PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1850946

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1850946

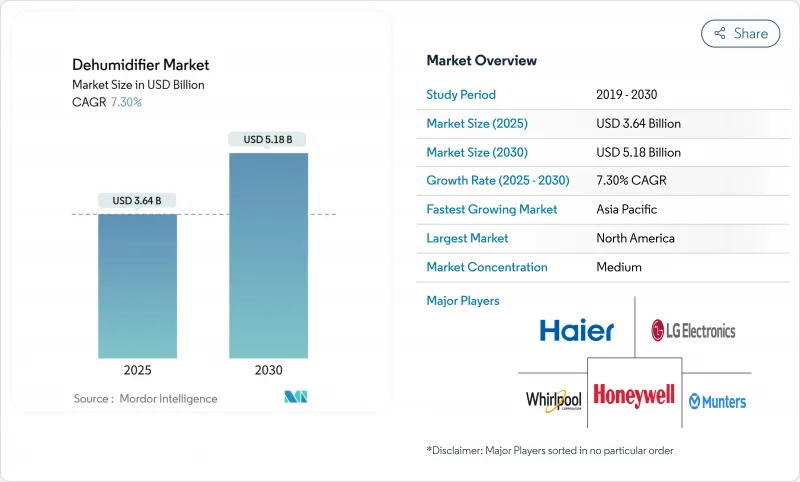

Dehumidifier - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The dehumidifier market stood at USD 3.64 billion in 2025 and is forecast to reach USD 5.18 billion by 2030, advancing at a 7.30% CAGR.

This scale places the dehumidifier market among the faster-growing small-appliance categories as health-conscious consumers, energy mandates, and data-centre investments converge to lift demand. Growing clinical evidence that rooms held between 40% and 60% relative humidity reduce respiratory infections is pushing hospitals, schools, and households to treat dehumidifiers as health equipment rather than comfort add-ons . Governments now link humidity control to energy codes, and building owners view the devices as insurance against mold losses. Digital infrastructure opens an additional growth engine because servers need tight moisture tolerances to avoid corrosion or static discharge. On the supply side, manufacturers widen product portfolios with smart connectivity, while distributors add e-commerce channels that reach buyers in secondary cities.

Global Dehumidifier Market Trends and Insights

Rising Humidity-Related Health Concerns

Hospitals and public health agencies now treat indoor moisture management as a frontline defence against respiratory disease. Europe's environmental regulator and the U.S. EPA each advise keeping rooms under 60% to curb mold growth . Insurance companies incorporate medical insights into their pricing strategies for water-damage policies, using these thresholds as commercial decision-making triggers. This strategic alignment has driven the dehumidifier market's growth beyond coastal regions, extending its reach to temperate interior areas dealing with seasonal humidity challenges, thereby creating new opportunities for market players to cater to evolving consumer needs.

Construction Boom in Humid Regions

Urban housing, data halls, and tourism projects in Southeast Asia, the Gulf, and the U.S. Gulf Coast all face design rules that require mechanical moisture removal. Saudi Arabia's tightened code cut projected energy use in new buildings by 30-40% once dehumidification and better insulation entered mandatory specifications. To fulfill the mandate of delivering code-compliant estates, contractors now incorporate dehumidifiers directly into HVAC tender documents. This integration not only ensures adherence to regulatory standards but also creates a recurring revenue model through service contracts and replacement parts. Additionally, the inclusion of dehumidifiers enhances the overall value proposition of HVAC systems by addressing humidity control needs. Consequently, the dehumidifier market benefits from a stable and predictable annuity stream, reinforcing its long-term growth potential.

High Operating Cost of Compressor Units

Energy consumption concerns limit the adoption of traditional refrigerant-based dehumidifiers, particularly in regions with elevated electricity costs. Comparative analysis reveals that condensing dehumidification systems achieve 2-3 times higher coefficient of performance than conventional air conditioning, yet still demonstrate 3-4 times lower exergy efficiency compared to desiccant wheel systems. This performance gap creates hesitancy among cost-conscious consumers and commercial operators evaluating the total cost of ownership. Industrial applications face particularly acute pressure, with energy consumption for desorption reaching 8.27 kJ/g H2O without heat recovery, though this reduces to 4.77 kJ/g H2O when utilizing waste heat recovery systems. The operating cost challenge intensifies in regions with time-of-use electricity pricing, where peak demand charges can double operational expenses during high-humidity periods.

Other drivers and restraints analyzed in the detailed report include:

- Energy-Efficiency Regulations in Commercial HVAC

- Humidity Control in Data Centers & Electronics

- Margin Pressure from Low-Cost Imports

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Advanced desiccant systems emerge as the fastest-growing product category at 7.76% CAGR through 2030, challenging the dominance of refrigerant-based compressor units that maintain 46.34% market share in 2024. The performance advantage of desiccant technology becomes evident in industrial applications, where waste heat recovery systems achieve 33.7% operational cost reductions compared to conventional methods. Thermoelectric Peltier systems occupy a specialized niche for compact applications, while hybrid configurations combine multiple technologies to optimize performance across varying conditions. The technology shift reflects growing demand for energy-efficient solutions that can operate effectively in extreme humidity conditions where traditional refrigerant systems struggle.

Refrigerant-based systems retain market leadership through established manufacturing scale and distribution networks but face increasing pressure from environmental regulations targeting traditional refrigerants. Desiccant systems demonstrate particular strength in industrial applications where waste heat availability enables cost-effective regeneration, with multifunctional hybrid systems achieving 87.1% heat recovery efficiency. Thermoelectric systems serve specialized applications requiring precise control and minimal maintenance, while hybrid solutions address the performance limitations of single-technology approaches. The competitive landscape increasingly favours manufacturers capable of offering technology-agnostic solutions tailored to specific application requirements rather than promoting single-technology platforms.

Industrial applications command 42.23% market share in 2024, reflecting the mission-critical nature of humidity control in manufacturing processes, while residential adoption accelerates at 8.12% CAGR through 2030. The industrial dominance stems from applications requiring precise environmental control, including pharmaceutical manufacturing, food processing, and electronics assembly, where humidity variations can compromise product quality or safety. Commercial applications occupy the middle ground, driven by office buildings, retail spaces, and hospitality facilities implementing comprehensive indoor air quality management. The residential surge reflects growing health consciousness and the integration of smart home technologies that enable automated humidity management.

Emerging applications in data centers and server rooms create high-value industrial demand, with facilities requiring continuous operation and precise environmental control to prevent equipment failure. The U.S. Department of Energy's building energy efficiency initiatives drive commercial adoption through mandated HVAC upgrades and energy management systems. Residential growth accelerates through insurance industry initiatives that recognize humidity control as a mold prevention strategy, with water damage claims averaging USD 13,954 per incident. The convergence of health awareness, energy efficiency regulations, and smart home integration creates a multi-faceted growth driver that extends beyond traditional comfort applications to encompass preventive health and property protection strategies.

The Dehumidifier Market is Segmented by Product Type (Refrigerant (Compressor), Desiccant, and More), by End-User (Residential, Commercial, and More), by Capacity (Pints/Day) (<=30, 31-70, and More), by Distribution Channel (Offline / In-Store and Online / E-Commerce), and by Geography (North America, South America, Europe, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America maintains a 36.45% market share in 2024, driven by established building codes, insurance requirements, and consumer awareness of humidity-related health issues. The region's mature market reflects decades of experience with humidity control in residential and commercial applications, supported by comprehensive distribution networks and service infrastructure. Europe demonstrates steady growth through energy efficiency regulations and building performance standards that mandate environmental control systems. The regulatory environment creates compliance-driven demand while consumer awareness of health benefits drives voluntary adoption.

Asia-Pacific emerges as the fastest-growing region at 10.12% CAGR through 2030, fuelled by rapid urbanization, rising disposable incomes, and increasing awareness of indoor air quality issues. The region's diverse climate conditions create varied demand patterns, with humid subtropical areas driving natural demand while arid regions develop awareness through health and comfort considerations. China's position as both a major manufacturer and a growing consumer market creates unique dynamics, with domestic demand growth offsetting export market pressures. The regional growth reflects the convergence of economic development, urbanization, and evolving consumer preferences for indoor environmental quality.

The Middle East and Africa represent emerging markets with significant growth potential, driven by extreme climate conditions and expanding construction activity. The region's harsh environmental conditions create natural demand for humidity control, while economic development enables consumer adoption of advanced environmental control systems. South America demonstrates growing awareness of humidity-related health issues, with countries like Brazil and Argentina developing markets for both residential and commercial applications. The geographic expansion reflects the global nature of climate challenges and the universal need for indoor environmental quality management.

- Haier Smart Home

- LG Electronics

- Whirlpool Corporation

- Honeywell International

- Munters AB

- Frigidaire (Electrolux)

- De'Longhi Group

- Gree Electric Appliances

- Mitsubishi Electric

- Midea Group

- Panasonic Corporation

- Hisense

- Danby Appliances

- Aprilaire

- Therma-Stor LLC (Phoenix, Dri-Eaz)

- Ebac Industrial Products

- Desiccant Technologies Group

- Sharp Corporation

- Toshiba

- Airwatergreen AB

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising humidity-related health concerns

- 4.2.2 Construction boom in humid regions

- 4.2.3 Energy-efficiency regulations in commercial HVAC

- 4.2.4 Humidity control in data centres & electronics

- 4.2.5 Insurance claims surge from extreme-weather mold damage

- 4.2.6 Industrial uptake of waste-heat-powered desiccant systems

- 4.3 Market Restraints

- 4.3.1 High operating cost of compressor units

- 4.3.2 Margin pressure from low-cost imports

- 4.3.3 Low consumer awareness in arid sub-markets

- 4.3.4 Shortage of installers for whole-house systems

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Buyer Power

- 4.7.2 Supplier Power

- 4.7.3 Threat of Substitutes

- 4.7.4 Threat of New Entrants

- 4.7.5 Competitive Rivalry

5 Market Size & Growth Forecasts (Value)

- 5.1 By Product Type

- 5.1.1 Refrigerant (Compressor)

- 5.1.2 Desiccant

- 5.1.3 Thermoelectric (Peltier)

- 5.1.4 Hybrid / Others

- 5.2 By End-user

- 5.2.1 Residential

- 5.2.2 Commercial

- 5.2.3 Industrial

- 5.3 By Capacity (Pints/Day)

- 5.3.1 <=30

- 5.3.2 31-70

- 5.3.3 >70

- 5.4 By Distribution Channel

- 5.4.1 Offline / In-store

- 5.4.2 Online / E-commerce

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Peru

- 5.5.2.3 Chile

- 5.5.2.4 Argentina

- 5.5.2.5 Rest of South America

- 5.5.3 Europe

- 5.5.3.1 United Kingdom

- 5.5.3.2 Germany

- 5.5.3.3 France

- 5.5.3.4 Spain

- 5.5.3.5 Italy

- 5.5.3.6 BENELUX (Belgium, Netherlands, and Luxembourg)

- 5.5.3.7 NORDICS (Denmark, Finland, Iceland, Norway, and Sweden)

- 5.5.3.8 Rest of Europe

- 5.5.4 Asia-Pacific

- 5.5.4.1 India

- 5.5.4.2 China

- 5.5.4.3 Japan

- 5.5.4.4 Australia

- 5.5.4.5 South Korea

- 5.5.4.6 South East Asia (Singapore, Malaysia, Thailand, Indonesia, Vietnam, and Philippines)

- 5.5.4.7 Rest of Asia-Pacific

- 5.5.5 Middle East and Africa

- 5.5.5.1 United Arab Emirates

- 5.5.5.2 Saudi Arabia

- 5.5.5.3 South Africa

- 5.5.5.4 Nigeria

- 5.5.5.5 Rest of Middle East and Africa

- 5.5.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products & Services, Recent Developments)

- 6.4.1 Haier Smart Home

- 6.4.2 LG Electronics

- 6.4.3 Whirlpool Corporation

- 6.4.4 Honeywell International

- 6.4.5 Munters AB

- 6.4.6 Frigidaire (Electrolux)

- 6.4.7 De'Longhi Group

- 6.4.8 Gree Electric Appliances

- 6.4.9 Mitsubishi Electric

- 6.4.10 Midea Group

- 6.4.11 Panasonic Corporation

- 6.4.12 Hisense

- 6.4.13 Danby Appliances

- 6.4.14 Aprilaire

- 6.4.15 Therma-Stor LLC (Phoenix, Dri-Eaz)

- 6.4.16 Ebac Industrial Products

- 6.4.17 Desiccant Technologies Group

- 6.4.18 Sharp Corporation

- 6.4.19 Toshiba

- 6.4.20 Airwatergreen AB

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-need Assessment