PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1850265

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1850265

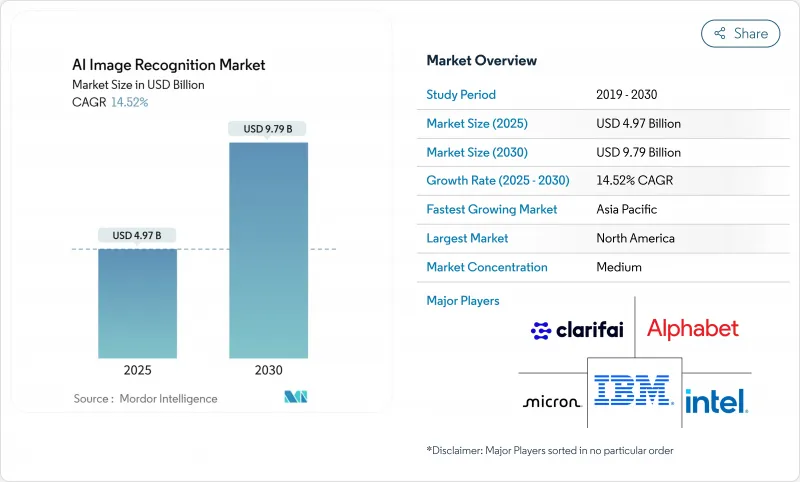

AI Image Recognition - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The AI image recognition market size is estimated at USD 4.97 billion in 2025 and is forecast to reach USD 9.79 billion by 2030, reflecting a 14.52% CAGR.

This expansion is rooted in enterprise reliance on automated visual intelligence that now stretches from factory floors to diagnostic suites. Falling silicon costs, multimodal foundation models, and maturing edge hardware keep total cost of ownership on a downward trajectory, making large-scale rollouts economically viable. Vendors redirect capital toward vertically integrated stacks that bundle chips, software, and services, streamlining procurement cycles and boosting deployment velocity. Meanwhile, synthetic data engines shrink labeling budgets, broadening participation for mid-sized firms that previously lacked annotated imagery. Collectively, these trends position the AI image recognition market for durable double-digit growth.

Global AI Image Recognition Market Trends and Insights

Cloud-Native AI Adoption Boom

Hyperscale providers deliver containerized vision pipelines that push models from prototype to production inside weeks, trimming time-to-value for manufacturers and retailers. Microsoft Azure and Google Cloud showcase packaged defect-detection blueprints that lower entry barriers for firms with limited ML staff. Kubernetes-orchestrated inference endpoints allocate compute only when imagery arrives, enabling 15-40% cost savings versus fixed on-premise clusters. As a result, the AI image recognition market benefits from faster procurement cycles and broader user diversity.

Proliferation of High-Resolution Cameras

Fifth-generation automotive ADAS units and 8K industrial sensors now pair with on-device AI accelerators that deliver sub-50 ms inference without network round-trips. Continental's MFC525 camera offers a 110-degree field of view while performing object classification locally, and Samsung's latest neural engines hit 38 TOPS inside consumer smartphones. These capabilities unlock real-time quality control and immersive AR functions, widening the addressable base of the AI image recognition market.

Data-Privacy and Compliance Hurdles

The EU AI Act and California statutes impose robust audit trails, inflating validation costs by up to 30% for medical-imaging deployments. Conflicting data-residency mandates compel dual-stack architectures, slowing rollouts among mid-size hospitals that lack dedicated privacy teams. Such friction tempers growth momentum in the AI image recognition market.

Other drivers and restraints analyzed in the detailed report include:

- Retail Loss-Prevention Initiatives

- Synthetic Data Pipelines Slashing Labelling Cost

- GPU Supply Chain Geopolitics Elevating Capex Risk

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Hardware controlled 45.6% of 2024 revenue, yet services post a 14.9% CAGR that outpaces all other categories. Edge-ready cameras and inference chips from NVIDIA and Intel lower latency below 50 ms, energizing brownfield retrofits in manufacturing plants. Software, especially low-code model-ops platforms, eases custom pipeline creation for firms without deep data-science benches. Meanwhile, professional services providers craft domain-tuned datasets and continuous-learning workflows that elevate production accuracy beyond initial proof points. This shift toward holistic outcomes rather than discrete products broadens wallet share for integrators inside the AI image recognition market.

On-premises systems retained 68.7% revenue in 2024 because hospitals, banks, and defense agencies must keep imagery within local firewalls. Edge scenarios in mines, ships, and remote factories mirror this preference, where intermittent connectivity precludes cloud round-trips. Even so, cloud workloads grow at 16.7% CAGR as elastic GPU pools absorb seasonal or burst-heavy image pipelines. Hybrid topologies marry edge preprocessing with cloud retraining, letting enterprises tune inference at the edge while leveraging petascale datasets centrally. This blended paradigm safeguards compliance yet benefits from hyperscaler economics, reinforcing long-run expansion of the AI image recognition market.

AI Image Recognition Market Report is Segmented by Type (Hardware, Software, and Services), Deployment Model (Cloud, On-Premises), Application (Image Classification, Object Detection and Tracking, Facial Recognition, and More), End-User Industry (Automotive, BFSI, and More), and by Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America held 27.8% revenue in 2024, buoyed by a dense funding ecosystem and domestic chip fabrication initiatives such as TSMC's USD 165 billion Arizona campus. Corporate M&A, evidenced by Meta's USD 14.8 billion stake in Scale AI, intensifies regional R&D velocity. Government incentives for semiconductor resilience further anchor the AI image recognition market in the United States and Canada.

Europe exhibits moderated yet steady adoption, framed by the bloc's stringent AI Act. German heavy-industry leaders weave vision into automated assembly, while French startups refine clinical decision support under GDPR safeguards. Investment remains disciplined but targeted, favoring vendors able to certify transparency and bias mitigation. Such rigor shapes solution design across the AI image recognition market.

Asia-Pacific shows the highest trajectory at 15.9% CAGR. China allocates multiyear budgets topping USD 70 billion for smart-city and surveillance grids. Japan's USD 65 billion semiconductor program and South Korea's leadership in HBM memory create a vertically integrated supply base. India's developer pool sustains global model-tuning services at competitive rates, collectively accelerating the AI image recognition market.

- Google (Alphabet)

- Clarifai

- IBM

- Intel

- Micron Technology

- Microsoft

- NVIDIA

- Qualcomm

- Samsung Electronics

- AMD/Xilinx

- Apple

- SenseTime

- Hikvision

- Megvii

- NEC Corporation

- Cognex

- Zebra Technologies

- Huawei Technologies

- Palantir

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Cloud-native AI adoption boom

- 4.2.2 Proliferation of high-resolution cameras

- 4.2.3 Retail loss-prevention initiatives

- 4.2.4 Expansion of Smart Cities and Surveillance Infrastructure

- 4.2.5 Synthetic data pipelines slashing labeling cost

- 4.2.6 Satellite imagery firms open-sourcing labeled sets

- 4.3 Market Restraints

- 4.3.1 Data-privacy and compliance hurdles

- 4.3.2 Shortage of domain-specific talent

- 4.3.3 GPU supply chain geopolitics elevating capex risk

- 4.3.4 Rising legal exposure from biased algorithms

- 4.4 Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook (Edge vs Cloud inference)

- 4.7 Porter's Five Forces

- 4.7.1 Bargaining Power of Buyers

- 4.7.2 Bargaining Power of Suppliers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Degree of Competition

- 4.8 Assessment of Macroeconomic Factors

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Component

- 5.1.1 Hardware

- 5.1.2 Software

- 5.1.3 Services

- 5.2 By Deployment Model

- 5.2.1 Cloud

- 5.2.2 On-premises

- 5.3 By Application

- 5.3.1 Image Classification

- 5.3.2 Object Detection and Tracking

- 5.3.3 Facial Recognition

- 5.3.4 Industrial Inspection

- 5.3.5 Medical Imaging

- 5.3.6 Other Niche Applications

- 5.4 By End-user Industry

- 5.4.1 Automotive

- 5.4.2 BFSI

- 5.4.3 Healthcare Providers and Med-tech

- 5.4.4 Retail and E-commerce

- 5.4.5 Security and Surveillance Integrators

- 5.4.6 Manufacturing

- 5.4.7 Others (Agriculture, Energy, etc.)

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Argentina

- 5.5.2.3 Rest of South America

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 France

- 5.5.3.4 Italy

- 5.5.3.5 Spain

- 5.5.3.6 Rest of Europe

- 5.5.4 Asia-Pacific

- 5.5.4.1 China

- 5.5.4.2 Japan

- 5.5.4.3 India

- 5.5.4.4 South Korea

- 5.5.4.5 Australia

- 5.5.4.6 Rest of Asia-Pacific

- 5.5.5 Middle East and Africa

- 5.5.5.1 Middle East

- 5.5.5.1.1 Saudi Arabia

- 5.5.5.1.2 United Arab Emirates

- 5.5.5.1.3 Turkey

- 5.5.5.1.4 Rest of Middle East

- 5.5.5.2 Africa

- 5.5.5.2.1 South Africa

- 5.5.5.2.2 Nigeria

- 5.5.5.2.3 Egypt

- 5.5.5.2.4 Rest of Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Google (Alphabet)

- 6.4.2 Clarifai

- 6.4.3 IBM

- 6.4.4 Intel

- 6.4.5 Micron Technology

- 6.4.6 Microsoft

- 6.4.7 NVIDIA

- 6.4.8 Qualcomm

- 6.4.9 Samsung Electronics

- 6.4.10 AMD/Xilinx

- 6.4.11 Apple

- 6.4.12 SenseTime

- 6.4.13 Hikvision

- 6.4.14 Megvii

- 6.4.15 NEC Corporation

- 6.4.16 Cognex

- 6.4.17 Zebra Technologies

- 6.4.18 Huawei Technologies

- 6.4.19 Palantir

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment