PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1850305

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1850305

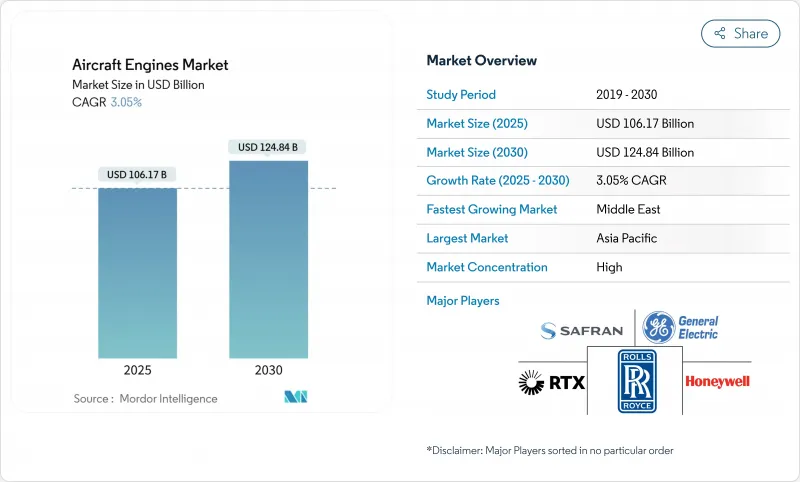

Aircraft Engines - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The aircraft engines market size stood at USD 106.17 billion in 2025 and is expected to reach USD 124.84 billion by 2030, expanding at a 3.05% CAGR.

Demand recovery in long-range commercial programs, renewed narrow-body backlogs, and military tanker upgrades combine with fleet-wide sustainability objectives to sustain this moderate expansion. Twin-aisle production is normalizing after the pandemic pause. At the same time, airlines accelerated replacing older engines with fuel-efficient LEAP and GTF models to contain operating costs and meet emissions targets. Asia-Pacific remains the primary growth engine, Middle-East carriers drive the fastest regional trajectory, and sustained defense modernization across NATO members underpins the military segment. Supply-chain bottlenecks in castings and forgings remain a limiting factor, yet targeted investment in additive manufacturing and dual-sourcing has begun to ease the tightest constraints.

Global Aircraft Engines Market Trends and Insights

Twin-aisle production ramp-up boosts demand

Output targets set by Airbus and Boeing for 2026 mark the clearest signal that wide-body assembly lines are nearing pre-pandemic cadence. Engine makers must increase weekly throughput while navigating lingering raw-material shortages. CFM disclosed that 2024 LEAP deliveries trailed demand by 10%, though tier-1 suppliers are now shipping more than 90% of the scheduled volume, indicating gradual normalization. Advances in additive-manufactured fuel nozzles and broader dual-source strategies aim to close the gap within two years.

Rapid LEAP and GTF uptake in Asia-Pacific

Fleet expansion across India, Vietnam, and Malaysia has produced the world's densest pipeline of single-aisle orders. IndiGo's purchase agreement for 280 LEAP-1A engines and VietJet's commitment to more than 400 LEAP-1B units underscore the preference for high-bypass, low-fuel-burn propulsion. CFM shipped 1,570 LEAP engines in 2023 and retains an order backlog exceeding 10,600 units, creating near-term production visibility and reinforcing the aircraft engines market narrative around Asian carrier growth.

Casting and forging capacity shortfalls restrict output

Specialty alloy turbine blades remain the gating factor for higher monthly production. Howmet Aerospace reported schedule slips affecting narrow-body delivery slots, and CFM instituted additional incoming-inspection gates after finding non-conforming hardware in 2024. Investment in powdered-metal supply and high-capacity HIP facilities is underway, though most expansions will not fully come online before late 2026.

Other drivers and restraints analyzed in the detailed report include:

- NATO modernization programs elevate military requirements

- EU sustainable-aviation-fuel legislation reshapes design rules

- Hot-and-high durability concerns add maintenance burden

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Turbofan units held 64.45% of the aircraft engines market share in 2024, a position sustained by the LEAP and GTF families that dominate single-aisle platforms. High bypass ratios, composite fan blades, and digital engine controls underpin cost efficiency that airlines prioritize for fleet renewal. Hybrid-electric concepts are accelerating, validated by GE Aerospace's NASA demonstrator that integrates a 2 MW electric motor with a thermal core. This project illustrates the transition path from incremental efficiency gains to partial electrification within the aircraft engines market.

Hybrid-electric propulsion, forecast to rise at a 7.51% CAGR through 2030, captures industry attention as regulators tighten emissions caps. Battery energy densities of 400 Wh/kg remain the technical hurdle, yet distributed-propulsion architectures promise substantial noise and fuel-burn reductions. Turboprops retain relevance for short-range routes where airport infrastructure constrains jet operations, while turboshafts serve offshore energy, EMS, and military assault roles. Together, these niches ensure diversified revenue flows that cushion cyclical swings in the commercial turbofan segment of the aircraft engines market.

In 2024, narrow-body programs accounted for 43.35% of the aircraft engines market size, anchored by the Airbus A320neo and B737 MAX families. Airlines favor the seating flexibility and route economics these airframes provide, leading OEMs to prioritize medium-thrust production lines. Wide-body propulsion demand is staging a comeback as international travel rebounds, but sustained growth will hinge on punctual certification of the B777X and steady A350 output.

Advanced air mobility (AAM) vehicles represent the fastest-growing application, advancing at a 9.06% CAGR. Vertical Aerospace, Joby Aviation, and other pioneers are flight-testing prototype hybrid-electric VTOL aircraft with ranges up to 1,000 mi, targeting corporate shuttle and regional connectivity markets.Military requirements span from high-performance combat engines-optimized for super-cruise and low observability-to adapted commercial cores in transport and tanker roles. This diversified demand pattern underlines the resilience of the aircraft engines market across aviation segments.

The Aircraft Engines Market Report is Segmented by Engine Type (Turbofan, Turboprop, and More), Aircraft Type (Commercial Aviation, and More), Technology (Geared Turbofan, and More), Thrust Class (Less Than 10, 000 Lbf, and More), Component (Compressor, Turbine, and More), End-User (OEM Factory-Fit, and More) and Geography (North America, Europe, Asia-Pacific, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific held 33.21% of global revenue in 2024, a position reinforced by high traffic growth, open-skies agreements, and aggressive fleet-renewal agendas among low-cost carriers. China's C919 program relies on LEAP-1C propulsion, while India's defense road map now includes potential GE participation in its Indigenous AMCA fighter, which could catalyze local MRO ecosystems. Southeast Asian hubs continue to benefit from tourism rebound and e-commerce logistics, fortifying demand visibility in the aircraft engines market.

North America remains a mature yet lucrative arena where replacement cycles for narrow-body workhorses and defense spending converge. The US Air Force KC-46A tanker and F-35 engine lots sustain high-thrust production, while a dense maintenance footprint anchors the global aftermarket. Sustainable-aviation-fuel infrastructure pilots in California and Texas also create early-adopter opportunities for SAF-ready engines.

Middle East operators headline growth at a 6.75% CAGR, fuelled by fleet expansions at Emirates, Qatar Airways, and Saudia. Harsh desert environments necessitate specialized maintenance, spurring regional MRO joint ventures that draw on OEM technology transfer. Europe preserves its technology leadership through Airbus final assembly, SAF legislative frameworks, and robust regional-jet networks. Africa remains the smallest region but posts the highest proportional fleet-growth forecast, supported by leasing models that lower capital barriers and new route rights under the African Continental Free Trade Area.

- General Electric Company

- Pratt & Whitney (RTX Corporation)

- CFM International

- Rolls-Royce plc

- Safran SA

- Honeywell International Inc.

- MTU Aero Engines AG

- IAE International Aero Engines AG

- IHI Corporation

- Mitsubishi Heavy Industries Aero Engines, Ltd.

- Lycoming Engines (Textron Inc.)

- United Engine Corporation (Rostec)

- China Aviation Industry Corporation Limited (AECC)

- Kawasaki Heavy Industries, Ltd.

- Hanwha Corporation

- Williams International Co., L.L.C.

- Honda Motor Co., Ltd.

- PBS International Trading,a.s.

- GKN Aerospace Services Limited

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Emerging twin-aisle production ramp-up post-supply-chain recovery

- 4.2.2 Fleet-wide shift toward LEAP and GTF engines in fast-growing Asian carriers

- 4.2.3 NATO transport- and tanker-fleet modernization programs boosting military engine demand

- 4.2.4 Helicopter fleet renewal for offshore energy operations raising turboshaft deliveries

- 4.2.5 EU mandates for 100% SAF-ready engines in new type certificates

- 4.2.6 Leasing-driven expansion of African regional-jet operators

- 4.3 Market Restraints

- 4.3.1 Persistent casting and forging bottlenecks limiting turbine-blade availability

- 4.3.2 High-temperature durability issues in hot-and-high Middle-East operations

- 4.3.3 Slow standardization of hydrogen-combustion engine architectures

- 4.3.4 Margin pressure from independent MRO capacity growth

- 4.4 Value Chain Analysis

- 4.5 Regulatory Outlook

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers/Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitute Products

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Engine Type

- 5.1.1 Turbofan

- 5.1.2 Turboprop

- 5.1.3 Turboshaft

- 5.1.4 Piston

- 5.1.5 Hybrid-Electric

- 5.2 By Aircraft Type

- 5.2.1 Commercial Aviation

- 5.2.1.1 Narrow-body Aircraft

- 5.2.1.2 Wide-body Aircraft

- 5.2.1.3 Regional Aircraft

- 5.2.2 Military Aviation

- 5.2.2.1 Combat Aircraft

- 5.2.2.2 Non-combat Aircraft

- 5.2.3 General Aviation

- 5.2.3.1 Business Jets

- 5.2.3.2 Helicopters

- 5.2.3.3 Turboprop Aircraft

- 5.2.3.4 Piston-Engine Aircraft

- 5.2.4 Unmanned Aerial Vehicles (UAVs)

- 5.2.5 Advanced Air-Mobility Vehicles (AAM)

- 5.2.1 Commercial Aviation

- 5.3 By Technology

- 5.3.1 Conventional Turbofan/Turboprop

- 5.3.2 Geared Turbofan (GTF)

- 5.3.3 Contra-rotating Open Rotor

- 5.3.4 Adaptive-cycle Engines

- 5.3.5 Hybrid-Electric Propulsion

- 5.4 By Thrust Class

- 5.4.1 Less than 10,000 lbf

- 5.4.2 10,001 to 25,000 lbf

- 5.4.3 25,001 to 50,000 lbf

- 5.4.4 Greater than 50,000 lbf

- 5.5 By Component

- 5.5.1 Compressor

- 5.5.2 Turbine

- 5.5.3 Nozzle

- 5.5.4 Gearbox

- 5.5.5 Other Components

- 5.6 By End-User

- 5.6.1 OEM Factory-Fit

- 5.6.2 Replacement/Aftermarket

- 5.7 By Geography

- 5.7.1 North America

- 5.7.1.1 United States

- 5.7.1.2 Canada

- 5.7.1.3 Mexico

- 5.7.2 South America

- 5.7.2.1 Brazil

- 5.7.2.2 Rest of South America

- 5.7.3 Europe

- 5.7.3.1 United Kingdom

- 5.7.3.2 Germany

- 5.7.3.3 France

- 5.7.3.4 Russia

- 5.7.3.5 Rest of Europe

- 5.7.4 Asia-Pacific

- 5.7.4.1 China

- 5.7.4.2 India

- 5.7.4.3 Japan

- 5.7.4.4 South Korea

- 5.7.4.5 Rest of Asia-Pacific

- 5.7.5 Middle East and Africa

- 5.7.5.1 Middle East

- 5.7.5.1.1 Saudi Arabia

- 5.7.5.1.2 United Arab Emirates

- 5.7.5.1.3 Rest of Middle East

- 5.7.5.2 Africa

- 5.7.5.2.1 Egypt

- 5.7.5.2.2 South Africa

- 5.7.5.2.3 Rest of Africa

- 5.7.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 General Electric Company

- 6.4.2 Pratt & Whitney (RTX Corporation)

- 6.4.3 CFM International

- 6.4.4 Rolls-Royce plc

- 6.4.5 Safran SA

- 6.4.6 Honeywell International Inc.

- 6.4.7 MTU Aero Engines AG

- 6.4.8 IAE International Aero Engines AG

- 6.4.9 IHI Corporation

- 6.4.10 Mitsubishi Heavy Industries Aero Engines, Ltd.

- 6.4.11 Lycoming Engines (Textron Inc.)

- 6.4.12 United Engine Corporation (Rostec)

- 6.4.13 China Aviation Industry Corporation Limited (AECC)

- 6.4.14 Kawasaki Heavy Industries, Ltd.

- 6.4.15 Hanwha Corporation

- 6.4.16 Williams International Co., L.L.C.

- 6.4.17 Honda Motor Co., Ltd.

- 6.4.18 PBS International Trading,a.s.

- 6.4.19 GKN Aerospace Services Limited

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment