PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1850361

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1850361

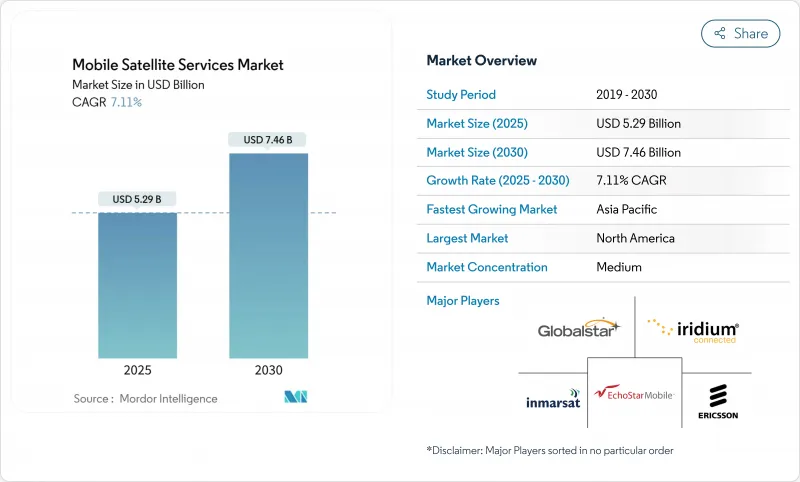

Mobile Satellite Services - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The mobile satellite services market reached USD 5.29 billion in 2025 and is forecast to rise to USD 7.46 billion by 2030, advancing at a 7.12% CAGR.

Rapid migration from voice-centric links to broadband and direct-to-device connectivity is reshaping demand patterns while lowering reliance on terrestrial backhaul. Commercialisation of 3GPP non-terrestrial network standards, the sharp drop in launch costs for Low-Earth-Orbit (LEO) constellations, and persistent connectivity gaps across rural and maritime zones are expanding the mobile satellite services market opportunity. Government procurement cycles are accelerating because secure sovereign links have moved from discretionary spend to strategic infrastructure, and enterprise digitalisation programmes now budget satellite capacity as standard insurance against fibre or cellular outages. Intensifying competition from vertically integrated LEO operators is also pressuring legacy geostationary incumbents to modernise fleet technologies, adopt software-defined payloads and bundle multi-orbit capacity into usage-based contracts.

Global Mobile Satellite Services Market Trends and Insights

Rising Integration of Satellite-Terrestrial Mobile Networks

Key Highlights

- Seamless handover between space-based and ground networks moved from concept to early commercial reality after the Federal Communications Commission adopted its Supplemental Coverage from Space framework in 2024, allowing secondary satellite operations within terrestrial mobile spectrum.Mobile operators now embed satellite capacity as an automated fallback layer so subscribers retain service on the same handset when fibre backhaul, microwave, or cellular radios fail. AT&T and Verizon opened the door to nationwide roaming trials that use AST SpaceMobile's L- and S-Band payloads to provide texting when towers are down. Satellite operators gain incremental wholesale revenue, while telcos strengthen coverage maps without capital outlay. The result is a virtuous cycle that enlarges the mobile satellite services market by blurring the historical boundary between terrestrial and non-terrestrial networks.

Escalating Government and Defense Demand for Secure Links

Sovereign connectivity requirements surged after several geopolitical flashpoints exposed reliance on foreign operators. The European Commission approved EUR 10.6 billion (USD 11.3 billion) for the multi-orbit IRIS2 programme that will furnish encrypted broadband to institutions, first responders, and critical infrastructure.Similar procurement tracks in the United States, Japan, and India specify quantum-resistant encryption and multi-orbit redundancy. SES completed its USD 3.1 billion acquisition of Intelsat in early 2025 to strengthen its government portfolio and offer layered GEO-MEO-LEO capacity under single-throat contracts. High-margin government deals therefore underpin fleet upgrades and expand the reachable revenue pool for the mobile satellite services market.

Lack of Interoperability Among Legacy MSS Systems

Enterprises with transcontinental fleets still juggle multiple terminals because L-Band, S-Band, and Ku-Band gateways do not interoperate. The Mobile Satellite Services Association formed in 2024 to champion roaming standards, yet chipset fragmentation persists and drives higher total cost of ownership for shippers and airlines that traverse many footprints. Without seamless roaming, the perceived value of the mobile satellite services market remains lower than terrestrial cellular, where a single SIM offers worldwide access. Multimode terminals are emerging, but certification, antenna design compromises, and limited production scale have slowed adoption.

Other drivers and restraints analyzed in the detailed report include:

- Growing Connectivity Needs for Remote IoT/M2M Assets

- Surge in Disaster-Resilient Communications Programmes

- High User-Terminal Cost Due to Phased-Array Antennas

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Data connectivity accounted for 63.4% of 2024 revenue, underscoring how broadband and streaming now anchor customer budgets in the mobile satellite services market. Enterprises book high-throughput circuits to backhaul video surveillance, crew welfare access, and remote software updates that would otherwise be impossible. Voice retains a niche in maritime distress and cockpit safety, yet bandwidth-driven contracts are eclipsing per-minute billing. IoT/M2M subscriptions grew fastest and are forecast to post 12.4% CAGR to 2030 as agriculture, mining, and utilities scale remote sensor fleets. Each new sensor module adds incremental revenue at negligible satellite operating cost, making the segment strategically significant for margin expansion. The mobile satellite services market size for IoT endpoints is therefore poised to rise meaningfully despite lower average revenue per device.

Video and data growth pushes operators to adopt regenerative payloads so traffic can be processed onboard, reducing ground bottlenecks. China's launch of 12 AI-enhanced LEO satellites that execute 744 TOPS showcases orbital edge computing, where spectral efficiency gains free additional throughput for sale without extra spectrum allocation. Flexible software-defined hubs let capacity be redeployed from seasonal maritime lanes to hurricane recovery zones within minutes, improving utilisation. The transition to capacity-as-a-service contracts also incentivises operators to provide performance guarantees rather than best-effort links, a model imported from cloud computing. These shifts collectively reinforce data's primacy and validate the expectation that data will still exceed 60% of the mobile satellite services market by 2030.

The Mobile Satellite Services Market Report is Segmented by Service (Voice, Data, Broadband, and More), Frequency (L-Band, S-Band, and More), End-User Industry (Maritime, Aviation, Government and Defense, and More),

Geography Analysis

North America retained 38.1% share of the mobile satellite services market in 2024 because of large Department of Defense contracts, well-established regulatory pathways, and early direct-to-device pilots. The United States accounted for most regional revenue, buoyed by fleet broadcasts across energy pipelines and first-responder networks. Canada increased demand through universal service mandates in its northern territories, and Mexico leveraged shared satellite capacity to connect mountainous communities. Regional C-band refarming provided additional downlink bandwidth, allowing operators to widen consumer broadband offers without launching new spacecraft.

Asia Pacific is set to post a 10.2% CAGR, the fastest among all regions, as governments pursue digital sovereignty and private conglomerates digitise logistics chains. Launch rates remain brisk, and regional players such as KDDI commercialised "au Starlink Direct" to bring messaging to standard smartphones across Japan's mountainous topography. China expanded national capacity by adding high-throughput Ka-Band satellites that will serve Belt and Road shipping routes, while India welcomed agreements between Bharti Airtel and SpaceX to widen rural broadband. Southeast Asian archipelagos signed procurement frameworks that bundle capacity for disaster-relief, fisheries monitoring, and school connectivity into a single sovereign contract.

Europe experienced robust institutional demand anchored by the IRIS2 security programme. The European GNSS Agency fast-tracked grants for quantum-safe uplink research, and the SpaceRISE consortium began constructing a multi-orbit network with combined GEO, MEO, and LEO segments. Middle East operators collaborated with European fleet owners to provide maritime coverage along new Red Sea shipping lanes, and African telcos sourced Ka-Band capacity from European providers to bridge national fibre gaps. Latin America pursued disaster-resilient satellite overlays in hurricane zones, and Andean nations adopted L-Band handheld satellite phones for emergency response in terrain where microwave links are infeasible.

- Inmarsat plc

- Iridium Communications Inc.

- Globalstar Inc.

- EchoStar Mobile Ltd

- Thuraya Telecommunications Co.

- Intelsat S.A.

- ORBCOMM Inc.

- ViaSat Inc. (Incl. ViaSat U.K.)

- Ericsson (Satellite IoT)

- SES S.A.

- Eutelsat Group

- Hughes Network Systems

- OneWeb

- AST SpaceMobile

- Ligado Networks

- Telesat Lightspeed

- Skylo Technologies

- Qualcomm Inc. (Snapdragon Satellite)

- SpaceX - Starlink Direct-to-Cell

- Thales Alenia Space

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising integration of satellite-terrestrial mobile networks

- 4.2.2 Escalating government and defense demand for secure links

- 4.2.3 Growing connectivity needs for remote IoT/M2M assets

- 4.2.4 Surge in disaster-resilient communications programs

- 4.2.5 3GPP-NTN standard enabling direct-to-device MSS

- 4.2.6 LEO narrow-band constellations lowering latency and cost

- 4.3 Market Restraints

- 4.3.1 Lack of interoperability among legacy MSS systems

- 4.3.2 Tightening spectrum and orbital slot regulations

- 4.3.3 High user-terminal cost due to phased-array antennas

- 4.3.4 Space-debris mitigation rules raising launch insurance

- 4.4 Value Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Buyers

- 4.7.2 Bargaining Power of Suppliers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Service

- 5.1.1 Voice

- 5.1.2 Data

- 5.1.3 Broadband

- 5.1.4 IoT / M2M

- 5.2 By Frequency Band

- 5.2.1 L-Band

- 5.2.2 S-Band

- 5.2.3 Ku-Band

- 5.2.4 Ka-Band

- 5.3 By End-User Industry

- 5.3.1 Maritime

- 5.3.2 Aviation

- 5.3.3 Government and Defense

- 5.3.4 Enterprise and Energy

- 5.3.5 Land Mobile

- 5.4 By Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.2 South America

- 5.4.2.1 Brazil

- 5.4.2.2 Argentina

- 5.4.2.3 Rest of South America

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 France

- 5.4.3.4 Russia

- 5.4.3.5 Rest of Europe

- 5.4.4 Asia Pacific

- 5.4.4.1 China

- 5.4.4.2 India

- 5.4.4.3 Japan

- 5.4.4.4 South Korea

- 5.4.4.5 ASEAN

- 5.4.4.6 Rest of Asia Pacific

- 5.4.5 Middle East

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 United Arab Emirates

- 5.4.5.3 Turkey

- 5.4.5.4 Rest of Middle East

- 5.4.6 Africa

- 5.4.6.1 South Africa

- 5.4.6.2 Nigeria

- 5.4.6.3 Rest of Africa

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Inmarsat plc

- 6.4.2 Iridium Communications Inc.

- 6.4.3 Globalstar Inc.

- 6.4.4 EchoStar Mobile Ltd

- 6.4.5 Thuraya Telecommunications Co.

- 6.4.6 Intelsat S.A.

- 6.4.7 ORBCOMM Inc.

- 6.4.8 ViaSat Inc. (Incl. ViaSat U.K.)

- 6.4.9 Ericsson (Satellite IoT)

- 6.4.10 SES S.A.

- 6.4.11 Eutelsat Group

- 6.4.12 Hughes Network Systems

- 6.4.13 OneWeb

- 6.4.14 AST SpaceMobile

- 6.4.15 Ligado Networks

- 6.4.16 Telesat Lightspeed

- 6.4.17 Skylo Technologies

- 6.4.18 Qualcomm Inc. (Snapdragon Satellite)

- 6.4.19 SpaceX - Starlink Direct-to-Cell

- 6.4.20 Thales Alenia Space

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment