PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1850369

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1850369

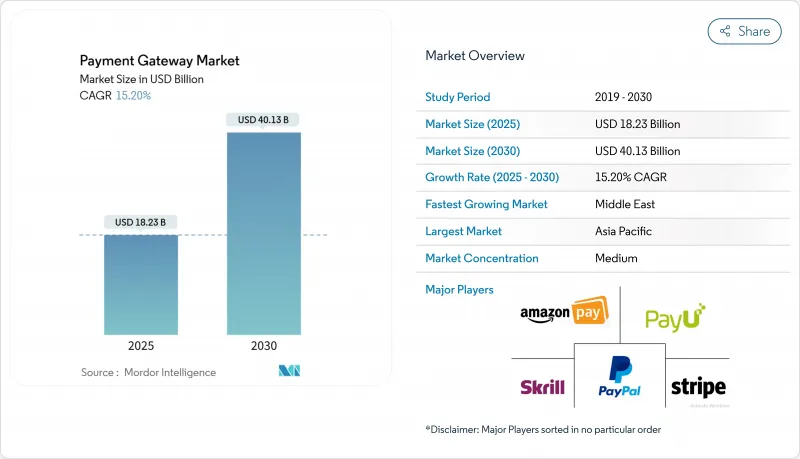

Payment Gateway - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The payment gateway market size is estimated at USD 18.23 billion in 2025 and is projected to climb to USD 40.13 billion by 2030, reflecting a solid 15.20% CAGR over the forecast period.

The industry's growth is underpinned by rapid digital-commerce expansion, rising real-time payment adoption, and intensifying regulatory focus on security. Adoption of Unified Payments Interface (UPI) and other instant-payment rails is triggering gateway upgrades that handle high-velocity authentication requests, while Europe's PSD2 Strong Customer Authentication (SCA) rules are accelerating tokenized, 3-DS-ready deployments. Competitive momentum is reinforced by megadeals such as Global Payments' agreement to acquire Worldpay and FIS's purchase of Global Payments' Issuer Solutions arm, which are reshaping scale economics. Hosted solutions retain the largest customer base, yet self-hosted architectures are advancing on data-sovereignty concerns. The payment gateway market also faces margin pressure from interchange-fee escalation and a proliferation of cross-border chargeback fraud, compelling providers to embed advanced fraud-mitigation AI.

Global Payment Gateway Market Trends and Insights

Explosion of Real-Time Payment Rails Accelerating Gateway Adoption in Asia

Real-time payment infrastructure is reshaping gateway demand, with India's UPI and Indonesia's BI-FAST exhibiting transaction growth that outpaces card schemes. Processing cost reductions of 50-90% versus legacy networks incentivize merchants to migrate. Gateways able to orchestrate authentication flows across more than 80 instant-payment systems gain a first-mover advantage, especially as volume is projected to reach 512 billion real-time transactions by 2027. Asia's mobile-first consumer base leapfrogs card rails, accelerating demand for API-rich gateways that can consolidate diverse real-time schemes into single merchant integrations.

Cross-Border E-Commerce Growth Driving Demand for Multi-Currency Routing

European SMEs selling on global marketplaces need gateways that support intelligent currency routing, alternative payment methods, and local acquiring to reduce decline rates. With European e-commerce valued at EUR 887 billion (USD 960 billion) in 2023, cross-border flows elevate demand for dynamic currency conversion and real-time FX risk management. Gateways that mask regulatory complexity while offering transparent settlement attract SMEs that lack treasury expertise. Investments in local licence acquisition and data residency help providers differentiate.

Rising Scheme Fees Squeezing Gateway Margins for Micro-Transactions

Interchange structures set by card networks can exceed the transaction value for sub-USD 5 purchases, particularly when flat-rate components apply. Recent "small merchant" programs by Visa and Mastercard lowered certain rates but have not solved the structural mismatch for sectors like digital content or transit. Congressional hearings have reignited scrutiny of swipe fees, adding regulatory uncertainty that complicates gateway pricing models. Providers are piloting account-to-account schemes and wallet-based micro-payment rails to defend margins while offering merchants alternative acceptance options.

Other drivers and restraints analyzed in the detailed report include:

- Regulatory Mandates Forcing Tokenised, 3-DS-Ready Gateways

- Surge in BNPL Checkout Options Expanding API Calls per Transaction

- Persistent Cross-Border Chargeback Fraud Undermining Merchant Trust

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Hosted gateways account for 62% of payment gateway market share in 2024 as merchants value outsourced PCI compliance and turnkey onboarding. Many SMEs prefer managed environments that bundle fraud tools and currency conversion under a single contract. Large enterprises, however, increasingly deploy self-hosted or hybrid models to customize routing algorithms, maximize authorization ratios, and meet jurisdiction-specific data-localization mandates. The payment gateway market size will continue tilting toward flexible deployment options as regulators intensify scrutiny of cross-border data flows.

Self-hosted solutions, projected to expand at 15.8% CAGR to 2030, attract merchants in healthcare and financial services that require direct control over token vaults and fraud-risk models. Gateway vendors are therefore offering containerized micro-services that merchants can deploy on owned infrastructure while still connecting to cloud-based reconciliation services. This modularity ensures adherence to Strong Customer Authentication mandates while allowing selective data residency. The approach also supports lower-latency connections to regional acquirers, improving approval rates in local markets.

Large organizations contributed 68% of global revenue in 2024, leveraging orchestration engines that route transactions across dozens of acquirers to shave basis-points off processing costs. These enterprises deploy A/B testing on authorization logic, integrate real-time machine-learning signals, and contract with redundant gateway providers to mitigate downtime risk. The payment gateway market size for SMEs is poised for a structural lift as low-cost cloud platforms and Tap to Phone solutions reduce adoption barriers.

SMEs expanding into cross-border e-commerce require gateways that automate FX conversion and offer straightforward pricing. Integrated Software Vendors embed payment acceptance within accounting and point-of-sale suites, accelerating merchant onboarding and improving stickiness. Progressive regulators encourage SME digitalization, further propelling adoption. Consequently, the payment gateway market will witness intensifying competition between pure-play payment facilitators and established processors courting the SME base.

Online Payment Gateway Market is Segmented by Type (Hosted, Self-/Non-Hosted), Enterprise Size (Small and Medium Enterprises (SME), Large Enterprises), Channel (Online / Web, Mobile In-App, In-Store POS (Omnichannel)), End-User Industry (Retail and E-Commerce, Travel and Hospitality, Banking, Financial Services and Insurance (BFSI), and More), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific leads the payment gateway market with a 38% revenue share in 2024, anchored by India's UPI, Indonesia's BI-FAST, and China's ubiquitous wallet ecosystems that together process billions of instant transactions daily. Government initiatives such as Singapore's SGQR and the ASEAN Regional Payment Connectivity project promote interoperability, fostering multi-currency gateways capable of tokens bridging retail accounts and wallets. Data-localization edicts, particularly the Reserve Bank of India's on-soil storage requirement, compel gateway vendors to deploy regional data centers or partner with domestic cloud providers.

The Middle East registers the fastest CAGR at 18.1% through 2030, propelled by national-level strategies such as Saudi Arabia's Vision 2030 cashless targets and the UAE's instant-payments platform launch. Domestic schemes like Saudi Payments' sarie and Bahrain's BenefitPay push acquirer-agnostic routing, creating openings for API-centric gateway brands. Foreign providers that combine Sharia-compliant financing options and Arabic-language support expand share swiftly.

Europe remains a sophisticated yet opportunity-rich market as PSD2 enforcement stabilizes fraud ratios and the European Central Bank drives pan-European instant-payment initiatives. Cross-border e-commerce volume from SMEs heightens demand for gateways integrating iDEAL, Sofort, and Bancontact. North America's uptake of FedNow and RTP modernizes settlement, while interchange politics create cost-recovery challenges for micro-transaction gateways. South America, spearheaded by Brazil's Pix and LGPD data framework, is transitioning from cash to mobile wallets at record speed. Africa's fragmented banking infrastructure demands gateways compatible with mobile-money schemes, making partnership ecosystems pivotal for penetration.

- PayPal Holdings Inc.

- Stripe Inc.

- PayU Group

- Amazon Pay (Amazon.com Inc.)

- Skrill Ltd (Paysafe)

- Square Inc. (Block)

- Adyen N.V.

- Alipay (Ant Group)

- WePay (J.P. Morgan Chase)

- Authorize.Net (Visa)

- Checkout.com

- Razorpay

- Paytm Payments Gateway

- Mollie

- Ingenico (Worldline SA)

- Payoneer Inc.

- Worldpay (FIS)

- Klarna Bank AB

- Verifone Systems Inc.

- BlueSnap Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Explosion of real-time payment rails accelerating gateway adoption in Asia

- 4.2.2 Cross-border e-commerce growth driving demand for multi-currency routing, especially among European SMEs

- 4.2.3 Regulatory mandates (e.g., PSD2-SCA) forcing upgrades to tokenised 3-DS-ready gateways

- 4.2.4 Surge in BNPL checkout options expanding API calls per transaction

- 4.2.5 Contactless-wallet boom in grocery chains spurring omnichannel gateway deployment

- 4.3 Market Restraints

- 4.3.1 Rising scheme fees squeezing gateway margins for micro-transactions

- 4.3.2 Persistent cross-border chargeback fraud undermining merchant trust

- 4.3.3 Data-localisation laws (India, Brazil, Russia) complicating token-vault architectures

- 4.4 Value Chain Analysis

- 4.5 Regulatory Outlook

- 4.6 Assessment of Macro Economic Trends on the Market

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUES)

- 5.1 By Type

- 5.1.1 Hosted

- 5.1.2 Self-/Non-Hosted

- 5.2 By Enterprise Size

- 5.2.1 Small and Medium Enterprises (SME)

- 5.2.2 Large Enterprises

- 5.3 By Channel

- 5.3.1 Online / Web

- 5.3.2 Mobile In-App

- 5.3.3 In-store POS (Omnichannel)

- 5.4 By End-User Industry

- 5.4.1 Retail and E-commerce

- 5.4.2 Travel and Hospitality

- 5.4.3 Banking, Financial Services and Insurance (BFSI)

- 5.4.4 Media and Entertainment

- 5.4.5 Other End-user Industries

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Nordics

- 5.5.2.5 Rest of Europe

- 5.5.3 Asia

- 5.5.3.1 China

- 5.5.3.2 India

- 5.5.3.3 Japan

- 5.5.3.4 South Korea

- 5.5.3.5 South-East Asia

- 5.5.3.6 Rest of Asia

- 5.5.4 South America

- 5.5.4.1 Brazil

- 5.5.4.2 Argentina

- 5.5.4.3 Rest of South America

- 5.5.5 Middle East and Africa

- 5.5.5.1 Middle East

- 5.5.5.1.1 GCC

- 5.5.5.1.2 Turkey

- 5.5.5.1.3 Rest of Middle East

- 5.5.5.2 Africa

- 5.5.5.2.1 South Africa

- 5.5.5.2.2 Nigeria

- 5.5.5.2.3 Rest of Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 PayPal Holdings Inc.

- 6.4.2 Stripe Inc.

- 6.4.3 PayU Group

- 6.4.4 Amazon Pay (Amazon.com Inc.)

- 6.4.5 Skrill Ltd (Paysafe)

- 6.4.6 Square Inc. (Block)

- 6.4.7 Adyen N.V.

- 6.4.8 Alipay (Ant Group)

- 6.4.9 WePay (J.P. Morgan Chase)

- 6.4.10 Authorize.Net (Visa)

- 6.4.11 Checkout.com

- 6.4.12 Razorpay

- 6.4.13 Paytm Payments Gateway

- 6.4.14 Mollie

- 6.4.15 Ingenico (Worldline SA)

- 6.4.16 Payoneer Inc.

- 6.4.17 Worldpay (FIS)

- 6.4.18 Klarna Bank AB

- 6.4.19 Verifone Systems Inc.

- 6.4.20 BlueSnap Inc.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment