PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1850298

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1850298

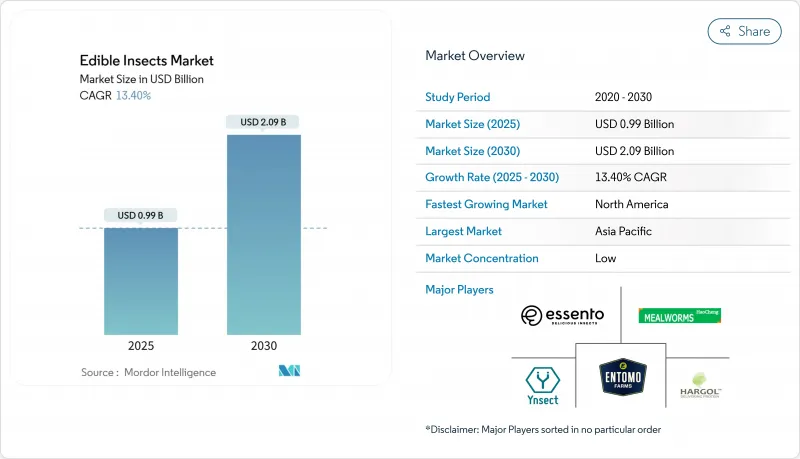

Edible Insects - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The edible insects market is valued at USD 0.99 billion in 2025 and is forecast to reach USD 2.09 billion by 2030 at a 13.4% CAGR during the forecast period.

Growth rests on converging factors, formal approvals of additional insect species in the European Union, rising consumer exposure through food-service channels, technology-driven efficiency gains in automated vertical farms, and expanding demand from premium pet-food brands that need novel proteins. Investors are also increasingly drawn to the sector because carbon-credit revenue can offset production costs, while blockchain traceability platforms reduce supply-chain risk. Regional performance diverges; Asia-Pacific continues to supply almost two-fifths of global volume on the back of long-standing entomophagy traditions, whereas North America is scaling faster due to sustainability-focused consumers and shifting regulatory attitudes. Segment trends mirror these dynamics; beetles dominate current volume, yet crickets are climbing quickest as processors look for neutral-flavored, high-protein inputs.

Global Edible Insects Market Trends and Insights

Sustainability Push and Protein Gap

Mounting pressure to double global protein output by 2050 while curbing land use, water draw, and emissions have elevated insects from novelty items to strategic resources. Such efficiency becomes more valuable as carbon pricing expands. South Africa's compliance market already pays insect farms for verified landfill-diversion credits that can shave up to 25% off operating costs. The minimal space and water requirements further suit regions where arable land is limited, yet protein demand climbs swiftly.

Rising Consumer Acceptance Via Food-Service Trials

Professional kitchens have emerged as laboratories for mainstreaming insect proteins. Menu items that blend insect powders into familiar dishes sidestep neophobia and build positive first experiences. Culinary training at the Insects to Feed the World Conference in Quebec showed that diners who tried chef-prepared cricket risotto later displayed higher purchase intent for retail insect products. Ghent University studies confirm that post-dining exposure, willingness to repurchase rises sharply, highlighting restaurants as gateways for market development.

Stringent Food-Safety and Labeling Regulations

The EU's novel food path demands dossiers that can exceed a high price and take up to two years, a hurdle that sidelines smaller firms European Food Safety Authority. In the United States, producers must secure GRAS status or navigate food-additive petitions while displaying shellfish allergen warnings because of potential cross-reactivity Burdock Group. Post-Brexit transitional rules in the UK lapsed in 2023, forcing the withdrawal of several SKUs, underscoring how regulatory uncertainty can erase shelf presence overnight.

Other drivers and restraints analyzed in the detailed report include:

- Carbon-Credit Monetization for Low-GHG Insect Farming

- Blockchain-Based Traceability Boosting Investor Confidence

- High Capital Expenditure for Automated Vertical Farming Systems

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Beetles held 32.90% of the edible insects market share in 2024, benefiting from mature mealworm farming networks and recent EU approval of UV-treated Tenebrio molitor powder. The segment's scale advantage provides a steady supply for both food and feed processors, anchoring the edible insects market. Industry players point to robust demand from bakery and snack producers that prefer beetle powders for their mild flavor and pale color.

Crickets, while smaller in the present volume, are advancing at a 16.30% CAGR to 2030, the fastest rate within the edible insects market. Growth is tied to high protein density and favorable amino-acid profiles, making crickets attractive for sports-nutrition blends and functional beverages. Marketing efforts emphasize the species' neutral taste and versatility in extruded snacks, which helps ease consumer hesitation.

The Edible Insects Market Report is Segmented by Insect Type (Beetles, Caterpillars, Crickets and Grasshoppers (Orthoptera), and More), Product Type (Whole Insects and Ingredient Type), Distribution Channel (Online and Offline), and Geography (North America, Europe, Asia-Pacific, South America, Middle East, and Africa). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific generated 38.80% of global revenue in 2024, anchored by deep-rooted entomophagy traditions and cost-effective farming clusters. China's large domestic demand offers scale, but urban dietary westernization tempers uptake. India's insect producers are gaining traction in processed segments after consumer studies showed a higher willingness to try powders than whole forms. Australia's regulators have cleared mealworms and crickets, spurring local startups to pilot snack lines that appeal to sustainability-minded millennials.

North America is the fastest-expanding region, with a 13.90% CAGR projected through 2030. Forty-plus commercial farms operate across the United States and Canada, yet output lags local demand, prompting feed manufacturers to import powders, which elevates landed costs. Regulatory clarity is improving, and the Association of American Feed Control Officials approved mealworm proteins for dog food, opening high-volume channels. California and Ontario have each set up state-backed grants that co-fund automation equipment, reducing capital hurdles for early adopters.

Europe holds advanced regulatory mechanisms and research depth. Germany's public-private Bioeconomy Cluster is trialing circular-economy models pairing brewery by-products with insect rearing, while French retailers stock chilled insect burgers in over 350 outlets. Post-Brexit, UK producers must navigate domestic authorization pathways that currently recognize only four species, a bottleneck that has slowed product launches. However, investor appetite remains high, evidenced by several figures in 2025. Adoption rates also vary as Scandinavian consumers report higher familiarity and acceptance scores than their southern European counterparts, guiding differentiated marketing tactics.

The Middle East and Africa make up a smaller, yet strategically vital, share of the edible insects market. Mexico leverages cultural staples such as chapulines to supply tourism-driven demand, and regional brands eye US Hispanic markets. In sub-Saharan Africa, BSF projects aligned with food-waste reduction plans qualify for climate-finance instruments, accelerating smallholder participation.

- JR Unique Foods Limited

- Entomo Farms

- Aspire Food Group

- Hargol FoodTech

- Nutribug Ltd.

- Entosense, LLC

- Micronutris

- Essento

- Beta Hatch

- HiProMine

- Innovafeed

- Protix

- Ynsect

- Powder Bugs (Thailand) Co., Ltd.

- HaoCheng Mealworms Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Sustainability Push and Protein Gap

- 4.2.2 Rising Consumer Acceptance via Food-Service Trials

- 4.2.3 Favorable European Union Novel-Food Approvals Pipeline

- 4.2.4 Carbon-Credit Monetization for Low-GHG Insect Farming

- 4.2.5 Demand from Premium Pet-Food Brands for Novel Proteins

- 4.2.6 Blockchain-Based Traceability Boosting Investor Confidence

- 4.3 Market Restraints

- 4.3.1 Stringent Food-Safety and Labeling Regulations

- 4.3.2 Allergenicity and Cross-Reactivity Concerns

- 4.3.3 High Capital Expenditure for Automated Vertical Farming Systems

- 4.3.4 Limited Shelf-life Knowledge for Unprocessed Insects

- 4.4 Regulatory Landscape

- 4.5 Technological Outlook

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Bargaining Power of Suppliers

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitutes

- 4.6.5 Intensity of Competitive Rivalry

5 Market Size and Growth Forecasts (Value)

- 5.1 By Insect Type

- 5.1.1 Beetles

- 5.1.2 Caterpillars

- 5.1.3 Crickets and Grasshoppers (Orthoptera)

- 5.1.4 Mealworms (Coleoptera)

- 5.1.5 Black Soldier Fly Larvae

- 5.1.6 Others (Ants, Wasps, etc.)

- 5.2 By Product Form

- 5.2.1 Whole Insects

- 5.2.1.1 BBQ

- 5.2.1.2 Steamed/Fried

- 5.2.1.3 Raw

- 5.2.2 Ingredient Type

- 5.2.2.1 Drinks

- 5.2.2.2 Insect Confectionery

- 5.2.2.3 Snacks and Backed Products

- 5.2.2.4 Others

- 5.2.1 Whole Insects

- 5.3 By Distribution Channel

- 5.3.1 Offline (Supermarkets, Specialty Stores)

- 5.3.2 Online (E-commerce, D2C)

- 5.4 Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.1.4 Rest of North America

- 5.4.2 South America

- 5.4.2.1 Brazil

- 5.4.2.2 Argentina

- 5.4.2.3 Rest of South America

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 France

- 5.4.3.4 Russia

- 5.4.3.5 Poland

- 5.4.3.6 Rest of Europe

- 5.4.4 Asia-Pacific

- 5.4.4.1 China

- 5.4.4.2 Japan

- 5.4.4.3 Thailand

- 5.4.4.4 Rest of Asia-Pacific

- 5.4.5 Middle East

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 Iran

- 5.4.5.3 Rest of Middle East

- 5.4.6 Africa

- 5.4.6.1 South Africa

- 5.4.6.2 Nigeria

- 5.4.6.3 Rest of Africa

- 5.4.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 JR Unique Foods Limited

- 6.4.2 Entomo Farms

- 6.4.3 Aspire Food Group

- 6.4.4 Hargol FoodTech

- 6.4.5 Nutribug Ltd.

- 6.4.6 Entosense, LLC

- 6.4.7 Micronutris

- 6.4.8 Essento

- 6.4.9 Beta Hatch

- 6.4.10 HiProMine

- 6.4.11 Innovafeed

- 6.4.12 Protix

- 6.4.13 Ynsect

- 6.4.14 Powder Bugs (Thailand) Co., Ltd.

- 6.4.15 HaoCheng Mealworms Inc.

7 Market Opportunities and Future Outlook