PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1850287

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1850287

Spark Plasma Sintering - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

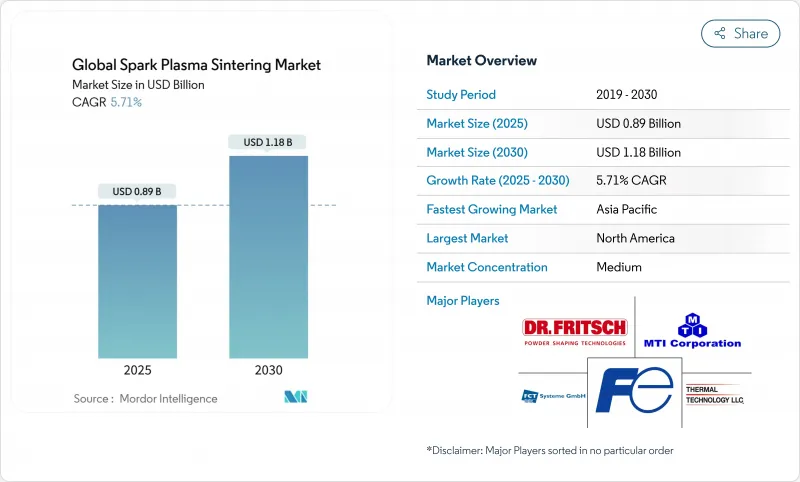

The spark plasma sintering market size is estimated at USD 0.89 billion in 2025 and is projected to reach USD 1.18 billion by 2030, registering a 5.71% CAGR.

Demand is fuelled by manufacturers combining rapid-heating sintering physics with edge-ready sensors, on-board AI chips, and contextual analytics that continually refine process parameters. Wider adoption in semiconductor back-end packaging, precision consumer electronics, and electrified vehicle components underscores how the technology supports tighter tolerances, lower scrap, and shorter production cycles. Equipment vendors now embed neural processing units that run predictive algorithms locally, while 5G links tie scattered lines into unified control hubs. At the same time, government incentives for domestic chip fabrication and clean-tech materials keep capital flowing into new installations, even as labour shortages push factories toward deeper automation.

Global Spark Plasma Sintering Market Trends and Insights

Rise in Integrated IoT Offerings

Manufacturers now embed miniature thermocouples, pressure cells, and densification sensors directly inside die sets, feeding millisecond data into edge gateways that analyse heating ramps and hold times. This closed-loop feedback lowers energy use and improves part density without human intervention. Predictive maintenance models built on sensor history flag anomalies, such as abnormal electrode wear hours before failure, avoid unplanned downtime. Wider deployment of chip-level encryption within sensor modules eases IT concerns about opening production networks to external analytics engines. The Manufacturing Institute reports that most executives see IoT as a core pillar of competitiveness, and edge computing now lets those devices crunch data locally, cutting latency for real-time control.

Integration of AI in Mobile and Edge Apps

Tablet dashboards running lightweight vision models scan sintered parts for micro-cracks that escape optical comparators, while voice-driven assistants suggest temperature offsets based on live densification curves. AI agents inside controllers autonomously fine-tune pulse width and pressure as soon as resistance spikes, maintaining uniform grain growth. Because inference happens on-board NPUs, remote plants keep full functionality even if cloud links drop. LTIMindtree observes manufacturers pivoting toward agentic AI that governs both documentation and design iterations, letting engineers iterate new material recipes in hours rather than weeks.

Computational Complexities

Real-time finite-element solvers and adaptive controllers running on embedded GPUs elevate the processing burden well beyond classic PLCs. Many midsized job shops lack the IT talent to orchestrate containerized microservices that run tuning algorithms, forcing them to outsource to managed edge providers. NetSuite identifies this skills gap as a top challenge, with firms modernizing ERP stacks to harness machine data without coding from scratch. Until turnkey platforms mature, complexity tempers adoption speed.

Other drivers and restraints analyzed in the detailed report include:

- Proliferation of 5G-Enabled Smart Devices

- Contextual-Ads ROI Surge in Retail Media

- OEM Demand for In-Vehicle Emotion Sensing

- OT-Cyber Convergence in Industry 4.0 Lines

- Data-Privacy Regulations Tightening

- Edge-AI Silicon Supply Bottlenecks

- Context Drift Undermining ML Model Accuracy

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Software captured 46% of 2024 revenue because contextual analytics engines interpret multivariate sensor streams and prescribe energy-efficient recipes. The spark plasma sintering market relies on middleware to connect flagship furnaces with MES and ERP suites, allowing synchronized lot tracking. AI chips/NPUs are slated to grow at a 23.4% CAGR, reflecting demand for edge inference that keeps feedback loops under 50 milliseconds. Hardware sensors continue to expand because each new furnace ships with denser instrumentation footprints. Managed services teams offer subscription-based monitoring so smaller plants can benefit from data science without hiring specialists. Generative AI modules document process adjustments and auto-populate quality reports, further widening the software's value proposition.

Secondarily, services contribute through integration, training, and lifecycle support. Providers bundle digital twin templates that mirror chamber thermodynamics based on alloy type, reducing trial cycles during product launch. Projects that once ran for months now close in weeks as engineers import best-practice sintering curves from shared libraries. This collective learning adds momentum to software adoption, ensuring recurring upgrades add features such as anomaly segmentation and voice-activated dashboards.

Device manufacturers held 37.2% share in 2024 by shipping turnkey presses pre-loaded with embedded analytics. Their expertise in pulse generation and electrode wear patterns positions them to fuse mechanical design with compute modules. The spark plasma sintering market now sees these OEMs partnering with sensor fabricators and cloud vendors, creating end-to-end stacks that shorten commissioning time. Meanwhile, online/web vendors grow 21.1% annually by hosting recipe repositories and brokering idle furnace capacity-effectively creating "manufacturing clouds" that match demand and supply.

Mobile network operators join consortia to guarantee service-level agreements for sub-10 millisecond latency needed in synchronous heating waves across distributed campuses. The ecosystem approach means competitive dynamics revolve around interoperability; vendors publish open APIs so third-party apps can call real-time data streams, spurring a marketplace of micro-services for niche tasks such as electrode life prediction or vacuum seal diagnostics.

Spark Plasma Sintering Market is Segmented by Component (Hardware, Software and Services), Vendor Type (Device Manufacturers, Mobile Network Operators and More), Context Type (Computing Context, User Context), Network Type (Wireless Cellular, WLAN /Wi-Fi and PAN /BLE), End-User Industry (BFSI, Consumer Electronics and More) and by Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America owns 34% of 2024 revenue thanks to a mature semiconductor ecosystem, strong university-industry collaboration, and federal incentives such as the CHIPS Act's USD 39 billion fund. Plants in Arizona, Texas, and New York expand back-end packaging lines, generating sustained demand for pulse-current presses capable of joining metal-ceramic interposers. Canada's push toward a low-carbon industry dovetails with sintering's shorter cycle times and lower energy footprint. Mexico's rising electronics assembly sector sources sintered feedthroughs and heat spreaders domestically, shortening supply chains for near-shoring OEMs.

Asia-Pacific is on track for an 18.5% CAGR, driven by China's manufacturing automation push, Japan's heritage in powder metallurgy, and South Korea's memory-chip capacity race. State-backed funds channel billions into smart-factory retrofits that bundle next-gen sintering. India's Production Linked Incentive scheme for electronics spurs greenfield fabs incorporating fast cycle sintering for power devices. Taiwan's OSAT players install new presses to produce advanced substrates, reinforcing regional leadership.

Europe stresses sustainability and worker safety, encouraging closed-loop furnaces that reclaim off-gas and minimize particulate emissions. Germany's Industry 4.0 framework speeds adoption of connected presses with open OPC-UA interfaces. France exploits the technology for lightweight aerospace brackets, and Italy for super-alloy turbine disks. In the Middle East and Africa, budding industrial parks in Saudi Arabia and the UAE adopt sintering for additive-manufactured tooling, while South Africa explores localized production of mining wear parts.

- IBM Corporation

- Microsoft Corporation

- Cisco Systems Inc.

- Google LLC

- Oracle Corporation

- Amazon Web Services Inc.

- Verizon Communications Inc.

- Samsung Electronics Co. Ltd

- Intel Corporation

- Apple Inc.

- NVIDIA Corporation

- Qualcomm Technologies Inc.

- ATandT Inc.

- Huawei Technologies Co. Ltd

- Baidu Inc.

- Infosys Ltd.

- Ericsson AB

- Telefonica, S.A.

- Bosch Sensortec GmbH

- STMicroelectronics N.V.

- Arm Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Mainstream Rise in integrated IoT offerings

- 4.2.2 Mainstream Integration of AI in mobile and edge apps

- 4.2.3 Mainstream Proliferation of 5G-enabled smart devices

- 4.2.4 Under-the-Radar Contextual-ads ROI surge in retail media

- 4.2.5 Under-the-Radar OEM demand for in-vehicle emotion sensing

- 4.2.6 Under-the-Radar OT-cyber convergence in Industry 4.0 lines

- 4.3 Market Restraints

- 4.3.1 Mainstream Computational complexities

- 4.3.2 Mainstream Data-privacy regulations tightening

- 4.3.3 Under-the-Radar Edge-AI silicon supply bottlenecks

- 4.3.4 Under-the-Radar Context drift undermining ML model accuracy

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers/Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitute Products

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Component

- 5.1.1 Hardware

- 5.1.1.1 Sensors and MCUs

- 5.1.1.2 AI Chips/NPUs

- 5.1.2 Software

- 5.1.2.1 SDKs and Middleware

- 5.1.2.2 Contextual Analytics Platforms

- 5.1.3 Services

- 5.1.3.1 Managed Edge Services

- 5.1.3.2 Professional Services

- 5.1.1 Hardware

- 5.2 By Vendor Type

- 5.2.1 Device Manufacturers

- 5.2.2 Mobile Network Operators

- 5.2.3 Online, Web and Social Networking Vendors

- 5.3 By Network Type

- 5.3.1 Wireless Cellular

- 5.3.2 WLAN /Wi-Fi

- 5.3.3 PAN /BLE

- 5.4 By End-user Industry

- 5.4.1 BFSI

- 5.4.2 Consumer Electronics

- 5.4.3 Media and Entertainment

- 5.4.4 Automotive

- 5.4.5 Healthcare

- 5.4.6 Telecommunications

- 5.4.7 Logistics and Transportation

- 5.4.8 Other Industries

- 5.5 By Context Type

- 5.5.1 Computing Context

- 5.5.2 User Context

- 5.5.3 Physical Context

- 5.5.4 Time Context

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Mexico

- 5.6.2 South America

- 5.6.2.1 Brazil

- 5.6.2.2 Argentina

- 5.6.2.3 Rest of South America

- 5.6.3 Europe

- 5.6.3.1 United Kingdom

- 5.6.3.2 Germany

- 5.6.3.3 France

- 5.6.3.4 Italy

- 5.6.3.5 Rest of Europe

- 5.6.4 Asia-Pacific

- 5.6.4.1 China

- 5.6.4.2 Japan

- 5.6.4.3 India

- 5.6.4.4 South Korea

- 5.6.4.5 Rest of Asia-Pacific

- 5.6.5 Middle East and Africa

- 5.6.5.1 Middle East

- 5.6.5.1.1 Israel

- 5.6.5.1.2 Saudi Arabia

- 5.6.5.1.3 United Arab Emirates

- 5.6.5.1.4 Turkey

- 5.6.5.1.5 Rest of Middle East

- 5.6.5.2 Africa

- 5.6.5.2.1 South Africa

- 5.6.5.2.2 Egypt

- 5.6.5.2.3 Rest of Africa

- 5.6.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 IBM Corporation

- 6.4.2 Microsoft Corporation

- 6.4.3 Cisco Systems Inc.

- 6.4.4 Google LLC

- 6.4.5 Oracle Corporation

- 6.4.6 Amazon Web Services Inc.

- 6.4.7 Verizon Communications Inc.

- 6.4.8 Samsung Electronics Co. Ltd

- 6.4.9 Intel Corporation

- 6.4.10 Apple Inc.

- 6.4.11 NVIDIA Corporation

- 6.4.12 Qualcomm Technologies Inc.

- 6.4.13 ATandT Inc.

- 6.4.14 Huawei Technologies Co. Ltd

- 6.4.15 Baidu Inc.

- 6.4.16 Infosys Ltd.

- 6.4.17 Ericsson AB

- 6.4.18 Telefonica, S.A.

- 6.4.19 Bosch Sensortec GmbH

- 6.4.20 STMicroelectronics N.V.

- 6.4.21 Arm Ltd.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment