PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1850387

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1850387

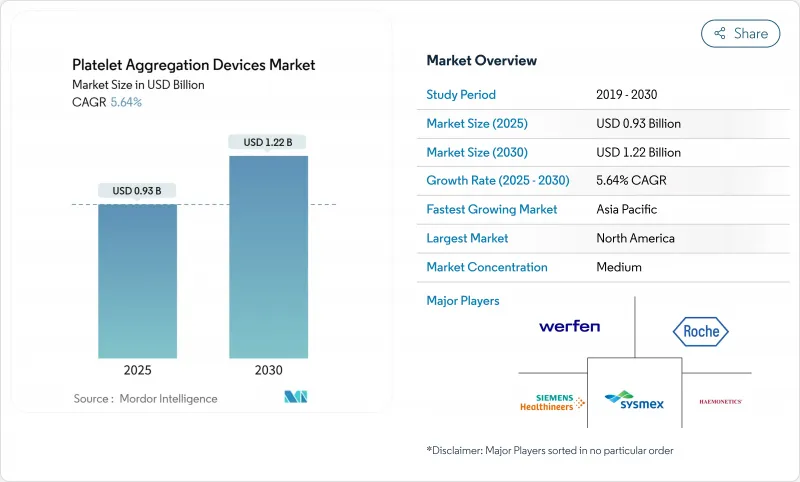

Platelet Aggregation Devices - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The platelet aggregometer market size reached USD 928 million in 2025 and is projected to reach USD 1.22 billion in 2030, posting a 5.64% CAGR through the period.

Robust demand stems from aging populations, the wider spread of cardiovascular disease, and faster adoption of point-of-care hemostasis tests. Ongoing innovation in microfluidics, artificial intelligence, and multiple-electrode technologies keeps the market on an upward trajectory as hospitals and laboratories modernize their coagulation work-flows. Health systems are also implementing personalized antiplatelet therapy programs that require regular platelet function checks, while decentralized clinical trials add fresh use cases for portable analyzers. Rising cost pressures push vendors to offer integrated platforms and long-term service contracts, but strong reimbursement support in high-income countries and growing government health budgets in Asia-Pacific buffer the impact of price sensitivity.

Global Platelet Aggregation Devices Market Trends and Insights

Rising Incidence of Cardiovascular and Hematological Disorders

Cardiovascular disease prevalence continues to climb, prompting hospitals to increase routine platelet testing volumes. The American Heart Association projects hypertension rates rising to 61% and diabetes to 26.8% by 2050, trends that drive long-term utilization of platelet analyzers. Clinical teams also observe high rates of platelet dysfunction in hematologic therapies such as CAR-T, adding complex testing needs to oncology departments. These converging disease burdens intensify demand across the platelet aggregometer market.

Increasing Geriatric Population and Surgical Procedures

Older patients undergo more surgical interventions and present higher bleeding risk, so perioperative teams rely on rapid platelet assessments to guide transfusion choices. Studies show 73.5% of cardiac patients monitored with point-of-care platforms required adjustments within 10 days post-surgery.As minimally invasive techniques spread, clinics favor compact analyzers that deliver results in minutes, strengthening adoption across the platelet aggregometer market.

High Cost of Systems and Reagents; Skills Gap

Capital investment for advanced aggregometers remains a hurdle, especially for smaller hospitals in low-resource settings. Reagent prices add ongoing expense, and laboratories struggle to recruit staff trained in complex hemostasis workflows. These constraints temper adoption even as clinical demand rises.

Other drivers and restraints analyzed in the detailed report include:

- Technological Advancements in Platelet Aggregometers

- Personalized Antiplatelet Therapy Driving POC Testing

- Stringent Regulatory Validation Requirements

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

The platelet aggregometer market size for systems stood at USD 486 million in 2024, equal to 52.34% of total revenue. High share reflects recurring instrument upgrades and bundled service contracts. Systems revenue will rise at 9.23% CAGR as laboratories favor automated multi-assay platforms that consolidate hemostasis testing. Reagent sales grow in parallel but face competitive pricing. Portable point-of-care systems expand addressable settings and broaden clinical use, sustaining long-term demand within the platelet aggregometer market.

Consumables also benefit as single-use cartridges minimize contamination and maintenance. Vendors embed software analytics that spot outliers and flag maintenance needs, supporting predictable uptime and laboratory accreditation.

Light-transmission aggregometry retained the largest share, at 37.65%, thanks to decades of clinical validation and physician familiarity. Yet growth momentum favors chip-based and impedance platforms, which log 9.44% CAGR on the back of lower sample volumes and shorter run times.

Multiple-electrode designs augment throughput by handling several agonists simultaneously. Hybrid systems that layer optical, impedance, and AI-driven analytics on a single bench-top unit broaden clinical insights and drive fresh investment across the platelet aggregometer market.

Platelet Aggregation Devices Market Report is Segmented by Product (Systems, Reagents, and More), Technology (Light-Transmission Aggregometry, Impedance Aggregometry and More), Sample Type (Platelet-Rich Plasma and More), Application (Clinical Diagnostics, Antiplatelet-Therapy Monitoring and More), End User (Hospitals, Diagnostic Laboratories, and More), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America commanded 34.41% of platelet aggregometer market share in 2024, underpinned by robust reimbursement, extensive cardiovascular screening programs, and clear regulatory guidance. Major centers run multicenter trials that showcase evidence-based workflows, boosting confidence and triggering copycat adoption region-wide.

Europe follows with entrenched hemostasis excellence, stringent ISO-aligned lab accreditation, and broad access to specialty reagents. Collaborative networks such as the International Federation of Clinical Chemistry support harmonized protocols that cut variability and encourage cross-border procurement. The region also hosts many life-science headquarters, elevating drug-development testing volumes.

Asia-Pacific records the fastest expansion, with a 7.62% CAGR projected to 2030. Government health reforms in China and India upgrade tertiary care hospitals and add new laboratory clusters. Japan remains a technology leader and early buyer of AI-integrated platforms. Rising cardiovascular burden across Southeast Asia encourages private hospital chains to purchase modern analyzers to attract patients and meet accreditation standards. The broader penetration of advanced coagulation tests solidifies the long-term outlook for the platelet aggregometer market in this region.

- Siemens Healthineers

- Sysmex

- Werfen

- Haemonetics

- Roche

- Chrono-Log

- Bio/Data

- AggreDyne Inc

- Stago

- Helena Laboratories

- Terumo

- Fresenius

- Drucker Diagnostics

- Sienco Inc

- Grifols

- Medica S.p.A.

- Platelet Solutions Ltd

- Stasys Medical

- Entegrion Inc

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising Incidence Of Cardiovascular & Hematological Disorders

- 4.2.2 Increasing Geriatric Population & Surgical Procedures

- 4.2.3 Technological Advancements In Platelet Aggregometers

- 4.2.4 Personalised Antiplatelet Therapy Driving POC Testing

- 4.2.5 Pharmacovigilance Needs In Cell / Gene Therapies

- 4.2.6 Decentralised Trials Adopting Portable Devices

- 4.3 Market Restraints

- 4.3.1 High Cost Of Systems & Reagents; Skills Gap

- 4.3.2 Stringent Regulatory Validation Requirements

- 4.3.3 Sample-Prep Variability Limits POC Uptake

- 4.3.4 Competition From Viscoelastic Testing Platforms

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technology Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

5 Market Size and Growth Forecasts (Value-USD)

- 5.1 By Product

- 5.1.1 Systems

- 5.1.2 Reagents

- 5.1.3 Consumables & Accessories

- 5.2 By Technology

- 5.2.1 Light-Transmission Aggregometry

- 5.2.2 Impedance Aggregometry

- 5.2.3 Multiple-Electrode Aggregometry

- 5.2.4 Flow-Cytometry Based

- 5.2.5 Microfluidic / Chip-based

- 5.3 By Sample Type

- 5.3.1 Platelet-Rich Plasma (PRP)

- 5.3.2 Whole Blood

- 5.3.3 Washed Platelets

- 5.4 By Application

- 5.4.1 Clinical Diagnostics

- 5.4.2 Antiplatelet-therapy Monitoring

- 5.4.3 Disease & Translational Research

- 5.4.4 Drug Development & Toxicology

- 5.5 By End User

- 5.5.1 Hospitals

- 5.5.2 Diagnostic Laboratories

- 5.5.3 Blood Banks

- 5.5.4 Academic & Research Institutes

- 5.5.5 Point-of-Care Settings

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Mexico

- 5.6.2 Europe

- 5.6.2.1 Germany

- 5.6.2.2 United Kingdom

- 5.6.2.3 France

- 5.6.2.4 Italy

- 5.6.2.5 Spain

- 5.6.2.6 Rest of Europe

- 5.6.3 Asia-Pacific

- 5.6.3.1 China

- 5.6.3.2 Japan

- 5.6.3.3 India

- 5.6.3.4 Australia

- 5.6.3.5 South Korea

- 5.6.3.6 Rest of Asia-Pacific

- 5.6.4 Middle East and Africa

- 5.6.4.1 GCC

- 5.6.4.2 South Africa

- 5.6.4.3 Rest of Middle East and Africa

- 5.6.5 South America

- 5.6.5.1 Brazil

- 5.6.5.2 Argentina

- 5.6.5.3 Rest of South America

- 5.6.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.3.1 Siemens Healthineers

- 6.3.2 Sysmex Corporation

- 6.3.3 Werfen

- 6.3.4 Haemonetics Corporation

- 6.3.5 F. Hoffmann-La Roche Ltd

- 6.3.6 Chrono-Log Corporation

- 6.3.7 Bio/Data Corporation

- 6.3.8 AggreDyne Inc

- 6.3.9 Stago

- 6.3.10 Helena Laboratories

- 6.3.11 Terumo BCT

- 6.3.12 Fresenius Kabi

- 6.3.13 Drucker Diagnostics

- 6.3.14 Sienco Inc

- 6.3.15 Grifols S.A.

- 6.3.16 Medica S.p.A.

- 6.3.17 Platelet Solutions Ltd

- 6.3.18 Stasys Medical

- 6.3.19 Entegrion Inc

7 Market Opportunities and Future Outlook

- 7.1 White-Space and Unmet-Need Assessment