PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1850284

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1850284

Barley - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

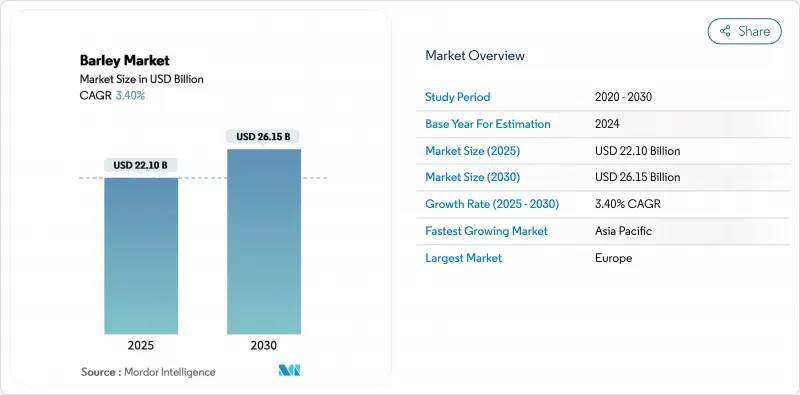

The Barley Market size is estimated at USD 22.10 billion in 2025 and is anticipated to reach USD 26.15 billion by 2030, at a CAGR of 3.4% during the forecast period.

The barley market growth is driven by consistent demand from brewing, increased usage in animal feed, and growing demand for beta-glucan-fortified functional foods. Changes in global trade patterns have emerged as Russia addresses supply gaps from Ukraine, while the European Union remains the leading exporter. The brewing industry's demand for premium malting barley varieties and government support for sustainable farming practices encourage varietal development. The adoption of precision agriculture techniques helps maintain yields despite weather uncertainties. Multiple end-use applications and ongoing research and development activities provide stability to the barley market.

Global Barley Market Trends and Insights

Growing demand from brewing industry

Malting barley commands a premium of up to 20% over feed-grade barley, reflecting craft brewers' emphasis on quality ingredients. While Canada's overall beer consumption decreased by 2.8% in 2023, the growth in craft and non-alcoholic beer segments maintained steady malt demand. Brewers' sustainability commitments enhance the value of barley grown using regenerative practices. Heineken plans to expand its program to incorporate 500 farmers by 2025, with further expansion to 1,000 farmers and 100,000 hectares by 2026. The market's long-term expansion is supported by sustainable farming methods and the development of drought-resistant barley varieties.

Rising usage in animal feed

Barley's ability to withstand drought conditions appeals to feed manufacturers in arid regions. Saudi Arabia aims to increase imports by 10% to reach 3.3 million metric tons in the Marketing Year (MY) 2025-2026. The UAE maintains steady demand at 360,000 metric tons, with Russia supplying 67% under zero-tariff agreements. The grain's high fiber content and digestibility support precision-feeding strategies that reduce livestock emissions.

Volatile commodity price cycles

Global grain prices fluctuate by 15-20% due to drought conditions and geopolitical conflicts affecting supply. A 3% reduction in harvested area typically results in a 12% price increase. While Russian grain exports increased significantly, Ukrainian exports declined, leading the EU to consider implementing tariffs on Russian grain. The involvement of financial investors in grain markets intensifies price volatility, making contract negotiations and risk hedging more challenging.

Other drivers and restraints analyzed in the detailed report include:

- Government incentives for climate-resilient cereals

- Genome-edited hull-less barley commercialization

- Climate-change-driven water scarcity

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Feed barley accounts for 51% of total market volume in 2024, maintaining its position as a core component in global feed rations and providing stable demand during market fluctuations. The expansion of livestock production in the Asia-Pacific and the Middle East regions establishes sustained demand for barley. The specialty and functional barley segment grows at 7.80% CAGR, exceeding the overall market growth rate, as food manufacturers increase beta-glucan content for health benefits. Research demonstrates that replacing 20% of wheat flour with barley flour increases soluble fiber content while maintaining product texture, enabling bakeries to develop healthier product lines. The malt barley segment maintains steady performance, as brewing quality requirements limit rapid substitution, while European supply normalization returns premiums to historical levels. The development of genome-edited hull-less varieties with increased beta-glucan content demonstrates how health-oriented innovation supports volume growth. These market dynamics indicate that functional attributes, rather than production volume, determine pricing power in the barley market.

Current genetic improvement programs enhance grain consistency and enzyme characteristics, creating opportunities in craft and low-alcohol brewing segments. Feed manufacturers diversify their ingredient compositions to reduce dependency on maize price fluctuations, providing indirect support for baseline barley demand. The development of low-input varieties may increase the market position of premium barley types by combining environmental benefits with nutritional advantages as environmental regulations increase. The market size for specialty barley categories shows significant growth potential, while conventional feed varieties maintain their essential role in market stability. The combination of product development and agricultural adaptability supports value creation in the barley market.

The Barley Market Report is Segmented by Type (Feed Barley and More), by End User (Animal Feed and More), by Nature (Conventional and Organic), and by Geography (North America, Europe, Asia-Pacific, and More). The Report Includes Production Analysis, Consumption Analysis, Export Analysis, Import Analysis, and Price Trend Analysis. The Market Forecasts are Provided in Terms of Value (USD) and Volume (Metric Tons).

Geography Analysis

Europe maintains a 34% share of global barley supplies, supported by established infrastructure. The region's export dynamics are influenced by potential Russian grain tariffs and duty-free access policies for Ukrainian crops. European barley producers are implementing regenerative agriculture programs in response to sustainability requirements.

The Asia-Pacific barley market is growing at 5.9% annually. This growth is driven by increased premium beer consumption in China and Southeast Asia, while livestock sectors adopt barley as a feed grain due to its fiber content and drought resistance. Australia's production recovery improves regional supply, though future growth requires addressing water scarcity and developing gene-edited varieties for marginal growing areas.

North America maintains its position as the global quality malt standard despite reduced cultivation area. Direct contracts between craft brewers and farmers help maintain premium prices. The USDA's climate-smart programs support the transition to traceable, low-carbon grain production. The current development of winter-hardy and versatile varieties enables the region to serve both brewing and functional food markets.

- Market Overview

- Market Drivers

- Market Restraints

- Value/Supply-Chain Analysis

- Regulatory Landscape

- Technological Outlook

- PESTLE Analysis

- List of Key Stakeholders

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Growing demand from brewing industry

- 4.2.2 Rising usage in animal feed

- 4.2.3 Expanding craft-beer culture in emerging economies

- 4.2.4 Government incentives for climate-resilient cereals

- 4.2.5 Genome-edited hull-less barley commercialization

- 4.2.6 Rising demand for beta-glucan fortified functional foods

- 4.3 Market Restraints

- 4.3.1 Volatile commodity price cycles

- 4.3.2 Agronomic challenges (soil salinity, pests, lodging)

- 4.3.3 Competition from alternative gluten-free grains

- 4.3.4 Climate-change-driven water scarcity in key regions

- 4.4 Value/Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 PESTLE Analysis

5 Market Size and Growth Forecasts (Value and Volume)

- 5.1 By Type (Value)

- 5.1.1 Feed Barley

- 5.1.2 Malt Barley

- 5.1.3 Food Barley

- 5.1.4 Specialty and Functional Barley

- 5.2 By End User (Value)

- 5.2.1 Brewing and Distilling

- 5.2.2 Animal Feed

- 5.2.3 Food and Beverage

- 5.2.4 Industrial and Biofuels

- 5.2.5 Seed

- 5.3 By Nature (Value)

- 5.3.1 Conventional

- 5.3.2 Organic

- 5.4 By Geography (Production Analysis (Volume), Consumption Analysis (Volume and Value), Import Analysis (Volume and Value), Export Analysis (Volume and Value), and Price Trend Analysis)

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 France

- 5.4.2.3 Russia

- 5.4.2.4 Spain

- 5.4.2.5 Ukraine

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 Australia

- 5.4.3.3 India

- 5.4.3.4 Pakistan

- 5.4.3.5 New Zealand

- 5.4.3.6 Japan

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.5 Middle East

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 Turkey

- 5.4.6 Africa

- 5.4.6.1 Morocco

- 5.4.6.2 Ethiopia

- 5.4.6.3 South Africa

- 5.4.1 North America

6 Competitive Landscape

- 6.1 List of Key Stakeholders

- 6.1.1 Cargill Inc

- 6.1.2 Archer Daniels Midland Co.

- 6.1.3 Sunrise Foods International (ITC Limited)

- 6.1.4 Olam International

- 6.1.5 Louis Dreyfus Company

- 6.1.6 The Scoular Company

- 6.1.7 Viterra Ltd. (Bunge SA)

- 6.1.8 Compac S.A.

- 6.1.9 Midstar

- 6.1.10 Savaliya Agri Commodity Export Pvt. Ltd.

- 6.1.11 Pramoda Exim Corporation

- 6.1.12 Prima K

- 6.1.13 Berium Group

- 6.1.14 Yuvaraju Agro Impex.

- 6.1.15 Baghel Agro Industries

7 Market Opportunities and Future Outlook