PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1850289

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1850289

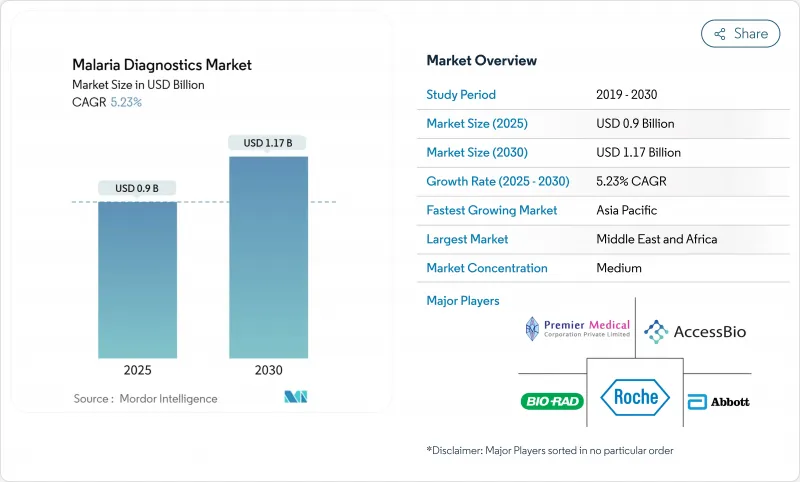

Malaria Diagnostics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The malaria diagnostics market is valued at USD 0.90 billion in 2025 and is forecast to reach USD 1.16 billion by 2030, advancing at a 5.23% CAGR.

Growth is anchored in the persistent global disease burden, the emergence of drug-resistant parasite strains, and the transition toward molecular detection platforms that identify resistance markers and low-density infections with greater accuracy. Funding security from multilateral agencies, regulatory approvals for innovative test formats, and national elimination roadmaps collectively strengthen demand across public-health procurement channels. At the same time, accuracy gaps in legacy rapid diagnostic tests (RDTs) caused by pfhrp2/3 gene deletions are pushing healthcare systems to adopt loop-mediated isothermal amplification (LAMP), polymerase chain reaction (PCR), and emerging non-invasive modalities, signaling a technology refresh cycle that supports the long-term momentum of the malaria diagnostics market. Competitive rivalry remains moderate, yet established firms continue to refresh portfolios through acquisitions and product approvals, while nimble start-ups commercialize point-of-care molecular devices and AI-enhanced image analytics that promise near-laboratory sensitivity outside traditional facilities. Across endemic regions, decentralization of testing to community health posts and diagnostic centres increases throughput, shortens time to treatment, and raises surveillance quality-an essential capability as climate change expands transmission seasons.

Global Malaria Diagnostics Market Trends and Insights

High Disease Burden and Global Prevalence

Malaria continues to place a heavy toll on public health systems, with 263 million cases and 597,000 deaths recorded in 2023, 94% of which occurred in Sub-Saharan Africa. Endemic countries experience slowed economic productivity that motivates ministries of health to prioritize diagnostic delivery networks that can trigger same-day treatment decisions. Governments in Nigeria, Uganda, and the Democratic Republic of the Congo increasingly channel donor funds toward procurement of high-volume test kits, mobile outreach units, and digital case-reporting tools that reinforce surveillance quality. Persistent transmission also forces employers in mining, agriculture, and construction to procure on-site diagnostic capacity to minimize worker absenteeism. Climate variability further widens seasonal windows for mosquito breeding, expanding the geographic footprint of the malaria diagnostics market into previously low-risk zones across the Sahel, East African highlands, and parts of South Asia.

Advancements in Diagnostic Technologies

Field-adapted molecular systems now deliver PCR-level sensitivity without sophisticated laboratories. LAMP assays can detect as few as 0.5 parasites/μL and read results within 40 minutes, supporting mass screening-and-treat campaigns in remote areas. AI-enabled mid-infrared spectroscopy platforms analyze dried blood spots through cloud-based algorithms, differentiating Plasmodium species at varying parasite densities, a capability that reduces misclassification and informs drug selection. Photoacoustic flow cytometry devices such as the Cytophone identify infected red blood cells in vivo with >= 90% sensitivity, eliminating finger-stick procedures and improving patient acceptance. Smartphone-linked microfluidic immunoassays now quantify histidine-rich protein-2 in 15 minutes, enabling immediate therapy in community settings. Continuous miniaturization of optics, batteries, and reagent storage broadens the reach of the malaria diagnostics market to facilities lacking cold chains or grid electricity.

Limited Healthcare Infrastructure in Remote Areas

Just 26% of low- and lower-middle-income nations deploy modern diagnostics, restricting test availability to urban centers and leaving rural populations dependent on clinical symptoms for case confirmation. Power outages, erratic internet, and unreliable refrigeration compromise reagent integrity and data reporting. In Burkina Faso and Senegal, supply-chain studies show RDT consignments frequently exceed 30 °C during transit, shortening shelf life and raising stock-out risks. Remote clinics seldom have biosafety cabinets required for PCR contamination control, translating into higher capital hurdles for molecular adoption. These deficits delay diagnosis, inflate case fatality rates, and cap the growth trajectory of the malaria diagnostics market in the most burdened geographies.

Other drivers and restraints analyzed in the detailed report include:

- Increased Investments from Governments and Global Health Organizations

- Emergence of Drug-Resistant Malaria Strains

- False Negatives and Diagnostic Limitations

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Rapid diagnostic tests held 45.65% of malaria diagnostics market share in 2024, reflecting their affordability, minimal training needs, and ability to confirm infection within 20 minutes in peripheral settings. However, molecular diagnostics are growing fastest at a 6.84% CAGR, propelled by their capacity to detect sub-microscopic parasitemia and resistance markers that RDTs and microscopy miss. The malaria diagnostics market size for molecular platforms is projected to reach USD 381 million by 2030, nearly doubling its 2024 base as loop-mediated isothermal amplification carts, disposable PCR chips, and portable genetic sequencers penetrate donor-funded programs. RDT vendors respond by launching combination antigen tests and heat-stable formats that tolerate 45 °C storage, yet their performance still declines in areas with high pfhrp2 deletions, providing a wedge for molecular adoption. AI-assisted image recognition layered onto smartphone microscopes now counts parasites with 95% concordance to expert microscopists, signaling incremental value upgrades to legacy microscopy.

Molecular test developers emphasize single-use cartridges, lyophilized reagents, and solar-powered analyzers that operate off-grid, narrowing the infrastructure gap that historically confined PCR to reference laboratories. The bCUBE device validated in Cameroon highlights this shift, identifying Plasmodium in capillary blood and mosquito pools on the same platform, a feature attractive to entomological surveillance teams. Venture-capital investment into non-invasive modalities, including breath-based volatile organic compound sensors, further supplies innovation pathways that may erode RDT dominance post-2030. Consequently, the malaria diagnostics market exhibits a dual-track profile where RDT volumes sustain broad access while molecular dollar revenues accelerate on higher average selling prices and expanding menu versatility.

The Malaria Diagnostics Market Report is Segmented by Technology (Clinical Diagnostics, Microscopic Diagnostics, Rapid Diagnostic Tests, Molecular Diagnostics, and Other Technologies) End-User (Hospitals, Clinics, Diagnostic Centres, and Community Health Posts), and Geography (North America, Europe, Asia-Pacific, Middle East and Africa, and South America). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

The Middle East & Africa retained 38.82% of malaria diagnostics market share in 2024, reflecting the region's 246 million cases and sustained donor funding. Nigeria alone procured over 100 million RDTs through Global Fund channels, anchoring a robust commodity pipeline that stretches from central warehouses to village health posts. Intensified vaccine deployment in 20 African countries demands high-granularity surveillance capable of detecting breakthrough infections and assessing strain diversity, prompting ministries to purchase species-specific PCR reagents alongside routine HRP-2 tests. Yet logistics hurdles persist; road inaccessibility during rainy seasons and limited cold-chain capacity hamper timely delivery, underscoring the need for heat-stable formats and on-site molecular devices that bypass distant reference labs.

Asia-Pacific stands as the fastest-growing geography, advancing at a 6.26% CAGR to 2030. India contributes 82.5% of Southeast Asian cases and has formalized elimination targets that require district-level data granularity, stimulating procurement of LAMP kits and the recently WHO-prequalified G6PD point-of-care test to support safe P. vivax radical cure. Cross-border surveillance along the Greater Mekong tracks Kelch13 mutations, pressuring national programs to layer resistance genotyping onto routine diagnostic algorithms. Indonesia's archipelagic geography drives investment in drone-delivered test consignments and cloud-based result aggregation, exemplifying how digital infrastructure complements physical commodity distribution in the malaria diagnostics market.

North America and Europe form niche but high-value segments focused on imported case management and blood-donor screening. FDA approval of Roche's cobas Malaria molecular test in 2024 positions nucleic-acid screening as the new standard for transfusion safety, expanding instrument placements across blood banks and military screening facilities. South America remains a smaller share contributor yet adopts targeted elimination strategies; Brazil's Amazon surveillance network integrates satellite mapping with PCR confirmation to pre-empt outbreaks. Collectively, these regional profiles illustrate a convergence toward sensitive diagnostics that support elimination or prevention goals, reinforcing the global relevance of the malaria diagnostics market.

- Abbott Laboratories

- SD Biosensor Inc.

- Access Bio

- Thermo Fisher Scientific

- Bio-Rad Laboratories

- Siemens Healthineers

- Ortho Clinical Diagnostics

- Danaher Corp. (Beckman Coulter)

- Roche

- QIAGEN

- Premier Medical Corporation

- Zephyr Biomedicals

- Advy Chemical

- QuantuMDx

- Human Diagnostics

- Meridian Bioscience

- Mologic (Latrobe)

- Atlas Genetics

- Zeesan Biotech

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 High Disease Burden and Global Prevalence

- 4.2.2 Advancements in Diagnostic Technologies

- 4.2.3 Increased Investments from Governments and Global Health Organizations

- 4.2.4 Rising Awareness and Health Campaigns

- 4.2.5 Emergence of Drug-Resistant Malaria Strains

- 4.3 Market Restraints

- 4.3.1 Limited Healthcare Infrastructure in Remote Areas

- 4.3.2 Lack of Standardization and Regulatory Challenges

- 4.3.3 False Negatives and Diagnostic Limitations

- 4.4 Porter's Five Forces

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitutes

- 4.4.5 Competitive Rivalry

5 Market Size & Growth Forecasts (Value, USD)

- 5.1 By Technology

- 5.1.1 Clinical Diagnostics

- 5.1.2 Microscopic Diagnostics

- 5.1.3 Rapid Diagnostic Tests (RDTs)

- 5.1.4 Molecular Diagnostics

- 5.1.5 Other Technologies

- 5.2 By End-User

- 5.2.1 Hospitals

- 5.2.2 Clinics

- 5.2.3 Diagnostic Centres

- 5.2.4 Community Health Posts

- 5.3 Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Mexico

- 5.3.2 Europe

- 5.3.2.1 Germany

- 5.3.2.2 United Kingdom

- 5.3.2.3 France

- 5.3.2.4 Italy

- 5.3.2.5 Spain

- 5.3.2.6 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 Japan

- 5.3.3.3 India

- 5.3.3.4 South Korea

- 5.3.3.5 Australia

- 5.3.3.6 Rest of Asia-Pacific

- 5.3.4 Middle East and Africa

- 5.3.4.1 GCC

- 5.3.4.2 South Africa

- 5.3.4.3 Rest of Middle East and Africa

- 5.3.5 South America

- 5.3.5.1 Brazil

- 5.3.5.2 Argentina

- 5.3.5.3 Rest of South America

- 5.3.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.3.1 Abbott Laboratories

- 6.3.2 SD Biosensor Inc.

- 6.3.3 Access Bio Inc.

- 6.3.4 Thermo Fisher Scientific

- 6.3.5 Bio-Rad Laboratories

- 6.3.6 Siemens Healthineers

- 6.3.7 Ortho Clinical Diagnostics

- 6.3.8 Danaher Corp. (Beckman Coulter)

- 6.3.9 Roche Diagnostics

- 6.3.10 Qiagen N.V.

- 6.3.11 Premier Medical Corporation

- 6.3.12 Zephyr Biomedicals

- 6.3.13 Advy Chemical

- 6.3.14 QuantuMDx

- 6.3.15 Human Diagnostics

- 6.3.16 Meridian Bioscience

- 6.3.17 Mologic (Latrobe)

- 6.3.18 Atlas Genetics

- 6.3.19 Zeesan Biotech

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-need Assessment