PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1850356

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1850356

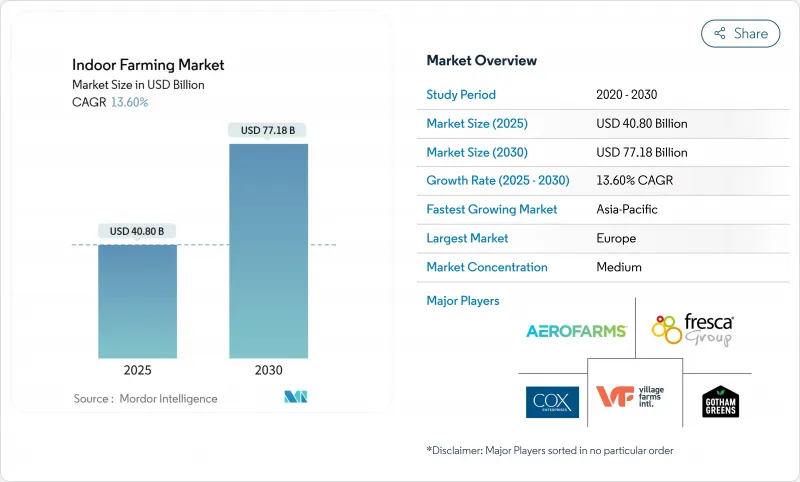

Indoor Farming - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Indoor Farming Market size is estimated at USD 40.80 billion in 2025 and is projected to reach USD 77.18 billion by 2030, at a CAGR of 13.60% during the forecast period.

Adoption is gaining momentum as cities search for resilient food systems and growers look for predictable yields that are insulated from weather shocks. Rapid improvements in LED efficacy have cut lighting energy use by up to 40% compared with high-pressure sodium fixtures. Artificial intelligence controls now trim overall facility energy consumption by another 25%, which pushes many projects into breakeven territory earlier in their lifecycles. Europe holds the largest indoor farming market share at 33.9% on the strength of Dutch greenhouse know-how, while Asia-Pacific is expanding the fastest at an 18.20% CAGR as land scarcity and food security concerns intensify. Hydroponics remains the dominant growing method, yet aeroponics is scaling quickly because it delivers higher yields with less water-an attractive formula in drought-prone markets. Greenhouses still account for more than two-thirds of global installations, although multilevel vertical farms are proliferating where urban real-estate economics reward space efficiency.

Global Indoor Farming Market Trends and Insights

Urban Demand for Fresh, Pesticide-Free Produce

Consumers living in dense cities are gravitating toward produce grown in controlled environments where contamination risks are virtually eliminated and "picked today, sold tomorrow" freshness is achievable. Major retailers such as Sam's Club have, therefore, signed direct grower agreements to guarantee a reliable supply and extend shelf life, reducing store-level shrinkage and transport emissions. Controlled-environment farms meet these expectations by fine-tuning nutrients, humidity, and airflow, leading to consistent taste and visual appeal that command premium pricing. The COVID-19 pandemic reinforced demand for traceable food systems, persuading supermarket executives to dedicate more shelf space to locally grown indoor crops. Governments are responding as well. The United Arab Emirates' "Plant the Emirates" program targets a 20% jump in domestic controlled-environment output within five years. Collectively, these shifts underpin the steady expansion of the indoor farming market in core consumption hubs.

LED Efficiency and HVAC Cost Declines

Breakthroughs in photonics and thermal management technology are redefining unit economics. Field trials by Grodan and Signify validated a 40% cut in heating requirements while preserving premium tomato yields. Modern fixtures now incorporate spectral tuning that enhances crop morphology and boosts nutrient density. Machine-learning HVAC systems predict optimal setpoints based on external weather and plant growth phase, dropping total energy needs by a further 15%. Utility rebate programs plus participation in demand-response markets allow operators to shift load away from peak-price periods and monetize unused capacity. Renewable integration is accelerating. Latvian demonstration sites have reached positive cash flow using roof-mounted photovoltaics that cover 30% of annual demand. Lower operating costs translate directly into wider adoption and deeper penetration of the indoor farming market.

High CAPEX and Energy Intensity

Building a multilevel farm with sophisticated lighting, irrigation, and automation often costs multiples of a conventional greenhouse, and electricity can represent 40% of ongoing expenses. A recent Chapter 11 filing by Plenty, despite USD 941 million in funding, underscores how aggressive scaling without disciplined cost control jeopardizes solvency. Operators cultivating highlight crops such as cannabis are migrating from high-pressure sodium lamps to LEDs that cut consumption by more than 40%, yet upfront fixture costs remain material. Demand-response participation partially offsets power bills but requires advanced scheduling software and resilient crop plans. In markets with high tariff volatility, renewable power purchase agreements, and behind-the-meter batteries are becoming standard risk-mitigation tools.

Other drivers and restraints analyzed in the detailed report include:

- Shrinking Arable Land and Extreme Weather Volatility

- Corporate Scope-3 Targets Driving Long-Term Off-Take Contracts

- VC Funding Pull-Back After High-Profile Bankruptcies

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Hydroponics retained a 58.3% share of the indoor farming market in 2024 because of its proven scalability, extensive supplier network, and moderate technical complexity. Many mature greenhouse operators use computerized nutrient-film systems that deliver predictable yields for high-volume leafy greens. Aeroponics is advancing at a 24.30% CAGR as growers focus on water savings and faster root oxygenation, attributes that are critical when cultivating premium strawberries or vine crops prone to root diseases. Aquaponics occupies a smaller niche but is attracting sustainability-minded municipalities, creating circular-economy models that co-locate fish and vegetable production. AI-driven sensor suites now optimize dissolved oxygen and nutrient dosing, cutting waste across all systems and trimming electricity bills by 25% in large hydroponic setups.

The choice between systems increasingly reflects crop economics rather than technical preference. Leafy greens require shallow root zones and quick turnover that align with nutrient-film methods. High-margin berries justify aeroponic complexity because increased airflow delivers superior fruit firmness and color that command premiums. Operators often blend techniques, reserving deep-water culture beds for long-cycle tomatoes while dedicating stacked aeroponic towers to herbs demanding exacting flavor profiles. Such hybrid strategies help maximize the indoor farming market size per facility by tailoring conditions to each crop's physiology.

The Indoor Farming Market Report is Segmented by Growing System (Aeroponics, Hydroponics, Aquaponics, and More), by Facility Type (Glass or Poly Greenhouses, Indoor Vertical Farms, Container Farms, and More), by Crop Type (Fruits and Vegetables, Herbs and Microgreens, and More), and by Geography (North America, Europe, South America, Asia-Pacific, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Europe boasts a 33.9% portion of global spending, anchored by the Netherlands' cluster of high-tech greenhouses, a workforce skilled in climate control, and carbon-tax incentives that speed the adoption of low-emission agriculture. German and Spanish retailers, meanwhile, broaden sourcing contracts to include mid-sized vertical farms that shorten truck routes and ensure year-round inventory. Energy-price volatility is a hurdle, but widespread district-heating networks and the growing availability of renewable power purchase agreements counterbalance cost risk.

Asia-Pacific records the fastest 18.20% CAGR, propelled by land constraints and a sizeable urban middle class seeking safe, traceable produce. Singapore's government offers grants and floor-area concessions for rooftop farms, although several high-profile closures reveal the difficulty of matching capital intensity with local demand. China's coastal provinces are establishing controlled-environment hubs within new "agri-tech parks" that pair universities with venture investors, accelerating best-practice diffusion. In Japan, municipal utilities subsidize LED deployment to stabilize night-time grid load, indirectly lowering production costs.

North America, while mature, continues to add large greenhouse acreage. BrightFarms' 1.5 million square feet Texas complex features evaporative cooling that keeps summer leaf temperatures below 77 degrees Fahrenheit, enabling year-round supply contracts with regional grocers. Mexico is scaling shade-house vegetables for export into border states, leveraging favorable sunlight and labor cost advantages. The Middle East invests aggressively in sovereign funds back vertical projects that promise food-security dividends and reduced desalination demand. Africa exhibits early-stage adoption, most notably in Kenya and South Africa, where solar-powered container farms mitigate unreliable grid supply. Collectively, these dynamics confirm that the indoor farming market expands fastest wherever public policy, energy prices, and urban demand align.

- Village Farms International Inc.

- COX Enterprises, Inc (BrightFarms)

- Pure Harvest Smart Farms

- Plenty Unlimited Inc.

- Fresca Group (Thanet Earth)

- UrbanKisaan Inc.

- Emirates Hydroponics Farms

- Revol Greens

- Gotham Greens

- Windset Farms

- Badia Farms (Green Corp)

- Eden Green Technology

- Bustanica (The Emirates Group)

- Sky Greens

- AeroFarms

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Urban demand for fresh, pesticide-free produce

- 4.2.2 LED efficiency and HVAC cost declines

- 4.2.3 Shrinking arable land and extreme weather volatility

- 4.2.4 Surplus vacant retail/warehouse real estate repurposed

- 4.2.5 Carbon-credit monetization for low-footprint produce

- 4.2.6 Corporate Scope-3 targets driving long-term off-take contracts

- 4.3 Market Restraints

- 4.3.1 High CAPEX and energy intensity

- 4.3.2 Scarcity of skilled horticultural workforce

- 4.3.3 VC funding pull-back after high-profile bankruptcies

- 4.3.4 Urban grid-congestion and power-availability limits

- 4.4 Regulatory Landscape

- 4.5 Technological Outlook

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers/Consumers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

5 Market Size and Growth Forecasts (Value)

- 5.1 By Growing System

- 5.1.1 Aeroponics

- 5.1.2 Hydroponics

- 5.1.3 Aquaponics

- 5.1.4 Soil-based

- 5.1.5 Hybrid

- 5.2 By Facility Type

- 5.2.1 Glass or Poly Greenhouses

- 5.2.2 Indoor Vertical Farms

- 5.2.3 Container Farms

- 5.2.4 Indoor Deep-Water Culture Systems

- 5.2.5 Other Facility Types (Tunnel greenhouses, Hoop houses, etc.)

- 5.3 By Crop Type

- 5.3.1 Fruits and Vegetables

- 5.3.1.1 Leafy Vegetables

- 5.3.1.2 Tomato

- 5.3.1.3 Strawberry

- 5.3.1.4 Eggplant

- 5.3.1.5 Other Fruits and Vegetables (Cucumber, Bell pepper, etc.)

- 5.3.2 Herbs and Microgreens

- 5.3.2.1 Basil

- 5.3.2.2 Tarragon

- 5.3.2.3 Wheatgrass

- 5.3.2.4 Other Herbs and Microgreens (Micro-broccoli, Sorrel, etc.)

- 5.3.3 Flowers and Ornamentals

- 5.3.3.1 Perennials

- 5.3.3.2 Annuals

- 5.3.3.3 Ornamentals

- 5.3.3.4 Other Flowers and Ornamentals (Roses, Chrysanthemums, etc.)

- 5.3.4 Other Crop Types (Mushrooms, Cannabis, etc.)

- 5.3.1 Fruits and Vegetables

- 5.4 By Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.1.4 Rest of North America

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Spain

- 5.4.2.5 Italy

- 5.4.2.6 Russia

- 5.4.2.7 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 Japan

- 5.4.3.3 India

- 5.4.3.4 Australia

- 5.4.3.5 Singapore

- 5.4.3.6 South Korea

- 5.4.3.7 Rest of Asia-Pacific

- 5.4.4 Middle East

- 5.4.4.1 Saudi Arabia

- 5.4.4.2 United Arab Emirates

- 5.4.4.3 Turkey

- 5.4.4.4 Rest of Middle East

- 5.4.5 Africa

- 5.4.5.1 South Africa

- 5.4.5.2 Kenya

- 5.4.5.3 Nigeria

- 5.4.5.4 Rest of Africa

- 5.4.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Village Farms International Inc.

- 6.4.2 COX Enterprises, Inc (BrightFarms)

- 6.4.3 Pure Harvest Smart Farms

- 6.4.4 Plenty Unlimited Inc.

- 6.4.5 Fresca Group (Thanet Earth)

- 6.4.6 UrbanKisaan Inc.

- 6.4.7 Emirates Hydroponics Farms

- 6.4.8 Revol Greens

- 6.4.9 Gotham Greens

- 6.4.10 Windset Farms

- 6.4.11 Badia Farms (Green Corp)

- 6.4.12 Eden Green Technology

- 6.4.13 Bustanica (The Emirates Group)

- 6.4.14 Sky Greens

- 6.4.15 AeroFarms

7 Market Opportunities and Future Outlook