PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1850378

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1850378

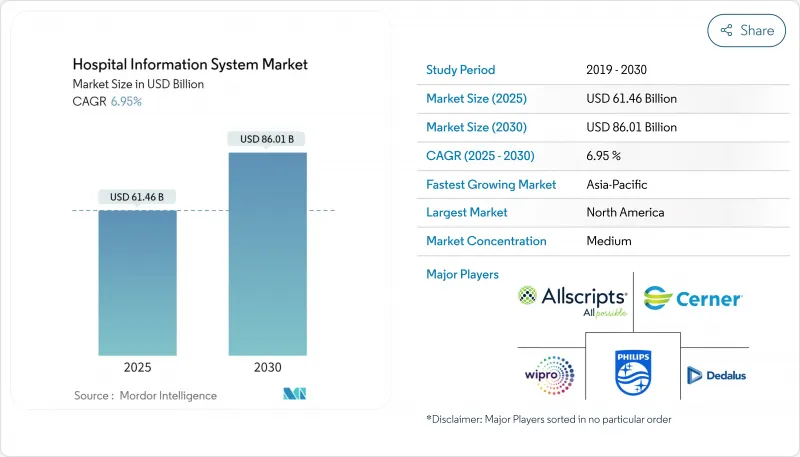

Hospital Information System - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The hospital information system market is valued at USD 61.46 billion in 2025 and is forecast to reach USD 86.01 billion by 2030, registering a 6.95% CAGR.

A growing consensus that integrated digital platforms are no longer optional but foundational infrastructure is reshaping procurement agendas. Buyers now focus on lifetime total cost of ownership, measurable clinical outcomes and vendor support for modular cloud upgrades. These priorities have pushed decision-making from siloed departments to enterprise-level digital steering committees that blend financial and clinical oversight. Competition is intensifying as suppliers bundle analytics, cybersecurity and managed services, positioning themselves as partners in multi-year "digital modernisation" programmes rather than one-time software vendors.

Global Hospital Information System Market Trends and Insights

Rising Use of AI-Driven Analytics and Clinical Decision Support

Hospitals now embed machine-learning models to flag sepsis, optimise antibiotics and predict discharge readiness in near real time. Epic lists more than 100 AI features on its roadmap, signalling how deeply analytics is being woven into core platforms . Duke Health shortened bed-assignment intervals after implementing GE HealthCare's Command Center Software, demonstrating tangible throughput gains . Boards increasingly demand model-explainability statements, and governance teams work with data scientists to calibrate algorithms that reflect local care pathways. As these practices become mainstream, AI functionality is shifting from pilots to default requirements, enlarging addressable spend in the hospital information system market.

Large-Scale Hospital Infrastructure Investments in Emerging Markets

Gulf Cooperation Council states and multiple Southeast Asian countries now budget digital platforms alongside construction, allowing new tertiary centres to leapfrog legacy architectures. Projects in the United Arab Emirates allocate substantial funds to EHR, imaging archives and command-centre analytics, ensuring that digital maturity grows in lockstep with physical capacity . Vendors providing multilingual interfaces gain first-mover advantage. These dynamics redirect revenue pools toward fast-growing, infrastructure-rich regions, reinforcing Asia-Pacific's role as the quickest-expanding hospital information system market.

High Total Cost of Ownership

Comprehensive EHR deployments can cost hundreds of millions of USD when hardware, data migration, workflow redesign and multi-year maintenance are included. Northwell Health's board approved a USD 1.2 billion initiative after leadership demonstrated a credible payback horizon through reduced duplicative testing and improved population-health management. Smaller hospitals lack the balance sheets to absorb such capital outlays, pushing them toward subscription pricing or shared-services models. Innovative financing mechanisms-ranging from managed-service concessions to public-private partnerships-are therefore gaining traction. Vendors respond by bundling optimisation services within contracts, recognising that clients judge value over the full life cycle. This evolving economics is nudging the Hospital Information System industry toward outcome-based pricing structures that reward measurable improvements rather than mere software installation.

Other drivers and restraints analyzed in the detailed report include:

- Interoperability mandates such as the US ONC Cures Act driving digital consolidation

- AI-powered clinical decision support adoption boosting CIS modules

- Growing demand for a quality healthcare system

- Technological advancement in the healthcare sector

- Increasing Cybersecurity and Compliance Risks

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Services accounted for the largest Hospital Information System market share, representing 46% of 2024 revenue, while the software component is forecast to record an 8% CAGR between 2025 and 2030. Complex data-conversion projects and multi-site rollouts continue to drive demand for consultative and managed services, particularly among health systems consolidating multiple legacy platforms. Meanwhile, the rising popularity of AI-enabled modules is fuelling software licence growth, especially for decision-support and ambient documentation. Epic's partnership with Mayo Clinic and Abridge to pilot generative AI for nursing workflows typifies how vendors are deepening service wrap-arounds to accelerate time-to-value. An observable consequence is that implementation timelines are shortening as repeatable, cloud-native templates replace bespoke coding. Providers that align service engagements to measurable clinical and financial objectives tend to realise faster benefit realisation, reinforcing the strategic role of professional services in the Hospital Information System industry.

On-premise deployments retained the largest hospital information system market size in 2024, with an estimated 55% share, yet cloud-based models are projected to expand at close to a 9 % CAGR through 2030. Chief technology officers cite scalability and business-continuity features as primary cloud motivators, but many still keep core EHR databases on local servers for latency and sovereignty reasons. Progressive organisations adopt hybrid architectures, hosting analytics sandboxes in the cloud while maintaining high-transaction modules in dedicated data centres. Epic's success stories from early public-cloud adopters demonstrate operational elasticity, though cost efficiencies remain contingent on rigorous instance-rightsizing. A practical implication is that network-bandwidth planning and identity-access management become as critical as application logic in project roadmaps. Consequently, mode-of-delivery decisions now involve multidisciplinary reviews that balance resilience, cost, data-residency and innovation goals.

The Hospital Information System Market Report Segments the Industry Into Mode of Delivery (Cloud-Based, On-Premise, and More), Type (Clinical Information Systems, Administrative Information Systems, and More), by Component (Software, Services, and Hardware), by End User (Multi-Specialty Hospitals, Specialty Hospitals, and More), and Geography. The Market Sizes and Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America recorded a 42% hospital information system market share in 2024, buoyed by mandated EHR adoption and sizeable budgets. After the Change Healthcare cyber incident, US hospitals tightened vendor risk assessments and embedded real-time threat-intelligence clauses in contracts. A BMC Digital Health review noted that 84% of US systems deploy AI predictive models, though governance teams remain under-resourced. Providers therefore seek managed services for model validation, fostering a service-rich hospital information system market.

Asia-Pacific is poised for the fastest 9.5% CAGR to 2030, fuelled by rising health expenditure and cloud-first policies. India's federal health budget increased double digits in 2024, and Thailand's ministry pilots tele-medicine kiosks interfacing with AI triage engines. Singapore's smart-ward initiatives emphasise IoT-enabled vital-sign tracking, raising interoperability expectations. Vendors offering language localisation gain headroom, especially as personal-data-protection acts proliferate. Leapfrogging older infrastructure, hospitals adopt cloud EHR platforms that align with regional broadband upgrades, fortifying Asia-Pacific's role in the hospital information system market.

Europe, the Middle East and Africa present a spectrum of digital maturity. Germany's Krankenhauszukunftsgesetz (KHZG) fund compels hospitals to certify digital-medication management, spurring suppliers to expand ecosystem services. GCC nations report more than three-quarters of public hospitals already on EHRs, amplified by Saudi Arabia's Vision 2030 tele-consultation targets. Regulatory convergence on data-interchange standards eases multi-national implementations, while talent flows from Europe to Gulf megaprojects accelerate skill-mix evolution. Collectively, the region remains a heterogeneous but strategically important theatre for the hospital information system market.

- Oracle Health (Cerner)

- Epic Systems

- Dedalus Group

- Allscripts (Altera Digital Health)

- Koninklijke Philips

- GE Healthcare

- Meditech

- Mckesson

- Wipro

- Siemens Healthineers

- Intersystems

- CPSI (Evident & TruBridge)

- NextGen Healthcare

- Integrated Medical Systems

- Optum (Change Healthcare)

- IBM

- eClinicalWorks

- NTT DATA Corporation

- Alcatel-Lucent Enterprise

- Tata Consultancy Services (TCS)

- DXC Technology

- Sectra

- Telstra Health Pty Ltd

- Orion Health Group

- Agfa-Gevaert NV (AGFA HealthCare)

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising use of AI-driven analytics and clinical decision support

- 4.2.2 Large-scale hospital infrastructure investments in emerging markets

- 4.2.3 Interoperability Mandates such as US ONC Cures Act Driving Digital Consolidation

- 4.2.4 AI-powered Clinical Decision Support Adoption Boosting CIS Modules

- 4.2.5 Growing demand for quality healthcare system

- 4.2.6 Technological advancement in healthcare sector

- 4.3 Market Restraints

- 4.3.1 High total cost of ownership

- 4.3.2 Increasing cybersecurity and compliance risks

- 4.3.3 Physician Resistance due to Workflow Disruption

- 4.3.4 Lack of IT infrastructure in emerging nations

- 4.4 Value Chain Analysis

- 4.5 Regulatory Outlook

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

5 Market Size & Growth Forecasts (Value, USD)

- 5.1 By Component

- 5.1.1 Software

- 5.1.2 Services

- 5.1.3 Hardware

- 5.2 By Mode of Delivery

- 5.2.1 On-premise

- 5.2.2 Cloud-based

- 5.2.3 Hybrid (Hosted)

- 5.3 By Type

- 5.3.1 Clinical Information Systems

- 5.3.1.1 Electronic Health/Medical Records

- 5.3.1.2 Computerized Physician Order Entry

- 5.3.1.3 Laboratory Information System

- 5.3.1.4 Radiology Information System

- 5.3.1.5 Pharmacy Information System

- 5.3.1.6 Picture Archiving & Communication Systems

- 5.3.1.7 Others (ICU, Anesthesia, etc.)

- 5.3.2 Administrative Information Systems

- 5.3.2.1 Patient Registration & Scheduling

- 5.3.2.2 Revenue Cycle Management

- 5.3.2.3 Workforce Management

- 5.3.2.4 Supply Chain & Inventory Management

- 5.3.3 Ancillary Information Systems

- 5.3.1 Clinical Information Systems

- 5.4 By End-user

- 5.4.1 Multi-specialty Hospitals

- 5.4.2 Specialty Hospitals

- 5.4.3 Academic Medical Centers

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Spain

- 5.5.2.6 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 Japan

- 5.5.3.3 India

- 5.5.3.4 South Korea

- 5.5.3.5 Australia

- 5.5.3.6 Rest of Asia-Pacific

- 5.5.4 Middle East

- 5.5.4.1 GCC

- 5.5.4.2 South Africa

- 5.5.4.3 Rest of Middle East

- 5.5.5 South America

- 5.5.5.1 Brazil

- 5.5.5.2 Argentina

- 5.5.5.3 Rest of South America

- 5.5.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global-level Overview, Market-level Overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products & Services, Recent Developments)

- 6.4.1 Oracle Health (Cerner)

- 6.4.2 Epic Systems Corporation

- 6.4.3 Dedalus Group

- 6.4.4 Allscripts (Altera Digital Health)

- 6.4.5 Koninklijke Philips NV

- 6.4.6 GE HealthCare

- 6.4.7 MEDITECH

- 6.4.8 McKesson Corporation

- 6.4.9 Wipro Limited

- 6.4.10 Siemens Healthineers AG

- 6.4.11 InterSystems Corporation

- 6.4.12 CPSI (Evident & TruBridge)

- 6.4.13 NextGen Healthcare Inc.

- 6.4.14 Integrated Medical Systems

- 6.4.15 Optum (Change Healthcare)

- 6.4.16 IBM

- 6.4.17 eClinicalWorks

- 6.4.18 NTT DATA Corporation

- 6.4.19 Alcatel-Lucent Enterprise

- 6.4.20 Tata Consultancy Services (TCS)

- 6.4.21 DXC Technology

- 6.4.22 Sectra AB

- 6.4.23 Telstra Health Pty Ltd

- 6.4.24 Orion Health Group

- 6.4.25 Agfa-Gevaert NV (AGFA HealthCare)

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-need Assessment