PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1850338

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1850338

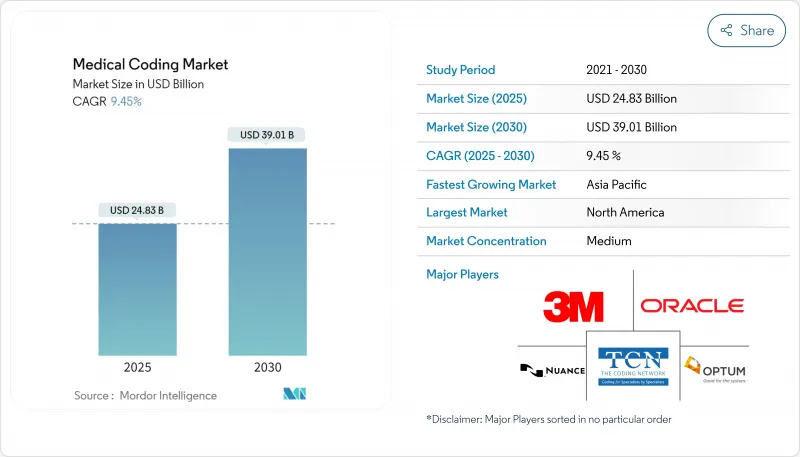

Medical Coding - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Medical Coding Market size is estimated at USD 24.83 billion in 2025, and is expected to reach USD 39.01 billion by 2030, at a CAGR of 9.45% during the forecast period (2025-2030).

Cloud-hosted platforms dominate because hospitals prefer scalable, subscription-based systems that integrate smoothly with electronic health records. Web access also enables remote teams, a necessity since healthcare providers still confront a 30% coder shortfall. The fast rollout of ICD-11, expansion of national insurance programs in emerging economies, and accelerating use of AI tools to cut charge lags all reinforce demand. Strategic acquisitions among service providers and software firms signal a race to build end-to-end solutions that link documentation, coding, and claims seamlessly across every care setting.

Global Medical Coding Market Trends and Insights

Transition to ICD-11 and global standardization

ICD-11 came into force on 1 January 2022 and now spans about 17,000 diagnostic categories and 130,000 clinical terms. The 2025 release adds multilingual support across 14 languages and introduces clustered codes that capture complex conditions more precisely. Fourteen European, eleven Asia-Pacific, six African, and four American nations already use the new system, prompting large-scale software upgrades and staff retraining. Vendors supplying automated map-ping tools and bundled training are gaining contracts because health systems must convert legacy ICD-10 libraries. The United States is expected to need a four-to-five-year migration window because its ICD-10-CM variant contains more than 70,000 codes, creating sustained business for transition consultants.

Surge in healthcare claims volume amid aging populations

Payers process unprecedented claim loads as seniors require multifaceted care; Humana alone adjudicates 480,000 claims. Electronic data interchange covers 96% of Medicaid submissions, and 99.1% clear within ten days, compressing revenue cycles. Faster payment targets obligate coders to match rising acuity with pinpoint documentation. Hospitals are therefore investing heavily in computer-assisted platforms that combine natural language processing with real-time edits to curb denials. Vendors able to scale processing power during seasonal spikes, such as influenza peaks, command premium contracts.

Acute shortage of certified coders

The United States posts a 30% coder vacancy rate, with many employees nearing retirement . Baptist Health Medical Group recently received 300 applicants for 20 internal training slots, illustrating training bottlenecks. Pay scales and signing bonuses are climbing, but smaller clinics struggle to compete. Outsourcing therefore grows 10.67% annually, and AI rollouts receive accelerated funding to offset staff deficits. High turnover also raises compliance risks because new hires often need six months of experience before coding autonomously, slowing productivity during onboarding.

Other drivers and restraints analyzed in the detailed report include:

- Accelerating adoption of AI-assisted auto-coding solutions in hospitals

- Expansion of public health insurance schemes in emerging countries

- Continuous regulatory code-set updates causing operational disruptions

For complete list of drivers and restraints, kindly check the Table Of Contents.

List of Companies Covered in this Report:

- 3M Health Information Systems

- Optum360 (UnitedHealth Group)

- nThrive, Inc. (FinThrive)

- Nuance Communications (Microsoft Corp.)

- Aviacode, Inc.

- The Coding Network

- Dolbey Systems, Inc.

- Maxim Healthcare

- Infosys BPM

- Cognizant

- GeBBs Healthcare Solutions

- Omega Healthcare Management Services

- R1 RCM

- Parexel International

- HGS Healthcare

- iMedX, Inc.

- MRA Health Information Services

- ACU-Serve Corp.

- Conifer Health Solutions

- Sutherland Global Services

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Transition to ICD-11 and global standardization of healthcare coding

- 4.2.2 Surge in healthcare claims volume amid aging populations

- 4.2.3 Accelerating adoption of AI-assisted auto-coding solutions in hospitals

- 4.2.4 Expansion of public health insurance schemes in emerging countries.

- 4.2.5 Regulatory push for accurate risk adjustment under value-based care programs

- 4.2.6 Expansion of public health insurance schemes in emerging Asian economies

- 4.3 Market Restraints

- 4.3.1 Acute shortage of certified coders

- 4.3.2 Continuous regulatory code-set updates causing operational disruptions along with data security

- 4.3.3 Data security & HIPAA compliance concerns in offshore coding centers

- 4.3.4 High training costs limiting adoption in small physician practices

- 4.4 Supply-Chain Analysis

- 4.5 Regulatory or Technological Outlook

- 4.6 Porter's Five Forces

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Suppliers

- 4.6.3 Bargaining Power of Buyers

- 4.6.4 Threat of Substitutes

- 4.6.5 Industry Competitive Rivalry

5 Market Size & Growth Forecasts

- 5.1 By Classification System (Value, USD)

- 5.1.1 ICD Series (ICD-10, ICD-11)

- 5.1.2 CPT

- 5.1.3 HCPCS

- 5.2 By Component (Value, USD)

- 5.2.1 In-house Coding

- 5.2.2 Outsourced Coding

- 5.3 By Delivery Mode (Value, USD)

- 5.3.1 On-premise

- 5.3.2 Web & Cloud-based

- 5.4 By End User (Value, USD)

- 5.4.1 Hospitals and clinics

- 5.4.2 Insurance Payers

- 5.4.3 Others

- 5.5 By Specialty Type (Value, USD)

- 5.5.1 Radiology

- 5.5.2 Oncology

- 5.5.3 Cardiology

- 5.5.4 Pathology

- 5.5.5 Other Specialties

- 5.6 By Geography (Value, USD)

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Mexico

- 5.6.2 Europe

- 5.6.2.1 Germany

- 5.6.2.2 United Kingdom

- 5.6.2.3 France

- 5.6.2.4 Italy

- 5.6.2.5 Spain

- 5.6.2.6 Rest of Europe

- 5.6.3 Asia-Pacific

- 5.6.3.1 China

- 5.6.3.2 India

- 5.6.3.3 Japan

- 5.6.3.4 South Korea

- 5.6.3.5 Australia

- 5.6.3.6 Rest of Asia-Pacific

- 5.6.4 Middle East

- 5.6.4.1 GCC

- 5.6.4.2 South Africe

- 5.6.4.3 Rest of Middle East

- 5.6.5 South America

- 5.6.5.1 Brazil

- 5.6.5.2 Argentina

- 5.6.5.3 Rest of South America

- 5.6.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles {(includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)}

- 6.4.1 3M Health Information Systems

- 6.4.2 Optum360 (UnitedHealth Group)

- 6.4.3 nThrive, Inc. (FinThrive)

- 6.4.4 Nuance Communications (Microsoft Corp.)

- 6.4.5 Aviacode, Inc.

- 6.4.6 The Coding Network LLC

- 6.4.7 Dolbey Systems, Inc.

- 6.4.8 Maxim Health Information Services

- 6.4.9 Infosys BPM

- 6.4.10 Cognizant Technology Solutions

- 6.4.11 GeBBS Healthcare Solutions

- 6.4.12 Omega Healthcare Management Services

- 6.4.13 R1 RCM Inc.

- 6.4.14 Parexel International

- 6.4.15 HGS Healthcare

- 6.4.16 iMedX, Inc.

- 6.4.17 MRA Health Information Services

- 6.4.18 ACU-Serve Corp.

- 6.4.19 Conifer Health Solutions

- 6.4.20 Sutherland Global Services

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment