PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1850281

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1850281

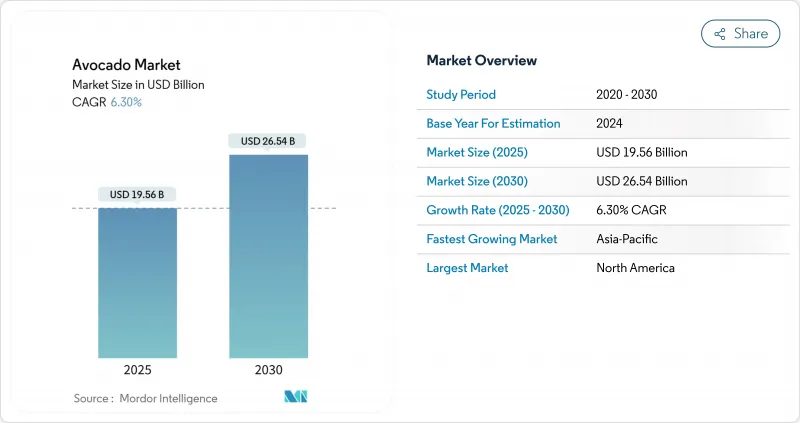

Avocado - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Avocado Market size is estimated at USD 19.56 billion in 2025 and is projected to reach USD 26.54 billion by 2030, at a CAGR of 6.3% during the forecast period (2025-2030).

Robust demand for nutrient-dense foods, wider varietal availability, and controlled-atmosphere logistics are the primary growth catalysts. North America remains the largest consuming bloc, supported by mature cold-chain infrastructure and strong retail penetration, while Asia-Pacific is advancing at the fastest pace as disposable income and health awareness rise. Water-scarcity pressure in Mexico and California, phytosanitary rules governing new supply origins, and price volatility tied to bumper-crop cycles inject measured uncertainty, yet they also open innovation lanes in drought-tolerant cultivars, blockchain-based provenance, and year-round sourcing partnerships. Competitive intensity is fragmenting into two strategic camps-vertically integrated multinationals investing in precision farming technologies and smaller growers targeting premium or organic niches.

Global Avocado Market Trends and Insights

Growing global health-food perception

More than 70% of United States shoppers identify avocados as nutrient-rich, an association that translates into price resilience despite supply swings. Similar sentiment is taking hold in Europe, where German intake climbed 20% in 2023 to nearly 140,000 metric tons. India's consumption expanded from 200 metric tons in 2024 to 4,000 metric tons in 2025 after targeted education programs by Westfalia Fruit. Organic lines are benefiting disproportionately. Mission Produce disclosed that organic sales outpaced conventional volumes two-to-one between 2018 and 2023. The broad health halo keeps the avocado market on a steady premium trajectory across mature and emerging retail channels.

Rising year-round availability via controlled-atmosphere shipping

Reefer containers equipped with low-oxygen, high-humidity controls have reduced hard-green loss ratios by up to 30% on ocean voyages exceeding 30 days. Mission Produce, in partnership with Hazel Technologies, reports that treated cartons retained internal firmness five days longer than untreated fruit in 2025 trials. Guatemala's dual-harvest calendar now fills seasonal gaps between Mexican and Peruvian peaks, stabilizing weekly North American spot prices. Smart packaging with ethylene absorbers and nano-sensor indicators is progressing from pilot to commercial scale, which is anticipated to curb shrinkage and reinforce consumer trust. These logistics gains underpin dependable supply windows, a necessary condition for food-service menu planning and supermarket promotions.

Heightened water-use scrutiny in drought-prone regions

Michoacan communities in 2025 proposed allotting 80% of stream water back to residential uses, leaving only 20% for orchards and prompting grower investment in drip systems and lined reservoirs. California groves require 40-50 inches of annual irrigation, escalating production costs as groundwater pumping fees rise. Satellite-driven soil-moisture models trialed in the Dominican Republic now inform deficit-irrigation plans, saving up to 18% water without yield loss. The European Union and Peru have launched joint biodiversity projects that tie tariff benefits to on-farm water audits, foreshadowing tighter compliance regimes in other trade corridors.

Other drivers and restraints analyzed in the detailed report include:

- Expansion of super-food branding in mainstream retail

- Rapid acreage conversion from citrus to avocado

- Volatile farm-gate prices due to bumper-crop cycles

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

The Hass segment controlled 84.7% of the avocado market share in 2024, and its projected 10.1% CAGR anchors overall avocado market growth through 2030. That dominance arises from consistent skin-darkening cues that simplify ripeness marketing and from supply-chain protocols tuned to Hass physiology. Controlled-atmosphere freight parameters, retail shelf-life calculators, and consumer familiarity all converge to reinforce volume leadership. Lamb Hass and Zutano varieties sit inside the "Others" basket, which appeals to niche culinary uses but remains limited by shorter shelf-life windows and higher shrink rates.

Variety development programs aim to mitigate Hass's vulnerabilities to drought and heat while keeping consumer-accepted flavor profiles intact. UC ANR's Luna UCR cultivar, jointly commercialized with Mission Produce, enters scale trials in 2025 and targets higher yields under warmer growing conditions. Australia's Jala variety produces fruit up to 1.2 kg and exhibits a 10-fold longer post-cut shelf-life, opening a new premium tier for food-service plating. Genomic studies mapping 12 markers tied to flesh firmness and oil content now inform marker-assisted breeding, accelerating advancement cycles and fortifying long-run genetic diversity frontiersin.org. While Hass will continue to underpin the avocado market size for the foreseeable future, specialty cultivars will enhance portfolio resilience as climatic stresses intensify.

The Avocado Market Report is Segmented by Variety (Hass, Fuerte, Bacon, and More) and by Geography (North America, South America, Europe, Asia-Pacific, and More). The Report Includes Production Analysis (Volume), Consumption Analysis (Value and Volume), Export Analysis (Value and Volume), Import Analysis (Value and Volume), and Price Trend Analysis. The Market Forecasts are Provided in Terms of Value (USD) and Volume (Metric Tons).

Geography Analysis

North America retained a 34.5% slice of the avocado market in 2024, buoyed by per-capita consumption of 8.43 pounds in the United States and efficient rail-and-truck links from Mexican packinghouses. USDA green-lighted 15,552.8 metric tons of Guatemalan Hass imports in 2025, equal to 1.1% of the United States supply, to broaden sourcing diversity and mitigate phytosanitary risk. Water scarcity in California and potential tariff actions toward Mexico remain the region's prime supply-side concerns, but investment in ripening centers and private-label expansion continues to secure shelf space for year-round programs. Canadian chains increasingly feature bagged avocados, citing household penetration gains of 7% in 2025.

Asia-Pacific is poised for the fastest growth, with the avocado market size expansion tied to a 9.2% CAGR outlook through 2030. China imported 66,000 metric tons in 2023-overtaking Japan-and relies on Peru for 76% of its arrivals. Australia is negotiating final phytosanitary protocols with Beijing, a shift that could rebalance regional flows once approved. India's leap from 200 metric tons to 4,000 metric tons in one year underscores how consumer education programs and rising middle-class incomes unlock latent demand. Southeast Asia's e-commerce grocery platforms now feature ready-to-eat avocados sourced via Singapore, shortening delivery windows and raising brand awareness.

Europe consumed 850,000 metric tons in 2023, a 9% jump year on year, and remains the second-largest avocado market globally. The Netherlands acts as the gateway, handling more than half of inbound shipments and serving as the top destination for Peruvian exports valued at USD 409 million in 2024. Germany lifted intake by 20%, while Italy advanced 16%, reflecting deepening penetration beyond legacy strongholds such as France. Eastern Europe recorded 20% growth, led by Poland, signaling that catch-up potential persists. EU buyer protocols increasingly reward farms with audited water-management plans, nudging producers toward micro-irrigation and canopy sensor adoption.

- Market Overview

- Market Drivers

- Market Restraints

- Value / Supply-Chain Analysis

- Regulatory Landscape

- Technological Outlook

- PESTLE Analysis

- List of Key Stakeholders

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Growing global health-food perception

- 4.2.2 Rising year-round availability via controlled-atmosphere shipping

- 4.2.3 Expansion of super-food branding in mainstream retail

- 4.2.4 Rapid acreage conversion from citrus to avocado

- 4.2.5 Blockchain-based provenance premiums in wholesale

- 4.2.6 Climate-smart cultivar Research and Development grants

- 4.3 Market Restraints

- 4.3.1 Heightened water-use scrutiny in drought-prone regions

- 4.3.2 Volatile farm-gate prices due to bumper-crop cycles

- 4.3.3 Phytosanitary barriers for exports of Avocado

- 4.3.4 Rising labour costs and shortages in orchards

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 PESTLE Analysis

5 Market Size and Growth Forecasts (Value and Volume)

- 5.1 Variety

- 5.1.1 Hass

- 5.1.2 Fuerte

- 5.1.3 Bacon

- 5.1.4 Others (Lamb Hass, Zutano, etc.)

- 5.2 Geography (Production Analysis (Volume), Consumption Analysis (Volume and Value), Import Analysis (Volume and Value), Export Analysis (Volume and Value), and Price Trend Analysis)

- 5.2.1 North America

- 5.2.1.1 United States

- 5.2.1.2 Mexico

- 5.2.2 South America

- 5.2.2.1 Brazil

- 5.2.2.2 Chile

- 5.2.2.3 Peru

- 5.2.3 Europe

- 5.2.3.1 Spain

- 5.2.3.2 Netherlands

- 5.2.3.3 Russia

- 5.2.4 Asia-Pacific

- 5.2.4.1 China

- 5.2.4.2 Japan

- 5.2.4.3 South Korea

- 5.2.5 Middle East

- 5.2.5.1 UAE

- 5.2.5.2 Saudi Arabia

- 5.2.6 Africa

- 5.2.6.1 South Africa

- 5.2.6.2 Kenya

- 5.2.1 North America

6 Competitive Landscape

- 6.1 List of Key Stakeholders

- 6.1.1 Calavo Growers, Inc.

- 6.1.2 Mission Produce, Inc.

- 6.1.3 Westfalia Fruit

- 6.1.4 Camposol

- 6.1.5 Del Rey Avocado Co.

- 6.1.6 Henry Avocado Corporation

- 6.1.7 Nature's Pride

- 6.1.8 Cartama

- 6.1.9 The Avolution

- 6.1.10 Shanghai Supafresh Trading Co., Ltd.

- 6.1.11 Kakuzi

- 6.1.12 Abacate International

- 6.1.13 NutreeFarm Agricultural Company

- 6.1.14 Fresca Group Limited (The Avocado Company)

- 6.1.15 GreenFruit Avocados

7 Market Opportunities and Future Outlook