PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1850320

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1850320

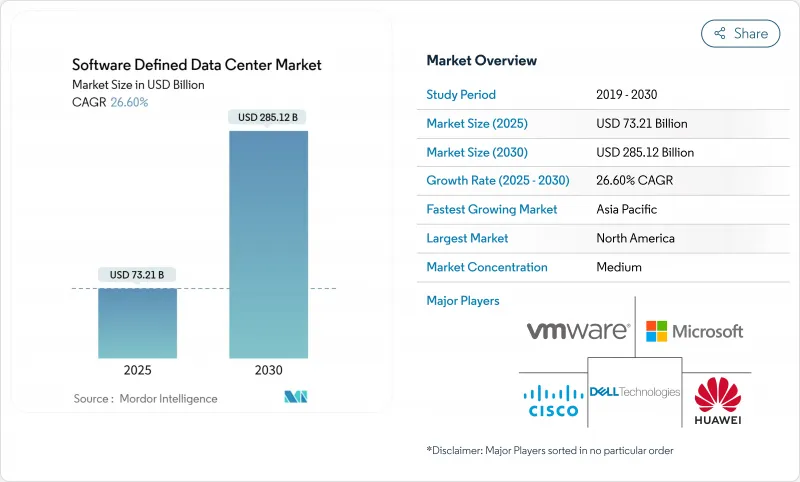

Software Defined Data Center - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The software-defined data center market size is expected to be valued at USD 73.21 billion in 2025 and is forecast to reach USD 285.12 billion by 2030, reflecting a vigorous 26.6% CAGR over the period.

Strong momentum comes from enterprise demand for agile infrastructure, cloud-first strategies, and steady advances in virtualization and automation platforms. Hyperscaler build-outs, coupled with rapid algorithmic workloads, are prompting record capital spending that spills over to colocation and edge operators. Sustained investment in AI-enabled data center infrastructure management, stricter carbon targets, and the arrival of nuclear micro-reactors for on-site generation further reshape competitive dynamics. Vendors able to unify compute, storage, and networking under policy-driven software layers are capturing wallet share from legacy hardware suppliers, while service partners monetize complex migration and managed operations mandates.

Global Software Defined Data Center Market Trends and Insights

Cost reduction in hardware and resource use

Widespread decoupling of hardware and software lowers capital outlays and shrinks refresh cycles. Enterprises running full-stack SDDC platforms report infrastructure cost savings of 34% and a 564% three-year ROI on VMware Cloud Foundation deployments. Automated provisioning tightens utilization, letting firms cut data center footprints by 50% without performance degradation. Lower power and cooling bills compound the benefit, reinforcing project paybacks across regions.

Cloud and virtualization boom among enterprises

Virtualized compute, storage, and network pools underpin hybrid strategies that reconcile latency-sensitive workloads with public-cloud elasticity. Financial institutions using software defined data center market platforms achieved 40% faster message processing and 30% less downtime after modernizing middleware stacks intuitive.cloud. Kubernetes-ready hosts run side by side with virtual machines, simplifying DevOps pipelines and hastening rollouts.

Data-security and compliance complexities

Regulations such as the EU Digital Operational Resilience Act mandate tighter controls from January 2025, pushing financial institutions to verify cyber resilience across virtual layers. Abstracted resource pools challenge perimeter defenses, driving demand for unified key-management hubs like Fortanix Data Security Manager that integrate with VMware Sovereign Cloud. Compliance audits prolong project timelines and raise consulting spend.

Other drivers and restraints analyzed in the detailed report include:

- Hyper-converged and composable infrastructure uptake

- AI-driven DCIM and digital-twin optimisation

- Legacy integration and migration costs

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

The software-defined data center market size for software components reached USD 54.9 billion in 2025, equating to 75.4% of overall revenue. Orchestration engines and policy-based controllers are expanding at a 28.4% CAGR, underlining enterprise appetite for hands-free provisioning. Early adopters record sub-12-month paybacks on workflow automation and drift remediation. Security plug-ins, AI observability modules, and developer tool chains widen the addressable base as ecosystems mature.

Services contribute the remaining share, encompassing advisory, customization, and 24X7 managed operations. Providers bundle migration playbooks, reference architectures, and consumption-based billing to ease entry for heavily regulated verticals. Hardware innovations shift toward composable designs but stay governed by software policies, reinforcing the primacy of code-driven infrastructure.

Private instances captured 41.2% of the software-defined data center market in 2024, favored by organizations securing sensitive data. VMware Cloud Foundation exemplifies turnkey stacks that mimic public-cloud economies while retaining on-premises governance. Hybrid estates, however, are projected to post the highest 26.9% CAGR as firms seek elasticity for spiky workloads without abandoning sunk assets.

Rackspace SDDC Flex merges hosted private clouds with hyperscale extensions under a consumption model, illustrating how service providers blur deployment categories. Public-only footprints remain relevant for cloud-native firms, yet even they demand consistent policy engines across zones to avoid tool sprawl.

Software Defined Data Center Market is Segmented by Component (Solutions and Services), Deployment Model (On-Premises, Private Cloud, Public Cloud, and Hybrid Cloud), Data Center Type ( Colocation, Hyperscalers/ Cloud, and Enterprise and Edge), End-User Vertical (IT and Telecom, BFSI, Healthcare, Retail, and More), and by Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America generated 47.6% of 2024 revenue, a consequence of early virtualization adoption, deep cloud ecosystems, and hyperscaler expansion corridors. Nuclear micro-reactor announcements in Texas signal creative approaches to power adequacy. Regulatory clarity around data-sovereignty zones fuels cross-border disaster-recovery pairings between the United States and Canada, while Mexico's fintech sector ramps up hybrid footprints for open-banking initiatives.

The Asia-Pacific software-defined data center market will rise at a 28.23% CAGR to 2030, aided by sovereign cloud grants, e-commerce surges, and digital-bank licensing rounds. Hyperscalers lease bulk capacity yet still rely on third-party developers to secure land, power, and permits. Singapore maintains hub status through carrier-dense campuses employing novel liquid cooling to meet power caps. India, Japan, and China inaugurate gigawatt-scale campuses, while Australia backs edge rollouts to serve remote mining operations.

Europe adopts SDDC in response to sovereignty and carbon targets. DORA's January 2025 deadline is spurring financial institutions to harden cyber-resilience, expanding budgets for encrypted per-tenant overlays. Northern markets lead in adoption, and southern states accelerate via public-cloud landing zones and green-hydrogen pilots. The Middle East and Africa see rising activity in the UAE and Saudi Arabia, where utility-scale solar farms couple with modular data halls for clean-energy hosting.

- VMware Inc.

- Microsoft Corp.

- Dell Technologies

- Cisco Systems

- Hewlett Packard Enterprise

- IBM Corp.

- Huawei Technologies

- Oracle Corp.

- Citrix Systems

- NEC Corp.

- Nutanix Inc.

- Amazon Web Services

- Google Cloud Platform

- Broadcom (VMware division)

- Juniper Networks

- Arista Networks

- Red Hat (IBM)

- Equinix Inc.

- Lenovo Group

- Rackspace Technology

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Cost reduction in hardware and resource use

- 4.2.2 Cloud and virtualization boom among enterprises

- 4.2.3 Hyper-converged and composable infrastructure uptake

- 4.2.4 AI-driven DCIM and digital-twin optimisation (under-radar)

- 4.2.5 Nuclear micro-reactors unlocking rack-level densities (under-radar)

- 4.2.6 Edge-native micro-SDDC orchestration at 5G sites (under-radar)

- 4.3 Market Restraints

- 4.3.1 Data-security and compliance complexities

- 4.3.2 Legacy integration and migration costs

- 4.3.3 Grid-power scarcity and interconnect delays (under-radar)

- 4.3.4 Increased vendor consolidation/TCO risk (under-radar)

- 4.4 Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Assessment of Macro Economic Trends on Market

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Component

- 5.1.1 Solutions (SDN, SDS, SDC, Automation and Orchestration Security)

- 5.1.2 Services (Consulting and Integration, Managed, Training and Support)

- 5.2 By Deployment Model

- 5.2.1 On-Premises

- 5.2.2 Private Cloud

- 5.2.3 Public Cloud

- 5.2.4 Hybrid Cloud

- 5.3 By Data Center Type

- 5.3.1 Colocation

- 5.3.2 Hyperscalers/Cloud

- 5.3.3 Enterprise and Edge

- 5.4 By End-user Vertical

- 5.4.1 IT and Telecom

- 5.4.2 BFSI

- 5.4.3 Healthcare

- 5.4.4 Retail and E-Commerce

- 5.4.5 Manufacturing

- 5.4.6 Government and Defense

- 5.4.7 Media and Entertainment

- 5.4.8 Energy and Utilities

- 5.4.9 Other End Users

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 United Kingdom

- 5.5.2.2 Germany

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Spain

- 5.5.2.6 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 Japan

- 5.5.3.3 India

- 5.5.3.4 Singapore

- 5.5.3.5 Australia

- 5.5.3.6 Malaysia

- 5.5.3.7 Rest of Asia-Pacific

- 5.5.4 South America

- 5.5.4.1 Brazil

- 5.5.4.2 Chile

- 5.5.4.3 Argentina

- 5.5.4.4 Rest of South America

- 5.5.5 Middle East and Africa

- 5.5.5.1 Middle East

- 5.5.5.1.1 United Arab Emirates

- 5.5.5.1.2 Saudi Arabia

- 5.5.5.1.3 Turkey

- 5.5.5.1.4 Rest of Middle East

- 5.5.5.2 Africa

- 5.5.5.2.1 South Africa

- 5.5.5.2.2 Nigeria

- 5.5.5.2.3 Rest of Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 VMware Inc.

- 6.4.2 Microsoft Corp.

- 6.4.3 Dell Technologies

- 6.4.4 Cisco Systems

- 6.4.5 Hewlett Packard Enterprise

- 6.4.6 IBM Corp.

- 6.4.7 Huawei Technologies

- 6.4.8 Oracle Corp.

- 6.4.9 Citrix Systems

- 6.4.10 NEC Corp.

- 6.4.11 Nutanix Inc.

- 6.4.12 Amazon Web Services

- 6.4.13 Google Cloud Platform

- 6.4.14 Broadcom (VMware division)

- 6.4.15 Juniper Networks

- 6.4.16 Arista Networks

- 6.4.17 Red Hat (IBM)

- 6.4.18 Equinix Inc.

- 6.4.19 Lenovo Group

- 6.4.20 Rackspace Technology

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment