PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1850352

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1850352

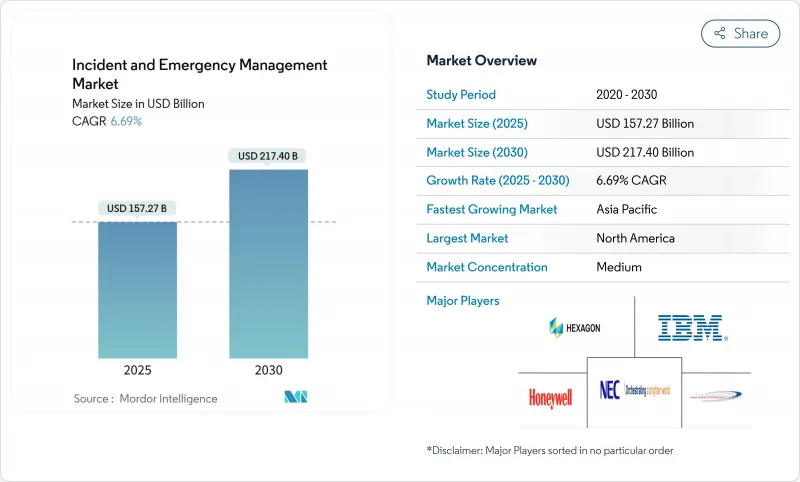

Incident And Emergency Management - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The incident and emergency management market size is valued at USD 157.27 billion in 2025 and is forecast to reach USD 217.40 billion by 2030, reflecting a steady 6.69% CAGR over the period.

This trajectory mirrors the rapid institutionalisation of emergency-preparedness budgets in both the public and private sectors, coupled with rising weather-driven disasters that command more comprehensive, technology-enabled response capabilities. North America maintains a broad lead on account of sophisticated federal funding programmes, while Asia registers the fastest expansion as governments upgrade early-warning and mass-notification infrastructures. Demand pivots toward integrated platforms that fuse geospatial analytics, cloud-native architectures, and AI-driven decision support, shortening the time between detection and coordinated field action. Intensifying cyber-physical threats and the migration of traffic and public-safety controls into smart-city fabrics round out the near-term growth catalysts.

Global Incident And Emergency Management Market Trends and Insights

Increasing frequency and severity of climate-related mega-disasters

Economic losses from natural catastrophes reached USD 320 billion in 2024, with North America absorbing roughly 60% and Asia Pacific recording 79 hydro-meteorological events, spotlighting preparedness gaps. Rising loss ratios push governments and enterprises to procure multi-hazard early-warning networks, cloud-based incident dashboards, and satellite-enabled situational-awareness feeds. Development lenders such as the World Bank-hosted GFDRR underwrite capacity-building grants, anchoring multi-year procurement pipelines that fortify the incident and emergency management market.

Mandated compliance with public alerting standards (FEMA IPAWS, EU EECC)

Legislation now obliges telecom operators and public agencies to support authenticated cell-broadcast and multimodal warnings, accelerating mass-notification deployments. FEMA's IPAWS benchmarks spurred heavy county-level adoption in the United States, while the EU's Electronic Communications Code has set a 2025 deadline for continent-wide alerting reach. France's upcoming mission-critical broadband network illustrates how spectrum migration unlocks richer media-location-pinpointed texts, images, and short videos-that heighten public responsiveness during crises.

Interoperability gaps between legacy P25/TETRA networks and IP-based platforms

Many European public-safety agencies still depend on narrowband P25 or TETRA radios that operate on proprietary protocols, hampering seamless roaming onto broadband cellular or satellite links. SAFECOM grant guidance presses states to adopt standards-based bridging technologies, yet funding and procurement cycles slow roll-out of converged solution. The resulting patchwork delays cross-border coordination and marginally dampens the incident and emergency management market's near-term growth.

Other drivers and restraints analyzed in the detailed report include:

- Adoption of AI-powered geospatial analytics for real-time situational awareness upgrades

- Escalating cyber-physical attacks on critical infrastructure

- High CapEx for resilient communications in remote APAC and island nations

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Solutions generated 55% of the incident and emergency management market in 2024, a testament to buyer preference for end-to-end platforms that orchestrate alerting, resource allocation, and after-action reporting in a single pane of glass. Rapid upgrades to AI engines and cloud elasticity underpin continued wallet share expansion. Vendors accentuate open-API ecosystems that plug into CAD, GIS, and EOC modules, improving time-to-value for regional agencies. Over the forecast horizon, tighter integration with insurance-risk scoring tools will further entrench platform revenues.

Simulation & Training, though smaller in absolute revenue, is scaling at 7.8% CAGR as agencies institutionalise scenario-based preparedness policies. Gamified modules such as George Mason University's AI-augmented "Go-Repair" illustrate how immersive learning cuts attrition and raises competence, thereby elevating training budgets. This segment's expansion feeds a virtuous cycle: stronger preparedness metrics qualify states for resilience grants, reinforcing upstream demand for platform solutions.

Emergency/Mass Notification continues to anchor 28% of 2024 revenue as regulated mandates lock in upgrade cycles. However, Surveillance & Security Monitoring is the fastest-moving niche at 8.5% CAGR, propelled by AI-driven video analytics and object detection that shorten dispatch times. Video feeds now integrate directly into 911 centres, producing a continuous intelligence loop that amplifies situational clarity and responder safety. Over the outlook period, the incident and emergency management market size attached to this sub-segment could exceed USD 35 billion if municipal vision-zero programmes accelerate as projected.

Traffic & Incident Management rides urban-mobility investments, whereas CBRNE/HazMat Detection broadens sensor deployment via unmanned aerial systems that minimise human exposure. Disaster Recovery & Backup solutions play a crucial role, mitigating secondary business-interruption costs.

The Incident and Emergency Management Market is Segmented by Component (Solutions, Services, and More), Solution Type (Emergency/Mass Notification, and More), Service Type (Professional Services, Consulting and Advisory, and More), Communication System (First-Responder Communication, Emergency Radios, and More), Simulation Module (Traffic Simulation Software, and More), End-User (Government, BFSI, and More), and Geography.

Geography Analysis

North America anchors 42% of 2024 revenue, sustained by FEMA grants, private-sector cyber-investment, and wide FirstNet penetration. US counties align on interoperable protocols, and Canada's DFAA framework pairs fiscal backstops with modernisation commitments, cultivating a mature ecosystem of suppliers, systems integrators, and academia. Pilot deployments of tethered drones for TIM lend tangible proof points that reinforce municipal budget renewals.

Asia delivers a 7.3% CAGR, spurred by megacities' exposure to typhoons and seismic risk. China overlays city-wide HD camera grids onto command centres, and Japan's J-ALERT system extends real-time hazard feeds to the public. India leverages AI-driven geospatial platforms to triage relief corridors after cyclones, elevating enterprise spending on emergency operations centres. Multilateral funding via ADB's Disaster Risk Management Action Plan catalyses procurement in ASEAN markets.

Europe sustains steady replacement cycles as the EECC compliance clock counts down. Projects such as BroadWay pilot cross-border roaming for first responders, driving solution providers to embed secure SIM credentialing and quality of service tiers. Meanwhile, the Middle East and Africa witness incremental adoption as humanitarian-relief agencies and national security bodies standardise on early-warning analytics to counter compound drought and conflict risks.

- Honeywell International Inc.

- Motorola Solutions Inc.

- Hexagon AB

- IBM Corporation

- The Response Group LLC

- Everbridge Inc.

- NEC Corporation

- Johnson Controls International plc

- BlackBerry AtHoc

- Alert Technologies Corporation

- Veoci (Grey Wall Software LLC)

- Eccentex Corporation

- Haystax Technology (Fishtech Group)

- MissionMode Solutions Inc.

- Resolver Inc.

- NC4 Inc. (An Everbridge Company)

- MetricStream Inc.

- Genetec Inc.

- Collins Aerospace

- Esri Inc.

- Hexagon Safety and Infrastructure

- Nokia Corporation

- Airbus SLC

- Tabletop Command

- TigerConnect

- Rave Mobile Safety

- PagerDuty Inc.

- RapidSOS

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increasing frequency and severity of climate-related mega-disasters across North America and Asia

- 4.2.2 Mandated compliance with public alerting standards (FEMA IPAWS, EU EECC) driving mass-notification deployments

- 4.2.3 Adoption of AI-powered geospatial analytics for real-time situational awareness upgrades

- 4.2.4 Escalating cyber-physical attacks on critical infrastructure boosting unified incident response demand

- 4.2.5 Smart-city programs integrating traffic and emergency management control centers

- 4.2.6 Risk-based insurance incentives spurring enterprise Emergency Operations Center investments

- 4.3 Market Restraints

- 4.3.1 Interoperability gaps between legacy P25/TETRA networks and IP-based platforms in Europe

- 4.3.2 High CapEx for resilient communications in remote APAC and island nations

- 4.3.3 Data-privacy regulations (GDPR, CCPA) limiting location-based alert capabilities

- 4.3.4 Shortage of systems-integration talent for command-and-control roll-outs

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory or Technological Outlook

- 4.6 Porter's Five Forces

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitutes

- 4.6.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Component

- 5.1.1 Solutions

- 5.1.2 Services

- 5.1.3 Communication Systems

- 5.1.4 Simulation and Training

- 5.2 By Solution Type

- 5.2.1 Emergency/Mass Notification

- 5.2.2 Surveillance and Security Monitoring

- 5.2.3 Traffic and Incident Management

- 5.2.4 Disaster Recovery and Backup

- 5.2.5 CBRNE/HazMat Detection Systems

- 5.2.6 Public Information Management

- 5.3 By Service Type

- 5.3.1 Professional Services

- 5.3.2 Consulting and Advisory

- 5.3.3 Training and Education

- 5.3.4 System Integration and Deployment

- 5.3.5 Managed Services

- 5.3.6 Support and Maintenance

- 5.4 By Communication System

- 5.4.1 First-Responder Communication (P25, TETRA)

- 5.4.2 Emergency Radios and Satellite Phones

- 5.4.3 Vehicle-Mounted Mobile Data Terminals

- 5.4.4 Drones and Robotics for Situational Awareness

- 5.5 By Simulation Module

- 5.5.1 Traffic Simulation Software

- 5.5.2 Hazard Propagation and Evacuation Modeling

- 5.5.3 Incident Command Training Simulators

- 5.6 By End-User Vertical

- 5.6.1 Government and Defense

- 5.6.2 Energy and Utilities

- 5.6.3 Healthcare

- 5.6.4 BFSI

- 5.6.5 Transportation and Logistics

- 5.6.6 IT and Telecom

- 5.6.7 Manufacturing and Industrial

- 5.6.8 Aviation and Maritime

- 5.6.9 Mining and Oil and Gas

- 5.6.10 Media and Entertainment

- 5.7 By Geography

- 5.7.1 North America

- 5.7.1.1 United States

- 5.7.1.2 Canada

- 5.7.1.3 Mexico

- 5.7.2 South America

- 5.7.2.1 Brazil

- 5.7.2.2 Rest of South America

- 5.7.3 Europe

- 5.7.3.1 United Kingdom

- 5.7.3.2 Germany

- 5.7.3.3 France

- 5.7.3.4 Nordics

- 5.7.3.5 Rest of Europe

- 5.7.4 APAC

- 5.7.4.1 China

- 5.7.4.2 Japan

- 5.7.4.3 India

- 5.7.4.4 South Korea

- 5.7.4.5 ASEAN

- 5.7.4.6 Australia

- 5.7.4.7 New Zealand

- 5.7.4.8 Rest of APAC

- 5.7.5 Middle East and Africa

- 5.7.5.1 Saudi Arabia

- 5.7.5.2 United Arab Emirates

- 5.7.5.3 South Africa

- 5.7.5.4 Rest of Middle East and Africa

- 5.7.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles {(includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)}

- 6.4.1 Honeywell International Inc.

- 6.4.2 Motorola Solutions Inc.

- 6.4.3 Hexagon AB

- 6.4.4 IBM Corporation

- 6.4.5 The Response Group LLC

- 6.4.6 Everbridge Inc.

- 6.4.7 NEC Corporation

- 6.4.8 Johnson Controls International plc

- 6.4.9 BlackBerry AtHoc

- 6.4.10 Alert Technologies Corporation

- 6.4.11 Veoci (Grey Wall Software LLC)

- 6.4.12 Eccentex Corporation

- 6.4.13 Haystax Technology (Fishtech Group)

- 6.4.14 MissionMode Solutions Inc.

- 6.4.15 Resolver Inc.

- 6.4.16 NC4 Inc. (An Everbridge Company)

- 6.4.17 MetricStream Inc.

- 6.4.18 Genetec Inc.

- 6.4.19 Collins Aerospace

- 6.4.20 Esri Inc.

- 6.4.21 Hexagon Safety and Infrastructure

- 6.4.22 Nokia Corporation

- 6.4.23 Airbus SLC

- 6.4.24 Tabletop Command

- 6.4.25 TigerConnect

- 6.4.26 Rave Mobile Safety

- 6.4.27 PagerDuty Inc.

- 6.4.28 RapidSOS

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment