center Build-Outs

Hyperscale facilities require precise, often liquid-based cooling that traditional mechanical contractors cannot service without significant up-skilling. Cooling can reach 50% of a data center's power budget, making efficiency gains central to operators' total cost of ownership and a decisive service-provider selection factor . The HVAC services market therefore rewards firms with advanced fluid-handling skills and AI-driven monitoring that predict hot-spots before failures occur. Trane Technologies' collaboration with LiquidStack illustrates how OEMs partner with liquid-cooling experts to accelerate capability build-out. Data-center capital outlays surged 185% to USD 54 billion in early 2024, guaranteeing a robust pipeline of specialized service demand.

Skilled-Labor Shortages and Escalating Wage Bills

The HVAC services market needs an additional 110,000 technicians worldwide, while half the current workforce is already older than 45 . Providers now pay USD 59,620 on average, with specialized data-center roles commanding far higher compensation, squeezing smaller contractors that lack tiered pricing power. The talent gap becomes more acute as IoT platforms converge IT and OT, demanding hybrid mechanical-digital skills. Companies funding in-house academies can maintain service quality and uptime guarantees, while less capitalized rivals risk client attrition.

Other drivers and restraints analyzed in the detailed report include:

- Mandatory Refrigerant Phase-Downs Driving Retrofit Demand

- Aging Building Stock in OECD Markets Requiring Upgrades

- Volatile HVAC Component Supply & Material Inflation

For complete list of drivers and restraints, kindly check the Table Of Contents.

List of Companies Covered in this Report:

- Johnson Controls International PLC

- Carrier Global Corporation

- Daikin Industries Ltd.

- Trane Technologies plc

- Lennox International Inc.

- Honeywell International Inc.

- Siemens AG

- LG Electronics Inc.

- Electrolux AB

- Robert Bosch GmbH

- Fujitsu General Ltd.

- Nortek Global HVAC

- Mitsubishi Electric Corporation

- Rheem Manufacturing Company

- Danfoss A/S

- GREE Electric Appliances Inc.

- Midea Group Co. Ltd.

- Johnson Service Group plc

- Comfort Systems USA, Inc.

- EMCOR Group Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Growing construction activity in emerging economies

- 4.2.2 Expansion of hyperscale data-center build-outs

- 4.2.3 Mandatory refrigerant phase-downs driving retrofit demand

- 4.2.4 Aging building stock in OECD markets requiring upgrades

- 4.2.5 Remote diagnostics and robotics lowering service costs

- 4.2.6 HVAC-as-a-Service contracts unlocking annuity revenues

- 4.3 Market Restraints

- 4.3.1 Skilled-labor shortages and escalating wage bills

- 4.3.2 Volatile HVAC component supply and material inflation

- 4.3.3 Cyber-security risks in connected building systems

- 4.3.4 Subscription-based disruptors compressing margins

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porters Five Forces

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Investment and M&A Landscape

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Implementation Type

- 5.1.1 New Construction

- 5.1.2 Retrofit Buildings

- 5.2 By Service Type

- 5.2.1 Installation and Replacement Services

- 5.2.2 Maintenance and Repair Services

- 5.2.3 Energy-Efficiency and Retrofit Services

- 5.2.4 HVAC Controls Upgrade and Integration

- 5.2.5 Consulting and Other Services

- 5.3 By System Type

- 5.3.1 Heating Services

- 5.3.2 Cooling Services

- 5.3.3 Ventilation and IAQ Services

- 5.3.4 Integrated Building-Management Services

- 5.4 By End User

- 5.4.1 Residential

- 5.4.2 Commercial

- 5.4.3 Industrial

- 5.5 By Application Vertical

- 5.5.1 Data Centers

- 5.5.2 Healthcare Facilities

- 5.5.3 Educational Institutions

- 5.5.4 Hospitality and Leisure

- 5.5.5 Retail Spaces

- 5.5.6 Government and Public Buildings

- 5.5.7 Others

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Mexico

- 5.6.2 South America

- 5.6.2.1 Brazil

- 5.6.2.2 Argentina

- 5.6.2.3 Mexico

- 5.6.2.4 Rest of South America

- 5.6.3 Europe

- 5.6.3.1 United Kingdom

- 5.6.3.2 Germany

- 5.6.3.3 France

- 5.6.3.4 Benelux

- 5.6.3.5 Rest of Europe

- 5.6.4 APAC

- 5.6.4.1 China

- 5.6.4.2 India

- 5.6.4.3 Japan

- 5.6.4.4 Rest of APAC

- 5.6.5 Middle East and Africa

- 5.6.5.1 United Arab Emirates

- 5.6.5.2 Saudi Arabia

- 5.6.5.3 South Africa

- 5.6.5.4 Rest of Middle East and Africa

- 5.6.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.4.1 Johnson Controls International PLC

- 6.4.2 Carrier Global Corporation

- 6.4.3 Daikin Industries Ltd.

- 6.4.4 Trane Technologies plc

- 6.4.5 Lennox International Inc.

- 6.4.6 Honeywell International Inc.

- 6.4.7 Siemens AG

- 6.4.8 LG Electronics Inc.

- 6.4.9 Electrolux AB

- 6.4.10 Robert Bosch GmbH

- 6.4.11 Fujitsu General Ltd.

- 6.4.12 Nortek Global HVAC

- 6.4.13 Mitsubishi Electric Corporation

- 6.4.14 Rheem Manufacturing Company

- 6.4.15 Danfoss A/S

- 6.4.16 GREE Electric Appliances Inc.

- 6.4.17 Midea Group Co. Ltd.

- 6.4.18 Johnson Service Group plc

- 6.4.19 Comfort Systems USA, Inc.

- 6.4.20 EMCOR Group Inc.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-Space and Unmet-Need Assessment