PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1850365

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1850365

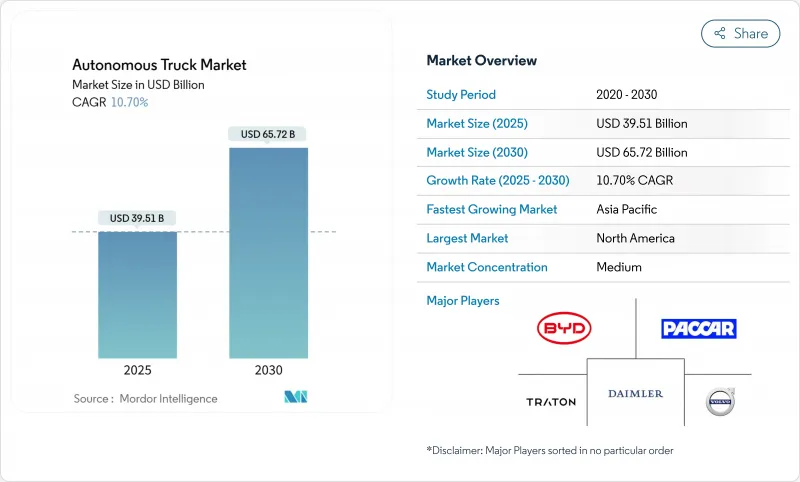

Autonomous Truck - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Autonomous Truck Market size is estimated at USD 39.51 billion in 2025, and is expected to reach USD 65.72 billion by 2030, at a CAGR of 10.70% during the forecast period (2025-2030).

Persistent driver shortages and rising labor costs challenge traditional fleets, driving the adoption of heavy-duty platforms with high asset utilization. Regulatory mandates, such as emergency-braking systems, and falling sensor prices are accelerating modernization and commercial pilots. As Level 4 trucks prove reliable on long-haul routes, stakeholders benefit from faster pay-back cycles, increased trailer turnover, and fuel and emission savings, advancing the autonomous truck market toward scaled deployment.

Global Autonomous Truck Market Trends and Insights

Driver Shortage & Rising Line-Haul Labor Cost

The American Trucking Associations reported more than 80,000 unfilled heavy-duty positions in 2024, a gap expected to widen as driver retirements outpace new entrants. Mandatory rest breaks and overtime premiums inflate total cost of ownership, making 24/7 autonomous operation financially attractive on routes exceeding 500 miles. Successful Level 4 pilots along Texas corridors have doubled trailer turns and cut per-mile labor spend by over 35%. Logistics majors are now redesigning networks with autonomous trunk lines complemented by human-driven last-mile loops.

Demand for 24/7 Hub-to-Hub Logistics

E-commerce fulfillment windows and just-in-time manufacturing call for clock-round capacity. The controlled access of interstate highways suits sensor perception and redundancy targets, allowing fleets to dispatch autonomous Class 8 tractors on predictable lanes. Aurora completed a 1,200-mile driver-out run between Dallas and Houston in 2024, validating the uptime promise of hub-to-hub models. Retail shippers link the resulting latency reductions to inventory shrink, propelling long-term contracts for dedicated autonomous capacity.

Patchwork Global Regulation & Cross-Border Liability

California's AB 316, which restricts autonomous trucks above 10,000 lb without on-board human operators, underscores the fragmented U.S. policy landscape. Similar inconsistencies appear across EU member states despite Brussels' push for a unified framework by 2026. These mismatches require separate permitting, insurance riders, and data-reporting workflows, diluting economies of scale and postponing continent-wide deployments.

Other drivers and restraints analyzed in the detailed report include:

- Tightening Safety Regulations

- Platooning-Driven Fuel Savings & Emission Mandates

- Cyber-Security & OTA Update Risks

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Heavy-duty tractors accounted for 64.5% of the autonomous truck market size in 2024, reflecting the economic leverage of automating long-haul lanes where labor costs eclipse fuel as the largest expense line. Fleet CFO models show pay-back periods under four years when Level 4 systems pass 500-mile duty cycles at 95% uptime. Medium-duty units focus on regional grocery and parcel runs, balancing tighter curbweight limits with growing urban-access restrictions. Light-duty autonomous vans, boosted by e-commerce volumes, post the fastest growth at a 15.1% CAGR, aided by simplified form-factor sensor integration.

Technology partnerships reinforce heavy-duty leadership. Daimler Truck shipped a batch of autonomous-ready Freightliner Cascadia tractors to Torc Robotics for Texas trials, demonstrating OEM commitment to factory-installed redundancy architectures. Meanwhile, light-duty builders exploit camera-only perception to trim bill-of-material costs, positioning for last-mile autonomy once municipal rules evolve. The divergent trajectories suggest a barbell market split: high-value interstate rigs on one end and agile city vans on the other.

SAE 1-2 driver-assist suites represented 58.2% of the autonomous truck market share 2024, but the spotlight is shifting to Level 4 and set to foresee a growth of 26.25% CAGR by 2030. Annualized deployments of driver-out pilots rose 140% between 2024 and 2025, and capital inflows favor companies with L4 roadmaps. Volvo's VNL Autonomous platform, slated for customer delivery in 2025, illustrates OEM faith that full-route autonomy will unlock premium service contracts. Level 3 remains a bridging solution where regulations require fallback readiness, yet its commercial window is narrowing as regulators warm to complete driver removal in set corridors.

Investors endorse the transition: Waabi secured USD 200 million in a Series B round led by Uber and Nvidia to refine AI-first simulation, cutting road-test miles by 80%. This influx underscores the belief that scalable virtual training will speed homologation and compress time-to-revenue for Level 4 entrants. As high-definition mapping costs fall, market analysts expect Level 4 to pass 30% share of active freight miles by 2030, reshaping asset-scheduling logic and insurance underwriting norms.

The Autonomous Truck Market is Segmented by Truck Type (Light-Duty Trucks, and More), Level of Autonomy (SAE Level 1-2 (Driver Assist), and More), ADAS Features (Adaptive Cruise Control, Lane Departure Warning, and More), Component (LIDAR, RADAR, Cameras, and More), Drive Type (IC Engine, Battery-Electric, Hybrid, and More), and Geography. The Market Forecasts are Provided in Terms of Value (USD) and Volume (Units).

Geography Analysis

North America captured 33.7% of the autonomous truck market share in 2024 due to permissive state-level pilot frameworks and a 48,000-mile Interstate system favoring lane-centered autonomy. Texas hosts commercial routes linking Dallas, Houston, El Paso, and Phoenix, where Aurora, Kodiak, Volvo, and DHL operate revenue-generating loads. Venture funding remains robust: start-ups raised more than USD 1 billion across 2024-2025, reflecting investor confidence in near-term monetisation.

Europe contributed roughly one-third of the 2024 revenue. Germany, Sweden, and the Netherlands spearhead testing thanks to early adoption of UNECE cybersecurity and lane-keeping directives. The Volvo-Daimler software JV positions EU OEMs to deliver over-the-air-upgradable platforms ahead of the 2026 GSR phase-in. Cross-border freight edges forward via digital corridor pilots such as Scandinavia-Hamburg, yet variable national certification timelines still hamper continent-wide scale.

Asia-Pacific remains the fastest-growing region at a 21.4% CAGR. China's Ministry of Transport endorsed nationwide smart-highway projects, enabling local players to rack up 20 million driver-out kilometres by mid-2025. Japan targets Level 4 coverage of trunk lines by 2027, pairing autonomy incentives with support for hydrogen and battery charging depots. South Korea's K-Mobility 2030 plan accelerates telematics coverage, while India eyes autonomous mining and port haulage as first-mover niches. Open-source stacks like Autoware give regional integrators a springboard to customise perception for left-hand-drive urban grids.

- AB Volvo

- Daimler Truck AG

- Traton SE

- PACCAR Inc.

- BYD Co. Ltd.

- Tesla, Inc.

- TuSimple

- Aurora Innovation

- Waymo Via

- Plus.ai

- Torc Robotics

- Kodiak Robotics

- Nikola Corp.

- Einride

- Embark Technology

- Hyzon Motors

- Gatik AI

- Volvo-Uber ATG JV

- Scania

- Navistar

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Driver shortage & rising line-haul labor cost

- 4.2.2 Demand for 24/7 hub-to-hub logistics

- 4.2.3 Tightening safety regulations (e.g., U.S. AV bills, EU GSR)

- 4.2.4 Platooning-driven fuel savings & emission mandates

- 4.2.5 Synergy of autonomy with zero-emission powertrains

- 4.2.6 Open-source autonomy stacks lowering entry barriers

- 4.3 Market Restraints

- 4.3.1 Patchwork global regulation & cross-border liability

- 4.3.2 Cyber-security & OTA update risks

- 4.3.3 High LiDAR / sensor-suite costs

- 4.3.4 Scarcity of high-resolution HD maps beyond Tier-1 corridors

- 4.4 Value/Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

5 Market Size & Growth Forecasts (Value (USD) and Volume (Units))

- 5.1 By Truck Type

- 5.1.1 Light-Duty Trucks

- 5.1.2 Medium-Duty Trucks

- 5.1.3 Heavy-Duty Trucks

- 5.2 By Level of Autonomy

- 5.2.1 SAE Level 1-2 (Driver Assist)

- 5.2.2 SAE Level 3 (Conditional)

- 5.2.3 SAE Level 4 (High)

- 5.2.4 SAE Level 5 (Full)

- 5.3 By ADAS Feature

- 5.3.1 Adaptive Cruise Control

- 5.3.2 Lane Departure Warning

- 5.3.3 Traffic Jam Assist

- 5.3.4 Highway Pilot

- 5.3.5 Automatic Emergency Braking

- 5.3.6 Blind-Spot Detection

- 5.3.7 Lane-Keeping Assist

- 5.4 By Component

- 5.4.1 LiDAR

- 5.4.2 RADAR

- 5.4.3 Cameras

- 5.4.4 Ultrasonic & Other Sensors

- 5.4.5 AI Compute Modules

- 5.5 By Drive Type

- 5.5.1 Internal-Combustion

- 5.5.2 Battery-Electric

- 5.5.3 Hybrid

- 5.5.4 Hydrogen Fuel-Cell

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Rest of North America

- 5.6.2 South America

- 5.6.2.1 Brazil

- 5.6.2.2 Argentina

- 5.6.2.3 Rest of South America

- 5.6.3 Europe

- 5.6.3.1 Germany

- 5.6.3.2 United Kingdom

- 5.6.3.3 France

- 5.6.3.4 Spain

- 5.6.3.5 Russia

- 5.6.3.6 Rest of Europe

- 5.6.4 Asia-Pacific

- 5.6.4.1 China

- 5.6.4.2 Japan

- 5.6.4.3 India

- 5.6.4.4 South Korea

- 5.6.4.5 Australia

- 5.6.4.6 Rest of Asia-Pacific

- 5.6.5 Middle East and Africa

- 5.6.5.1 GCC

- 5.6.5.2 Turkey

- 5.6.5.3 South Africa

- 5.6.5.4 Rest of Middle East and Africa

- 5.6.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.4.1 AB Volvo

- 6.4.2 Daimler Truck AG

- 6.4.3 Traton SE

- 6.4.4 PACCAR Inc.

- 6.4.5 BYD Co. Ltd.

- 6.4.6 Tesla, Inc.

- 6.4.7 TuSimple

- 6.4.8 Aurora Innovation

- 6.4.9 Waymo Via

- 6.4.10 Plus.ai

- 6.4.11 Torc Robotics

- 6.4.12 Kodiak Robotics

- 6.4.13 Nikola Corp.

- 6.4.14 Einride

- 6.4.15 Embark Technology

- 6.4.16 Hyzon Motors

- 6.4.17 Gatik AI

- 6.4.18 Volvo-Uber ATG JV

- 6.4.19 Scania

- 6.4.20 Navistar

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment