PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1910450

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1910450

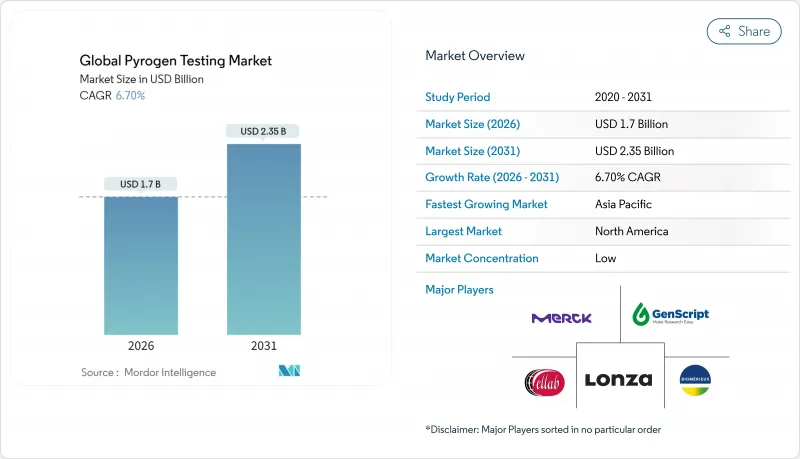

Global Pyrogen Testing - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

Pyrogen testing market size in 2026 is estimated at USD 1.7 billion, growing from 2025 value of USD 1.59 billion with 2031 projections showing USD 2.35 billion, growing at 6.7% CAGR over 2026-2031.

Sustained growth is shaped by rising biologics production, strong regulatory backing for recombinant assays, and a broad move toward outsourcing quality-control (QC) services. Companies adopt automation to cut manual intervention, reduce errors, and release products faster. Regulatory agencies are approving animal-free tests to protect horseshoe crab populations while securing supply continuity. Asia-Pacific manufacturers add high-throughput capacity, creating new demand pockets even as North America maintains the largest installed base of QC laboratories. Sustained vaccine funding, expanding cell- and gene-therapy pipelines, and cost-efficient microfluidic kits all reinforce the long-term expansion of the pyrogen testing market.

Global Pyrogen Testing Market Trends and Insights

Rapid Growth of Biologics & Biosimilars Pipeline

Biologic manufacturing capacity topped 16.5 million L in 2024, and new plants now open almost entirely with single-use systems requiring more frequent QC cycles. Large-molecule drugs can activate pyrogenic pathways beyond endotoxins, prompting firms to layer monocyte-based methods on top of LAL assays. Updated FDA guidance for cell- and gene-therapy candidates calls for material-mediated pyrogen checks, broadening test menus inside QC labs . Biosimilar sponsors replicate reference lots across many sites, multiplying batch release events that each demand pyrogen clearance. Europe's mandate to replace rabbit tests with MAT by 2026 further lifts demand for diversified assays. Altogether, biologics momentum injects consistent volume growth into the pyrogen testing market.

Expansion of Contract Research & Manufacturing Outsourcing

Global CDMOs handle rising volumes of fill-finish and final-release analytics for multinational drug makers. Leaders such as IQVIA, Thermo Fisher, and WuXi AppTec bundle pyrogen testing into integrated service contracts, which stabilizes instrumentation utilization and funds automation upgrades. Charles River's Nexus platform, capable of 120 samples per run, illustrates how outsourced hubs exploit throughput economics that single in-house benches cannot match. Asian CDMOs compound these efficiencies with wage advantages, enabling reinvestment in recombinant assays and MAT capacity to serve Western clientele pursuing sustainability goals. Consequently, outsourcing magnifies the global reach of the pyrogen testing market while compressing unit costs for sponsors.

Horseshoe-Crab Lysate Supply Volatility

Wild harvest quotas for Atlantic Limulus remain tight, yet real extraction volumes routinely over-shoot, raising conservation alarms. Any sudden clampdown could stall LAL reagent deliveries and jeopardize vaccine supply chains. Small-cap biotech firms face price spikes first, widening cost differentials versus larger peers with volume contracts. Severe weather events or habitat loss pose multi-season threats, and a single hurricane can wipe out thousands of breeding crabs along Delaware Bay. Such exposure accelerates portfolio shifts to rFC but adds near-term uncertainty that can temper growth in the pyrogen testing market.

Other drivers and restraints analyzed in the detailed report include:

- Regulatory Endorsement of Recombinant Factor C Assays

- Conservation-Driven Shift to Animal-Free Endotoxin Detection

- Microfluidic-Based Rapid Pyrogen Detection Platforms

- Surge in Vaccine & Cell-/Gene-Therapy Manufacturing Volumes

- Uncertainty During rFC Transition for Legacy QC Protocols

- Inter-Lab Variability of Monocyte Activation Test Results

- High Upfront Cost of Automated Endotoxin Analyzers

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Instruments captured are on track to log an 7.86% CAGR to 2031, the fastest among all product lines. Their rise rests on pharma's push for data integrity and lean staffing, which favors closed-system readers that generate automatic audit trails. Cartridge-based units integrate reagent packs, alleviating dilution errors and trimming analyst time by 85%. Kits & Reagents still contributed 44.08% of 2025 revenues, underscoring the recurring consumables model that underwrites vendor profitability. The services slice grows steadily as CDMOs add fee-for-service endotoxin panels to turnkey offerings.

Portable spectrophotometers with barcode tracking now enable on-floor release, allowing facilities to shorten lot disposition by as much as six hours. Microfluidic kits use 95% less lysate than traditional tubes, a material efficiency welcomed by sustainability teams. End-users cite easier validation and higher sample throughput as core reasons to budget for new readers despite elevated capital prices. Combined, these preferences reinforce the upgrade cycle and widen adoption, sustaining momentum in the pyrogen testing market.

The Pyrogen Testing Market Report Segments the Industry Into by Product (Kits and Reagents, Services, Instruments), by Test Type (LAL Tests, Rabbit Pyrogen Test, Monocyte Activation Test, Other Test Types), by End User (Pharmaceutical and Biotechnology Companies, Medical Device Companies, Other End Users), and Geography. The Market Sizes and Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America generated 42.05% of 2025 revenues, helped by the FDA's speedy acceptance of rFC and a dense cluster of biotech HQs. The region benefits from mature automation penetration and entrenched test culture but faces slower percentage growth due to its high base. Asia-Pacific, by contrast, is set to expand at an 8.18% CAGR, underpinned by Chinese and Indian build-outs of biologics mega-plants. Generous incentives from India's Production Linked scheme and China's provincial grants fund state-of-the-art QC labs, lifting reagent pull-through.

Europe holds steady growth, supported by early alternative-assay adoption and cross-border standards from EDQM. Stringent animal-welfare laws push firms to validate MAT and rFC earlier than peers elsewhere. Brexit added administrative filings but did not materially deter trade, with UK-EU assay producers retaining reciprocal certifications. Collectively, geographic diversification balances global demand and cements resilience across the pyrogen testing market.

- Associates of Cape Cod Inc.

- bioMerieux

- Charles River

- Ellab

- GenScript Biotech

- Lonza Group

- Merck

- Thermo Fisher Scientific

- Fujifilm Wako Pure Chemical Corp.

- WuXi App Tec

- Eurofins

- Microcoat Biotechnologie

- Sotera Health (Nelson Labs)

- Sanquin

- Seikagaku

- Hyglos GmbH

- Toxin Technology Inc.

- Labor Dr. Merk & Kollegen

- Endosafe (Charles River)

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rapid growth of biologics & biosimilars pipeline

- 4.2.2 Expansion of contract research & manufacturing outsourcing

- 4.2.3 Regulatory endorsement of recombinant Factor C (rFC) assays

- 4.2.4 Conservation-driven shift to animal-free endotoxin detection

- 4.2.5 Microfluidic-based rapid pyrogen detection platforms

- 4.2.6 Surge in vaccine & cell-/gene-therapy manufacturing volumes

- 4.3 Market Restraints

- 4.3.1 Horseshoe-crab lysate supply volatility

- 4.3.2 Uncertainty during rFC transition for legacy QC protocols

- 4.3.3 Inter-lab variability of Monocyte Activation Test results

- 4.3.4 High upfront cost of automated endotoxin analyzers

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value, USD mn)

- 5.1 By Product

- 5.1.1 Kits and Reagents

- 5.1.2 Services

- 5.1.3 Instruments

- 5.2 By Test Type

- 5.2.1 LAL Tests

- 5.2.2 Rabbit Pyrogen Test

- 5.2.3 Monocyte Activation Test

- 5.2.4 Other Test Types

- 5.3 By End User

- 5.3.1 Pharmaceutical & Biotechnology Companies

- 5.3.2 Medical Device Companies

- 5.3.3 Other End Users

- 5.4 By Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Italy

- 5.4.2.5 Spain

- 5.4.2.6 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 Japan

- 5.4.3.3 India

- 5.4.3.4 Australia

- 5.4.3.5 South Korea

- 5.4.3.6 Rest of Asia-Pacific

- 5.4.4 Middle East & Africa

- 5.4.4.1 GCC

- 5.4.4.2 South Africa

- 5.4.4.3 Rest of Middle East & Africa

- 5.4.5 South America

- 5.4.5.1 Brazil

- 5.4.5.2 Argentina

- 5.4.5.3 Rest of South America

- 5.4.1 North America

6 Competitive Landscape

- 6.1 Market Share Analysis

- 6.2 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.2.1 Associates of Cape Cod Inc.

- 6.2.2 bioMerieux SA

- 6.2.3 Charles River Laboratories Inc.

- 6.2.4 Ellab A/S

- 6.2.5 GenScript Biotech

- 6.2.6 Lonza Group

- 6.2.7 Merck KGaA

- 6.2.8 Thermo Fisher Scientific Inc.

- 6.2.9 Fujifilm Wako Pure Chemical Corp.

- 6.2.10 WuXi AppTec

- 6.2.11 Eurofins Scientific

- 6.2.12 Microcoat Biotechnologie GmbH

- 6.2.13 Sotera Health (Nelson Labs)

- 6.2.14 Sanquin

- 6.2.15 Seikagaku Corporation

- 6.2.16 Hyglos GmbH

- 6.2.17 Toxin Technology Inc.

- 6.2.18 Labor Dr. Merk & Kollegen

- 6.2.19 Endosafe (Charles River)

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-need Assessment