PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1850301

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1850301

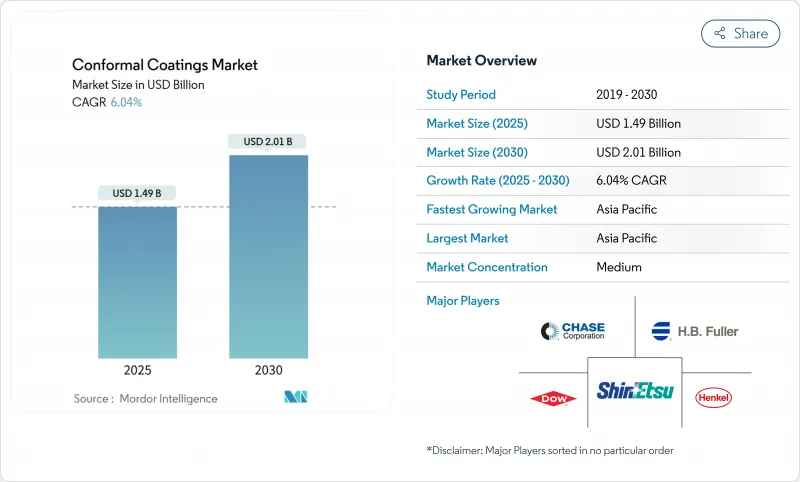

Conformal Coatings - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The global conformal coatings market is valued at USD 1.49 billion in 2025 and is set to reach USD 2.01 billion in 2030, reflecting a 6.04% CAGR through the forecast window.

Robust demand for circuit protection across smartphones, 5G base stations, electric vehicles, and satellite payloads keeps volume requirements on an upward trajectory. Miniaturization in consumer electronics continues to shrink component spacing by 30-40%, steering research toward ultra-thin films that still block moisture, chemicals, and ionic contamination. Regulatory curbs on volatile organic compounds are redirecting formulator attention to water-borne and UV-cured options that lower emissions while cutting process time. At the same time, selective robotic dispensing and chemical vapor deposition are unlocking new design freedom by coating only the most vulnerable traces and vias, a capability that reduces material use and rework. Competitive intensity is moderate, and suppliers are leveraging proprietary chemistries, in-line plasma surface preparation, and local technical centers to match the expanding geographic footprint of electronics manufacturing.

Global Conformal Coatings Market Trends and Insights

5G Smartphones and IoT Wearables Driving Miniaturized Circuit Protection in Asia

High-density boards in next-generation handhelds require conformality at 5-25 μm while preserving signal integrity. Leading Asian assemblers rely on plasma surface activation to raise adhesion, enabling reliable coverage on micro-BGAs and stacked dies. Robotic selective systems further trim coating volume by 25% and cut masking steps, easing throughput bottlenecks. Together, these advances let brands protect thinner devices without adding weight, which sustains the conformal coatings market momentum in the region.

LEO Satellites and Avionics Electronics Demanding High-Performance Coatings

Constellation operators increasingly specify thermally stable coatings that withstand -65 °C to +200 °C excursions and resist atomic oxygen. MAP Space Coatings supplies vacuum-compatible films with ultralow outgassing to major integrators, reinforcing reliability of on-board electronics. Extended environmental envelopes keep North American and European tier-one aero suppliers loyal to premium chemistries, lifting the conformal coatings market in specialized aerospace segments.

Rework and Inspection Complexity for UV-Cured Opaque Films

Opaque formulations mask solder joints, mandating X-ray or infrared tools for quality control, which raises capital outlays. Removal often relies on micro-abrasion and chemical stripping that can lift pads or crack chips, extending service cycles. These constraints slow momentum for UV chemistries in high-mix factories, temporarily capping conformal coatings market penetration until transparent or dye-traceable versions proliferate.

Other drivers and restraints analyzed in the detailed report include:

- Regulatory Shift to RoHS-Compliant Low-VOC Water/UV Systems

- Expansion of Telecom Infrastructure and 5G Rollout

- Silicone Monomer Price Volatility

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

The acrylic subset of the conformal coatings market held 44% revenue in 2024, supported by balanced moisture protection, easy rework, and competitive cost profiles. The segment is expected to grow at a 6.81% CAGR, helped by high-volume smartphone lines that favor fast, tack-free times. Electrolube's HFAC series delivers halogen-free performance with low odor, appealing to automotive and defense plants that maintain strict air-quality guidelines. Silicone garners attention for harsh thermal loads in EV packs and avionics, while epoxy and urethane preserve niche roles in chemical-rich and under-hood niches. Emerging nano-fluoropolymer blends promise hydrophobicity at sub-10 μm, underscoring a constant push toward lighter coatings that align with miniaturization.

The conformal coatings market size is growing because of the installation of radar, lidar, and high-power converters that rely on -65 °C to +200 °C resilience. In contrast, epoxies grow at a muted clip because irreversibility complicates board rework. Urethane sees renewed interest as a flexible yet chemical-tough shield for drivetrain controllers and agricultural machinery printed circuit boards. Collectively, material diversification lets OEMs match protection levels to equipment risk profiles, cementing multi-material strategies within the broader conformal coatings industry.

Solvent-borne methods still anchor 55% of 2024 revenue, yet legislation in the EU and California tightens allowable emissions, accelerating migration to greener platforms. UV-cure technology logs the swiftest expansion at 7.01% CAGR, leveraging instant tack and <=50 g/L VOC. Henkel's solvent-free UV line attests to industrial appetite for in-line curing that halves floor space. Water-borne chemistries capture production lines that tolerate 1-24 hour cures and value equipment simplicity. Hybrid UV-moisture systems extend these gains to shadowed areas, preventing uncured pockets under tall components.

UV-cured coatings are emerging as the fastest-growing segment at 7.01% CAGR (2025-2030), driven by their rapid processing times, reduced energy consumption, and minimal VOC emissions. Adoption is most aggressive in Germany and the United States, where energy-efficient curing dovetails with corporate net-zero pledges. The conformal coatings market benefits as regulatory policy dovetails with production efficiency, aligning environmental stewardship and cost reduction.

The Conformal Coatings Market Report Segments the Industry by Material Type (Acrylic, Epoxy, Urethane/Polyurethane, and More), Technology (Solvent-Based, Water-Based, and More), Operation Method (Spray Coating, Dip Coating, Brush Coating, and Others), End-User Industry (Consumer Electronics, Automotive, and More), and Geography (Asia-Pacific, North America, Europe, South America, and Middle East and Africa).

Geography Analysis

Asia Pacific led the conformal coatings market with 42% share in 2024 and posts a 7.54% CAGR to 2030. China's ODM hub and increasing penetration of 5G small cells keep regional line utilization high. India and Vietnam lure new PCB capacity through incentive schemes, driving coatings demand upward. Local demonstrations, such as Plasmatreat's REDOX-Tool at productronica China, underscore sustained supplier engagement with the region's process engineers.

North America remains a premium market for harsh-environment electronics. Space exploration, advanced avionics, and implantable medical devices require qualified coatings that meet NASA and FDA protocols. This focus on mission-critical reliability supports higher average selling prices and stable contractual volumes. Further north, governments continue to sponsor 5G and radar research that deepens partnerships between coating giants and defense primes. Together, these elements reinforce the conformal coatings market growth momentum on the continent.

Europe, occupying an environmentally stringent regulatory regime, hastens the shift to water-borne and UV platforms. German automotive supply chains deploy hybrid UV-moisture chemistries for under-hood control boards. The conformal coatings market size in the bloc is forecast to climb steadily as vehicle electrification raises board counts per car. Elsewhere, South America and the Middle East and Africa remain nascent but are evolving as 5G macro towers and photovoltaic inverters multiply in climates that demand corrosion-proof electronics. Suppliers often ship pre-packaged coating lines to local contract manufacturers to shorten start-up time and secure after-sales maintenance revenue.

- 3M

- Actnano Inc.

- Altana AG

- Bostik (Arkema)

- Chase Corporation

- Chemtronics (KEMET)

- CHT UK Ltd

- Dow

- Dymax Corporation

- Electrolube

- Europlasma NV

- H.B. Fuller Company

- Henkel AG & Co. KGaA

- Illinois Tool Works Inc.

- MG Chemicals

- Nordson Corporation

- Panacol-Elosol GmbH

- PVA

- Shin-Etsu Chemical Co., Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 5G Smartphones and IoT Wearables Driving Miniaturized Circuit Protection in Asia

- 4.2.2 LEO Satellites and Avionics Electronics Demanding High-Performance Coatings in North America and Europe

- 4.2.3 Regulatory Shift to RoHS-Compliant Low-VOC Water/UV Systems

- 4.2.4 Expansion of Telecom Infrastructure and 5G Rollout.

- 4.2.5 Increasing Use in Aerospace and Defense Sectors

- 4.3 Market Restraints

- 4.3.1 Rework and Inspection Complexity for UV-Cured Opaque Films

- 4.3.2 Silicone Monomer Price Volatility

- 4.3.3 EU Solvent-Based VOC Caps Shrinking Legacy Product Demand

- 4.3.4 Scarcity of High-Purity Parylene Dimer for Medical/Aerospace

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces Analysis

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Consumers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Degree of Competition

5 Market Size and Growth Forecasts (Value)

- 5.1 By Material Type

- 5.1.1 Acrylic

- 5.1.2 Epoxy

- 5.1.3 Urethane/Polyurethane

- 5.1.4 Silicone

- 5.1.5 Other Chemistries (Fluoropolymer, Nano-coatings)

- 5.2 By Technology

- 5.2.1 Solvent-Based

- 5.2.2 Water-Based

- 5.2.3 UV-Cured

- 5.2.4 Hybrid/Other Advanced Systems

- 5.3 By Operation Method

- 5.3.1 Spray Coating (Atomised / Film)

- 5.3.2 Dip Coating

- 5.3.3 Brush Coating

- 5.3.4 Others (Selective/Robotic Dispense and Chemical Vapour Deposition (CVD))

- 5.4 By End-user Industry

- 5.4.1 Consumer Electronics

- 5.4.2 Automotive (ICE, EV, ADAS)

- 5.4.3 Aerospace and Defense

- 5.4.4 Medical and Life-Sciences Electronics

- 5.4.5 Others (Industrial, Power and Energy)

- 5.5 By Geography

- 5.5.1 Asia Pacific

- 5.5.1.1 China

- 5.5.1.2 India

- 5.5.1.3 Japan

- 5.5.1.4 South Korea

- 5.5.1.5 Rest of Asia Pacific

- 5.5.2 North America

- 5.5.2.1 United States

- 5.5.2.2 Canada

- 5.5.2.3 Mexico

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 France

- 5.5.3.4 Italy

- 5.5.3.5 Nordics

- 5.5.3.6 Rest of Europe

- 5.5.4 South America

- 5.5.4.1 Brazil

- 5.5.4.2 Argentina

- 5.5.4.3 Rest of South America

- 5.5.5 Middle-East and Africa

- 5.5.5.1 Saudi Arabia

- 5.5.5.2 United Arab Emirates

- 5.5.5.3 South Africa

- 5.5.5.4 Nigeria

- 5.5.5.5 Rest of Middle-East and Africa

- 5.5.1 Asia Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles {(includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)}

- 6.4.1 3M

- 6.4.2 Actnano Inc.

- 6.4.3 Altana AG

- 6.4.4 Bostik (Arkema)

- 6.4.5 Chase Corporation

- 6.4.6 Chemtronics (KEMET)

- 6.4.7 CHT UK Ltd

- 6.4.8 Dow

- 6.4.9 Dymax Corporation

- 6.4.10 Electrolube

- 6.4.11 Europlasma NV

- 6.4.12 H.B. Fuller Company

- 6.4.13 Henkel AG & Co. KGaA

- 6.4.14 Illinois Tool Works Inc.

- 6.4.15 MG Chemicals

- 6.4.16 Nordson Corporation

- 6.4.17 Panacol-Elosol GmbH

- 6.4.18 PVA

- 6.4.19 Shin-Etsu Chemical Co., Ltd.

7 Market Opportunities and Future Outlook

- 7.1 White-Space and Unmet-Need Assessment

- 7.2 Increasing Demand from Sensors and Displays