PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1850310

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1850310

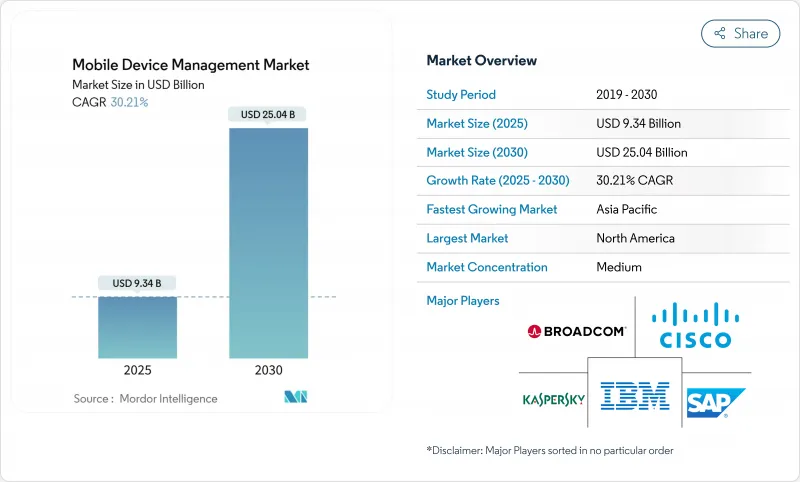

Mobile Device Management - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The mobile device management market size reached USD 9.34 billion in 2025 and is projected to reach USD 25.04 billion in 2030, progressing at a 30.21% CAGR through the forecast period.

Surging enterprise mobility-first strategies, rising bring-your-own-device (BYOD) expectations, and post-quantum security preparations collectively accelerate adoption. Cyber-insurance carriers now require proof of endpoint control before underwriting policies, which elevates mobile device management from discretionary spend to operational necessity. A widening gap between cloud-native unified endpoint management (UEM) platforms and legacy on-premise stacks is reshaping vendor positioning. Meanwhile, 5G-enabled field-service expansion and escalating IoT deployments are enlarging the addressable device base, amplifying total contract value for vendors. Competitive intensity is rising as Microsoft, Broadcom-Omnissa, and Jamf consolidate capabilities while niche specialists chase industrial and quantum-safe opportunities.

Global Mobile Device Management Market Trends and Insights

Explosion of enterprise BYOD policies

Employee expectations have shifted sharply, with 87% of workers anticipating the option to use personal devices for professional tasks. Organizations cite 33% device-procurement savings and productivity gains when BYOD programs are deployed. These advantages heighten demand for data-segregating containers and user-centric experience tuning. Yet, 61% of employees admit bypassing security safeguards when tools seem cumbersome. This tension forces vendors to rethink identity, privacy, and user-experience design, propelling innovation across the mobile device management market.

Accelerating shift to cloud-native UEM suites

Cloud-first UEM deployments deliver 40% lower total cost of ownership than on-premise alternatives. Microsoft Intune already commands 23.4% market share by embedding endpoint security controls inside Microsoft 365 environments. Enterprises cut management overhead by 60% and enforce security patches faster, a valuable benefit for geographically dispersed workforces that persist post-pandemic. This momentum widens the competitive gap for vendors still tethered to data-center architectures.

Up-front integration cost with legacy IAM/ITSM stacks

Enterprises report annual integration outlays exceeding USD 73,000 when aligning modern UEM platforms with incumbent identity and service-management systems. Multiple authentication providers deepen complexity, often doubling roll-out timelines. Mid-market firms lacking dedicated engineers face the steepest hurdle, delaying full deployment and restraining early-period revenue recognition in the mobile device management market.

Other drivers and restraints analyzed in the detailed report include:

- Surge in cyber-insurance mandates for endpoint control

- 5G-enabled field-service workforce expansion

- Growing employee privacy push-back on device tracking

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Cloud platforms accounted for 57.5% of the mobile device management market in 2024 and will grow at 17.6% CAGR to 2030. Organizations migrating to subscription models reduce infrastructure spending, accelerate policy roll-outs, and gain elastic scalability. Microsoft, VMware-Omnissa, and Google industry alliances lower entry barriers for mid-sized enterprises by bundling identity, productivity, and security. On-premise deployments persist in defense, healthcare, and government domains where data-sovereignty or air-gap mandates prevail. Hybrid frameworks serve as transitional architectures, blending local control with cloud orchestration to avoid forklift migrations. As integration toolkits mature, buyers evaluate vendors on self-service provisioning, automation depth, and analytics rather than simple device counts. These dynamics broaden the total addressable base for the mobile device management market while intensifying platform differentiation.

The mobile device management market size for cloud deployments is projected to reach USD 15.8 billion by 2030, propelled by continual software updates and shorter contracting cycles. Vendors capitalize on this momentum through consumption-based pricing that aligns with seat expansions. Conversely, on-premise license renewals contract as CFOs favor opex-led cloud budgeting. Service integrators adapt by bundling managed security and compliance audits, turning deployment flexibility into recurring consulting revenue. Strategic partnerships between hyperscale clouds and niche MDM vendors expand distribution, particularly in emerging economies where local resellers guide compliance navigation.

Smartphones and tablets delivered 64.1% of 2024 revenue, underscoring their role in knowledge-worker productivity. However, industrial IoT sensors, gateways, and rugged wearables register 23.6% CAGR through 2030, dwarfing growth in mature form factors. Manufacturers, utilities, and logistics operators integrate thousands of low-power nodes, pushing device counts per enterprise into six-digit territory. Battery-constrained equipment necessitates lightweight agents that minimize compute cycles, forcing vendors to innovate beyond standard MDM stacks. The mobile device management market size attributable to IoT is forecast to exceed USD 6.4 billion by 2030, reflecting new billing metrics based on active connections rather than human users.\

Edge computing intersects with device diversity. Enterprises deploy micro data centers on factory floors, demanding local policy enforcement even during WAN disruptions. MDM platforms now embed remote firmware management, zero-touch provisioning, and AI-driven anomaly detection to maintain uptime. The expanded endpoint mix blurs boundaries between operational-technology and information-technology teams, reshaping procurement and governance models.

The Enterprise Mobile Device Management Industry and is Segmented by Deployment Mode (On-Premise, Cloud), Device Type (Smartphones and Tablets, Laptops and Desktops, and More), End-User Industry (IT and Telecom, BFSI, Healthcare and Life Sciences, Retail and E-Commerce, and More), Ownership Model (Corporate-Owned Devices, BYOD, COPE (Corporate-Owned, Personally Enabled), and More), and Geography.

Geography Analysis

North America held 39.5% of the mobile device management market in 2024, supported by early smartphone adoption, stringent HIPAA and PCI DSS regulations, and a mature cyber-insurance ecosystem that requires endpoint governance. Regional enterprises integrate threat intelligence from Microsoft Defender and Jamf Threat Defense, tightening zero-trust architectures. Large healthcare systems extend MDM to remote patient-monitoring kits, while fintechs emphasize biometric authentication on consumer mobiles.

Asia-Pacific is the fastest-growing territory at 17.7% CAGR through 2030, buoyed by 5G roll-outs and government-driven Industry 4.0 incentives. China, South Korea, and India add hundreds of millions of enterprise-enabled devices as factories digitalize and banks promote mobile wallets. Public-sector smart-city projects in Singapore and Japan require resilient endpoint orchestration across sensors, kiosks, and field-service tablets. Country-specific data-residency laws spark demand for localized cloud regions, giving rise to regional hosting partnerships that expand the mobile device management market.

Europe registers solid momentum anchored in GDPR compliance. Enterprises must demonstrate lawful processing, explicit consent, and breach notification, turning encryption at rest and data-siloing into baseline features. ESG-linked procurement encourages selection of vendors with carbon-aware device analytics and equipment-life-cycle extensions. Automotive and aerospace manufacturers integrate MDM into shop-floor tablets to meet CE marking requirements. Fragmented regulations, however, prolong sales cycles as buyers conduct country-level legal reviews. Vendors able to package multilingual support, field-level encryption, and local professional-services reach gain share.

- VMware Inc.

- Microsoft Corp. (Intune)

- IBM Corporation

- Citrix Systems Inc.

- SAP SE

- Broadcom Inc. (Symantec)

- Cisco Systems Inc.

- Ivanti Software Inc.

- JAMF Software LLC

- SOTI Inc.

- ManageEngine (Zoho Corp.)

- Hexnode (UEM)

- 42Gears Mobility Systems

- Scalefusion

- Baramundi Software AG

- Addigy

- Miradore Ltd.

- Kaspersky Lab

- Sophos Group plc

- MobileIron (Inc.)

- Prey Inc.

- Fleetsmith (Apple Inc.)

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Explosion of enterprise BYOD policies

- 4.2.2 Accelerating shift to cloud-native UEM suites

- 4.2.3 Surge in cyber-insurance mandates for endpoint control

- 4.2.4 5G-enabled field-service workforce expansion

- 4.2.5 Post-quantum security preparations elevating device trust stacks

- 4.2.6 ESG-linked procurement favouring secure-device vendors

- 4.3 Market Restraints

- 4.3.1 Up-front integration cost with legacy IAM/ITSM stacks

- 4.3.2 Fragmented regulatory data-sovereignty rules

- 4.3.3 Growing employee privacy push-back on device tracking

- 4.3.4 Limited battery/CPU headroom on rugged IoT endpoints

- 4.4 Evaluation of Critical Regulatory Framework

- 4.5 Technological Outlook

- 4.6 Porter's Five Forces

- 4.6.1 Bargaining Power of Suppliers

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitutes

- 4.6.5 Competitive Rivalry

- 4.7 Impact Assessment of Key Stakeholders

- 4.8 Key Use Cases and Case Studies

- 4.9 Impact on Macroeconomic Factors of the Market

5 MARKET SIZE AND GROWTH FORECAST (VALUE)

- 5.1 By Deployment Mode

- 5.1.1 On-premise

- 5.1.2 Cloud

- 5.2 By Device Type

- 5.2.1 Smartphones and Tablets

- 5.2.2 Laptops and Desktops

- 5.2.3 Rugged and Wearable Devices

- 5.2.4 IoT/IIoT Endpoints

- 5.3 By End-user Industry

- 5.3.1 IT and Telecom

- 5.3.2 BFSI

- 5.3.3 Healthcare and Life Sciences

- 5.3.4 Retail and E-commerce

- 5.3.5 Government and Public Sector

- 5.3.6 Manufacturing

- 5.3.7 Education

- 5.3.8 Transportation and Logistics

- 5.4 By Ownership Model

- 5.4.1 Corporate-owned Devices

- 5.4.2 BYOD

- 5.4.3 COPE (Corporate-Owned, Personally Enabled)

- 5.4.4 CYOD (Choose-Your-Own-Device)

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Argentina

- 5.5.2.3 Rest of South America

- 5.5.3 Europe

- 5.5.3.1 United Kingdom

- 5.5.3.2 Germany

- 5.5.3.3 France

- 5.5.3.4 Italy

- 5.5.3.5 Spain

- 5.5.3.6 Nordics

- 5.5.3.7 Rest of Europe

- 5.5.4 Asia-Pacific

- 5.5.4.1 China

- 5.5.4.2 India

- 5.5.4.3 Japan

- 5.5.4.4 South Korea

- 5.5.4.5 ASEAN

- 5.5.4.6 Australia

- 5.5.4.7 New Zealand

- 5.5.4.8 Rest of Asia-Pacific

- 5.5.5 Middle East and Africa

- 5.5.5.1 Middle East

- 5.5.5.1.1 Saudi Arabia

- 5.5.5.1.2 United Arab Emirates

- 5.5.5.1.3 Turkey

- 5.5.5.1.4 Rest of Middle East

- 5.5.5.2 Africa

- 5.5.5.2.1 South Africa

- 5.5.5.2.2 Egypt

- 5.5.5.2.3 Nigeria

- 5.5.5.2.4 Rest of Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 VMware Inc.

- 6.4.2 Microsoft Corp. (Intune)

- 6.4.3 IBM Corporation

- 6.4.4 Citrix Systems Inc.

- 6.4.5 SAP SE

- 6.4.6 Broadcom Inc. (Symantec)

- 6.4.7 Cisco Systems Inc.

- 6.4.8 Ivanti Software Inc.

- 6.4.9 JAMF Software LLC

- 6.4.10 SOTI Inc.

- 6.4.11 ManageEngine (Zoho Corp.)

- 6.4.12 Hexnode (UEM)

- 6.4.13 42Gears Mobility Systems

- 6.4.14 Scalefusion

- 6.4.15 Baramundi Software AG

- 6.4.16 Addigy

- 6.4.17 Miradore Ltd.

- 6.4.18 Kaspersky Lab

- 6.4.19 Sophos Group plc

- 6.4.20 MobileIron (Inc.)

- 6.4.21 Prey Inc.

- 6.4.22 Fleetsmith (Apple Inc.)

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment