PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1850263

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1850263

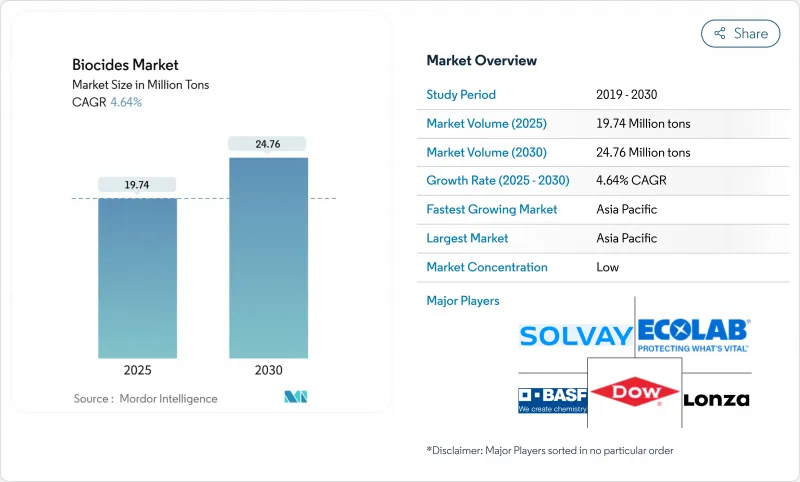

Biocides - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The biocides market size is valued at 19.74 million tons in 2025 and is forecast to attain 24.76 million tons by 2030, reflecting a 4.64% CAGR during 2025-2030.

Robust demand for antimicrobial solutions in water treatment, food safety, healthcare, and construction continues to underpin volume growth, even as end-users confront stricter environmental regulations. A steady rise in industrial water reuse projects is widening the application base, and the resulting consumption uptick suggests that dosage-optimization technologies are translating directly into larger addressable volumes. At the same time, sustainability requirements are encouraging manufacturers to diversify portfolios toward oxidizing and biobased formulations, which implies that overall industry expansion is being accompanied by a qualitative technology upgrade. The coexistence of rising output and greener chemistries signals that scale efficiencies are improving alongside compliance readiness. Evidence from leading suppliers' investment plans further indicates that the industry is aligning capacity additions with the projected demand curve rather than chasing speculative growth.

Global Biocides Market Trends and Insights

Increasing Demand for Water Treatment Globally

Rising water scarcity and heightened reuse targets drive municipalities and industrial operators to deploy biocide formulations that maintain residual efficacy with lower active-ingredient loads. Utilities are adopting dosage-control platforms that integrate sensors with cloud analytics, which is nudging the biocides market toward performance-based procurement models. Peracetic acid and stabilized bromine, recently endorsed for groundwater remediation by United States regulators, demonstrate that oxidation strength combined with rapid decomposition is considered the sweet spot for compliance. A key inference is that suppliers who embed data-driven dosing guidance into their product offering will likely defend market positions against commoditization pressure.

Growing Demand From the Food and Beverage Industry

Food processors are revising sanitation protocols to minimize cross-contamination without leaving detectable residues, which lifts demand for hydroxyl-radical systems that work in ambient air as well as on surfaces. Packaging plants now trial biocide-embedded nanocomposites to extend shelf life by suppressing spoilage organisms, a shift that expands the functional scope of preservation beyond the product itself. This convergence of air, surface, and package sterilization suggests that integrated hygiene solutions can unlock cross-sell opportunities across multiple budget lines. The pattern indicates a gradual substitution away from legacy wet-chemistry disinfectants toward continuous-action technologies.

Environmental Issues and Health Hazards Related to Biocides

Regulators are phasing out active substances with persistence or carcinogenicity concerns; the European Commission's withdrawal of ethylene oxide illustrates the regulatory unpredictability facing formulators. Research estimating up to 4.3 kg of microplastic paint particles released per 10,000 m2 of ship hull during cleaning underscores the ecological cost of certain coatings. Such findings are intensifying demand for degradable actives, which in turn encourage research and development into biobased feedstocks. An emerging signal is that insurers and port authorities could start penalizing operators that rely on legacy coatings, indirectly boosting eco-optimized biocides adoption.

Other drivers and restraints analyzed in the detailed report include:

- Heightened Awareness of Health and Hygiene

- Rising Demand in Paints and Coatings Industry

- Fluctuating Raw Material Prices

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Halogen compounds account for 28% biocides market share in 2024 and are forecast to expand at a 5.8% CAGR to 2030, indicating that efficacy still outweighs environmental apprehensions in many end-uses. Bromine-based solutions remain the first choice for high-temperature cooling systems because their biostatic effect persists where chlorination falters, revealing an operational rationale behind the segment's growth. Encapsulation methods that meter bromine release now prolong service intervals, which reduces overall chemical discharge and aligns with tightening wastewater rules. The inference is that incremental process tweaks, rather than wholesale active-switching, can reconcile performance with compliance.

Competition within halogens intensifies as suppliers seek greener credentials by improving biodegradability profiles. Albemarle's extraction optimization lowers energy input per bromine unit, signaling that upstream sustainability gains can cascade into stronger downstream demand. Parallel research and development explores chlorine-dioxide generators with real-time monitoring, indicating that digital capabilities are becoming a differentiator alongside chemistry. Collectively, these initiatives suggest that halogen suppliers are pivoting from product sellers to solution partners.

The Biocides Market Report Segments the Industry by Type (Halogen Compounds, Metallic Compounds, and More), Application (Water Treatment, Pharmaceutical and Personal Care, Wood Preservation, and More), Mode of Action (Oxidizing Biocides and Non-Oxidizing Biocides), and Geography (Asia-Pacific, North America, Europe, South America, and Middle East and Africa). The Market Forecasts are Provided in Terms of Volume (tons).

Geography Analysis

Asia-Pacific contributes 35% of the global biocides market share in 2024 and shows the fastest CAGR at 5.15% to 2030, reflecting industrial expansion accompanied by stricter public-health oversight. China's push for higher water-reuse ratios in industrial parks is accelerating the adoption of high-performing oxidizing biocides, while India's Smart Cities Mission channels budget toward municipal disinfection infrastructure. Japanese suppliers leverage specialty know-how to export high-purity actives to regional neighbors, indicating intra-Asian supply-chain deepening. Meanwhile, Southeast Asian economies are leapfrogging legacy chlorination by adopting modular bromine-based systems, highlighting how latecomers can embrace state-of-the-art chemistry from inception. Collectively, the region's demand pattern suggests that volume increases are accompanied by fast technology assimilation.

North America remains a technology trailblazer, where the United States Environmental Protection Agency's ongoing TSCA and FIFRA reviews compel formulators to maintain robust toxicology data packages. This regulatory rigour spurs innovation in less persistent actives, which in turn gets exported to other jurisdictions. Canada's forestry heritage sustains a sizable wood-preservation segment, and provincial authorities now stipulate lower leachate thresholds, pushing suppliers toward copper-azole hybrids. The regional market also benefits from large-scale cooling-tower retrofits in petrochemical complexes, implying that demand is tied not only to new-builds but also to maintenance cycles.

Europe stands out for the toughest biocide product authorization framework worldwide, where active-substance approvals can lapse if applicants fail to supply new environmental-risk data. The recent withdrawal of ethylene oxide underscores this dynamic, reinforcing the business case for safer substitutes. Germany and the United Kingdom dominate consumption, yet Nordic countries often pioneer biodegradable solutions that later scale southwards. Circular-economy legislation favors actives with minimal end-of-life footprint, so suppliers investing in cradle-to-grave assessments are better positioned for future tenders. The cumulative effect is that Europe acts as a proving ground: products succeeding under its rules can typically secure acceptance elsewhere with minor adaptations.

- Albemarle Corporation

- Arxada

- Baker Hughes Company

- BASF SE

- Dow

- Ecolab

- IRO Group Inc.

- Italmatch AWS

- Kemipex

- Kemira

- LANXESS

- Lonza

- Merck KGaA

- Nouryon

- Solvay

- Stepan Company

- The Lubrizol Corporation

- Thor Group Ltd.

- Valtris Specialty Chemicals

- Veolia

- Vink Chemicals GmbH & Co. KG

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increasing Demand for Water Treatment Globally

- 4.2.2 Growing Demand From the Food and Beverage Industry

- 4.2.3 Heightened Awareness of Health and Hygiene

- 4.2.4 Rising Demand in Paints and Coatings Industry

- 4.2.5 Regulatory Support for Safer Alternatives

- 4.3 Market Restraints

- 4.3.1 Environmental Issues and Health Hazards Related to Biocides

- 4.3.2 Fluctuating Raw Material Prices

- 4.3.3 High Research and Development Costs

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Degree of Competition

5 Market Size and Growth Forecasts (Volume)

- 5.1 By Type

- 5.1.1 Halogen Compounds

- 5.1.2 Metallic Compounds

- 5.1.3 Organosulfurs

- 5.1.4 Organic Acids

- 5.1.5 Phenolics

- 5.1.6 Other Types (Quaternary Ammonium Compounds)

- 5.2 By Application

- 5.2.1 Water Treatment

- 5.2.2 Pharmaceutical and Personal-care

- 5.2.3 Wood Preservation

- 5.2.4 Food and Beverage

- 5.2.5 Paints and Coatings

- 5.2.6 Other Applications (Oil and Gas, Agriculture, Disinfectants and Sanitization)

- 5.3 By Mode of Action

- 5.3.1 Oxidizing Biocides

- 5.3.2 Non-oxidizing Biocides

- 5.4 By Geography

- 5.4.1 Asia-Pacific

- 5.4.1.1 China

- 5.4.1.2 India

- 5.4.1.3 Japan

- 5.4.1.4 South Korea

- 5.4.1.5 Thailand

- 5.4.1.6 Malaysia

- 5.4.1.7 Indonesia

- 5.4.1.8 Vietnam

- 5.4.1.9 Rest of Asia-Pacific

- 5.4.2 North America

- 5.4.2.1 United States

- 5.4.2.2 Canada

- 5.4.2.3 Mexico

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 Italy

- 5.4.3.4 France

- 5.4.3.5 Spain

- 5.4.3.6 Russia

- 5.4.3.7 Nordics

- 5.4.3.8 Rest of Europe

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle East and Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 United Arab Emirates

- 5.4.5.3 Qatar

- 5.4.5.4 South Africa

- 5.4.5.5 Nigeria

- 5.4.5.6 Egypt

- 5.4.5.7 Rest of Middle East and Africa

- 5.4.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global Overview, Market Level Overview, Core Segments, Financials, Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 Albemarle Corporation

- 6.4.2 Arxada

- 6.4.3 Baker Hughes Company

- 6.4.4 BASF SE

- 6.4.5 Dow

- 6.4.6 Ecolab

- 6.4.7 IRO Group Inc.

- 6.4.8 Italmatch AWS

- 6.4.9 Kemipex

- 6.4.10 Kemira

- 6.4.11 LANXESS

- 6.4.12 Lonza

- 6.4.13 Merck KGaA

- 6.4.14 Nouryon

- 6.4.15 Solvay

- 6.4.16 Stepan Company

- 6.4.17 The Lubrizol Corporation

- 6.4.18 Thor Group Ltd.

- 6.4.19 Valtris Specialty Chemicals

- 6.4.20 Veolia

- 6.4.21 Vink Chemicals GmbH & Co. KG

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-need Assessment

- 7.2 Increasing Awareness in the Agricultural Sector