PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1850288

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1850288

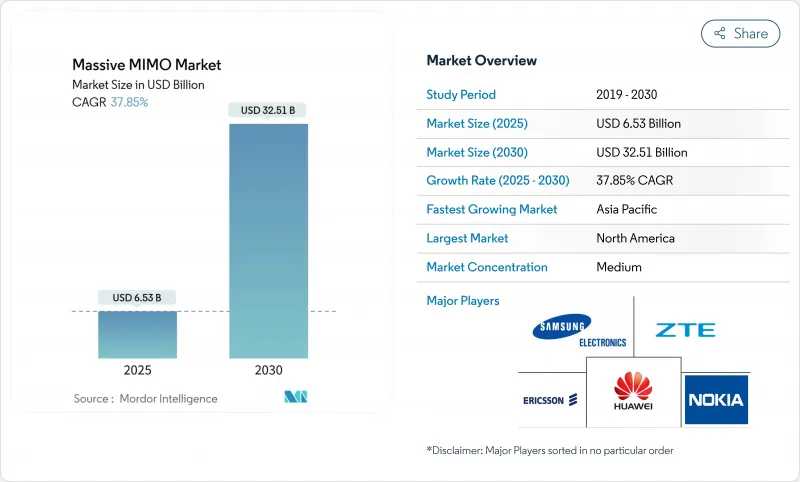

Massive MIMO - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The massive MIMO market stood at USD 6.53 billion in 2025 and is projected to expand to USD 32.51 billion by 2030, reflecting a vigorous 37.85% CAGR that confirms the technology's strategic importance for 5G roll-outs.Steady operator migration from broad-coverage roll-outs toward capacity-oriented urban deployments is amplifying demand, because beamforming increases spectral efficiency and lifts average revenue per user.

The massive MIMO market receives additional momentum from an installed base headed toward 8.3 billion global 5G subscriptions by 2029, greater adoption of private 5G networks, and policy support for Open RAN architectures that encourage multi-vendor ecosystems. Hardware vendors are also moving to higher-order 128T128R and 512T512R arrays, which multiply throughput per site, while operators deploy AI-native energy-saving software to meet net-zero goals. Emerging industrial IoT and fixed-wireless-access use cases add incremental site demand, ensuring that the technology remains the backbone of network densification strategies over the forecast period.

Global Massive MIMO Market Trends and Insights

Surging Mobile-Data Traffic and Device Density

China expects mobile data traffic to quadruple by 2030, creating density levels that legacy cell-splitting strategies cannot manage cost-effectively. Fixed-wireless-access lines are forecast to climb from 160 million in 2024 to 350 million by 2030, with 80% serviced by 5 G-Advanced networks anchored by massive MIMO radio arrays, ZTE. Industrial IoT adds further load; China targets 10,000 wireless-enabled factories by 2027, each placing tight performance constraints on network capacity. As 5G penetration exceeds 75.9% in leading markets, congestion at the cell edge intensifies, making beamforming vital for sustaining a consistent user experience. The massive MIMO market, therefore, aligns directly with traffic growth, positioning operators to meet throughput needs without proportional site expansion.

Rapid Global Roll-out of 5G NR (Sub-6 GHz and mmWave)

Standalone 5G subscriptions reached 1.2 billion worldwide by end-2024 and are forecast to touch 3.6 billion by 2030, according to Ericsson. China plans to add 4.5 million new 5G base stations by 2025, mandating massive MIMO as the default antenna system for fresh sites. India achieved nationwide 5G coverage by October 2024, accelerating demand for high-order arrays during back-haul upgrades. mmWave economics improved in 2025 when Ericsson, NBN Co, and Qualcomm demonstrated 14 km gigabit links that rely on advanced beamforming, according to Ericsson. Private 5G saw over 40% RAN revenue growth in 2024, and interference-managed radios are indispensable for guaranteed service-level agreements.

High Unit Cost and Power-Consumption of RF Front-end

China controls 98% of gallium nitride wafer output, raising supply-security and pricing concerns for RF front-end modules essential in high-order arrays. Component maker Qorvo recorded a 12.4% sales decline in Q3 2025 as handset demand softened, hinting that vendor margins already feel pressure from cost-push inflation. AI-enabled power-saving algorithms can trim radio energy draw by up to 80%, but they require additional silicon, raising bill-of-materials until volume scales. The U.S. Defense Department has funded domestic gallium processing pilots, yet commercial volumes will lag beyond 2027, leaving operators exposed to currency swings and export controls. These factors restrain near-term adoption in cost-sensitive geographies and encourage deferred upgrades.

Other drivers and restraints analyzed in the detailed report include:

- Operator CAPEX Savings via Beamforming Efficiency

- Open RAN Catalysts Enabling Multi-vendor Massive MIMO

- Complex Site-level Deployment and Maintenance

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

5G NR Sub-6 GHz technology commanded 58% revenue in 2024 because its propagation traits support wide-area coverage and indoor penetration, making it the default option for early 5G launches. The segment benefited from harmonized mid-band allocations across several regions, which streamlined device ecosystems and reduced radio costs. In contrast, 5G NR mmWave occupies only premium use cases today, but its 39.8% CAGR indicates accelerating take-up in fixed wireless access and stadium hotspots. The massive MIMO market size for mmWave is projected to widen significantly as operators replicate the 14 km rural link success in Australia, proving high-frequency economics for non-urban broadband.

The Sub-6 layer nevertheless remains essential for control-plane anchoring, giving carriers a balanced spectrum strategy that marries coverage and capacity. Reliance Jio's AirFiber trials show mmWave FWA cutting last-mile rollout times compared with fiber. Japan's private 5G licensing landscape still favors Sub-6, but early mmWave projects in warehouses hint at forthcoming diversification. Once device costs fall and propagation enhancements mature under 5G-Advanced, the mmWave share should climb, contributing a rising portion of the massive MIMO market revenue through 2030.

64T64R panels held 39% volume share in 2024 by balancing high cell-edge throughput with manageable weight and power draw. Operators favor this format when upgrading macro sites in dense metros because installation requires minimal structural reinforcement. The 128T128R and larger class will register a 41.2% CAGR as vendors improve heat-sink efficiency and as AI tools mitigate beam calibration overhead. Research at Georgia Tech demonstrates receiver architectures that support substantial element counts across 27-41 GHz bands, signaling practical viability for extremely large-scale arrays.

As applications migrate toward XR and industrial robotics, demand for consistent multi-gigabit throughput climbs, prompting carriers to test 256-element prototypes. The massive MIMO market size for 128T128R systems is projected to reach USD 11.9 billion by 2030, equal to 36.6% of overall sales. Qualcomm's 4,096-element Giga-MIMO concept underlines the runway for step-function capacity gains, although commercial adoption is likely after 2028 when power-amplifier efficiency improves. Near-term, 32T32R arrays still serve rural and cost-sensitive deployments where tower loading limits preclude heavier panels, preserving a multi-tier market structure.

Massive MINO Market Report is Segmented by Technology (LTE (4G), 5G NR Sub-6 GHz, and More), Antenna Type (16T16R, 32T32R, and More), Deployment Type (Centralised (C-RAN), Distributed RAN, and More), Architecture (Time-Division Duplex (TDD), Frequency-Division Duplex (FDD), and More), End-User Application (Mobile Network Operators, Enterprises and Private Networks, and More), and Geography.

Geography Analysis

North America generated 40% of global revenue in 2024 on the back of aggressive C-band roll-outs, enterprise FWA adoption, and favorable policy toward Open RAN. Verizon plans USD 17.5-18.5 billion in 2025 capital outlays, a sizable share earmarked for 64T64R sector upgrades that keep per-subscriber throughput competitive. Canada's TELUS is partnering with Samsung to deploy the first nationwide virtualized RAN, underscoring regional appetite for software-defined radios. FCC reforms around 70/80/90 GHz backhaul and 37 GHz sharing further broaden mmWave business cases for rural broadband.

Asia Pacific is the fastest-growing territory, forecast at 37.89% CAGR to 2030 as China surpasses 4.4 million 5G sites by March 2025 and commits to 4.5 million additional base stations within the year. India reached nationwide 5G coverage in late 2024, with Reliance Jio responsible for 85% of active cells, creating a sizable procurement funnel for 32T32R and 64T64R radios. Government programs such as Bharat 6G emphasize indigenous R&D, potentially reshaping regional vendor shares. China Unicom's 5G-Advanced coverage across 300 cities by end-2025 further raises antenna order volumes, providing economies of scale that exert downward price pressure globally.

Europe shows measured expansion as operators juggle capital efficiency and regulatory scrutiny over vendor diversification. Samsung and O2 Telefonica activated Germany's first commercial vRAN site with 64T64R radios in 2024, signaling market willingness to test disaggregated stacks. Ericsson and MasOrange demonstrated an open programmable network in Spain, focusing on automation and energy optimization rather than raw capacity. Spectrum auctions in France and Italy favored contiguous 3.4-3.8 GHz blocks, reinforcing TDD dominance. The European massive MIMO market therefore emphasizes performance per watt and supply-chain resilience, supporting gradual but firm growth.

- Samsung Electronics

- Ericsson

- Huawei

- Nokia

- ZTE

- Qualcomm

- Intel

- Texas Instruments

- Qorvo

- NEC

- Fujitsu

- CommScope

- Airspan Networks

- Mavenir

- Parallel Wireless

- Keysight Technologies

- Rohde and Schwarz

- Viavi Solutions

- Analog Devices

- Renesas

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Surging mobile-data traffic and device density

- 4.2.2 Rapid global roll-out of 5G NR (Sub-6 GHz and mmWave)

- 4.2.3 Operator CAPEX savings via beam-forming efficiency

- 4.2.4 Open-RAN catalysts enabling multi-vendor mMIMO

- 4.2.5 AI-assisted cell-edge beam-optimization

- 4.3 Market Restraints

- 4.3.1 High unit cost and power-consumption of RF front-end

- 4.3.2 Complex site-level deployment and maintenance

- 4.3.3 Semiconductor-grade gallium nitride (GaN) supply risk

- 4.3.4 EMF-exposure and urban footprint opposition

- 4.4 Value Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Technology

- 5.1.1 LTE (4G)

- 5.1.2 5G NR Sub-6 GHz

- 5.1.3 5G NR mmWave

- 5.2 By Antenna Type

- 5.2.1 16T16R

- 5.2.2 32T32R

- 5.2.3 64T64R

- 5.2.4 128T128R and Above

- 5.3 By Deployment Type

- 5.3.1 Centralised (C-RAN)

- 5.3.2 Distributed RAN

- 5.3.3 Open RAN

- 5.4 By Architecture

- 5.4.1 Time-Division Duplex (TDD)

- 5.4.2 Frequency-Division Duplex (FDD)

- 5.4.3 Hybrid Duplex

- 5.5 By End-user Application

- 5.5.1 Mobile Network Operators

- 5.5.2 Enterprises and Private Networks

- 5.5.3 Public Safety and Defence

- 5.5.4 Fixed Wireless Access (FWA)

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Mexico

- 5.6.2 South America

- 5.6.2.1 Brazil

- 5.6.2.2 Rest of South America

- 5.6.3 Europe

- 5.6.3.1 Germany

- 5.6.3.2 United Kingdom

- 5.6.3.3 France

- 5.6.3.4 Russia

- 5.6.3.5 Rest of Europe

- 5.6.4 Asia Pacific

- 5.6.4.1 China

- 5.6.4.2 India

- 5.6.4.3 Japan

- 5.6.4.4 South Korea

- 5.6.4.5 ASEAN

- 5.6.4.6 Rest of Asia Pacific

- 5.6.5 Middle East and Africa

- 5.6.5.1 Middle East

- 5.6.5.1.1 Saudi Arabia

- 5.6.5.1.2 UAE

- 5.6.5.1.3 Turkey

- 5.6.5.1.4 Rest of Middle East

- 5.6.5.2 Africa

- 5.6.5.2.1 South Africa

- 5.6.5.2.2 Nigeria

- 5.6.5.2.3 Rest of Africa

- 5.6.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Samsung Electronics

- 6.4.2 Ericsson

- 6.4.3 Huawei

- 6.4.4 Nokia

- 6.4.5 ZTE

- 6.4.6 Qualcomm

- 6.4.7 Intel

- 6.4.8 Texas Instruments

- 6.4.9 Qorvo

- 6.4.10 NEC

- 6.4.11 Fujitsu

- 6.4.12 CommScope

- 6.4.13 Airspan Networks

- 6.4.14 Mavenir

- 6.4.15 Parallel Wireless

- 6.4.16 Keysight Technologies

- 6.4.17 Rohde and Schwarz

- 6.4.18 Viavi Solutions

- 6.4.19 Analog Devices

- 6.4.20 Renesas

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment