PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1850319

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1850319

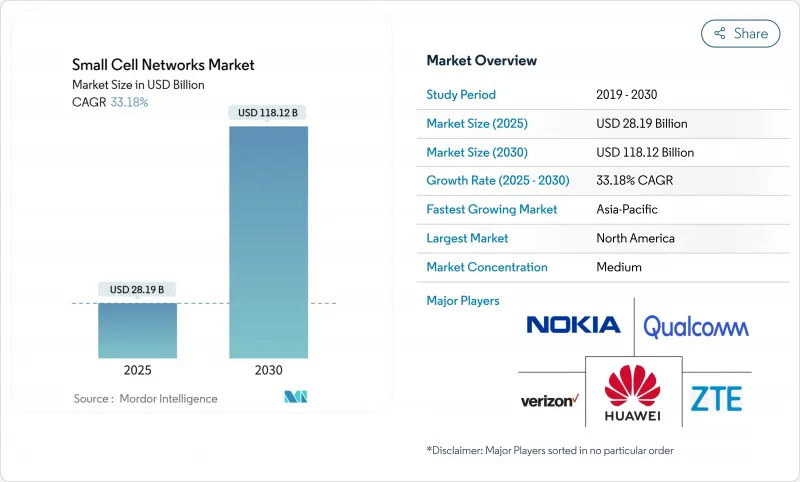

Small Cell Networks - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The small cell networks market is valued at USD 28.19 billion in 2025 and is forecast to expand at a robust 33.18% CAGR, reaching USD 118.12 billion by 2030.

Rising mobile-data volumes, the transition to higher-frequency 5G bands, and supportive spectrum policies have moved small cells from niche solutions to core network assets. Carriers now treat densification as a necessity because millimeter-wave and mid-band signals attenuate rapidly, especially indoors, where more than 80% of traffic originates. Early wins with shared and neutral-host models are lowering ownership costs, while AI-enabled self-optimizing features are cutting energy use by up to 45% relative to traditional distributed antenna systems. Consolidation is intensifying as incumbents seek scale advantages ahead of the AWS-3 auction mandated for completion by June 2026, a sale projected to redirect USD 3 billion-4.5 billion of mid-band spectrum into commercial hands.

Global Small Cell Networks Market Trends and Insights

5G spectrum auctions accelerate network densification

Mid-band allocations are unlocking the spectral headroom needed for 5G. Independent economic modelling shows that every extra 100 MHz could add USD 264 billion to GDP. The forthcoming AWS-3 sale will reinforce this effect. Faster permitting has trimmed U.S. approval cycles from several years to months, enabling operators to scale from macro sites to thousands of street-level nodes per city. Because millimeter-wave signals decay sharply, achieving contiguous coverage can demand up to 10 times more small cells than legacy macrocells, driving orders for compact radios and integrated antennas.

Mobile-data explosion drives adoption

Annual traffic is rising 20%, and 5G will carry 75% of bits by 2029, according to Ericsson. Streaming UHD video, XR content, and cloud gaming create hotspot demand profiles that strain sectorized macros. Targeted clusters of small cells deliver localized capacity without full-scale overlays, enabling operators to throttle capex while preserving user experience. Deployments have already quadrupled over the past decade; industry associations expect an eight-fold increase in the next ten years.

Regulatory hurdles impede deployment velocity

Even after federal streamlining, local rules vary widely. Historic districts often impose design reviews, stretching approvals to 12-24 months and inflating construction budgets. Roughly 20 U.S. states now have small-cell statutes, yet inconsistent interpretation complicates multi-state builds. Operators are standardizing pole-top enclosures and leveraging street furniture leases to shorten cycles, but friction remains a brake on outdoor rollout.

Other drivers and restraints analyzed in the detailed report include:

- Enterprise private networks create new growth vectors

- Neutral-host models transform deployment economics

- Semiconductor supply constraints threaten scaling

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Femtocells captured 37% of 2024 revenue, reflecting their affordability for homes and small offices. They handle up to six users within roughly 60 feet, making them the go-to for spot indoor remediation. Yet microcells are slated to grow fastest at 35.30% CAGR, benefiting from an ability to serve 200 users across 1,000 feet-ideal for dense shopping streets and transit stations. The small cell networks market size for the microcell tier is expected to expand swiftly as carriers combine these nodes with edge compute to support latency-sensitive use cases. Radio designs are also converging with Open RAN standards, enabling multi-vendor ecosystems that reduce lock-in and accelerate innovation.

Compatibility upgrades in picocells-covering 750 feet for mid-sized venues-are unlocking new enterprise contracts, while metrocells are rolling out along arterial roads to smooth hand-offs at pedestrian level. Indoor radio-dot architectures have passed 120 operators and deliver macro-parity speeds with minimal on-site equipment. Collectively, these trends underscore how the small cell networks market is becoming a multi-layered ecosystem rather than a single-device proposition.

The Small Cell Networks Market Report is Segmented by Cell Type (Femtocell, Picocell, Microcell, Metrocell, and Radio Dot Systems), Operating Environment (Indoor and Outdoor), End-User Vertical (BFSI, IT and Telecom, Healthcare, Retail, Power and Energy, and Smart City and Government), and Geography.

Geography Analysis

North America held 35% revenue in 2024, anchored by early C-band auctions and federal siting reforms. The United States alone counted more than 452,000 outdoor nodes by 2022 and is budgeted to invest USD 9 billion via the 5G Fund for Rural America to expand beyond metro cores. A landmark USD 14 billion modernization project is replacing legacy basebands with open-architecture radios, illustrating carrier commitment to vendor diversity.

Asia Pacific is projected to deliver a 38.49% CAGR, the steepest regional trajectory. China has deployed more than 500,000 5G base stations, and India's Digital Communications Policy is easing right-of-way barriers nationwide. The regional mobile ecosystem added USD 880 billion to GDP in 2023, underscoring economic stakes. Flagship indoor small-cell implementations-such as KT's Radio Dot roll-out for smart offices-demonstrate the business case for enterprise-grade indoor coverage.

Europe emphasizes sustainability, pursuing solutions that cut site energy by up to 45%. National roadmaps-Germany's 5G Strategy being an example-prioritize tight-grid small cells to support automated driving and Industry 4.0. Operators in the region routinely embed compact radios on streetlamps; one London pilot added 80 cells across Westminster with minimal visual impact.

The Middle East and parts of Africa are scaling 5G for pilgrimage sites and smart-city corridors, as seen in Saudi Arabia's multi-vendor program that combines macro and small-cell layers.

List of Companies Covered in this Report:

- Huawei Technologies Co. Ltd.

- Telefonaktiebolaget LM Ericsson

- Nokia Corporation

- ZTE Corporation

- Samsung Electronics Co. Ltd.

- Cisco Systems Inc.

- CommScope Inc. (incl. Airvana)

- American Tower Corporation

- Qualcomm Technologies Inc.

- ATandT Inc.

- Verizon Communications Inc.

- Crown Castle International Corp.

- Airspan Networks Holdings Inc.

- Qucell Inc.

- Cirrus Core Networks

- Casa Systems Inc.

- Sercomm Corporation

- Baicells Technologies

- Comba Telecom Systems Holdings Ltd.

- IP.Access Ltd.

- Boingo Wireless Inc.

- Parallel Wireless Inc.

- JMA Wireless

- Corning Inc. (SpiderCloud)

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 5G spectrum auctions and network densification mandates

- 4.2.2 Explosive mobile-data and video traffic growth

- 4.2.3 Enterprise demand for private 5G / LTE-A networks

- 4.2.4 Regulator-led spectrum-sharing and CBRS uptake

- 4.2.5 Neutral-host and shared-infrastructure investment wave

- 4.2.6 AI-driven self-optimising networks lowering OPEX

- 4.3 Market Restraints

- 4.3.1 Complex site-acquisition and municipal permitting

- 4.3.2 Backhaul fibre / power availability gaps

- 4.3.3 Rising energy-efficiency compliance costs

- 4.3.4 RF front-end chipset export controls and supply risk

- 4.4 Value Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

- 4.8 Investment and Funding Trends Analysis

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Cell Type

- 5.1.1 Femtocell

- 5.1.2 Picocell

- 5.1.3 Microcell

- 5.1.4 Metrocell

- 5.1.5 Radio Dot Systems

- 5.2 By Operating Environment

- 5.2.1 Indoor

- 5.2.2 Outdoor

- 5.3 By End-user Vertical

- 5.3.1 BFSI

- 5.3.2 IT and Telecom

- 5.3.3 Healthcare

- 5.3.4 Retail

- 5.3.5 Power and Energy

- 5.3.6 Smart City and Government

- 5.4 By Geography

- 5.4.1 North America

- 5.4.2 South America

- 5.4.3 Europe

- 5.4.4 Asia-Pacific

- 5.4.5 Middle East and Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles {(includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)}

- 6.4.1 Huawei Technologies Co. Ltd.

- 6.4.2 Telefonaktiebolaget LM Ericsson

- 6.4.3 Nokia Corporation

- 6.4.4 ZTE Corporation

- 6.4.5 Samsung Electronics Co. Ltd.

- 6.4.6 Cisco Systems Inc.

- 6.4.7 CommScope Inc. (incl. Airvana)

- 6.4.8 American Tower Corporation

- 6.4.9 Qualcomm Technologies Inc.

- 6.4.10 ATandT Inc.

- 6.4.11 Verizon Communications Inc.

- 6.4.12 Crown Castle International Corp.

- 6.4.13 Airspan Networks Holdings Inc.

- 6.4.14 Qucell Inc.

- 6.4.15 Cirrus Core Networks

- 6.4.16 Casa Systems Inc.

- 6.4.17 Sercomm Corporation

- 6.4.18 Baicells Technologies

- 6.4.19 Comba Telecom Systems Holdings Ltd.

- 6.4.20 IP.Access Ltd.

- 6.4.21 Boingo Wireless Inc.

- 6.4.22 Parallel Wireless Inc.

- 6.4.23 JMA Wireless

- 6.4.24 Corning Inc. (SpiderCloud)

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment