PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1850364

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1850364

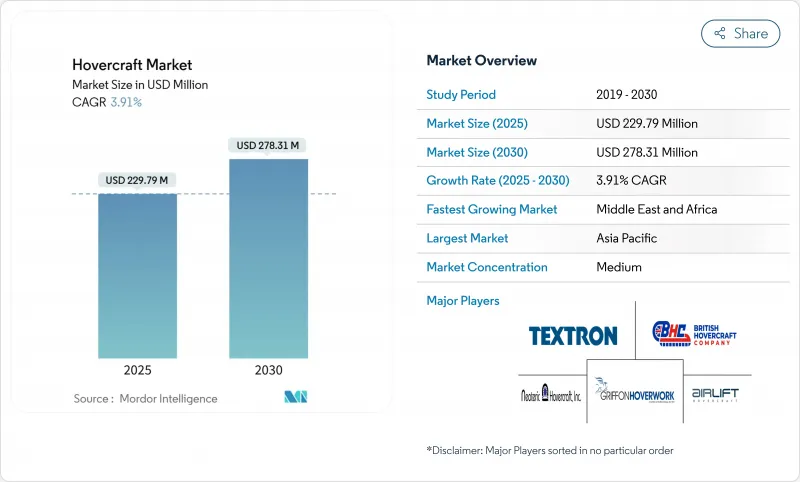

Hovercraft - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The hovercraft market size stood at USD 229.79 million in 2025 and is forecasted to advance to USD 278.31 million by 2030, registering a 3.91% CAGR.

Demand is shifting from predominantly military fleets toward commercial uses as coastal flooding, offshore energy expansion, and disaster-response planning make air-cushion vehicles part of critical transport infrastructure. Military fleet replacement programs contribute steady baseline spending, while environmental regulations and noise limits accelerate investment in electric and hybrid propulsion. Manufacturers that can certify low-noise craft and prove multi-mission flexibility are capturing new contracts, especially where ground transport is unreliable or sea-state conditions are harsh. Partnerships between technology providers and energy operators also broaden the customer base, supporting sustained growth in the hovercraft market.

Global Hovercraft Market Trends and Insights

Rising demand for amphibious transport amid climate-driven floods

Coastal flooding disrupts roads, railways, and runways, prompting agencies to procure vehicles that can glide over water, mud, and debris. The Canadian Coast Guard's USD 5 million order for next-generation air-cushion craft is emblematic of how governments now treat hovercraft as core resilience assets rather than niche tools. Municipal authorities in Southeast Asia and the United States Gulf Coast are conducting pilot programs that measure response-time savings during storms. Insurance firms increasingly recognize the value of rapid evacuation capability, which shortens claim settlements and reduces business-interruption losses. These factors collectively strengthen the long-term foundation of the hovercraft market.

Military fleet replacement cycles for modern assault craft

Legacy landing craft built in the 1980s are nearing the end of their service life, and defense ministries are funding successors with higher payloads, lower signatures, and autonomous options. The US Navy's Ship-to-Shore Connector program illustrates this push with multi-year contracts exceeding USD 600 million as of late 2024. Similar procurement lines exist in Japan, the UK, and China, emphasizing common hull modules that can accept future sensor or weapons upgrades. Long acquisition horizons translate into predictable revenue streams for incumbent manufacturers, reinforcing the central role of military budgets in the hovercraft market.

High operating noise and environmental limits

Propeller tip vortices generate tonal peaks propagating over flat water surfaces, often exceeding 90 dB at 200 m. The UK statutes, dating back to the Hovercraft Act of 1968, still influence license terms, requiring operators to curtail schedules during evening hours. Coastal communities in France and California have blocked proposed routes until acoustic modeling proves compliance. Manufacturers now invest in variable-pitch fans and shrouded intakes, yet engineering trade-offs remain between noise, thrust, and range.

Other drivers and restraints analyzed in the detailed report include:

- Advances in low-noise electric and hydrogen propulsion

- Offshore energy and polar logistics requirements

- Shortage of certified pilots and technicians

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Medium craft between 20 m and 30 m length made up 45.11% of 2024 revenue, largely because their 30-70 t payloads satisfy the broadest range of missions from troop lift to ambulance duty. However, small craft under 12 m length show the liveliest 4.82% CAGR as coastal patrol units and scientific agencies prioritize agility over capacity. Lower crew requirements and simplified licensing in many jurisdictions also support the hovercraft market size for small platforms.

Manufacturers promote modular decks that accept survey sonar, agricultural sprayers, or stretchers, tailoring one hull to multiple niches. This customization trend and the spread of autonomy packages that offset limited crew availability underpin sustained double-digit order growth for the small-craft segment.

Defense and security missions led 2024 revenue with a 35.45% share, spanning amphibious assault, port protection, and mine countermeasures. Governments value fast beach access and the ability to ride over anti-landing obstacles. Conversely, offshore energy support, while smaller, is growing at a 5.12% CAGR that outpaces every other use case. Wind-farm crew transfer, Arctic resupply, and pipeline maintenance outperform passenger travel in investment momentum.

Hovercraft can berth directly on rocky causeways and floating ice, slashing transit times compared to barges requiring deeper drafts. Energy operators embrace this flexibility because it lowers weather-related shutdown days and improves safety. Collectively, these dynamics diversify revenue streams and cushion the market against defense-budget cycles.

The Hovercraft Market Report is Segmented by Hovercraft Size (Small, Medium, and Large), Application (Defense and Security, Passenger Ferry Services, Offshore Energy Support, and More), Propulsion System (Diesel Engine, Gas Turbine, Hybrid-Electric, Fully Electric, and Hydrogen Fuel-Cell), End User (Military and Commercial), and Geography (North America, Europe, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific retained 32.40% of global revenue in 2024. Chinese shipyards expand indigenous output of Type 716 and Type 726 assault craft to bolster island-chain logistics, while Japan invests in 12000TD passenger units that will connect remote communities to Honshu. South Korea explores hover-ambulance pilots for tidal flats, and India's National Disaster Response Force studies rapid-deployment craft for delta regions. These programs collectively ensure a stable demand for high-capacity platforms.

The Middle East and Africa region, representing a smaller base, is forecast to grow at 5.75% CAGR through 2030. Abu Dhabi's pact with Regent Craft to build 12-seat electric seagliders illustrates how investment funds leverage permissive regulations to leapfrog into low-emission transport. Saudi Arabia is monitoring the pilot line for potential Red Sea tourism links, while Nigeria evaluates hover-pipeline patrols in the Niger Delta. Climate resilience priorities and ample capital position the region for outsized expansion.

North America and Europe maintain mature yet resilient markets anchored in defense contracts and heritage passenger routes. The United States continues multi-year LCAC procurement, and Canada allocates a budget for Arctic rescue craft that operate on ice pans. Hovertravel celebrates six decades of cross-Solent service in Europe, but route expansions face stringent decibel caps and environmental impact assessments. Scandinavia, however, sees a niche for hydrogen-powered craft on fjord commuter lines, reflecting progressive emissions goals. South America remains nascent due to budget constraints, yet environmental NGOs in the Amazon explore hovercraft for anti-poaching patrols where road networks are sparse.

- Griffon Hoverwork Ltd.

- Textron Systems Corporation (Textron Inc.)

- The British Hovercraft Company Ltd.

- Neoteric Hovercraft Inc.

- AEROHOD Ltd.

- Airlift Hovercraft Pty Ltd.

- CHRISTY HOVERCRAFT

- Hovertechnics, LLC.

- Ivanoff Hovercraft AB

- Bill Baker Vehicles Ltd.

- Mad Hovercraft

- Vigor Industrial LLC

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising demand for amphibious transport amid climate-driven floods

- 4.2.2 Military fleet replacement cycles for modern assault craft

- 4.2.3 Advances in low-noise electric and hydrogen propulsion

- 4.2.4 Relaxed regulations supporting commercial passenger services

- 4.2.5 Offshore energy and polar logistics requirements

- 4.2.6 Increased investment in flood-oriented emergency response

- 4.3 Market Restraints

- 4.3.1 High operating noise and coastal environmental restrictions

- 4.3.2 Scarcity of certified pilots and maintenance technicians

- 4.3.3 Competition from ground-effect and hydrofoil vessels

- 4.3.4 Fuel-cost volatility affecting military procurement cycles

- 4.4 Value Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Buyers/Consumers

- 4.7.2 Bargaining Power of Suppliers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitute Products

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Hovercraft Size

- 5.1.1 Small

- 5.1.2 Medium

- 5.1.3 Large

- 5.2 By Application

- 5.2.1 Defense and Security

- 5.2.2 Passenger Ferry Services

- 5.2.3 Offshore Energy Support

- 5.2.4 Search and Rescue

- 5.2.5 Surveying and Mapping

- 5.2.6 Agricultural and Environmental Management

- 5.3 By Propulsion System

- 5.3.1 Diesel Engine

- 5.3.2 Gas Turbine

- 5.3.3 Hybrid-Electric

- 5.3.4 Fully Electric

- 5.3.5 Hydrogen Fuel-Cell

- 5.4 By End User

- 5.4.1 Military

- 5.4.2 Commercial

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 United Kingdom

- 5.5.2.2 France

- 5.5.2.3 Germany

- 5.5.2.4 Italy

- 5.5.2.5 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 Japan

- 5.5.3.3 South Korea

- 5.5.3.4 India

- 5.5.3.5 Australia

- 5.5.3.6 Rest of Asia-Pacific

- 5.5.4 South America

- 5.5.4.1 Brazil

- 5.5.4.2 Argentina

- 5.5.4.3 Rest of South America

- 5.5.5 Middle East and Africa

- 5.5.5.1 Middle East

- 5.5.5.1.1 Saudi Arabia

- 5.5.5.1.2 UAE

- 5.5.5.1.3 Rest of Middle East

- 5.5.5.2 Africa

- 5.5.5.2.1 South Africa

- 5.5.5.2.2 Rest of Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Griffon Hoverwork Ltd.

- 6.4.2 Textron Systems Corporation (Textron Inc.)

- 6.4.3 The British Hovercraft Company Ltd.

- 6.4.4 Neoteric Hovercraft Inc.

- 6.4.5 AEROHOD Ltd.

- 6.4.6 Airlift Hovercraft Pty Ltd.

- 6.4.7 CHRISTY HOVERCRAFT

- 6.4.8 Hovertechnics, LLC.

- 6.4.9 Ivanoff Hovercraft AB

- 6.4.10 Bill Baker Vehicles Ltd.

- 6.4.11 Mad Hovercraft

- 6.4.12 Vigor Industrial LLC

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment