PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1850341

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1850341

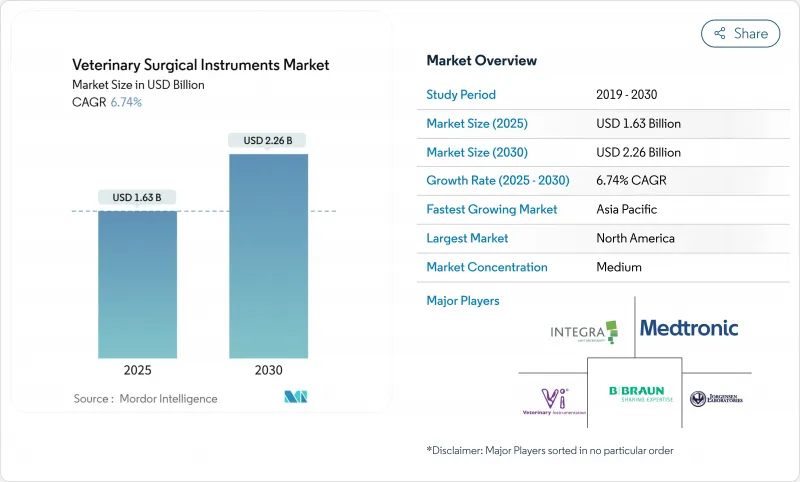

Veterinary Surgical Instruments - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The veterinary surgical instruments market is valued at USD 1.63 billion in 2025 and is forecast to reach USD 2.26 billion by 2030, advancing at a 6.74% CAGR.

Companion-animal demand, rapid innovations in electrosurgery, and expanding pet insurance coverage are propelling revenue. Precision-based protocols, particularly minimally invasive surgery, are pushing clinics to upgrade to high-definition visualization, bipolar electrosurgery, and 3D-printed orthopedic implants. Asia-Pacific shows the strongest momentum thanks to rising disposable income, government-led infrastructure programs, and a growing urban pet population. Orthopedic surgery is emerging as the next growth engine, supported by custom implants and AI-guided planning. Still, high capital costs and a global shortfall of board-certified surgeons threaten adoption rates, underscoring the importance of training and flexible financing for new equipment.

Global Veterinary Surgical Instruments Market Trends and Insights

Minimally-invasive surgery trend in animals

Demand for laparoscopic and arthroscopic procedures is transforming the veterinary surgical instruments market. Recovery times fall by up to 65% and complication rates decline when trocars, cannulas, and HD endoscopes replace open techniques. U.S. specialty clinics report 42% MIS adoption for spays, while 56% of orthopedic specialists deploy arthroscopy to refine joint diagnostics. Clinics that market shorter convalescence periods see higher case acceptance, pushing distributors to prioritize MIS-ready kits. Manufacturers respond with ergonomic instrument handles that minimize surgeon fatigue during procedures lasting beyond 90 minutes.

Rising pet ownership and pet-insurance penetration

Ninety-four million U.S. households kept pets in 2024, and 4.4 million of those owners insured their animals, triggering 40% higher veterinary outlays per insured pet. This behavior directly lifts procedure volumes for orthopedic repair, cardiac interventions, and advanced dentistry. Insurers, meanwhile, influence procurement by reimbursing clinics that use certified devices, indirectly accelerating premium instrument purchases. Cities such as London, New York, and Shanghai form dense clusters of high-end demand, allowing suppliers to pilot AI-enabled electrosurgery platforms before wider rollout.

High costs limiting adoption of advanced instruments

Premium electrosurgery towers can top USD 50,000 when bundled with smoke evacuators and bipolar forceps. Maintenance contracts, tip replacements, and technician training push total cost of ownership far above basic scalpel sets, widening the technology gap between high-end referral hospitals and rural practices. Leasing, pay-per-use, and refurbished options are gaining traction, but uptake remains uneven in India, Brazil, and South-East Asia.

Other drivers and restraints analyzed in the detailed report include:

- Growing disease burden and spay-neuter programs

- Intensifying R&D and product innovation

- Shortage of board-certified veterinary surgeons

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Sutures and staplers continued to command 33.7% of 2024 sales. Yet electrosurgery systems are the fastest climber with a 9.80% CAGR that will add roughly USD 250 million to the veterinary surgical instruments market size by 2030. The veterinary surgical instruments market benefits from ergonomically contoured handles and foot-switch integration that lessen fatigue during two-hour tumor resections. Handheld scissors, needle holders, and rongeurs remain essential, but demand now centers on premium steel grades and micro-serrated edges that prolong sharpness.

Veterinary teaching hospitals in the United States and Australia have publicized cardiology firsts such as transcatheter mitral-valve repair in dogs, demonstrating electrosurgery's widening clinical scope. This evidence base nudges private clinics toward mid-range bipolar generators instead of entry-level monopolar units. Suppliers bundle trocar sets and smoke extractors, boosting average sale value per clinic by 28% between 2024 and 2025.

The Veterinary Surgical Instruments Market Report is Segmented by Product (Sutures and Staplers, Handheld Instruments, Electro-Surgery Instruments, Other Products), Animal (Companion Animals and Farm Animals), Application (Soft-Tissue Surgery, Dental Surgery, Orthopedic Surgery, Ophthalmic Surgery, and Other Applications), and Geography (North America, Europe and More). The Market and Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America generated 38.0% of global sales in 2024. Early adoption of AI-assisted imaging and a pet-insurance culture enable clinics to upgrade every five to seven years instead of once a decade. Thirty percent of U.S. veterinarians already use some form of artificial intelligence during diagnosis, increasing data capture that feeds back into surgical planning. Nonetheless, the veterinarian shortage is acute in Midwest and Mountain states, stretching case loads and pushing tele-mentoring for general practitioners undertaking complex procedures.

Asia-Pacific is the fastest-growing territory at 10.23% CAGR. China's 2025 medical-device fair introduced an AI-integrated orthopedic robot, reinforcing investor appetite for high-precision systems. India's private chain hospitals are experimenting with subscription-based service contracts to spread equipment costs. Regional governments link zoonotic-disease surveillance with veterinary-hospital expansion, unlocking grants for autoclaves and endoscopes in tier-two cities. These policies are broadening distributor networks and compressing delivery times for critical parts.

Europe maintains stringent welfare regulations that require certified instrument traceability and sterile reprocessing logs. The CVS Group's USD 54.7 million spend on upgrades in 2024 underlines the region's willingness to rotate stock toward high-performance alloys with traceable lot numbers. Meanwhile, Latin America and the Middle East and Africa show accelerating demand as pet ownership climbs. Brazil leads surgical-instrument imports, while Gulf markets prioritize equine surgery, raising requirements for extra-long bone plates and laryngoscopic devices.

- B. Braun

- Medtronic

- Integra LifeSciences

- Jorgensen Laboratories

- Kshama Surgical

- Accesia AB

- GerVetUSA

- Arch Medical Solutions Company (gSource)

- Orthomed (UK) Ltd

- Johnson & Johnson

- Eickemeyer Veterinary Equipment

- World Precision Instruments

- Dentalaire International

- SAI Infusion Technologies

- Granim Healthcare (DRE Veterinary)

- Amerisource Bergen Corporation

- Surgical Holdings

- Aspen Surgical Products, Inc.

- IndoSurgicals Private Limited

- Rajindra Surgical Industries

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Minimally-invasive surgery trend in Animals

- 4.2.2 Rising Pet Ownership and Pet Insurance Penetration

- 4.2.3 Rising Animal Disease burden and spay/neuter programs are boosting surgical volumes

- 4.2.4 Increasing R&D Expenditure and Product Innovation for Animal Healthcare

- 4.2.5 Expansion of Veterinary healthcare Infrastructure Coupled with Government Inititiaves and Animal Welfare Regulations

- 4.2.6 Clinic corporatization unlocking budgets for premium instruments

- 4.3 Market Restraints

- 4.3.1 High Cost of Advanced Surgical Instruments and Procedures

- 4.3.2 Shortage of board-certified veterinary surgeons

- 4.3.3 Stringent Regulatory Approvals

- 4.3.4 Limited sterilization infrastructure in smaller clinics curbs adoption of complex reusable surgical tools

- 4.4 Regulatory and Technological Outlook

- 4.5 Porter's Five Forces Analysis

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Intensity of Competitive Rivalry

5 Market Size and Growth Forecasts (Value-USD)

- 5.1 Sutures and Staplers

- 5.1.1 Handheld Instruments

- 5.1.1.1 Scalpels

- 5.1.1.2 Forceps

- 5.1.1.3 Scissors

- 5.1.1.4 Retractors

- 5.1.2 Electro-surgery Instruments

- 5.1.3 Other Products

- 5.1.3.1 Trocars and Cannulas

- 5.1.3.2 Suction and Irrigation

- 5.1.1 Handheld Instruments

- 5.2 By Animal

- 5.2.1 Companion Animals

- 5.2.1.1 Dogs

- 5.2.1.2 Cats

- 5.2.2 Farm Animals

- 5.2.2.1 Bovine

- 5.2.2.2 Swine

- 5.2.2.3 Poultry

- 5.2.1 Companion Animals

- 5.3 By Application

- 5.3.1 Soft-Tissue Surgery

- 5.3.2 Dental Surgery

- 5.3.3 Orthopedic Surgery

- 5.3.4 Ophthalmic Surgery

- 5.3.5 Other Applications

- 5.4 By Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Italy

- 5.4.2.5 Spain

- 5.4.2.6 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 Japan

- 5.4.3.3 India

- 5.4.3.4 Australia

- 5.4.3.5 South Korea

- 5.4.3.6 Rest of Asia-Pacific

- 5.4.4 Middle East and Africa

- 5.4.4.1 GCC

- 5.4.4.2 South Africa

- 5.4.4.3 Rest of Middle East and Africa

- 5.4.5 South America

- 5.4.5.1 Brazil

- 5.4.5.2 Argentina

- 5.4.5.3 Rest of South America

- 5.4.1 North America

6 Competitive Landscape

- 6.1 Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.3.1 B. Braun SE

- 6.3.2 Medtronic

- 6.3.3 Integra LifeSciences Corporation

- 6.3.4 Jorgensen Laboratories

- 6.3.5 Kshama Surgical

- 6.3.6 Accesia AB

- 6.3.7 GerVetUSA

- 6.3.8 Arch Medical Solutions Company (gSource)

- 6.3.9 Orthomed (UK) Ltd

- 6.3.10 Johnson and Johnson

- 6.3.11 Eickemeyer

- 6.3.12 World Precision Instruments

- 6.3.13 Dentalaire International

- 6.3.14 SAI Infusion Technologies

- 6.3.15 Granim Healthcare (DRE Veterinary)

- 6.3.16 Amerisource Bergen Corporation

- 6.3.17 Surgical Holdings

- 6.3.18 Aspen Surgical Products, Inc.

- 6.3.19 IndoSurgicals Private Limited

- 6.3.20 Rajindra Surgical Industries

7 Market Opportunities and Future Outlook

- 7.1 White-Space and Unmet-Need Assessment