PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1850368

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1850368

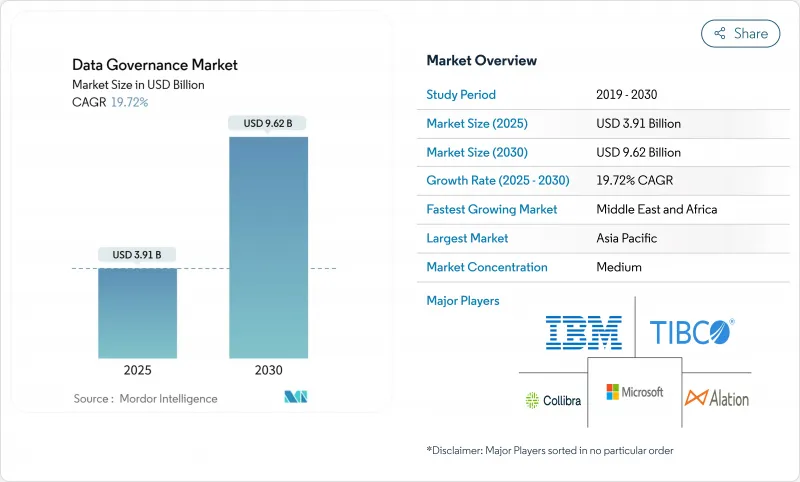

Data Governance - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The data governance market sized is estimated at USD3.91 billion in 2025 and is forecast to reach USD 9.62 billion by 2030, reflecting a 19.72% CAGR.

The surge is underpinned by stricter regulatory mandates, accelerating cloud adoption, and the growing realization that well-governed data is crucial for trustworthy AI, real-time payments, and cross-border commerce. Financial institutions, healthcare providers, and manufacturers are broadening investments as penalties for breaches escalate and as business models shift toward data monetization. Vendors are embedding AI into lineage and catalog tools to automate classification tasks, while buyers emphasize deployment flexibility that supports sovereign-cloud and hybrid architectures. The data governance market is therefore evolving from compliance-focused point solutions to integrated platforms that orchestrate quality, security, and accountability across dispersed data estates.

Global Data Governance Market Trends and Insights

EU AI Act and Global AI-Regulation Requiring Explainable Data Lineage

The EU AI Act, effective August 2024, obliges companies deploying high-risk AI to document data origins, transformations, and quality metrics. Failure can trigger fines up to USD 39.82 million or 7% of global turnover, pushing enterprises to adopt advanced lineage platforms that illustrate end-to-end data flows. Vendors are integrating model-level metadata with traditional catalog systems so that auditors can trace training sets and detect bias. Multinationals anticipate similar provisions in Brazil and Canada, turning compliance into a global requirement. These pressures elevate demand for tools that link datasets, models, and business outcomes in a single governance workspace. As a result, the data governance market is pivoting toward solutions that fuse AI oversight with conventional stewardship capabilities.

FedNow and Real-Time Payment Rails Forcing Sub-Millisecond Data Integrity in North-American BFSI

The FedNow Service went live in July 2023 and now operates 24/7 across participating banks. Sub-millisecond settlement demands pristine data quality and continuous lineage to satisfy anti-money-laundering checks without slowing transactions. Institutions are deploying AI-enabled screening and enrichment pipelines to flag anomalies instantly. Legacy batch-oriented compliance stacks cannot keep pace, so banks are modernizing metadata repositories and automating control tests. This driver accelerates subscription revenue for cloud-native governance vendors that can embed rules directly into payment workflows. It also spurs consulting engagements aimed at retrofitting lineage tools to mainframe cores, a lucrative niche within the wider data governance market.

High Total Cost of Ownership for Enterprise-Scale Data Lineage Tooling

Tier-1 banks grapple with multi-million-dollar annual outlays for licenses, integration, and hardware refresh when rolling out enterprise lineage platforms. An Aalto University study confirms that integration with legacy systems and the absence of standards inflate timelines and budgets. Some institutions resort to manual mapping to lower expenses, slowing full-fledged deployments. Vendors respond with modular pricing and consumption-based cloud editions, yet sticker shock remains a prominent brake on expansion within the data governance market.

Other drivers and restraints analyzed in the detailed report include:

- APAC Sovereign-Cloud Mandates Accelerating In-Country Data Catalog Investments

- Retail-Media Monetization Elevating Product-Master Data Quality Spend

- Talent Shortage of Certified Data Stewards and DCAM Practitioners

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Software solutions accounted for 57.1% of revenue in 2024, anchoring the data governance market with capabilities that automate policy enforcement, metadata harvesting, and lineage visualization. AI-driven classification and anomaly detection are now baseline features, helping organizations comply with the EU AI Act and FedNow directives in real time. The data governance market size for software is projected to deepen as vendors embed model-governance modules that audit AI pipelines.

Services, encompassing implementation, training, and managed operations, are forecast to expand at 23.4% CAGR. Talent shortages and rising regulatory complexity push organizations to outsource framework design and day-to-day stewardship. Managed services providers are layering SLAs for data quality and consent compliance, differentiating themselves in a fragmented services arena.

Growth in services is also propelled by industry-specific advisory packages. Banking clients demand lineage accelerators pre-mapped to BCBS 239, while healthcare buyers request HIPAA-ready templates. This vertical tailoring leaves room for boutique consultancies alongside global system integrators. Consequently, the data governance market continues shifting from purely licensing models toward mixed recurring revenue streams.

On-premise deployments retained a 53.6% share in 2024 as financial services and healthcare firms insist on local control over sensitive records. Mainframe coexistence and regulated workloads reinforce datacenter preferences despite broader enterprise migration to SaaS. The data governance market share for on-premise solutions is expected to erode gradually as cloud security certifications widen.

Cloud governance tools are advancing at 22.8% CAGR, driven by sovereign-cloud mandates and remote-work norms. Frameworks such as the EDM Council's CDMC provide best practices that reassure auditors. Hybrid patterns dominate: sensitive golden records sit on-premise, while catalog search, quality rules, and reporting run in the cloud. Vendors compete on cross-plane policy orchestration that keeps controls consistent across locations, a capability now essential to win enterprise contracts.

Data Governance Market is Segmented by Component (Software, Services), Deployment (Cloud, On-Premise), Organization Size (Large Enterprises, Small and Medium Enterprises), Business Function (IT and Operations, Legal and Compliance, and More) Application (Compliance Management, Risk Management, and More), End-User Industry (BFSI, IT and Telecom, and More), Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America commanded 35.6% revenue in 2024, supported by mature digital-transformation investments and frameworks such as the Federal Enterprise Architecture that emphasize FedRAMP-aligned governance. Financial institutions racing to integrate FedNow exemplify how regulatory deadlines catalyze spending. AI safety rule-making by the National Institute of Standards and Technology further spurs platform enhancements. The data governance market size in the region benefits from dense ecosystems of consultants and hyperscale cloud providers that embed stewardship capabilities natively.

Asia is the fastest-growing region at 26.3% CAGR. India's DPDP Act reshapes data flows, while China's draft negative list for data exports tightens local hosting requirements. These statutes propel investments in sovereign-cloud catalogs capable of enforcing locale-specific retention policies. Japan and South Korea refine existing directives to match global benchmarks, amplifying cross-border alignment. Multinationals now budget region-specific governance clusters, enlarging the addressable data governance market.

Europe retains significant scale through the GDPR and newly enacted EU AI Act. The European Data Governance Act stimulates sectoral data spaces in health, energy, and mobility, fostering demand for interoperable metadata standards . The Middle East and Africa are earlier in their maturity curve but are accelerating, driven by smart-city projects and Gulf Cooperation Council data-sovereignty rules. Canada's national roadmap pinpoints 35 standardization gaps, prompting federally funded pilots . Together, these dynamics produce a geographically diverse but regulatory-driven expansion path for the data governance market.

- IBM Corporation

- Microsoft Corporation

- Oracle Corporation

- SAP SE

- Collibra NV

- Informatica Inc.

- Alation Inc.

- SAS Institute Inc.

- TIBCO Software Inc.

- Talend SA

- Varonis Systems Inc.

- Amazon Web Services

- Precisely LLC

- Ataccama Corp.

- Quest Software (erwin Data Intelligence)

- OneTrust LLC

- OpenText Corp. (incl. Micro Focus)

- ASG Technologies (Rocket Software)

- Snowflake Inc.

- Databricks Inc.

- Cloudera Inc.

- Alfresco Software Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 EU AI Act and Global AI-Regulation Requiring Explainable Data Lineage

- 4.2.2 FedNow and Real-Time Payment Rails Forcing Sub-Millisecond Data Integrity in North-American BFSI

- 4.2.3 APAC Sovereign-Cloud Mandates (e.g., India DPDP Act) Accelerating In-Country Data Catalog Investments

- 4.2.4 Retail-Media Monetisation Elevating Product-Master Data Quality Spend

- 4.2.5 Edge Analytics in Manufacturing 4.0 Demands Near-Edge Metadata Federation

- 4.3 Market Restraints

- 4.3.1 High Total Cost of Ownership for Enterprise-Scale Data Lineage Tooling in Tier-1 Banks

- 4.3.2 Talent Shortage of Certified Data Stewards and DCAM Practitioners

- 4.3.3 Legacy Mainframe Interoperability Issues Limiting Real-Time Governance in Defense Agencies

- 4.4 Regulatory Outlook

- 4.5 Porter's Five Forces Analysis

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers / Consumers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Component

- 5.1.1 Software

- 5.1.1.1 Data Quality and Profiling Tools

- 5.1.1.2 Metadata Management and Data Catalog

- 5.1.1.3 Master Data Management

- 5.1.1.4 Data Lineage and Impact Analysis

- 5.1.1.5 Data Security and Privacy Governance

- 5.1.2 Services

- 5.1.2.1 Professional Services

- 5.1.2.2 Managed Services

- 5.1.1 Software

- 5.2 By Deployment

- 5.2.1 Cloud

- 5.2.2 On-Premise

- 5.3 By Organization Size

- 5.3.1 Large Enterprises

- 5.3.2 Small and Medium Enterprises (SMEs)

- 5.4 By Business Function

- 5.4.1 IT and Operations

- 5.4.2 Legal and Compliance

- 5.4.3 Finance and Risk

- 5.4.4 Marketing and Sales

- 5.4.5 Human Resources

- 5.4.6 Other Functions

- 5.5 By Application

- 5.5.1 Compliance Management

- 5.5.2 Risk Management

- 5.5.3 Audit Management

- 5.5.4 Incident Management

- 5.5.5 Data Quality Management

- 5.5.6 Other Applications

- 5.6 By End-user Industry

- 5.6.1 BFSI

- 5.6.2 IT and Telecom

- 5.6.3 Healthcare and Life Sciences

- 5.6.4 Retail and E-Commerce

- 5.6.5 Government and Defense

- 5.6.6 Manufacturing

- 5.6.7 Energy and Utilities

- 5.6.8 Media and Entertainment

- 5.6.9 Other Industries

- 5.7 By Geography

- 5.7.1 North America

- 5.7.1.1 United States

- 5.7.1.2 Canada

- 5.7.2 Latin America

- 5.7.2.1 Brazil

- 5.7.2.2 Argentina

- 5.7.2.3 Chile

- 5.7.2.4 Mexico

- 5.7.2.5 Rest of South America

- 5.7.3 Europe

- 5.7.3.1 Germany

- 5.7.3.2 United Kingdom

- 5.7.3.3 France

- 5.7.3.4 Italy

- 5.7.3.5 Spain

- 5.7.3.6 Sweden

- 5.7.3.7 Norway

- 5.7.3.8 Finland

- 5.7.3.9 Denmark

- 5.7.3.10 Rest of Europe

- 5.7.4 Asia-Pacific

- 5.7.4.1 China

- 5.7.4.2 India

- 5.7.4.3 Japan

- 5.7.4.4 South Korea

- 5.7.4.5 Southeast Asia

- 5.7.4.6 Australia

- 5.7.4.7 New Zealand

- 5.7.4.8 Rest of Asia-Pacific

- 5.7.5 Middle East

- 5.7.5.1 GCC (Saudi Arabia, UAE, Qatar)

- 5.7.5.2 Turkey

- 5.7.5.3 Israel

- 5.7.5.4 Rest of Middle East

- 5.7.6 Africa

- 5.7.6.1 South Africa

- 5.7.6.2 Nigeria

- 5.7.6.3 Kenya

- 5.7.6.4 Rest of Africa

- 5.7.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Strategic Developments

- 6.2 Vendor Positioning Analysis

- 6.3 Company Profiles {(includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Products and Services, and Recent Developments)}

- 6.3.1 IBM Corporation

- 6.3.2 Microsoft Corporation

- 6.3.3 Oracle Corporation

- 6.3.4 SAP SE

- 6.3.5 Collibra NV

- 6.3.6 Informatica Inc.

- 6.3.7 Alation Inc.

- 6.3.8 SAS Institute Inc.

- 6.3.9 TIBCO Software Inc.

- 6.3.10 Talend SA

- 6.3.11 Varonis Systems Inc.

- 6.3.12 Amazon Web Services

- 6.3.13 Precisely LLC

- 6.3.14 Ataccama Corp.

- 6.3.15 Quest Software (erwin Data Intelligence)

- 6.3.16 OneTrust LLC

- 6.3.17 OpenText Corp. (incl. Micro Focus)

- 6.3.18 ASG Technologies (Rocket Software)

- 6.3.19 Snowflake Inc.

- 6.3.20 Databricks Inc.

- 6.3.21 Cloudera Inc.

- 6.3.22 Alfresco Software Inc.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-Space and Unmet-Need Assessment

- 7.1.1 Databricks Inc.

- 7.1.2 Cloudera Inc.

- 7.1.3 Alfresco Software Inc.

8 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 8.1 White-Space and Unmet-Need Assessment