PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1850333

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1850333

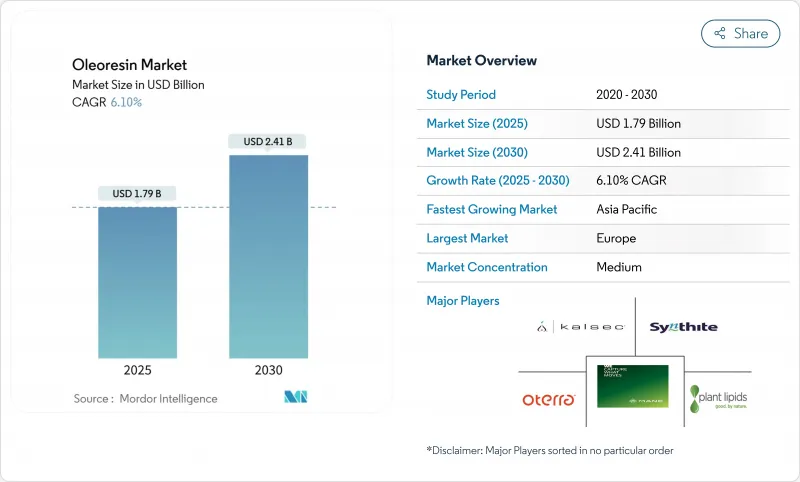

Oleoresin - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The oleoresin market, valued at USD 1.79 billion in 2025, is expected to reach USD 2.41 billion by 2030, with a compound annual growth rate (CAGR) of 6.10% during the forecast period.

The market expansion is driven by increasing global demand for natural and clean-label ingredients across industries. Oleoresins are preferred over synthetic additives due to their stability, longer shelf life, concentrated flavor, and health benefits, including antioxidant, antimicrobial, and anti-inflammatory properties. Growing consumer health consciousness has increased the use of turmeric, black pepper, ginger, and capsicum oleoresins in nutraceuticals and functional foods. The market growth is further supported by improved extraction methods, such as supercritical CO2 and solvent-free extraction, which enhance product quality and efficiency. Additionally, favorable regulations for natural ingredients and increased Research and Development investments are expanding oleoresin applications.

Global Oleoresin Market Trends and Insights

Regulatory Push for Natural Colors and Flavors in Processed Foods

Regulatory developments have significantly influenced oleoresin market dynamics, following the Food and Drug Administration's authorization of three natural color additives in 2025. The approved substances comprise butterfly pea flower extract, galdieria extract blue, and calcium phosphate for food applications. This regulatory modification demonstrates a systematic transition from petroleum-derived synthetic dyes, generating substantial opportunities for oleoresin manufacturers specializing in natural alternatives. The European Union's enforcement of Regulation 1334/2008 reinforces these requirements by mandating all food flavorings to be registered in the European Union flavoring database, thereby necessitating natural ingredient procurement. Furthermore, the European Food Safety Authority's scientific assessments of rosemary extracts and paprika oleoresins have established comprehensive protocols for natural ingredient utilization across multiple product categories, facilitating consistent market expansion.

Rising Clean-Label Demand in Food, Beverages, and Nutraceuticals

Consumer preferences for clean-label products are changing ingredient selection criteria, with oleoresins emerging as solutions that provide both functionality and label transparency. The clean-label movement includes sustainability credentials and processing methods, creating opportunities for oleoresin suppliers offering ethical sourcing and environmentally friendly extraction technologies. According to the International Food Information Council (IFIC), in 2023, approximately 29% of respondents in the United States regularly purchased food and beverages labeled as containing clean ingredients, which has directly influenced the demand for natural oleoresins in food applications . The European market shows the highest clean-label adoption rate, with organic certification becoming a basic requirement for market entry. Beverage manufacturers are adapting to clean-label demands, incorporating water-soluble oleoresin formulations that provide natural coloring and flavoring while maintaining product clarity and stability. This trend enables premium pricing, as consumers are willing to pay more for products with clean-label credentials, creating potential for increased margins for oleoresin suppliers who meet these requirements.

High Production Costs Due to Raw Material Price Volatility and Complex Extraction Processes

Raw material price volatility poses a significant constraint on oleoresin market growth, as spice commodity prices fluctuate due to climate disruptions and geopolitical tensions. Black pepper prices have increased substantially due to strong domestic and export demand, creating cost pressures for oleoresin manufacturers. According to the Office of the Economic Adviser, the Wholesale Price Index of black pepper across India during the financial year 2024 reached 185.4, showing an increase from the previous year . Production costs across the supply chain have increased, with Indian spice markets experiencing higher expenses for fertilizer and labor. Extraction technology costs present additional challenges, as supercritical CO2 systems require significant capital investment and specialized expertise, despite offering better yield and quality compared to traditional solvent extraction methods.

Other drivers and restraints analyzed in the detailed report include:

- Growing Global Demand for Ethnic and Spicy Flavors

- Extended Shelf Life and Logistical Advantages of Oleoresins

- Limited Availability of Raw Materials Due to Seasonal Variations and Climate Conditions

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Black pepper oleoresin holds 25.41% market share in 2024, maintaining its dominant position through its applications in food, pharmaceutical, and cosmetic industries. Turmeric oleoresin exhibits the highest growth rate at 8.38% CAGR through 2030, driven by its expanding use in nutraceuticals and increased regulatory approvals for curcumin-based products. The growth difference between these segments reflects consumer preferences, as turmeric gains prominence due to its anti-inflammatory and antioxidant properties, particularly in dietary supplements and functional foods. Paprika oleoresin maintains a strong market presence by functioning as both a colorant and flavoring agent, especially in processed meat products, where it provides natural coloring while meeting clean-label standards.

Capsicum oleoresin fills specific applications requiring standardized heat levels, with demand increasing due to the rising popularity of spicy foods and the need for consistent pungency in commercial food production. Supercritical CO2 extraction technology improves product quality across segments by delivering higher purity levels and better preservation of bioactive compounds compared to conventional solvent methods. Ginger oleoresin sees increased use in beverages and confectionery, while garlic and onion oleoresins serve specific markets requiring sulfur compound preservation for authentic flavors. The segment dynamics align with industry trends toward functional ingredients, as demonstrated by turmeric's transformation from a traditional spice to a recognized health-promoting compound.

The Oleoresin Market is Segmented by Product Type (Paprika, Black Pepper, Turmeric, Capsicum, Ginger, and More), by Form (Oil-Soluble Liquid Oleoresins, Water-Soluble Liquid Oleoresins, and Powdered Oleoresins), by Application (Food and Beverages, Dietary Supplements, Pharmaceuticals, and More), and by Geography (North America, Europe, Asia-Pacific, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Europe holds a dominant 29.16% market share in 2024, driven by strict regulations favoring natural ingredients and robust supply chains connecting Germany, Spain, and the Netherlands with global oleoresin suppliers. The region's mature market emphasizes premium pricing for organic and sustainably sourced oleoresins as standard requirements. Supply chain traceability and environmental responsibility create opportunities for ethical suppliers, while the established food processing industry maintains consistent demand across applications

Asia-Pacific exhibits the highest growth rate at 7.04% CAGR through 2030, with India's position as the world's largest spice producer. The Ministry of Agriculture and Farmers Welfare reports India's spice production reached 11.8 million metric tons in fiscal year 2024, supporting the country's oleoresin manufacturing and export capabilities . China's significant paprika oleoresin imports influence market dynamics, with trade requirements emphasizing organic production and traceability standards.

North America demonstrates a mature market with strong regulatory frameworks supporting natural ingredients and clean-label demands. Food manufacturers' shift away from artificial ingredients creates opportunities for natural oleoresin alternatives. The region prioritizes supply chain resilience following pandemic disruptions, focusing on domestic sourcing and strategic inventory management. The advanced food processing industry, high consumer purchasing power, and expanding nutraceutical sector support premium oleoresin product growth.

- Synthite Industries Ltd

- Kalsec Inc.

- Mane SA

- Plant Lipids Private Limited

- Oterra A/S

- Olam Food Ingredients

- Silverline Chemicals Ltd

- Universal Oleoresins Private Limited

- Naturite Agro Products Ltd

- Givaudan SA

- McCormick and Company

- Sensient Technologies

- Lionel Hitchen Limited

- Natura Vitalis Industries Pvt. Ltd.

- Ozone Naturals

- AVT Group

- Mul Group

- Arjuna Natural Private Limited

- Rakesh Sandal Industries

- Natures Natural India Oils Private Limited

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Drivers

- 4.1.1 Regulatory push for natural colors and flavors in processed foods

- 4.1.2 Rising Clean-Label Demand in Food, Beverages, and Nutraceuticals

- 4.1.3 Growing Global Demand for Ethnic and Spicy Flavors

- 4.1.4 Extended Shelf Life and Logistical Advantages of Oleoresins

- 4.1.5 Expanding use in personal care and cosmetic products

- 4.1.6 Rising adoption in the nutraceutical industry for dietary supplements

- 4.2 Market Restraints

- 4.2.1 High production costs due to raw material price volatility and complex extraction processes

- 4.2.2 Limited availability of raw materials due to seasonal variations and climate conditions

- 4.2.3 Competition from synthetic alternatives and flavor substitutes

- 4.2.4 Storage and handling challenges due to the sensitive nature of oleoresins

- 4.3 Supply-Chain Analysis

- 4.4 Regulatory Outlook

- 4.5 Porter's Five Forces

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers/Consumers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitute Products

- 4.5.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Product Type

- 5.1.1 Paprika

- 5.1.2 Black Pepper

- 5.1.3 Turmeric

- 5.1.4 Capsicum

- 5.1.5 Ginger

- 5.1.6 Garlic

- 5.1.7 Onion

- 5.1.8 Others

- 5.2 By Form

- 5.2.1 Oil-Soluble Liquid Oleoresins

- 5.2.2 Water-Soluble Liquid Oleoresins

- 5.2.3 Powdered Oleoresins

- 5.3 By Application

- 5.3.1 Food and Beverages

- 5.3.1.1 Bakery Goods

- 5.3.1.2 Spices and Condiments

- 5.3.1.3 Meat and Seafood Products

- 5.3.1.4 Ready Meals and Snacks

- 5.3.1.5 Other Food and Beverages

- 5.3.2 Dietary Supplements

- 5.3.3 Pharmaceuticals

- 5.3.4 Cosmetics and Personal-Care

- 5.3.5 Animal Feed and Pet Food

- 5.3.1 Food and Beverages

- 5.4 By Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.1.4 Rest of North America

- 5.4.2 South America

- 5.4.2.1 Brazil

- 5.4.2.2 Argentina

- 5.4.2.3 Rest of South America

- 5.4.3 Europe

- 5.4.3.1 United Kingdom

- 5.4.3.2 Germany

- 5.4.3.3 France

- 5.4.3.4 Italy

- 5.4.3.5 Spain

- 5.4.3.6 Russia

- 5.4.3.7 Rest of Europe

- 5.4.4 Asia-Pacific

- 5.4.4.1 China

- 5.4.4.2 India

- 5.4.4.3 Japan

- 5.4.4.4 Australia

- 5.4.4.5 Rest of Asia-Pacific

- 5.4.5 Middle East and Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 South Africa

- 5.4.5.3 Rest of Middle East and Africa

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Strategic Moves

- 6.2 Market Ranking Analysis

- 6.3 Company Profiles (includes Global-level Overview, Market-level Overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.3.1 Synthite Industries Ltd

- 6.3.2 Kalsec Inc.

- 6.3.3 Mane SA

- 6.3.4 Plant Lipids Private Limited

- 6.3.5 Oterra A/S

- 6.3.6 Olam Food Ingredients

- 6.3.7 Silverline Chemicals Ltd

- 6.3.8 Universal Oleoresins Private Limited

- 6.3.9 Naturite Agro Products Ltd

- 6.3.10 Givaudan SA

- 6.3.11 McCormick and Company

- 6.3.12 Sensient Technologies

- 6.3.13 Lionel Hitchen Limited

- 6.3.14 Natura Vitalis Industries Pvt. Ltd.

- 6.3.15 Ozone Naturals

- 6.3.16 AVT Group

- 6.3.17 Mul Group

- 6.3.18 Arjuna Natural Private Limited

- 6.3.19 Rakesh Sandal Industries

- 6.3.20 Natures Natural India Oils Private Limited

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK