PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1850272

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1850272

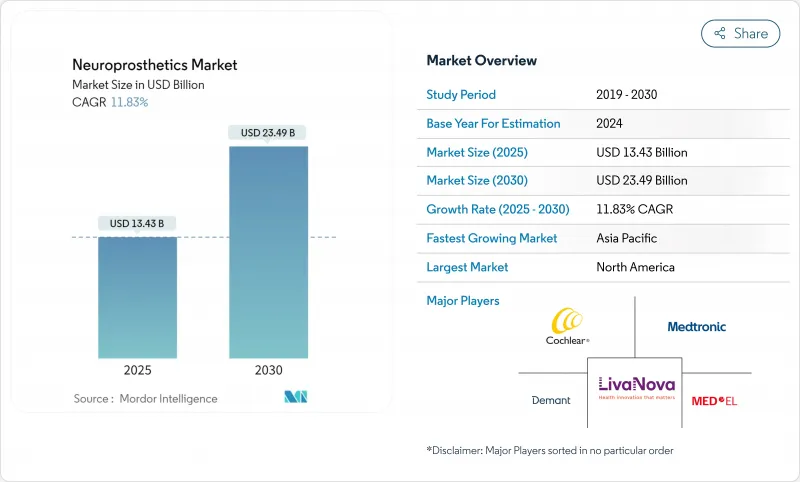

Neuroprosthetics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Neuroprosthetics market stands at USD 13.43 billion in 2025 and is projected to reach USD 23.49 billion by 2030, reflecting an 11.83% CAGR.

This swift expansion mirrors the transition from open-loop stimulation systems to closed-loop adaptive platforms that fine-tune therapy in real time. Miniaturized electronics, flexible biomaterials, and on-device artificial-intelligence algorithms now merge to deliver durable implants that outlast earlier generations while lowering surgical revision rates. Heightened FDA Breakthrough Device designations since 2024, broader Medicare coverage for neuromodulation procedures, and growing clinical evidence across motor, sensory, and psychiatric indications further unlock adoption. Venture capital inflows, averaging USD 1.4 billion per year since 2023, continue to fund novel brain-computer interfaces that target unmet needs in paralysis and severe depression, strengthening long-term demand across the Neuroprosthetics market.

Global Neuroprosthetics Market Trends and Insights

Rising Prevalence of Neurological Disorders

Stroke and Parkinson's incidence continues to rise among populations over 65, prompting sustained demand for multimodal neuroprosthetic therapies . Age-linked stroke and Parkinson's disease trends raise annual caseloads and prompt sustained demand for multi-modal neuroprosthetic therapies that address motor, cognitive, and sensory deficits concurrently. Six-year follow-up data on responsive neurostimulation show an 82% median seizure cut in treatment-resistant epilepsy, underscoring chronic efficacy. Health-economic models demonstrate that device longevity beyond eight years offsets higher up-front expenses, positioning neuroprosthetics as first-line rather than last-resort options across the Neuroprosthetics market.

Escalating Incidence of Sensorineural Hearing Loss

Urban noise exposure and industrialization accelerate cochlear-implant uptake, while next-generation bilateral electrode arrays equipped with graphene conductors preserve residual hearing and improve spatial sound perception . Pediatric early-implant programs lengthen individual device-upgrade cycles, expanding the lifetime value pool within the Neuroprosthetics market. Smartphone-linked sound-processing software now personalizes acoustic profiles, differentiating premium cochlear systems.

High Acquisition and Surgical Costs of Implants

Implantable pulse generators priced USD 24,000-60,000 and procedure bills surpassing USD 100,000 restrict access, especially where neurosurgical centers remain sparse. Only 200 facilities worldwide host the multidisciplinary expertise required, bottlenecking diffusion of the Neuroprosthetics market into lower-income regions until novel leasing or risk-sharing payment options scale.

Other drivers and restraints analyzed in the detailed report include:

- Technological Miniaturization and Biomaterial Advances

- Expanding Reimbursement for Neuromodulation Implants

- Availability of Pharmacological / Physical Rehabilitation Alternatives

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Closed-loop systems capture physiological feedback to auto-adjust stimulation, driving a 12.31% CAGR through 2030. Output devices still controlled 56.54% of the Neuroprosthetics market in 2024 thanks to mature deep brain, spinal cord, and cochlear franchises. Input interfaces that decode cortical intent now bridge paralyzed users to external robotics, widening the Neuroprosthetics market addressable base. Continuous algorithm refinement reduces clinic visits and supports superior long-term outcomes, making adaptive platforms the strategic growth engine over the forecast window.

Bidirectional designs that merge sensing and stimulation inside one implant underscore the sector's evolution toward integrated precision-medicine tools. Commercial launches such as Medtronic's Inceptiv spinal stimulator showcase real-time compound-action-potential tracking that locks analgesia within individualized therapeutic windows . As hospital systems favor devices that minimize re-programming workloads, adaptive units gain formulary preference, amplifying their influence on overall Neuroprosthetics market expansion.

Implantable hardware captured 63.81% revenue in 2024, yet AI-driven software modules are growing at 12.84% CAGR as manufacturers layer machine-learning analytics atop legacy devices. External wearables process high-bandwidth cortical recordings, reducing implant complexity while sustaining signal fidelity. Predictive-maintenance dashboards flag battery depletion and impedance drift, lowering unscheduled clinic appointments across the Neuroprosthetics market.

Regulatory frameworks now permit post-market software upgrades outside costly surgical revisions, extending product life cycles. NeuroPace's cloud-linked seizure analytics illustrate the pivot toward digitally differentiated offerings; incoming FDA guidance on machine-learning-enabled medical devices should further cement software subscriptions as recurring revenue channels within the Neuroprosthetics market.

The Neuroprosthetics Market Report Segments the Industry Into by Type (Output Neuroprosthetics, and More), by Component (Implantable Device, and More), by Technique (Deep Brain Stimulation, and More), by Application (Motor Disorders, and More), End User (Hospitals, and More) and Geography. The Market Sizes and Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America delivered 43.56% of 2024 global revenue, supported by dense functional-neurosurgery networks, Medicare payment coverage for closed-loop stimulators, and FDA Breakthrough Device pathways that shorten commercialization time. United States hospital groups now negotiate risk-share contracts that tie payment tranches to objective mobility or seizure-reduction milestones, accelerating real-world evidence generation and fueling continued Neuroprosthetics market growth.

Europe follows with stringent Medical Device Regulation standards that reinforce user safety while preserving a pan-regional CE-mark route to market. Countries such as Germany apply health-technology-assessment filters that reward implants delivering verifiable quality-of-life gains; this evidence-centric stance nurtures sustainable adoption curves. EU-funded Horizon Europe consortia invest in biodegradable electrodes and adaptive cortical interfaces, ensuring indigenous innovations feed directly into regional Neuroprosthetics market pipelines.

Asia-Pacific is the fastest-growing cluster, projected at 13.71% CAGR through 2030. China's National Medical Products Administration is piloting USD 902 reimbursement codes for invasive brain-computer-interface placements, while the Ministry of Industry and Information Technology lists neural interfaces as a strategic emerging industry. Japan and South Korea translate advanced semiconductor supply chains into cost-efficient implant manufacturing, whereas India scales neuro-rehabilitation centers that extend device access beyond Tier-1 cities. Together these moves support a more democratized Neuroprosthetics market landscape by decade's end.

- Abbott Laboratories

- Boston Scientific

- Cochlear

- Demant

- LivaNova

- MED-EL

- Medtronic

- Sonova

- Second Sight Medical Products

- Cyberonics Inc. (VNS Therapy)

- BrainGate Company

- Nevro

- Synchron

- Neuralink Corporation

- Blackrock Neurotech

- Pixium Vision SA

- Axonics Modulation Technologies

- BlueWind Medical

- MicroTransponder Inc.

- NeuroPace

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising prevalence of neurological disorders

- 4.2.2 Escalating incidence of sensorineural hearing loss

- 4.2.3 Technological miniaturisation & biomaterial advances

- 4.2.4 Expanding reimbursement for neuromodulation implants

- 4.2.5 Bio-hybrid neural interfaces entering clinical pipelines

- 4.2.6 Military & space-agency funding for human-machine augmentation

- 4.3 Market Restraints

- 4.3.1 High acquisition & surgical costs of implants

- 4.3.2 Availability of pharmacological / physical rehabilitation alternatives

- 4.3.3 Shortage of specialised functional-neurosurgery talent

- 4.3.4 Ethical & regulatory hurdles around elective cognitive enhancement

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value, 2021-2030)

- 5.1 By Type

- 5.1.1 Input Neuroprosthetics

- 5.1.2 Output Neuroprosthetics

- 5.1.3 Closed-loop/Adaptive Neuroprosthetics

- 5.2 By Component

- 5.2.1 Implantable Device

- 5.2.2 External Wearable Unit

- 5.2.3 Software & Algorithms

- 5.3 By Technique

- 5.3.1 Deep Brain Stimulation (DBS)

- 5.3.2 Spinal Cord Stimulation (SCS)

- 5.3.3 Vagus Nerve Stimulation (VNS)

- 5.3.4 Cortical & Peripheral Nerve Stimulation

- 5.4 By Application

- 5.4.1 Motor Disorders (Parkinson's, Essential Tremor, etc.)

- 5.4.2 Sensory Loss (Auditory, Visual)

- 5.4.3 Cognitive & Psychiatric Conditions (Alzheimer's, Depression, PTSD)

- 5.4.4 Chronic Pain & Epilepsy

- 5.5 By End User

- 5.5.1 Hospitals

- 5.5.2 Specialty & Rehabilitation Clinics

- 5.5.3 Home-care & Ambulatory Settings

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Mexico

- 5.6.2 Europe

- 5.6.2.1 Germany

- 5.6.2.2 United Kingdom

- 5.6.2.3 France

- 5.6.2.4 Italy

- 5.6.2.5 Spain

- 5.6.2.6 Rest of Europe

- 5.6.3 Asia-Pacific

- 5.6.3.1 China

- 5.6.3.2 Japan

- 5.6.3.3 India

- 5.6.3.4 Australia

- 5.6.3.5 South Korea

- 5.6.3.6 Rest of Asia-Pacific

- 5.6.4 Middle East & Africa

- 5.6.4.1 GCC

- 5.6.4.2 South Africa

- 5.6.4.3 Rest of Middle East & Africa

- 5.6.5 South America

- 5.6.5.1 Brazil

- 5.6.5.2 Argentina

- 5.6.5.3 Rest of South America

- 5.6.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global overview, Market overview, Core segments, Financials, Strategic information, Market Rank/Share, Products & Services, Recent Developments)

- 6.3.1 Abbott Laboratories

- 6.3.2 Boston Scientific Corporation

- 6.3.3 Cochlear Limited

- 6.3.4 Demant A/S

- 6.3.5 LivaNova PLC

- 6.3.6 MED-EL Medical Electronics

- 6.3.7 Medtronic PLC

- 6.3.8 Sonova Holding AG

- 6.3.9 Second Sight Medical Products

- 6.3.10 Cyberonics Inc. (VNS Therapy)

- 6.3.11 BrainGate Company

- 6.3.12 Nevro Corp.

- 6.3.13 Synchron Inc.

- 6.3.14 Neuralink Corporation

- 6.3.15 Blackrock Neurotech

- 6.3.16 Pixium Vision SA

- 6.3.17 Axonics Modulation Technologies

- 6.3.18 BlueWind Medical

- 6.3.19 MicroTransponder Inc.

- 6.3.20 NeuroPace Inc.

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment