PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1850379

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1850379

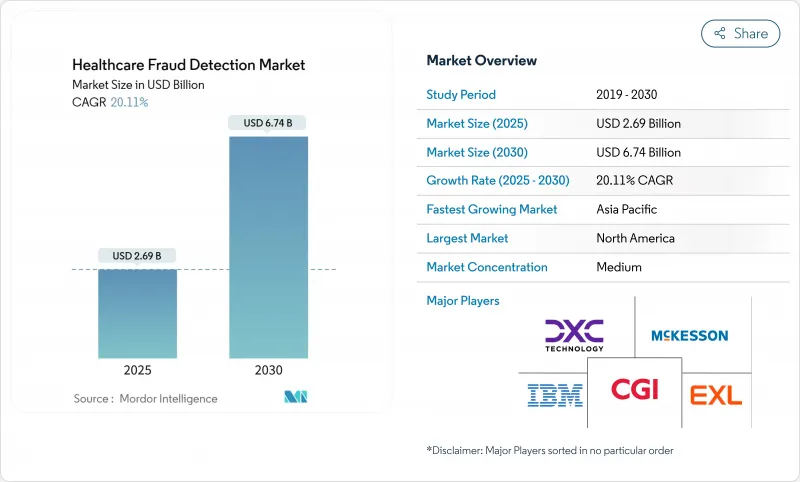

Healthcare Fraud Detection - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The healthcare fraud detection market reached a value of USD 2.69 billion in 2025 and is forecast to climb to USD 6.74 billion by 2030, implying a sturdy 20.11% CAGR.

Across the forecast window, payers and providers are expanding data-driven fraud and payment-integrity programs in response to an estimated USD 100 billion in annual fraud losses. Wider adoption of real-time analytics, cloud infrastructure, and FHIR-based interoperability is turning fraud-detection from an after-the-fact review into a proactive risk-control discipline. Government audits are intensifying-CMS alone will raise its medical-record review workforce from 40 to 2,000 coders-which, in turn, is spurring technology vendors to embed machine learning and generative AI into core claims workflows. Competitive differentiation now hinges on rapid model deployment, partner ecosystems, and the ability to process unstructured clinical data at scale. Implementation challenges remain-especially around data integration, transparency mandates, and staff change-management-yet the cost-benefit equation increasingly favors automated fraud detection as a must-have, not a "nice-to-have," capability.

Global Healthcare Fraud Detection Market Trends and Insights

Rising Healthcare Expenditure

Spending growth is sharpening executive focus on fraud because each lost percentage point equals billions in avoidable cost. CMS has earmarked USD 941 million for fraud and abuse control in fiscal 2025, signaling that analytics-driven prevention is now central to cost-containment. Private payers echo this urgency as value-based contracts expose them to downside risk. Organizations are finding that anomaly-detection algorithms reveal savings opportunities invisible to manual reviewers. Countries with aging populations feel the pressure most because chronic-care and drug claims dominate expenditure. As a result, budget growth and fraud-control investment move in lockstep, reframing fraud analytics as defensive infrastructure.

Increasing Fraudulent Activities in Healthcare

Fraudsters exploit technology faster than legacy, rule-based systems can respond, forcing a shift toward AI-enabled monitoring. The Medicare Transaction Fraud Prevention Act prioritizes artificial intelligence after CMS flagged anomalous billing for intermittent urinary catheters, a tactic that triggered improper payments. Healthcare networks now combine cross-provider claims data with synthetic datasets to uncover patterns spanning geographies. Deep-learning approaches such as autoencoders have achieved F1-scores of 0.97 in spotting overutilized procedure codes. This arms race accelerates investment as stakeholders see reactive reviews as an insufficient defense.

Unwillingness to Adopt Analytics Solutions

Smaller providers fear that sophisticated fraud platforms will disrupt familiar workflows and demand scarce technical skills. This mirrors findings in Asian finance, where more than half of institutions still forgo AI in anti-money-laundering programs despite clear benefits. Healthcare staff often equate new tools with added administrative burden rather than relief. Moreover, leadership teams struggle to quantify undetected fraud, making ROI appear speculative. Successful pilot programs that deliver quick wins typically shift perception and encourage wider rollout, yet change-management remains a barrier.

Other drivers and restraints analyzed in the detailed report include:

- Growing Pressure to Reduce Healthcare Spending

- Surge in Health-Insurance Enrolment & Claims Volumes

- High Implementation & Integration Costs

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

The healthcare fraud detection market size for analytics platforms was led by predictive tools, which captured 44.37% share in 2024. These models profile historical claims to forecast risk before payment. Nonetheless, demand is shifting toward real-time streaming analytics, forecast to climb at 24.56% CAGR through 2030. Organizations increasingly view millisecond-level scoring as essential for intercepting evolving schemes.

Stream-processing stacks such as Kafka and Flink underpin this pivot, enabling dynamic ingestion of unstructured notes, device data, and FHIR messages. Early adopters report materially lower overpayment rates once detections occur pre-payment rather than in retrospective audits. Descriptive analytics remains relevant for compliance reporting, while prescriptive models are emerging among mature payers seeking automated adjudication recommendations. Vendors that knit predictive, prescriptive, and real-time workflows into a single fabric are shaping the next wave of differentiation in the healthcare fraud detection market.

Software suites dominated the component landscape with 59.86% 2024 share, reflecting entrenched demand for end-to-end investigation platforms. Yet cloud services are the fastest-growing slice at 23.73% CAGR, propelled by migration away from rigid on-premise stacks. Payers cite elastic scaling, lower upfront cost, and faster update cycles as prime incentives.

Major alliances-Humana and Google Cloud, Oracle Health and G42-aim to marry deep health data with hyperscale infrastructure. This ecosystem approach lowers barriers for mid-market insurers that lack vast internal IT. In parallel, managed-service providers bundle model governance, system tuning, and regulatory reporting, thereby reshaping total-cost calculations. As health plans consolidate point solutions into unified SaaS platforms, cloud services are likely to become the de-facto delivery model for the healthcare fraud detection market.

The Healthcare Fraud Detection Market Report is Segmented by Analytics Type (Descriptive Analytics, Predictive Analytics, and More), Component (Software and Services), Deployment Mode (On-Premise, Cloud and More), Application (Review of Insurance Claims, Payment Integrity and More), End User (Private Insurance Payers, Government Agencies, and More), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America held 41.78% share of the healthcare fraud detection market in 2024, anchored by robust enforcement frameworks and funding. CMS is channeling USD 941 million into fraud-control activities for fiscal 2025, and regulations such as the 21st Century Cures Act mandate interoperability and algorithm transparency. High EHR penetration and a dense vendor ecosystem speed adoption cycles. Canada and Mexico follow the U.S. trajectory as cross-border claims rise and shared data lakes emerge.

Asia-Pacific is the fastest-growing region with a 21.34% CAGR, fueled by nationwide digital-health missions, expanding insurance pools, and cloud-first IT strategies. India's 500-million-plus health IDs, China's AI productivity gains among clinicians, and Japan's insurer-led generative-AI pilots exemplify momentum. Australia and South Korea add regulatory clarity and public grants that accelerate vendor uptake.

Europe maintains solid growth underpinned by GDPR-aligned privacy safeguards. Member states adopt privacy-preserving analytics and synthetic data to reconcile fraud prevention with stringent data-protection norms. Germany, United Kingdom, and France lead deployments through national digitization roadmaps, while Southern and Eastern European markets show steady demand as health-insurance coverage broadens. South America and the Middle East & Africa remain nascent but attractive, given rising private insurance penetration and government e-health agendas that will require fraud controls.

- United Health Group

- SAS Institute

- IBM

- Cotiviti, Inc.

- Fair Isaac Corporation (FICO)

- LexisNexis Risk Solutions

- BAE Systems plc

- DXC Technology

- CGI

- EXL Service Holdings

- Mckesson

- Northrop Grumman

- Oracle

- ClarisHealth

- Change Healthcare

- Pegasystems Inc.

- Codoxo

- C3.ai

- OSP Labs

- SCIO Health Analytics

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising Healthcare Expenditure

- 4.2.2 Increasing Fraudulent Activities In Healthcare

- 4.2.3 Growing Pressure To Reduce Healthcare Spending

- 4.2.4 Surge In Health-Insurance Enrolment & Claims Volumes

- 4.2.5 Real-Time Claims Adjudication Via FHIR APIs

- 4.2.6 Synthetic Data Generation For Cross-Institution Pattern Detection

- 4.3 Market Restraints

- 4.3.1 Unwillingness To Adopt Analytics Solutions

- 4.3.2 High Implementation & Integration Costs

- 4.3.3 Data-Privacy & Compliance Concerns (HIPAA / GDPR)

- 4.3.4 AI-Model Bias & False Positives Triggering Scrutiny

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technology Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

5 Market Size and Growth Forecasts (Value-USD)

- 5.1 By Analytics Type

- 5.1.1 Descriptive Analytics

- 5.1.2 Predictive Analytics

- 5.1.3 Prescriptive Analytics

- 5.1.4 Real-time / Streaming Analytics

- 5.2 By Component

- 5.2.1 Software

- 5.2.2 Services

- 5.3 By Deployment Mode

- 5.3.1 On-premise

- 5.3.2 Cloud

- 5.3.3 Hybrid

- 5.4 By Application

- 5.4.1 Review of Insurance Claims

- 5.4.2 Payment Integrity

- 5.4.3 Provider Audit & Revenue Recovery

- 5.4.4 Fraud, Waste & Abuse Management

- 5.4.5 Pharmacy Benefit Management

- 5.5 By End User

- 5.5.1 Private Insurance Payers

- 5.5.2 Government Agencies

- 5.5.3 Healthcare Providers

- 5.5.4 Employers & Unions

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Mexico

- 5.6.2 Europe

- 5.6.2.1 Germany

- 5.6.2.2 United Kingdom

- 5.6.2.3 France

- 5.6.2.4 Italy

- 5.6.2.5 Spain

- 5.6.2.6 Rest of Europe

- 5.6.3 Asia-Pacific

- 5.6.3.1 China

- 5.6.3.2 Japan

- 5.6.3.3 India

- 5.6.3.4 Australia

- 5.6.3.5 South Korea

- 5.6.3.6 Rest of Asia-Pacific

- 5.6.4 Middle East and Africa

- 5.6.4.1 GCC

- 5.6.4.2 South Africa

- 5.6.4.3 Rest of Middle East and Africa

- 5.6.5 South America

- 5.6.5.1 Brazil

- 5.6.5.2 Argentina

- 5.6.5.3 Rest of South America

- 5.6.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.3.1 UnitedHealth Group

- 6.3.2 SAS Institute Inc.

- 6.3.3 IBM Corporation

- 6.3.4 Cotiviti, Inc.

- 6.3.5 Fair Isaac Corporation (FICO)

- 6.3.6 LexisNexis Risk Solutions

- 6.3.7 BAE Systems plc

- 6.3.8 DXC Technology

- 6.3.9 CGI Inc.

- 6.3.10 EXL Service Holdings

- 6.3.11 McKesson Corporation

- 6.3.12 Northrop Grumman

- 6.3.13 Oracle Corporation

- 6.3.14 ClarisHealth

- 6.3.15 Change Healthcare

- 6.3.16 Pegasystems Inc.

- 6.3.17 Codoxo

- 6.3.18 C3.ai

- 6.3.19 OSP Labs

- 6.3.20 SCIO Health Analytics

7 Market Opportunities and Future Outlook

- 7.1 White-Space and Unmet-Need Assessment