PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1850381

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1850381

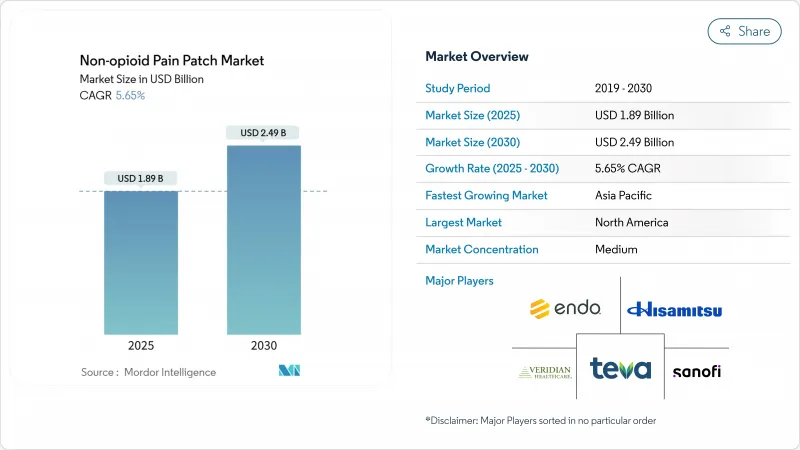

Non-opioid Pain Patch - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Non-opioid Pain Patch Market size is estimated at USD 1.89 billion in 2025, and is expected to reach USD 2.49 billion by 2030, at a CAGR of 5.65% during the forecast period (2025-2030).

Growth is rooted in the global shift away from opioid prescribing, steady innovation in transdermal delivery, and widening reimbursement for topical analgesics. New microneedle-enhanced systems are raising drug-delivery efficiency while large matrix formats preserve cost advantages for established brands. Online pharmacies are reshaping purchase journeys, letting manufacturers build direct bonds with patients and sharpen pricing transparency. Consolidation continues: Grunenthal's Qutenza licensing deal with Apotex broadened reach in Canada, while smaller firms such as Enokon Medical posted 87% clinical efficacy with natural-ingredient patches that appeal to safety-conscious users.

Global Non-opioid Pain Patch Market Trends and Insights

Rising burden of pain-related disorders

More than 1.5 billion people live with chronic pain, and aging societies push neuropathic conditions to the forefront. Diabetes alone is set to affect 783 million adults by 2045, swelling the pool of patients with diabetic peripheral neuropathy. Productivity losses tied to unmanaged pain top USD 300 billion each year in the United States. Payers and clinicians therefore favor localized, low-risk treatments that keep patients active and reduce reliance on systemic drugs.

Technological advances in transdermal delivery

Fourth-generation patches now integrate microneedles that bypass the tough outer skin layer and release analgesics in a controlled manner. Polymer-based microneedle arrays with porous coatings deliver three-times higher loads than metal designs and extend pain-relief duration. Such gains address prior limits for hydrophilic drugs and cut application frequency, raising patient adherence.

Price sensitivity versus low-cost oral analgesics

In many emerging countries a branded patch costs five-to-ten times more than generic ibuprofen tablets. Limited insurance coverage prompts patients to opt for the cheapest immediate relief. India's drug-makers hope to bridge this gap by launching generic patches as patents expire on over 300 products by 2030, yet near-term affordability hurdles stay in place.

Other drivers and restraints analyzed in the detailed report include:

- Growing consumer preference for OTC analgesics

- E-commerce and direct-to-consumer expansion

- Complex regional regulatory hurdles

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Lidocaine products held the largest slice of the non-opioid pain patch market size at 35.23% in 2024, supported by decades of clinical use and broad third-party payment. Strong safety and minimal systemic absorption make lidocaine popular in elderly populations, which are most affected by post-herpetic neuralgia. Grunenthal and Scilex broadened acceptance by delivering thinner, high-adhesion systems that permit exercise and showering without detachment.

Capsaicin patches expand at a 6.97% CAGR, the fastest among patch types, because high-concentration formulations produce multi-month relief from diabetic neuropathy and chemotherapy-induced pain. Older patients achieved statistically significant pain score reductions in a 2025 study that compared capsaicin to standard care. Diclofenac and ketoprofen hold niche roles in musculoskeletal injury management, while natural-ingredient patches from Enokon create a small but visible frontier for chemical-free therapy seekers.

Matrix construction accounted for 48.41% of the non-opioid pain patch market share in 2024. Manufacturers prefer the format because it supports a wide range of APIs at reasonable production cost. Hospitals value the steady plasma levels delivered over 12-24 hours.

Microneedle-enhanced patches post the highest growth at 7.12% CAGR, capitalizing on their ability to open microchannels that improve permeation of hydrophilic molecules like gabapentin. A 2024 carbon-master microneedle prototype raised delivery efficiency threefold compared with earlier metal units. Reservoir systems stay relevant in long-wear chronic treatment, and drug-in-adhesive sheets secure cosmetic appeal with ultra-thin designs. Smart pH-responsive microneedle arrays represent the next wave, adjusting dose to local inflammation levels.

The Non-Opioid Pain Patch Market Report is Segmented by Patch Type (Lidocaine Patches, Diclofenac Patches, Capsaicin Patches, and More), Technology (Matrix Patches, Reservoir Patches and More), Indication (Pain Type) (Neuropathic Pain, and More), Distribution Channel (Hospital Pharmacies, Retail Pharmacies, and More), and Geography (North America, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America contributed 39.45% of 2024 revenue, reflecting widespread awareness of opioid addiction risks and generous payer coverage for topical analgesics. The 2025 NOPAIN Act funds non-opioid postoperative options, driving hospital uptake of capsaicin and lidocaine systems. U.S. FDA approvals of novel non-opioid treatments also boost clinician confidence FDA.

Asia Pacific posts the fastest regional CAGR at 7.87% through 2030. Japan's super-aged society faces high rates of post-herpetic neuralgia, and reimbursement committees increasingly reimburse capsaicin 8% patches for long-term relief. In China and India growth hinges on price negotiation; domestic contract manufacturers prepare low-price generics that could widen access once global patents expire.

Europe holds a solid share with strong chronic-pain management frameworks but slower growth because the EMA demands extra skin-sensitization tests. Germany, the United Kingdom, and France incentivize e-prescriptions, easing digital pharmacy adoption. Latin America and the Middle East show moderate growth when private insurers reimburse branded patches in tier-one cities. Humid ASEAN climates challenge supply chains because high moisture shortens shelf life, prompting foil-laminated sachets and desiccant liners.

- Hisamitsu Pharmaceutical

- Endo International

- Scilex Pharmaceuticals (Sorrento Therapeutics)

- Teikoku Pharma USA / Teikoku Seiyaku Co.

- Teva Pharmaceutical Industries

- Averitas Pharma (Grunenthal)

- GlaxoSmithKline

- Sanofi

- Mylan (Viatris)

- IBSA Institut Biochimique

- Sparsha Pharma International Pvt. Ltd.

- Veridian Healthcare

- Amneal Pharmaceuticals

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising Burden of Pain-Related Disorders Worldwide

- 4.2.2 Technological Advancements in Transdermal Drug-Delivery Platforms

- 4.2.3 Growing Consumer Preference for OTC Topical Analgesics

- 4.2.4 Expansion of E-commerce & Direct-to-Consumer Channels Enhancing Accessibility

- 4.2.5 Regulatory & Payer Shift Toward Non-Opioid Analgesics Post-Opioid Crisis

- 4.2.6 Surge in the Volume of Sports Injuries

- 4.3 Market Restraints

- 4.3.1 Price Sensitivity Versus Low-Cost Oral Analgesics in Emerging Economies

- 4.3.2 Complex Regional Regulatory Hurdles for Transdermal Patch Safety & Skin Irritation

- 4.3.3 Competitive Threat from Alternative Topical & Device-Based Non-Opioid Pain Therapies

- 4.3.4 Humidity-Linked Shelf-life Issues Limiting ASEAN Distribution

- 4.4 Supply-Chain Analysis

- 4.5 Regulatory Outlook

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Bargaining Power of Suppliers

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value)

- 5.1 By Patch Type

- 5.1.1 Lidocaine Patches

- 5.1.2 Diclofenac Patches

- 5.1.3 Capsaicin Patches

- 5.1.4 Ketoprofen Patches

- 5.1.5 Other Patch Types

- 5.2 By Technology

- 5.2.1 Matrix Patches

- 5.2.2 Reservoir Patches

- 5.2.3 Drug-in-Adhesive Patches

- 5.2.4 Microneedle-Enhanced Patches

- 5.3 By Indication (Pain Type)

- 5.3.1 Neuropathic Pain

- 5.3.2 Musculoskeletal Pain

- 5.3.3 Cancer-Associated Pain

- 5.3.4 Others (Headache, Dental, Post-op)

- 5.4 By Distribution Channel

- 5.4.1 Hospital Pharmacies

- 5.4.2 Retail Pharmacies

- 5.4.3 Online Pharmacies

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Spain

- 5.5.2.6 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 Japan

- 5.5.3.3 India

- 5.5.3.4 Australia

- 5.5.3.5 South Korea

- 5.5.3.6 Rest of Asia-Pacific

- 5.5.4 Middle East and Africa

- 5.5.4.1 GCC

- 5.5.4.2 South Africa

- 5.5.4.3 Rest of Middle East and Africa

- 5.5.5 South America

- 5.5.5.1 Brazil

- 5.5.5.2 Argentina

- 5.5.5.3 Rest of South America

- 5.5.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.3.1 Hisamitsu Pharmaceutical Co. Inc.

- 6.3.2 Endo International plc

- 6.3.3 Scilex Pharmaceuticals (Sorrento Therapeutics)

- 6.3.4 Teikoku Pharma USA / Teikoku Seiyaku Co.

- 6.3.5 Teva Pharmaceutical Industries Ltd.

- 6.3.6 Averitas Pharma (Grunenthal)

- 6.3.7 GlaxoSmithKline plc

- 6.3.8 Sanofi

- 6.3.9 Mylan (Viatris)

- 6.3.10 IBSA Institut Biochimique

- 6.3.11 Sparsha Pharma International Pvt. Ltd.

- 6.3.12 Veridian Healthcare

- 6.3.13 Amneal Pharmaceuticals

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-need Assessment