PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1850384

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1850384

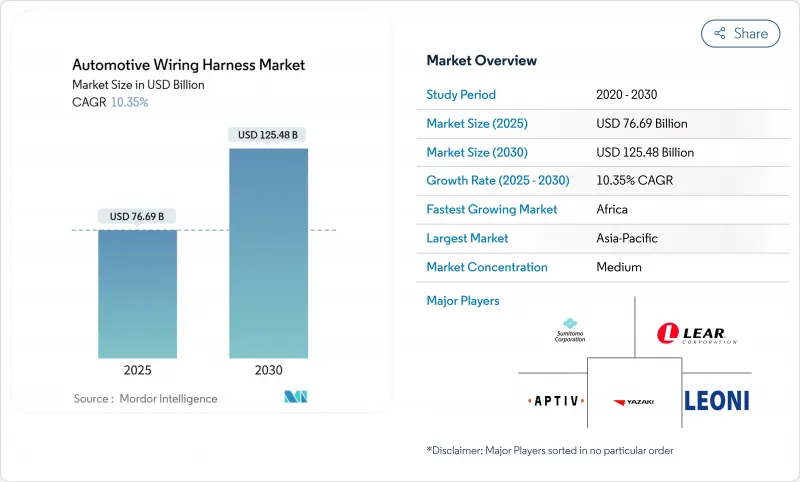

Automotive Wiring Harness - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Automotive Wiring Harness Market size is estimated at USD 76.69 billion in 2025, and is expected to reach USD 125.48 billion by 2030, at a CAGR of 10.35% during the forecast period (2025-2030).

The market is expanding steadily on the back of rising electronic content per vehicle, but the headline growth masks two contrasting currents: demand for high-voltage harnesses used in battery-electric vehicles is rising at a double-digit pace, while traditional low-voltage ICE looms are seeing price compression. Regionally, Asia remains the production and consumption hub, Africa is attracting new capacity thanks to favorable labor economics and local-content rules, and mature markets in North America and Europe are pivoting toward zonal electrical architectures that shorten cable runs yet increase the value of each remaining line.

Global Automotive Wiring Harness Market Trends and Insights

Electrification-Driven Surge in High-Voltage Harness Demand

Rising battery pack voltages to 800 V and even 1000 V are spurring a new class of cable assemblies that carry greater thermal loads while meeting tight electromagnetic-compatibility (EMC) targets. Many Chinese brands now specify aluminum-based conductors for main traction lines, directly linking material innovation to EV cost reduction. Because aluminum requires revised joining techniques, suppliers are investing in friction and laser welding cells at a pace unseen five years ago. An emerging inference is that welding know-how may soon overshadow raw copper sourcing as the key competitive barrier.

OEM Push for Lightweight Aluminum and Optical Harnesses

Automakers continue to chase every gram of weight saving, and wiring can account for more than 20 kg in premium cars. Aluminum conductors slash mass by roughly 60% relative to copper and also cut exposure to copper-price swings. The downside-lower conductivity-is being offset through multi-strand designs and bimetal terminals that keep contact resistance within specification. As connection technology matures, several OEMs have introduced mixed conductor looms that pair aluminum power lines with optical fibres for data, hinting that the next frontier will lie in hybrid composite bundles rather than single-metal solutions.

Margin Pressure from Volatile Copper and Resin Prices

Copper accounts for well over half of total bill-of-materials cost in a conventional loom, so recent price gyrations have compressed supplier gross margin. Although most line-fit contracts include pass-through clauses, automakers are increasingly reluctant to accept mid-cycle price increases. Suppliers are therefore hedging on commodity exchanges and diversifying into aluminum as a risk-spreading measure. The situation underscores that financial engineering and procurement sophistication are becoming as important as core engineering in safeguarding profitability.

Other drivers and restraints analyzed in the detailed report include:

- Shift Toward Centralized Zonal E/E Architectures in Premium Cars

- Regulatory Mandates for ADAS Wiring Redundancy

- EV-Specific Thermal and EMC Challenges Raising Validation Costs

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Body, Lighting, and Cabin Comfort systems command the largest share of the Automotive Wiring Harness market size in 2024, accounting for 35.90% of the market size. High LED adoption, power lift-gates, and multi-zone climate modules explain persistent demand. An interesting observation is that the same comfort features that boost volume also complicate final vehicle assembly, nudging OEMs to request pre-configured sub-looms that snap into dashboards and door panels.

Charging and power supply system harnesses show the fastest forecast CAGR expanding at an 26.50% through 2030, expanding in the mid-teens as more electric models reach showrooms. These harnesses must endure temperature spikes and mechanical vibration around battery packs, so higher-grade insulation materials are becoming mainstream. Suppliers that master liquid-cooling sleeves and low-profile shielding will likely command premium price points. Over time, expertise in high-voltage routing may provide cross-selling entry into battery management systems.

Copper retains around 93.90% of the Automotive Wiring Harness market share today, supported by unmatched conductivity and a century of process know-how. Yet its density and volatile cost profile keep pressure on OEM purchasing departments to pursue alternatives. An emerging pattern is the bundling of copper data pairs with aluminum power cores in the same trunk line, achieving weight reduction without sacrificing signal integrity.

Aluminum's forecast CAGR is 12.13% by 2030, easily outpacing the broader Automotive Wiring Harness industry trajectory. Advances in anti-corrosion terminals and friction-weld splice techniques have removed earlier reliability concerns. Because aluminum is price-stable relative to copper, finance teams increasingly model its use as a hedge. The shift indicates that material science choices now intersect directly with treasury risk management strategies inside large suppliers.

The Automotive Wiring Harness Market Report is Segmented by Application Type (Ignition System, and More), Conductor Material (Copper, and More), Voltage Rating (Low-Voltage [less Than 60V] and More), Propulsion Type (Internal Combustion Engine Vehicles and More), Vehicle Type (Passenger Cars and More), Sales Channel (OEM and More) and Geography. The Market Forecasts are Provided in Terms of Value (USD) and Volume (Units).

Geography Analysis

Asia Pacific holds almost 48.83% Automotive Wiring Harness market share and boasts the fastest absolute revenue expansion. China anchors the region through its vast light-vehicle output and deep EV supply chains, while Japan and South Korea contribute high-grade R&D for data and high-voltage applications. Government incentives for electrification in India and Southeast Asia suggest that regional demand will remain resilient even as global growth normalises. A noteworthy development is that multiple Chinese OEMs are exporting EVs to Europe, requiring harmonised wiring specifications that meet European Union regulatory norms and thus elevating Asia-based suppliers to global compliance standards.

Africa, records the highest CAGR of 11.97% between 2025-2030. Competitive labour costs, trade-agreement access to the European Union, and government industrial-park policies together attract fresh harness investment. Several European tier-1 firms are locating high-labour-content sub-assemblies in the region, freeing up home-market plants for automated processes. Local workforce up-skilling programs in cable crimping and quality inspection are emerging, indicating that human-capital strategy is entwined with regional growth.

North America and Europe grow more modestly but remain technology front-runners. Zonal architecture pilots are concentrated in German luxury brands and North American electric start-ups, so design offices in Munich, Stuttgart, and Silicon Valley serve as nerve centres for next-generation loom concepts. This pattern implies that intellectual property creation is decoupling from labour-intensive production. This reinforces the two-speed global footprint in which R&D clusters near OEM headquarters and large-batch assembly migrate to cost-optimised regions.

- Yazaki Corporation

- Sumitomo Electric Industries Ltd.

- LEONI AG

- Lear Corporation

- Motherson Wiring Harness Ltd.

- Furukawa Electric Co. Ltd.

- Fujikura Ltd.

- Kyungshin Corporation

- Draexlmaier Group

- Kromberg & Schubert

- Nexans Autoelectric

- PKC Group (Motherson)

- Coroplast Fritz Muller GmbH & Co.

- THB Group

- Prestolite Wire LLC

- Lear Yangzhou (China)

- Guangdong Hivolt Wiring Harness

- BizLink Holding Inc.

- Shanghai Shenglong Automotive Harness

- Samvardhana Motherson Reydel

- Korea Electric Terminal Co.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Drivers

- 4.1.1 Electrification-Driven Surge in High-Voltage Harness Demand (Asia)

- 4.1.2 OEM Push for Lightweight Aluminum & Optical Harnesses

- 4.1.3 Shift Toward Centralized Zonal E/E Architectures in Premium Cars (EU)

- 4.1.4 Regulatory Mandates for ADAS Wiring Redundancy (US, Japan)

- 4.1.5 Rising Local Content Rules Fueling Wire-Harness Localization (India, Mexico)

- 4.1.6 Autonomous Vehicle Development Driving Redundant Circuit Architectures

- 4.2 Market Restraints

- 4.2.1 Margin Pressure From Volatile Copper & Resin Prices

- 4.2.2 EV-Specific Thermal & EMC Challenges Raising Validation Costs

- 4.2.3 Mismatch Between Design Complexity & Skilled Labor Availability (ASEAN)

- 4.2.4 Manufacturing Automation Limitations Constraining Productivity Gains

- 4.3 Value / Supply-Chain Analysis

- 4.4 Regulatory & Technological Outlook

- 4.5 Porter's Five Forces

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value, USD)

- 5.1 By Application

- 5.1.1 Ignition System

- 5.1.2 Charging & Power Supply System

- 5.1.3 Drivetrain & Powertrain (ICE)

- 5.1.4 High-Voltage Traction Harness (xEV)

- 5.1.5 Infotainment, Cockpit & Telematics

- 5.1.6 ADAS & Safety Control

- 5.1.7 Body, Lighting & Cabin Comfort

- 5.2 By Conductor Material

- 5.2.1 Copper

- 5.2.2 Aluminum

- 5.3 By Voltage Rating

- 5.3.1 Low-Voltage (<60 V)

- 5.3.2 High-Voltage (60-1,000 V)

- 5.4 By Propulsion Type

- 5.4.1 Internal Combustion Engine Vehicles

- 5.4.2 Battery Electric Vehicles

- 5.4.3 Plug-in Hybrid & Hybrid Vehicles

- 5.5 By Vehicle Type

- 5.5.1 Passenger Cars

- 5.5.2 Light Commercial Vehicles

- 5.5.3 Heavy-duty Trucks & Buses

- 5.6 By Sales Channel

- 5.6.1 OEM

- 5.6.2 Aftermarket

- 5.7 By Geography

- 5.7.1 North America

- 5.7.1.1 United States

- 5.7.1.2 Canada

- 5.7.1.3 Rest of North America

- 5.7.2 Europe

- 5.7.2.1 Germany

- 5.7.2.2 United Kingdom

- 5.7.2.3 France

- 5.7.2.4 Spain

- 5.7.2.5 Russia

- 5.7.2.6 Rest of Europe

- 5.7.3 Asia Pacific

- 5.7.3.1 China

- 5.7.3.2 Japan

- 5.7.3.3 India

- 5.7.3.4 South Korea

- 5.7.3.5 Rest of Asia Pacific

- 5.7.4 Middle East

- 5.7.4.1 GCC

- 5.7.4.2 Turkey

- 5.7.4.3 Rest of Middle East

- 5.7.5 Africa

- 5.7.5.1 South Africa

- 5.7.5.2 Egypt

- 5.7.5.3 Rest of Africa

- 5.7.6 South America

- 5.7.6.1 Brazil

- 5.7.6.2 Argentina

- 5.7.6.3 Rest of South America

- 5.7.1 North America

6 Competitive Landscape

- 6.1 Strategic Initiatives

- 6.2 Market Share Analysis

- 6.3 Company Profiles

- 6.3.1 Yazaki Corporation

- 6.3.2 Sumitomo Electric Industries Ltd.

- 6.3.3 LEONI AG

- 6.3.4 Lear Corporation

- 6.3.5 Motherson Wiring Harness Ltd.

- 6.3.6 Furukawa Electric Co. Ltd.

- 6.3.7 Fujikura Ltd.

- 6.3.8 Kyungshin Corporation

- 6.3.9 Draexlmaier Group

- 6.3.10 Kromberg & Schubert

- 6.3.11 Nexans Autoelectric

- 6.3.12 PKC Group (Motherson)

- 6.3.13 Coroplast Fritz Muller GmbH & Co.

- 6.3.14 THB Group

- 6.3.15 Prestolite Wire LLC

- 6.3.16 Lear Yangzhou (China)

- 6.3.17 Guangdong Hivolt Wiring Harness

- 6.3.18 BizLink Holding Inc.

- 6.3.19 Shanghai Shenglong Automotive Harness

- 6.3.20 Samvardhana Motherson Reydel

- 6.3.21 Korea Electric Terminal Co.

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment