PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1850392

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1850392

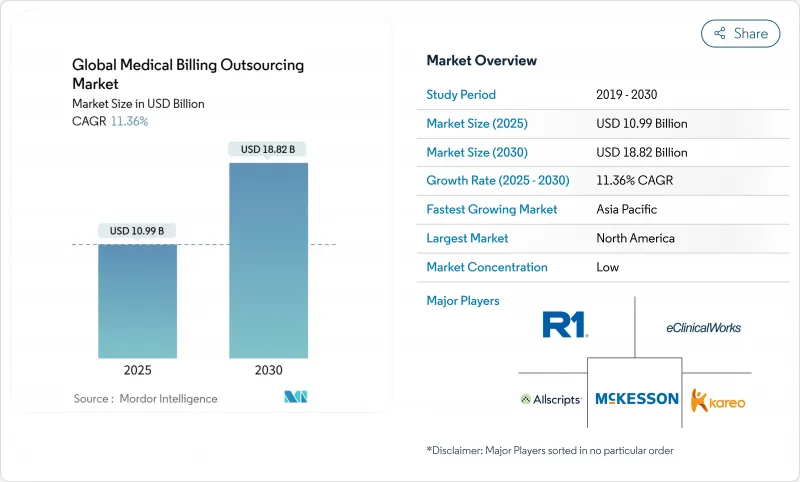

Global Medical Billing Outsourcing - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The medical billing outsourcing market size is estimated at USD 10.99 billion in 2025, and is expected to reach USD 18.82 billion by 2030, at a CAGR of 11.36% during the forecast period (2025-2030).

Demand is powered by providers moving work away from costly internal billing toward specialist partners who improve cash-flow velocity with higher first-pass claim acceptance. Growing coding complexity, payor denials and coder shortages have made external expertise indispensable. Technology-first vendors that embed artificial intelligence and cloud delivery now cut processing costs by as much as 40% while raising accuracy, prompting larger health systems and ambulatory centers alike to view outsourcing as an operational imperative. Intensifying cybersecurity rules and the price-tag of HIPAA Security updates are nudging even security-sensitive providers toward scale partners whose compliance investments outstrip most internal budgets.

Global Medical Billing Outsourcing Market Trends and Insights

Rising Claim Complexity & Documentation Burden

Coding rules continue to multiply, forcing providers to secure outside specialists who track every update and maintain year-round training programs. Outsourcing partners now supply AI-aided documentation tools that raise clean claim rates and shorten revenue cycles. As 46% of hospitals already use AI-enabled billing services, the medical billing outsourcing market gains strategic rather than tactical relevance.

Surge in Telehealth & Digital-Health Billing Volumes

Virtual visits require unique modifiers and cross-state eligibility checks that many internal teams cannot master quickly. Specialist vendors fill the gap, preventing revenue leakage by aligning telehealth codes with diverse payer rules. Demand spikes in North America and Asia Pacific help sustain double-digit growth for the medical billing outsourcing market.

Data-Privacy & Cybersecurity Concerns

Proposed HIPAA Security amendments could cost the industry USD 9.3 billion in year one compliance, a burden likely to lift service prices and prompt closer vendor vetting. Larger third-party partners invest heavily in encryption and multi-factor authentication, yet some providers hesitate to place sensitive data off-premise, tempering short-term adoption in privacy-focused regions.

Other drivers and restraints analyzed in the detailed report include:

- Efforts to Contain In-House Processing Costs

- Climbing Payor Denial Rates & Audit Intensity

- Increasing Legislative and Regulatory Pressure

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Middle-End outsourcing grew at 12.64% CAGR and is poised to widen its contribution as coding precision defines net reimbursement. The segment's 2024 expansion illustrates how clean-claim performance shapes the medical billing outsourcing market size for providers seeking immediate cash impacts. Artificial-intelligence coders funded by USD 40 million rounds demonstrate investor confidence.

Health systems report that AI-guided coding drives 96% first-pass rates against 88% for manual efforts, pushing more organizations toward specialist partners. Front-End tasks keep their 43.25% lead due to universal need for eligibility verification, but growth centers on Middle-End accuracy tools. Back-End collections remain essential for difficult balances, yet the medical billing outsourcing market increasingly markets full-cycle bundles anchored by coding excellence.

The Medical Billing Outsourcing Market Report is Segmented by Service (Front-End, Middle-End, and Back-End), Type of Deployment (On-Premise and Cloud-Based), End User (Hospitals, Physicians' Offices, and Ambulatory/Other Providers), and Geography (North America, Europe, Asia-Pacific, Middle-East and Africa, and South America). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America's 49.86% revenue share in 2024 highlights providers' reliance on external partners to navigate HIPAA updates and value-based payments. United States hospitals, burdened by rising denial volumes, choose vendors with specialized appeals teams and AI labs that push the medical billing outsourcing market forward. Canadian institutions align with cross-border firms now permitted to handle claims under modernized privacy pacts.

Asia Pacific's 13.21% CAGR reflects dual momentum. Offshore centers in Manila and Bangalore process global claims at scale, while domestic hospitals in Japan, Australia and Southeast Asia adopt outsourcing to handle growing digital-health workloads. Government e-health initiatives raise documentation complexity, further lifting regional demand.

Europe remains a mature but evolving opportunity. GDPR shapes strict data-handling rules, favoring regional providers with compliant cloud setups. Providers use outsourcing to curb cost pressures tied to aging populations, keeping the medical billing outsourcing market stable. Middle East and Africa experience brisk growth off small bases as EHR penetration expands past 75% in GCC public hospitals. South America's progress is uneven, slowed by economic swings yet buoyed by public-sector modernization programs in Brazil and Colombia.

- R1 RCM

- Optum / Change Healthcare

- Allscripts (Veradigm)

- Cerner (Oracle Health)

- GE Healthcare

- eClinicalWorks

- Experian Health

- Genpact

- Kareo Inc.

- Mckesson

- Quest Diagnostics

- The SSI Group

- Conifer Health Solutions

- GeBBs Healthcare Solutions

- Athenahealth

- AdvantEdge Healthcare Solutions

- Firstsource Solutions

- 247 MBS

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising claim complexity & documentation burden

- 4.2.2 Surge in telehealth & digital-health billing volumes

- 4.2.3 Efforts to contain and decrease in-house processing costs

- 4.2.4 Climbing payor denial rates & audit intensity

- 4.2.5 Global coder workforce shortages

- 4.2.6 Shift to value-based reimbursement models

- 4.3 Market Restraints

- 4.3.1 Data-privacy & cybersecurity concerns

- 4.3.2 Increasing legislative and regulatory pressue

- 4.3.3 High costs of technology

- 4.3.4 In-house platform investments by large IDNs

- 4.4 Regulatory Landscape

- 4.5 Technological Outlook

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitutes

- 4.6.5 Competitive Rivalry

5 Market Size & Growth Forecasts (Value)

- 5.1 By Service

- 5.1.1 Front-End

- 5.1.2 Middle-End

- 5.1.3 Back-End

- 5.2 By Type of Deployment

- 5.2.1 On-Premise

- 5.2.2 Cloud-based

- 5.3 By End User

- 5.3.1 Hospitals

- 5.3.2 Physicians' Offices

- 5.3.3 Ambulatory/Other Providers

- 5.4 By Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Italy

- 5.4.2.5 Spain

- 5.4.2.6 Rest of Europe

- 5.4.3 Asia Pacific

- 5.4.3.1 China

- 5.4.3.2 Japan

- 5.4.3.3 India

- 5.4.3.4 Australia

- 5.4.3.5 South Korea

- 5.4.3.6 Rest of Asia Pacific

- 5.4.4 Middle East and Africa

- 5.4.4.1 GCC

- 5.4.4.2 South Africa

- 5.4.4.3 Rest of Middle East and Africa

- 5.4.5 South America

- 5.4.5.1 Brazil

- 5.4.5.2 Argentina

- 5.4.5.3 Rest of South America

- 5.4.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.3.1 R1 RCM Inc.

- 6.3.2 Optum / Change Healthcare

- 6.3.3 Allscripts (Veradigm)

- 6.3.4 Cerner (Oracle Health)

- 6.3.5 GE Healthcare

- 6.3.6 EClinicalWorks

- 6.3.7 Experian Health

- 6.3.8 Genpact

- 6.3.9 Kareo Inc.

- 6.3.10 McKesson Corporation

- 6.3.11 Quest Diagnostics

- 6.3.12 The SSI Group

- 6.3.13 Conifer Health Solutions

- 6.3.14 GeBBS Healthcare Solutions

- 6.3.15 Athenahealth

- 6.3.16 AdvantEdge Healthcare Solutions

- 6.3.17 Firstsource Solutions

- 6.3.18 247 MBS

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment