PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1850357

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1850357

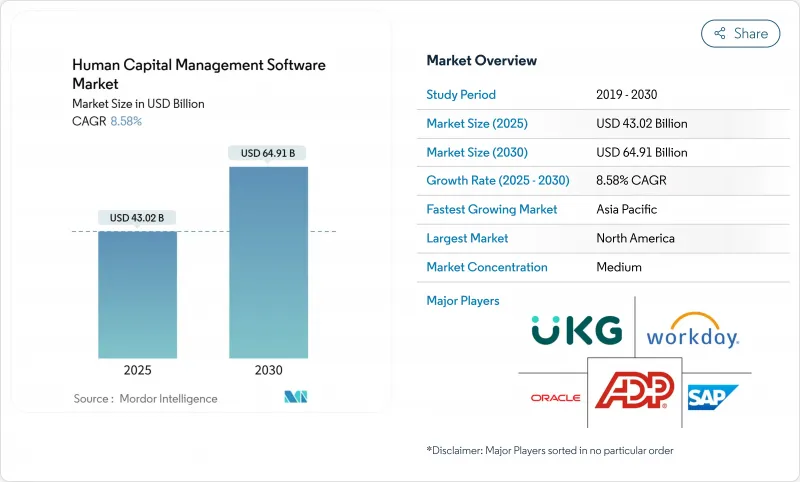

Human Capital Management Software - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The human capital management software market size is valued at USD 43.02 billion in 2025 and is projected to reach USD 64.91 billion by 2030, expanding at an 8.6% CAGR.

Cloud migration, embedded artificial intelligence, and always-on global compliance automation are the structural forces reshaping every stage of the purchase cycle, from RFP design to contract renewal. Boards now view integrated, cloud-native HR suites as essential risk-mitigation tools that automate pay-equity adjustments, tax changes, and privacy obligations, while simultaneously delivering real-time workforce analytics that lift productivity and retention. Small and medium enterprises are accelerating adoption because subscription-based deployments eliminate the capital costs and IT headcount traditionally associated with on-premise HRIS, creating a two-speed environment inside the human capital management software market where SME agility meets large-enterprise complexity. Vendors that can deliver universal data models, mobile-first workflows, and transparent AI pipelines are capturing a disproportionate share, whereas laggards tethered to legacy architectures are losing renewals. Over one-third of North American expansion deals already bundle machine-learning-driven goal-setting, attrition risk scoring, and skills matching as default entitlements, signaling that AI is no longer an optional add-on but a baseline requirement.

Global Human Capital Management Software Market Trends and Insights

Shift to Cloud-Native HCM Platforms

Cloud migration has progressed from hardware refresh to board-level mandate. Over 90% of HR leaders plan to protect or increase budgets specifically to unlock cloud analytics and auto-updated compliance engines. Real-time tax table pushes and jurisdiction-specific pay-equity rules arrive inside a single code line, eliminating quarterly patch backlogs. Yet only 22% of employers report full readiness to harness those capabilities, leaving an execution gap that implementation partners and professional-services teams are keen to monetize. Mid-market buyers dominate new-logo counts because they gain enterprise-class analytics without maintaining data centers, but large enterprises are now issuing phased migration RFPs that preserve prior custom logic while adopting containerized microservices. Within the human capital management software market, every provider's roadmap now centers on delivering multi-tenant scale, sovereign-cloud options, and zero-downtime upgrades to neutralize lingering security objections.

Integrated Talent and Payroll Suites Gain Traction

Stand-alone talent or payroll engines create costly data reconciliations that impede analytics accuracy. Eighty-five percent of employers currently license at least two paid HR products and are consolidating wherever commercial terms allow. In Asia-Pacific, fast-growing organizations deploy unified suites during first-generation digitization, avoiding technical debt and leapfrogging Western adoption curves. Convergence also unlocks richer insights: payroll data surfaces real-time budget constraints, while talent modules expose skills gaps, enabling algorithmic compensation recommendations linked to learning achievements. Vendors that invest in a unified object model-covering wages, skills, credentials, and performance-outperform peers still stitching together acquired codebases, a dynamic increasingly visible in renewal pricing inside the human capital management software market.

Cyber-Security and Data-Privacy Concerns

GDPR, CCPA, CPRA, and Brazil's LGPD impose strict constraints on data retention, residency, and employee consent. HR databases contain bank details, social-security numbers, and performance notes-prime targets for credential-stuffing attacks. Buyers, therefore, elevate ISO 27001 certification, zero-trust network designs, and continuous penetration testing to top selection criteria. The new hurdle is proving encryption of personally identifiable information both in transit and at rest while maintaining analytics performance. Vendors are responding with in-memory tokenization and attribute-based access controls, but those enhancements lengthen rollout timelines and raise total cost of ownership, tempering growth inside the human capital management software market.

Other drivers and restraints analyzed in the detailed report include:

- Workforce Analytics and AI for Strategic HR

- Compliance Mandates for Global Payroll and Taxation

- Legacy Migration Cost and Complexity

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Payroll remains the backbone of HR technology, accounting for 38.0% of 2024 revenue in the human capital management software market. Its criticality stems from legal requirements to pay employees accurately and on time, leaving little room for outsourcing delays. However, Learning and Development is advancing at a 9.5% CAGR toward 2030. Executives battling skill shortages prefer upskilling internal talent to avoid escalating recruiting costs and protracted vacancy periods. Incorporating learning catalogues, credential tracking, and mentorship workflows into the same platform that runs payroll unlocks a closed feedback loop: AI can correlate micro-credential completion with wage progression, boosting engagement while satisfying pay-equity reporting.

Beyond payroll and learning, demand for talent-management and workforce-management cubes remains steady, driven by employers seeking unified performance data that informs scheduling, overtime approval, and compensation bumps. Core HR Administration persists as a table-stakes module but rarely influences vendor selection unless bundled with value-add analytics. In the evolving human capital management software market, providers are embedding course marketplaces, skills ontologies, and internal gig-market modules to elevate learning from a compliance obligation to a strategic productivity engine. Those failing to retool will see wallet share erode as clients shift budget toward outcome-oriented applications.

On-premise still controls 68.4% of revenue in 2024, a legacy of decade-old ERP decisions. Many public-sector and highly regulated customers resist migration because of data-sovereignty clauses and integration tangles. Yet cloud implementations are climbing at a 10.1% CAGR, propelling the human capital management software market into a subscription-first era. Buyers appreciate converting capex to opex while gaining quarterly feature drops and security patches without downtime. Contracts now bundle sub-hour compliance pushes and real-time analytics sandboxes, benefits unattainable in static on-premise stacks.

A hybrid pattern is emerging: personal information and payroll calculations often remain on private or sovereign clouds, whereas front-end analytics run on hyperscaler instances for elasticity. Vendors offering containerized services and infrastructure-as-code blueprints capture implementation budgets because they reduce migration anxiety. Eventually, an inflection point will arise where artificial-intelligence feature velocity compels even conservative sectors to re-evaluate on-premise holdings, further tipping the human capital management software market toward cloud dominance.

The Human Capital Management Software Market Report is Segmented by Solution (Payroll Management, Talent Management, Workforce Management, and More), Deployment (On-Premise and Cloud), Organization Size (Large Enterprises and Small and Medium Enterprises), Industry Vertical (IT and Telecom, BFSI, and More), and Geography.

Geography Analysis

North America controls 43.1% of 2024 revenue inside the human capital management software market. Longstanding SaaS familiarity, strong venture funding, and dense implementation-partner ecosystems fuel upgrade cycles. Pay-equity legislation accelerates reporting module adoption; California alone mandates median-pay disclosure across gender and race categories, incentivizing real-time analytics. Vendors differentiate on AI explainability and workflow extensibility because functionality parity exists across payroll, benefits, and learning. Switching costs remain high, yet new entrants that promise consumer-grade mobile UX and transparent pricing still find footholds among venture-backed firms scaling headcount rapidly.

Europe presents a mosaic of labor codes; Germany, France, and the Nordics each impose unique works-council consultation workflows. GDPR drives strict data-sovereignty reviews; many buyers demand data centers within national borders. Hybrid deployments lead: sensitive HR files stay local, while machine-learning workloads run on EU-accredited public clouds. Sustainability credentials and responsible-AI commitments increasingly influence procurement; vendors highlight energy-efficient data centers and bias-mitigation frameworks to pass tender scoring.

Asia-Pacific is the fastest-growing region at 9.6% CAGR. Governments from India to Indonesia subsidize SME digitization, driving first-generation payroll and attendance purchases. Mobile-first features dominate, catering to field-based workforces. Regional providers thrive by integrating statutory returns, e-wallet disbursements, and chatbot support in local languages, yet often partner with global suites for advanced analytics. Multinational corporations seek unified processes across China, Japan, and Southeast Asia, pushing vendors to expand language packs and in-country tax content. Within the human capital management software market, this region showcases a two-tier structure: local champions owning regulatory nuance and global giants supplying AI-rich analytics.

- SAP SE

- Oracle Corporation

- Workday Inc.

- ADP LLC

- Ceridian HCM Holding Inc.

- UKG (Ultimate Kronos Group)

- Infor

- Cornerstone OnDemand Inc.

- IBM Corporation

- Ramco Systems

- BambooHR LLC

- Zoho Corporation (Zoho People)

- Namely Inc.

- Gusto Inc.

- Paycom Software Inc.

- Sage Group plc

- Epicor Software Corporation

- SumTotal Systems LLC

- PeopleFluent Inc.

- Meta4 (Cegid)

- Talentia Software

- OrangeHRM Inc.

- Rippling

- Deel Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Shift to cloud-native HCM platforms

- 4.2.2 Integrated talent and payroll suites gain traction

- 4.2.3 Workforce analytics and AI for strategic HR

- 4.2.4 Compliance mandates for global payroll and taxation

- 4.2.5 Pay-equity legislation spurs compensation tools

- 4.2.6 Mobile-first HCM for deskless and gig workforce

- 4.3 Market Restraints

- 4.3.1 Cyber-security and data-privacy concerns

- 4.3.2 Legacy migration cost and complexity

- 4.3.3 Low end-user adoption of complex suites

- 4.3.4 AI bias litigation risk restricts roll-outs

- 4.4 Value Chain Analysis

- 4.5 Technological Outlook

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitutes

- 4.6.5 Intensity of Competitive Rivalry

- 4.7 Assessment of the Impact of Macroeconomic Trends on the Market

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Solution

- 5.1.1 Payroll Management

- 5.1.2 Talent Management

- 5.1.3 Workforce Management

- 5.1.4 Core HR Administration

- 5.1.5 Learning and Development

- 5.2 By Deployment

- 5.2.1 On-Premise

- 5.2.2 Cloud

- 5.3 By Organization Size

- 5.3.1 Large Enterprises

- 5.3.2 Small and Medium Enterprises

- 5.4 By Industry Vertical

- 5.4.1 IT and Telecom

- 5.4.2 BFSI

- 5.4.3 Manufacturing

- 5.4.4 Healthcare

- 5.4.5 Retail and E-Commerce

- 5.4.6 Government and Public Sector

- 5.4.7 Others

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Spain

- 5.5.2.6 Russia

- 5.5.2.7 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 Japan

- 5.5.3.3 India

- 5.5.3.4 South Korea

- 5.5.3.5 ASEAN

- 5.5.3.6 Australia and New Zealand

- 5.5.3.7 Rest of Asia-Pacific

- 5.5.4 South America

- 5.5.4.1 Brazil

- 5.5.4.2 Argentina

- 5.5.4.3 Rest of South America

- 5.5.5 Middle East and Africa

- 5.5.5.1 Middle East

- 5.5.5.1.1 Saudi Arabia

- 5.5.5.1.2 UAE

- 5.5.5.1.3 Turkey

- 5.5.5.1.4 Rest of Middle East

- 5.5.5.2 Africa

- 5.5.5.2.1 South Africa

- 5.5.5.2.2 Nigeria

- 5.5.5.2.3 Rest of Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves and Developments

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 SAP SE

- 6.4.2 Oracle Corporation

- 6.4.3 Workday Inc.

- 6.4.4 ADP LLC

- 6.4.5 Ceridian HCM Holding Inc.

- 6.4.6 UKG (Ultimate Kronos Group)

- 6.4.7 Infor

- 6.4.8 Cornerstone OnDemand Inc.

- 6.4.9 IBM Corporation

- 6.4.10 Ramco Systems

- 6.4.11 BambooHR LLC

- 6.4.12 Zoho Corporation (Zoho People)

- 6.4.13 Namely Inc.

- 6.4.14 Gusto Inc.

- 6.4.15 Paycom Software Inc.

- 6.4.16 Sage Group plc

- 6.4.17 Epicor Software Corporation

- 6.4.18 SumTotal Systems LLC

- 6.4.19 PeopleFluent Inc.

- 6.4.20 Meta4 (Cegid)

- 6.4.21 Talentia Software

- 6.4.22 OrangeHRM Inc.

- 6.4.23 Rippling

- 6.4.24 Deel Inc.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment