PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1850268

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1850268

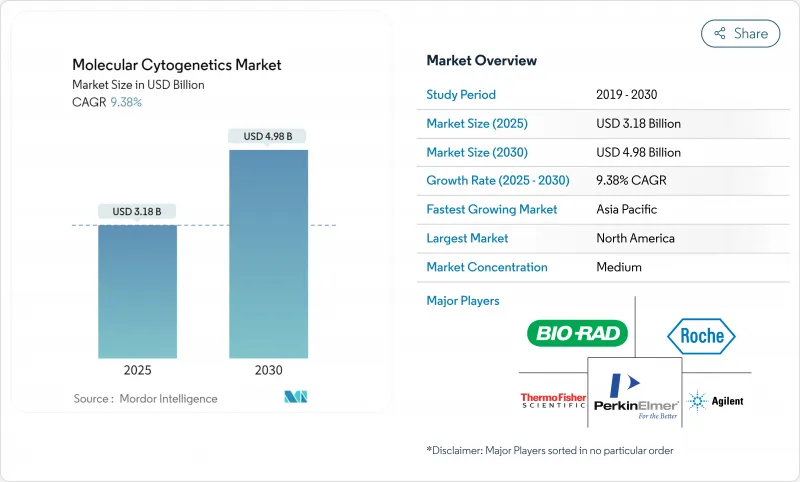

Molecular Cytogenetics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Molecular Cytogenetics Market size is estimated at USD 3.18 billion in 2025, and is expected to reach USD 4.98 billion by 2030, at a CAGR of 9.38% during the forecast period (2025-2030).

Standardized regulatory pathways from the FDA, expanded reimbursement for oncology-focused genetic tests, and rapid convergence of AI with image-based genomics keep demand on an upward curve fda.gov. Consolidation among smaller laboratories unable to meet the new compliance workload is reshaping competitive dynamics toward integrated platform providers. Companion diagnostics aligned with targeted therapies now form the commercial backbone of routine cytogenetic testing, spurring continuous menu expansion. Laboratories are also accelerating digital transformation to cope with higher specimen volumes, fueling double-digit growth in software solutions that automate karyotype interpretation and integrate cloud-based reporting.

Global Molecular Cytogenetics Market Trends and Insights

Rising Prevalence of Cancer & Genetic Disorders

Sustained escalation in global cancer incidence keeps cytogenetic testing volumes climbing in oncology clinics. Meta-analyses of whole-genome sequencing now show that 79% of solid-tumor cases harbor actionable genomic alterations identifiable through chromosomal analysis. Thalassemia screening programs in southern China and other high-prevalence regions have incorporated third-generation sequencing to uncover rare genotypes that escape conventional assays. As precision oncology gains mainstream status, cytogenetic assays have become indispensable elements of treatment decision algorithms. Their role stretches beyond diagnosis to direct therapy selection, thereby embedding them in long-term cancer care budgets.

Increasing Focus on Targeted Therapies & Companion Diagnostics

In 2024 the FDA cleared additional companion diagnostics, including expansion of PATHWAY HER2 testing to the ultralow category and authorization of TruSight Oncology Comprehensive as the first pancancer IVD kit. Drug sponsors now run more than 30 active companion-diagnostic collaborations, a figure that keeps rising as label claims tighten around molecular subtypes. Reclassification of in situ hybridization systems from Class III to Class II has shortened approval timelines,lowering development risk for start-ups and established players alike. Parallel reimbursement gains through expanded Medicare determinations encourage community oncology practices to adopt cytogenetic profiling as a standard of care. Together these policy shifts embed cytogenetics deeper into routine oncology workflows and accelerate menu innovation.

High Capital Cost of High-Throughput Instruments & FISH Imagers

Acquisition of automated FISH scanners and array systems can exceed USD 1 million per platform, burdening midsize laboratories with multi-year depreciation schedules. AI-enabled image-analysis modules add software licensing fees that further lift the entry bar. Although leasing programs exist, they often lock buyers into consumable minimums that crimp operating margins. Capital pressure is especially acute for facilities aspiring to build full-service menus that span FISH, aCGH, and optical genome mapping.

Other drivers and restraints analyzed in the detailed report include:

- Expansion of Public / Private Funding for Genomic Research

- Rapid Adoption of Personalized-Medicine-Centric Testing Menus

- Shortage of Trained Cytogenetic Technologists

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Software currently represents the most dynamic growth lever in the molecular cytogenetics market with a 12.24% forecast CAGR. While kits and reagents captured a 55.45% revenue slice in 2024, laboratories are channeling fresh capital toward cloud-native analytics that cut manual review time by half and enable decentralized case sign-out. One proof point is the CHROMA foundation model trained on 4 million chromosomal images, a resource that now underpins automated metaphase spread interpretation. Commercial platforms integrate continuous AI updates without hardware swaps, stretching the useful life of installed microscopes.

Services run in parallel with software, as remote bioinformaticians deliver on-demand validation for smaller sites that lack in-house cytogeneticists. Consumables remain indispensable, especially single-use probe sets tailored to tumor-specific abnormalities. Yet the convergence of cloud, AI, and micro-service billing is steadily redirecting spending patterns. Instruments still matter, but upgrades are software-centric, tilting revenue mix toward digital segments. The upshot is a broad redistribution of the molecular cytogenetics market size rather than a simple volume uplift.

FISH retained 58.78% molecular cytogenetics market share in 2024 because clinicians trust its time-tested accuracy and regulators grant it clear coding pathways. Nonetheless, aCGH is gaining velocity with a 15.83% forecast CAGR due to its genome-wide coverage and scalability. Hybrid techniques are also emerging; immunophenotyped-suspension-multiplex FISH can now detect multiple translocations in one run.

Optical genome mapping complements these methods, adding a 15% diagnostic uplift in hematologic malignancies over karyotyping alone. Laboratories are therefore blending modalities to maximize resolution and turnaround time. This multimodal toolkit underscores why future procurement strategies will revolve around flexible platforms capable of handling diverse probe chemistries and array formats.

The Molecular Cytogenetics Market Report Segments the Industry Into by Product (Instruments, and More), Technique (Fluorescence in Situ Hybridization, and More), Application (Cancer, Genetic Disorders, and More), End User (Clinical and Research Laboratories, and More), and Geography (North America, Europe, Asia-Pacific, Middle East and Africa, South America). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America retained 37.56% of the molecular cytogenetics market in 2024, a position safeguarded by Medicare reimbursement expansions for oncology genomics and by the FDA's modernization of laboratory-developed test oversight. Roche's USD 50 billion outlay on US diagnostics infrastructure including new AI research hubs signals long-term confidence in domestic demand. Canada and Mexico ride piggyback on regional supply chains, broadening access to companion diagnostics without shouldering full development costs.

Europe remains a mature but opportunity-rich arena. The UK's USD 190 million genomics investment supports pan-European data-sharing pilots, and device reclassifications across the EU shorten certification timeframes. Yet strict data-sovereignty rules can slow the shift to cloud-based imaging archives, obliging vendors to offer on-premise encryption modules. High cancer incidence and universal health coverage nonetheless ensure steady specimen volumes across Germany, France, and the Nordics.

Asia-Pacific records the fastest 11.34% CAGR, driven by China's population-scale oncology sequencing, Japan's reimbursement of precision-medicine panels, and India's rapidly expanding private hospital sector. Government grant programs underwrote multiple national biobank projects in 2024, widening laboratory networks that previously focused on infectious disease surveillance. Australia's USD 500 million decade-long genomics commitment further cements regional momentum. Middle East & Africa and South America sit on the adoption curve's early slope, yet rising cancer prevalence and diagnostics capacity building hint at an uptick in cytogenetic orders over the forecast horizon.

- Abbott Laboratories

- Agilent Technologies

- Bio-Rad Laboratories

- Roche

- Illumina

- Thermo Fisher Scientific

- Danaher (Leica Biosystems & Cytiva)

- PerkinElmer

- Quest Diagnostics

- Oxford Gene Technology

- Empire Genomics

- Genial Genetic Solutions

- CytoTest

- MetaSystems

- Applied Spectral Imaging

- Bionano Genomics

- BioView

- Sysmex

- Fulgent Genetics

- BGI

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising Prevalence of Cancer & Genetic Disorders

- 4.2.2 Increasing Focus on Targeted Therapies & Companion Diagnostics

- 4.2.3 Expansion of Public / Private Funding For Genomic Research

- 4.2.4 Rapid Adoption Of Personalized-Medicine-Centric Testing Menus

- 4.2.5 Automation & AI-Enabled Digital Cytogenetics Workflows

- 4.2.6 Emergence of Cloud-Based, Decentralised Image-Analysis Platforms

- 4.3 Market Restraints

- 4.3.1 High Capital Cost of High-Throughput Instruments & FISH Imagers

- 4.3.2 Shortage of Trained Cytogenetic Technologists in Clinical Labs

- 4.3.3 Data-Sovereignty / Compliance Burden for Large Genomic-Image Files

- 4.3.4 Reimbursement Delays for Array-Based Prenatal Testing Panels

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitutes

- 4.4.5 Competitive Rivalry

5 Market Size & Growth Forecasts (Value in USD)

- 5.1 By Product

- 5.1.1 Instruments

- 5.1.2 Kits & Reagents

- 5.1.3 Software

- 5.1.4 Services

- 5.2 By Technique

- 5.2.1 Fluorescence in Situ Hybridisation (FISH)

- 5.2.2 Array / Comparative Genomic Hybridisation (aCGH / CGH)

- 5.2.3 Karyotyping

- 5.2.4 Other Techniques

- 5.3 By Application

- 5.3.1 Cancer

- 5.3.2 Genetic Disorders

- 5.3.3 Personalised Medicine

- 5.3.4 Other Applications

- 5.4 By End User

- 5.4.1 Clinical and Research Laboratories

- 5.4.2 Hospitals and Reference Centres

- 5.4.3 Academic and Government Institutes

- 5.4.4 Pharmaceutical, Biotechnology Companies and CROs

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Spain

- 5.5.2.6 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 Japan

- 5.5.3.3 India

- 5.5.3.4 Australia

- 5.5.3.5 South Korea

- 5.5.3.6 Rest of Asia-Pacific

- 5.5.4 Middle East & Africa

- 5.5.4.1 GCC

- 5.5.4.2 South Africa

- 5.5.4.3 Rest of Middle East & Africa

- 5.5.5 South America

- 5.5.5.1 Brazil

- 5.5.5.2 Argentina

- 5.5.5.3 Rest of South America

- 5.5.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.3.1 Abbott

- 6.3.2 Agilent Technologies

- 6.3.3 Bio-Rad Laboratories

- 6.3.4 F. Hoffmann-La Roche

- 6.3.5 Illumina

- 6.3.6 Thermo Fisher Scientific

- 6.3.7 Danaher (Leica Biosystems & Cytiva)

- 6.3.8 PerkinElmer

- 6.3.9 Quest Diagnostics

- 6.3.10 Oxford Gene Technology

- 6.3.11 Empire Genomics

- 6.3.12 Genial Genetic Solutions

- 6.3.13 CytoTest

- 6.3.14 MetaSystems

- 6.3.15 Applied Spectral Imaging

- 6.3.16 Bionano Genomics

- 6.3.17 BioView

- 6.3.18 Sysmex

- 6.3.19 Fulgent Genetics

- 6.3.20 BGI Genomics

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment