PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1850405

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1850405

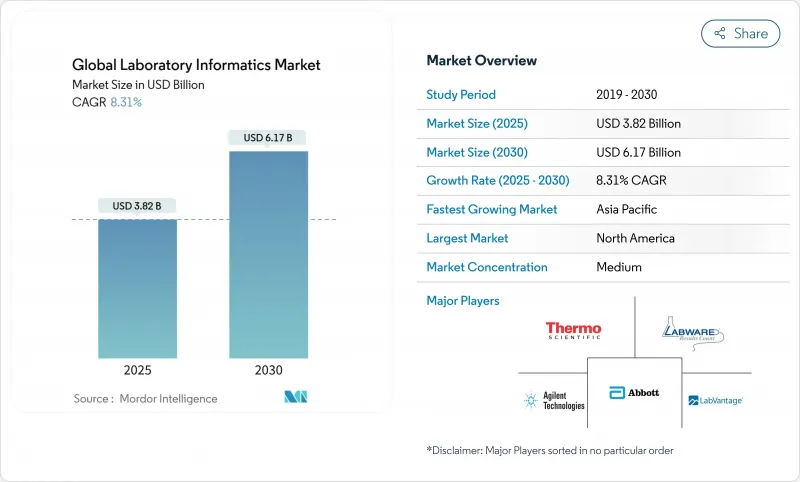

Global Laboratory Informatics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The laboratory informatics market is valued at USD 3.82 billion in 2024 and is projected to reach USD 6.17 billion by 2030, advancing at an 8.31% CAGR over 2025-2030.

Growth is underpinned by laboratories shifting to cloud deployment, the rising pace of outsourced drug discovery, and the expansion of precision-medicine biobanks that demand robust multi-omics data management. Cloud delivery already controls the largest revenue pool and is widening its lead because remote-access workflows have become standard in pharmaceutical R&D. Data-integrity mandates from regulators accelerate the replacement of legacy Laboratory Information Management Systems (LIMS) with modern platforms that embed compliance by design. Simultaneously, artificial-intelligence modules are being folded into informatics suites to shorten analysis cycles and surface predictive insights, especially in oncology and rare-disease research.

Global Laboratory Informatics Market Trends and Insights

Regulatory-Mandated Data Integrity Upgrades Driving LIMS Replacement Cycle

Legacy LIMS cannot satisfy today's audit-trail, chain-of-custody, and electronic-signature requirements, propelling a wave of rip-and-replace projects across pharmaceutical and clinical laboratories in the United States and Canada. The U.S. Food and Drug Administration adopted Abbott's STARLIMS across its testing sites, illustrating the regulatory preference for platforms that automate compliance workflows. Hospitals are following suit as infectious-disease reporting moves from manual logs to mandated electronic laboratory reporting that integrates with state surveillance networks. In practical terms, the upgrade cycle tightens vendor selection to systems with granular audit trails, validated instrument interfaces, and support for 21 CFR Part 11, pushing the laboratory informatics market toward higher annual maintenance revenue and longer multi-year support contracts.

Outsourcing Boom to Asian CROs Hikes Demand for Cloud-First Laboratory Informatics

Contract Research Organizations in China, India, and South-East Asia are winning a larger slice of early-stage drug development, lifting regional CRO revenue toward USD 46 billion in 2025. Sponsors demand real-time visibility into outsourced assays, forcing CROs to install cloud-architected LIMS that stream data to client portals. LabVantage expanded its professional-services footprint in Asia and South America by 80% between 2020-2023 to meet this need. Because cloud hosting sidesteps the capital outlay of on-premise data centers, smaller biotech firms can onboard CRO partners faster, contributing to sustained double-digit segment growth within the laboratory informatics market.

Legacy Instrument Fragmentation Hampers LIMS Integration in Latin America

Many Latin American laboratories rely on heterogeneous benchtop instruments acquired over decades, each running proprietary file formats and outdated firmware. The scarcity of local reagent suppliers and the elevated cost of importing consumables compound the challenge, as highlighted in Science's 2024 coverage of the Reagent Collaboration Network. Although initiatives that teach labs to manufacture reagents locally reduce consumable costs, they do not solve the core integration problem. Consequently, new LIMS rollouts must include custom driver development and interface validation, raising project budgets and elongating timelines, which tempers the expansion pace of the laboratory informatics market in the region.

Other drivers and restraints analyzed in the detailed report include:

- Precision-Oncology Biobank Expansion Necessitating High-Throughput Data Management

- AI-Enabled Analytics Integration for Personalized-Medicine Workflows

- EU GDPR-Driven Validation & Cyber-Security Costs Limit Cloud-Migration Budgets

For complete list of drivers and restraints, kindly check the Table Of Contents.

Geography Analysis

North America contributed 43.0% of 2024 revenue, reflecting the confluence of stringent regulatory oversight and high R&D intensity. The U.S. Centers for Disease Control and Prevention embedded electronic-laboratory-reporting infrastructure long before the COVID-19 emergency, giving public-health labs a head start in rapid data exchange. Pharmaceutical majors based in the region routinely earmark digital-transformation budgets for AI-enabled data analytics, ensuring steady refresh cycles for informatics platforms. Federal grants for pandemic preparedness and antimicrobial-resistance surveillance further fuel demand, maintaining North America's lead within the laboratory informatics market.

Asia Pacific is advancing at a 9.0% CAGR, the fastest worldwide. China and India dominate installation counts as domestic CROs scale capacity to service global sponsors. Governments are deploying national quality-infrastructure programs that subsidize laboratory automation and staff training, compressing adoption timelines. LabVantage's decision to bolster its local implementation teams signals a pivot from export-led service models to in-region support structures, a move that lowers language and time-zone friction for clients. The absence of entrenched legacy systems in many new labs allows direct leapfrogging to cloud deployment, magnifying the growth momentum of the laboratory informatics market across Asia Pacific.

Europe balances advanced precision-medicine initiatives with strict data-protection regimes. Cancer-image biobanks and multi-omics repositories mandate platforms that seamlessly integrate imaging, genomic, and clinical data while safeguarding personal identifiers. Compliance with GDPR drives vendor investment in encryption, tokenization, and cross-border data-transfer controls. Although the regulatory overhead trims short-term budgets, national health services and Horizon funding streams are earmarking grants for digital-infrastructure upgrades, ensuring a solid mid-term pipeline for vendors servicing the European segment of the laboratory informatics market size.

- Thermo Fisher Scientific

- LabWare

- Abbott (STARLIMS Corporation)

- LabVantage Solutions

- Agilent Technologies

- PerkinElmer

- Waters Corporation

- Siemens Healthineers

- Illumina

- Oracle

- Mckesson

- Autoscribe Informatics

- LabLynx

- Dotmatics Ltd.

- IDBS (Danaher)

- Accelerated Technology Laboratories (ATL)

- LabCollector (AgileBio)

- RURO Inc.

- Clinisys, Inc.

- Dassault Systmes SE (BIOVIA)

- Benchling Inc.

- Axtria

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Regulatory-mandated Data Integrity Upgrades Driving LIMS Replacement Cycle in North America

- 4.2.2 Outsourcing Boom to Asian CRO Hikes Demand for Cloud-First Laboratory Informatics

- 4.2.3 Precision-Oncology Biobank Expansion in Europe Necessitating High-Throughput Data Management

- 4.2.4 AI-Enabled Analytics Integration for Personalized Medicine Workflows in Japan & South Korea

- 4.2.5 Remote & Hybrid R&D Policies Accelerate Web-Hosted ELN Uptake Across Global Pharma Labs

- 4.2.6 EU Green Deal Digital Product Passport Pilots Requiring SDMS for Chemical Traceability

- 4.3 Market Restraints

- 4.3.1 Legacy Instrument Fragmentation Hampers LIMS Integration in Latin-American Clinical Labs

- 4.3.2 EU GDPR-Driven Validation & Cyber-Security Costs Limit Cloud Migration Budgets

- 4.3.3 Vendor Lock-in Concerns Owing to Proprietary Data Standards among Public Research Institutes

- 4.3.4 Skills Gap in API Scripting Across LATAM Food-Safety Labs Impeding LES Integration

- 4.4 Regulatory Outlook

- 4.5 Porter's Five Forces Analysis

- 4.5.1 Bargaining Power of Buyers/Consumers

- 4.5.2 Bargaining Power of Suppliers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitute Products

- 4.5.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value / USD)

- 5.1 By Product

- 5.1.1 Laboratory Information Management System (LIMS)

- 5.1.2 Electronic Lab Notebooks (ELN)

- 5.1.3 Enterprise Content Management (ECM)

- 5.1.4 Laboratory Execution System (LES)

- 5.1.5 Chromatography Data System (CDS)

- 5.1.6 Scientific Data Management System (SDMS)

- 5.1.7 Electronic Data Capture (EDC) & Clinical Data Management System (CDMS)

- 5.2 By Component

- 5.2.1 Services

- 5.2.2 Software

- 5.3 By Delivery Mode

- 5.3.1 On-premise

- 5.3.2 Web-hosted

- 5.3.3 Cloud-based

- 5.4 By End User

- 5.4.1 Pharmaceutical & Biotechnology Companies

- 5.4.2 Contract Research Organizations (CROs)

- 5.4.3 Other End Users

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Spain

- 5.5.2.6 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 Japan

- 5.5.3.3 India

- 5.5.3.4 Australia

- 5.5.3.5 South Korea

- 5.5.3.6 Rest of Asia-Pacific

- 5.5.4 Middle East & Africa

- 5.5.4.1 GCC

- 5.5.4.2 South Africa

- 5.5.4.3 Rest of Middle East & Africa

- 5.5.5 South America

- 5.5.5.1 Brazil

- 5.5.5.2 Argentina

- 5.5.5.3 Rest of South America

- 5.5.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and analysis of Recent Developments)

- 6.4.1 Thermo Fisher Scientific Inc.

- 6.4.2 LabWare

- 6.4.3 Abbott (STARLIMS Corporation)

- 6.4.4 LabVantage Solutions Inc.

- 6.4.5 Agilent Technologies Inc.

- 6.4.6 PerkinElmer Inc.

- 6.4.7 Waters Corporation

- 6.4.8 Siemens Healthineers AG

- 6.4.9 Illumina Inc.

- 6.4.10 Oracle

- 6.4.11 McKesson Corporation

- 6.4.12 Autoscribe Informatics

- 6.4.13 LabLynx Inc.

- 6.4.14 Dotmatics Ltd.

- 6.4.15 IDBS (Danaher)

- 6.4.16 Accelerated Technology Laboratories (ATL)

- 6.4.17 LabCollector (AgileBio)

- 6.4.18 RURO Inc.

- 6.4.19 Clinisys, Inc.

- 6.4.20 Dassault Systmes SE (BIOVIA)

- 6.4.21 Benchling Inc.

- 6.4.22 Axtria

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment