PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1850294

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1850294

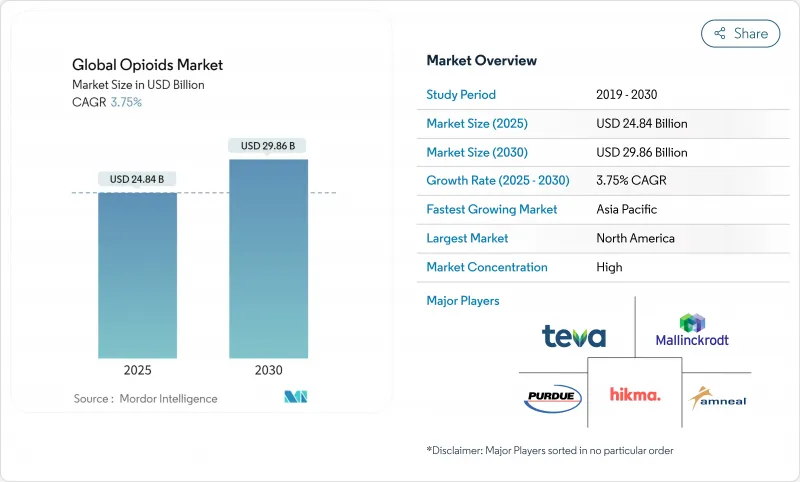

Global Opioids - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The opioids market generated USD 24.84 billion in revenue in 2025 and is forecast to reach USD 29.86 billion by 2030, advancing at a 3.75% CAGR.

The steady expansion of the opioids market reflects a careful equilibrium between persistent clinical need for potent analgesics and strict global controls aimed at curbing diversion and misuse. Demand is anchored in surgical, oncology, and severe chronic pain settings, yet growth is tempered by production-quota cuts, heightened prescription monitoring, and the rising availability of substitute therapies. Hospitals worldwide continue to account for the bulk of opioid consumption, although shortages of injectable morphine, hydromorphone, and fentanyl force providers to ration supply and adopt multimodal regimens. Product innovation is pivoting toward abuse-deterrent formulations and toward first-in-class non-opioid analgesics such as suzetrigine, a NaV1.8 inhibitor that secured FDA approval in 2025, illustrating a parallel trend toward diversification of advanced pain option. Meanwhile, digital therapeutics that guide precise opioid dosing are lowering average prescription sizes and reinforcing payers' preference for data-driven stewardship programs.

Global Opioids Market Trends and Insights

Rising Prevalence of Orthopedic Diseases & Chronic Pain

Population aging, obesity, and sedentary lifestyles are elevating rates of osteoarthritis and back disorders, sustaining demand within the opioids market. More than 50 million U.S. adults live with chronic pain, and opioids remain critical for breakthrough pain when non-pharmacological measures fail. Sophisticated care pathways now pair opioids with adjunctive physiotherapy and cognitive support, yet formulary restrictions and step-therapy mandates prolong time to therapy initiation. Pressure to minimize adverse events is intensifying post-marketing surveillance, spurring investment in tamper-resistant packaging and analytic dashboards that flag aberrant prescribing. As a result, manufacturers that can demonstrate real-world safety benefits are securing preferential reimbursement and sustaining high formulary tier placement across the opioids market.

Inclination Toward Extended-Release Opioid Formulations

Clinicians increasingly choose once- or twice-daily extended-release tablets to stabilize plasma concentrations and reduce nocturnal breakthrough pain. The FDA's evolving ADF pathway has accelerated approvals such as Xtampza ER, which employs microsphere technology to thwart crushing and injection abuse. Extended-release products command premium pricing, lifting unit revenues despite flat prescription volumes. Complex manufacturing processes and rigorous abuse-simulation studies, however, restrict new entrants and create elevated capital requirements, reinforcing the competitive positions of incumbents within the opioids market.

Advent & Legalization of Cannabis as an Alternative

Medical-marijuana legislation in 39 U.S. states and a growing number of European jurisdictions is producing substitution effects, cutting Schedule III opioid prescriptions among Medicaid patients by nearly 30%. Randomized trials report 39.3% reductions in morphine-milligram equivalents when cannabis is combined with opioids, especially for low-potency regimens. Nevertheless, cannabis does not fully replace high-potency opioids required for complex surgery, so its impact is more pronounced in primary care than in specialty hospitals. The trend restrains overall volume growth yet encourages manufacturers to target high-acuity niches in the opioids market.

Other drivers and restraints analyzed in the detailed report include:

- Rising Focus on Abuse-Deterrent Formulations (ADF)

- Growth in Surgical Procedures Requiring Peri-Operative Analgesia

- Prescription-Drug Abuse & Addiction Concerns

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Oxycodone secured 32.17% opioids market share in 2024, reflecting sustained physician preference for both immediate-release and extended-release formats that cover a wide spectrum of acute and chronic indications. Its bioavailability profile, predictable metabolism, and decades of clinical experience reinforce high formulary penetration even as DEA quota cuts and manufacturing outages periodically constrain supply. Multiple suppliers-Alvogen, Amneal, Camber-have reported shortages, prompting hospital purchasing teams to widen sourcing networks and preserve continuity of care. Methadone, with 4.16% share, remains a cornerstone of opioid-substitution treatment; long plasma half-life lowers withdrawal risk, supporting daily observed dosing within treatment programs.

Volatility persists for morphine and hydrocodone because hydrocodone production quotas have fallen 73% since 2015, and morphine shortages arise when manufacturing campaigns are delayed. Meperidine's use continues to erode due to neurotoxic metabolite concerns, while niche agents such as oxymorphone face sustained supply gaps. The emphasis on deterrence, combined with supply-chain diligence, is reshaping competitive tiers within the opioids market.

Strong agonists captured 50.71% opioids market share in 2024, underpinning their role in severe postoperative oncology and trauma care. Their full μ-receptor activation delivers unmatched potency, although risk mitigation requires continuous oxygen saturation monitoring and accelerated tapering protocols. Partial agonists, notably buprenorphine at 4.51% share, continue to expand under relaxation of telemedicine rules permitting e-prescribing without prior in-person visits . This flexibility boosts treatment-program enrollment and stabilizes revenue for specialized manufacturers.

The opioids industry is channeling R&D toward peripheral-selective molecules that minimize central nervous system penetration, thereby maintaining analgesia with reduced respiratory depression. Antagonists such as naloxone remain vital adjuncts across emergency medical services, and novel dual-action molecules that combine agonism with endocytic bias are entering Phase II trials. As regulatory scrutiny tightens, receptor-binding selectivity will increasingly define differentiation strategies and value capture in the opioids market.

The Opioids Market Report Segments the Industry Into by Product Type (Codeine, Fentanyl, Meperidine, and More), by Receptor Binding (Strong Agonist, Mild To Moderate Agonist, and More), by Route of Administration (Oral, Parenteral, and More), by Application (Pain Management, Cold and Cough, and More), by Distribution Channel (Hospital, and More) and by Geography. The Market Sizes and Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America sustained a commanding 42.91% opioids market share in 2024, anchored by advanced surgical capacity, comprehensive insurance coverage, and continued reliance on potent analgesics for high-acuity care. DEA production-quota reductions-68% for oxycodone and 73% for hydrocodone since 2015-tightened supply but did not derail demand, prompting 90% of surveyed pain patients to report access difficulties. U.S. health networks responded with prescription stewardship that cut new postoperative starts by 3.5% and trimmed tablet counts by 41.8%, yet the opioids market size for the region still rose on price-mix uplift as ADF products captured greater formulary share. Canada's centralized monitoring system keeps diversion low, while Mexico balances domestic need with its role as a transit corridor for finished pharmaceuticals.

Europe forms the second-largest regional pool, supported by deep manufacturing capabilities and robust pain-care infrastructure. Germany, France, and the U.K. prioritize ADF procurement, while Italy and Spain increasingly rely on multimodal regimens that reserve opioids for breakthrough episodes. The European Monitoring Centre for Drugs and Drug Addiction coordinates response protocols for synthetic opioid threats such as nitazenes, informing national prescribing guidelines . Brexit-linked customs checks introduced procedural frictions, yet continued mutual-recognition agreements uphold stable medicine flow across the Channel, keeping overall opioids market growth intact.

Asia-Pacific, with 5.43% opioids market share in 2024, is the fastest-advancing geography and is projected to post 5.9% CAGR through 2030. Japan's super-aged demographic drives steady demand for transdermal and oral controlled-release formulations, while Australia refines its real-time prescription-monitoring system to curb doctor shopping. China's reclassification of dextromethorphan to Category II Psychotropic Drugs in July 2024 underscores a broader tightening of controlled-substance rules, though severe-pain protocols remain intact for oncology and trauma centers. India's dual role as manufacturer and consumer positions it to benefit from export expansion even as domestic authorities grapple with balancing patient access against diversion risks. Growing surgical capacity across Indonesia, Thailand, and Vietnam further elevates regional volume, collectively reinforcing long-term growth prospects for the opioids market.

- Abbvie

- Purdue Pharma

- Johnson & Johnson

- Mallinckrodt Pharmaceuticals

- Teva Pharmaceutical Industries

- Hikma Pharmaceuticals

- Endo International

- Pfizer

- Sun Pharmaceuticals Industries

- Vertice Pharma

- Amneal Pharma

- Zyla Life Sciences

- AcelRx Pharma

- Alcaliber

- Collegium Pharmaceutical

- Indivior

- Camurus AB

- Lupin

- Mundipharma

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising prevalence of orthopedic diseases & chronic pain

- 4.2.2 Inclination toward extended-release opioid formulations

- 4.2.3 Rising focus on abuse-deterrent formulations (ADF)

- 4.2.4 Growth in surgical procedures requiring peri-operative analgesia

- 4.2.5 Adoption of opioid-substitution therapy in emerging markets

- 4.2.6 Integration of digital therapeutics for personalized opioid dosing

- 4.3 Market Restraints

- 4.3.1 Advent & legalization of cannabis as an alternative

- 4.3.2 Prescription-drug abuse & addiction concerns

- 4.3.3 Stricter production quotas & regulatory curbs

- 4.3.4 Late-stage non-opioid analgesics (Nav1.7, TRPV1 etc.) reducing future demand

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitute Products

- 4.7.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts

- 5.1 By Product Type

- 5.1.1 Morphine

- 5.1.2 Oxycodone

- 5.1.3 Hydrocodone

- 5.1.4 Meperidine

- 5.1.5 Methadone

- 5.1.6 Others

- 5.2 By Receptor Binding

- 5.2.1 Strong Agonist

- 5.2.2 Mild-to-Moderate Agonist

- 5.2.3 Partial Agonist

- 5.2.4 Antagonist

- 5.3 By Route of Administration

- 5.3.1 Oral

- 5.3.2 Parenteral / IV

- 5.3.3 Transdermal

- 5.3.4 Others (Sublingual, Nasal, etc.)

- 5.4 By Application

- 5.4.1 Pain Management

- 5.4.1.1 Cancer Pain

- 5.4.1.2 Neuropathic Pain

- 5.4.1.3 Post-surgical / Traumatic Pain

- 5.4.1.4 Osteoarthritis Pain

- 5.4.1.5 Other Pain

- 5.4.2 Cold & Cough

- 5.4.3 Diarrhea

- 5.4.4 Opioid-Dependence Therapy

- 5.4.5 Others

- 5.4.1 Pain Management

- 5.5 By Distribution Channel

- 5.5.1 Hospitals

- 5.5.2 Retail Pharmacies

- 5.5.3 Online Pharmacies

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Mexico

- 5.6.2 Europe

- 5.6.2.1 Germany

- 5.6.2.2 United Kingdom

- 5.6.2.3 France

- 5.6.2.4 Italy

- 5.6.2.5 Spain

- 5.6.2.6 Rest of Europe

- 5.6.3 Asia-Pacific

- 5.6.3.1 China

- 5.6.3.2 Japan

- 5.6.3.3 India

- 5.6.3.4 Australia

- 5.6.3.5 South Korea

- 5.6.3.6 Rest of Asia-Pacific

- 5.6.4 Middle East & Africa

- 5.6.4.1 GCC

- 5.6.4.2 South Africa

- 5.6.4.3 Rest of Middle East & Africa

- 5.6.5 South America

- 5.6.5.1 Brazil

- 5.6.5.2 Argentina

- 5.6.5.3 Rest of South America

- 5.6.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global & Market-level Overviews, Core Segments, Financials, Strategic Info, Market Rank/Share, Products & Services, Recent Developments)

- 6.3.1 AbbVie (Allergan)

- 6.3.2 Purdue Pharma

- 6.3.3 Johnson & Johnson (Janssen)

- 6.3.4 Mallinckrodt

- 6.3.5 Teva Pharmaceutical

- 6.3.6 Hikma Pharmaceuticals

- 6.3.7 Endo International

- 6.3.8 Pfizer

- 6.3.9 Sun Pharma

- 6.3.10 Vertice Pharma

- 6.3.11 Amneal Pharma

- 6.3.12 Zyla Life Sciences

- 6.3.13 AcelRx Pharma

- 6.3.14 Alcaliber SA

- 6.3.15 Collegium Pharmaceutical

- 6.3.16 Indivior PLC

- 6.3.17 Camurus AB

- 6.3.18 Lupin Ltd

- 6.3.19 Mundipharma

7 Market Opportunities & Future Outlook

- 7.1 White-Space & Unmet-Need Assessment