PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1850951

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1850951

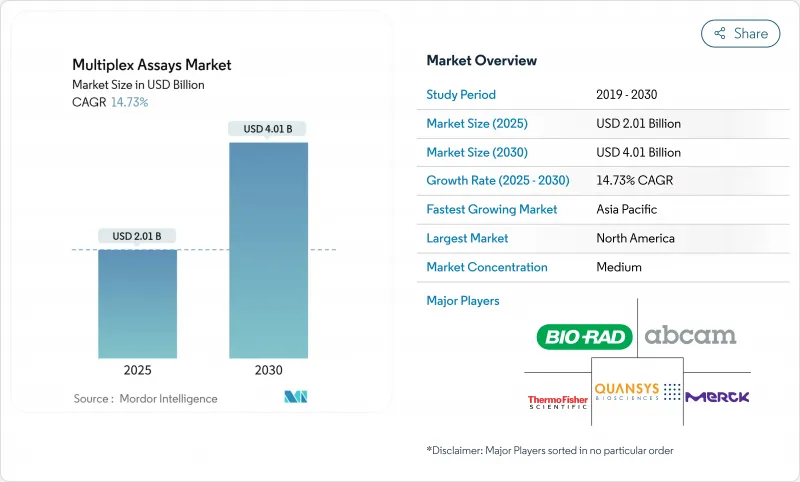

Multiplex Assays - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The multiplex assays market is valued at USD 2.01 billion in 2025 and is projected to reach USD 4.01 billion by 2030, advancing at a 14.73% CAGR.

A growing commitment to precision medicine, breakthroughs in CRISPR-enabled diagnostics, and routine use of 40-plus-color flow cytometry platforms underpin this expansion. Clinical laboratories favor multiplex formats because they reduce sample requirements, shorten turnaround time, and control costs while delivering multi-parameter insights that singleplex approaches cannot match. Pharmaceutical sponsors are embedding biomarker-rich study designs into trials, and regulatory authorities are clearing ever-broader companion diagnostics that rely on multiplex detection. At the same time, hospitals are adopting syndromic panels for respiratory and sepsis testing to improve bedside decision-making and curb antimicrobial misuse, further propelling the multiplex assays market.

Global Multiplex Assays Market Trends and Insights

Increasing Adoption of Precision-Personalized Medicine

Growing reliance on molecule-specific therapies demands tests that read several biomarkers at once. Thermo Fisher's USD 3.1 billion purchase of Olink in 2024 helped bring high-throughput proximity extension protein panels into mainstream clinical workflows. The FDA endorsed TruSight Oncology Comprehensive, a 500-gene pan-tumor companion diagnostic, illustrating official support for data-dense profiling. Large reference labs now routinely combine autoantibody and complement markers to refine lupus diagnoses, studies show improved sensitivity over single analytes. Health systems recognize that multiplex strategies cut repeat testing costs and speed treatment alignment, and machine-learning models further boost interpretive power by distilling complex signatures into clear guidance.

Expanding Burden of Chronic & Infectious Diseases

Aging populations drive chronic disease monitoring while recurrent outbreaks reinforce demand for broad pathogen panels. Prospective trials in intensive care settings confirm that respiratory syndromic tests improve time-to-appropriate therapy versus cultures. The FDA authorized a 20-minute four-pathogen molecular test for SARS-CoV-2, Influenza A/B, and RSV, underscoring the public-health value of rapid multiplex detection. Chronic kidney disease programs now integrate genomics, proteomics, and metabolomics in one assay to flag early deterioration, tightening the clinical link between multiomics and preventive care. Post-pandemic, clinicians expect panels that pivot quickly to new threats while maintaining throughput for routine surveillance, keeping the multiplex assays market on an upward trajectory.

High Capital Cost and Complex Workflows

A top-tier spectral flow cytometer costs more than USD 500,000, and supporting infrastructure adds to ownership burden. QIAGEN withdrew its automated PCR tower in 2024 due to shallow post-pandemic demand, illustrating commercial risk when capital budgets tighten. Smaller sites face steep learning curves around quality control and data handling, delaying return on investment.

Other drivers and restraints analyzed in the detailed report include:

- Distinct Advantages Over Singleplex Assays

- Rise of CRISPR-Powered Multiplex Point-of-Care Panels

- Stringent Multi-Jurisdictional Regulatory Pathways

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Protein panels accounted for 41.76% of multiplex assays market share in 2024, cementing their status in drug-target validation and clinical decision support. Bead-based immunoassays and proximity extension methods enable simultaneous quantification of hundreds of cytokines from microliter samples. The nucleic-acid category is set to log a 17.24% CAGR to 2030 as CRISPR and next-generation sequencing expand beyond oncology into transplant monitoring and infectious-disease genotyping. Cell-based formats serve immuno-oncology research, while integrated protein-gene workflows herald a multiomics future.

Integration trends reshape product design. Thermo Fisher's Stellar mass spectrometer, introduced in 2024, delivers ten-fold better quantitative sensitivity, encouraging labs to pair proteomics with genomics on shared automation. Regulatory approval of broad genomic companion diagnostics validates large-scale multiplex sequencing, reinforcing investment in nucleic-acid innovation. As these forces converge, the multiplex assays market continues to diversify across molecular classes.

Flow cytometry delivered 32.45% of 2024 revenue, thanks to entrenched instrument fleets and extensive clinical guidelines. Spectral unmixing now resolves more markers per channel, extending platform life. Mass cytometry, however, is forecast to grow at 15.23% CAGR, leveraging metal-tagged antibodies to read over 100 parameters without spectral overlap. Standard BioTools' CyTOF XT PRO exemplifies this push toward routine trial workflows.

Real-time PCR remains vital for respiratory and sepsis panels, whereas sequencing platforms capture oncology and rare-disease testing. Luminex xMAP satisfies high-throughput protein needs, and microarrays occupy niche gene-expression applications. Competitive gaps close rapidly as AI tools ease panel design and auto-gating, encouraging broader adoption of advanced flow and mass cytometry in clinical labs.

The Multiplex Assays Market Report is Segmented by Type (Cell-Based Multiplex Assays, Protein Multiplex Assays, and More), Technology (Multiplex Real-Time PCR, Flow Cytometry, and More), Application (Infectious Disease Diagnostics, Oncology & Companion Diagnostics and More), End-User (Pharmaceutical & Biopharmaceutical Companies, and More), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America captured 40.56% of 2024 revenue owing to early technology adoption and clear reimbursement paths. Thermo Fisher pledged USD 2 billion to expand U.S. manufacturing and R&D through 2029, reinforcing the region's leadership. Europe follows, guided by IVDR mandates that standardize performance claims, though conformity-assessment bottlenecks slow some launches.

Asia-Pacific is poised for a 16.89% CAGR as China, Japan, and South Korea boost biopharma investment and update reimbursement codes for molecular profiling. Government grants fund local manufacturing of reagents and instruments, cutting import dependency. India's hospital chains adopt multiplex sepsis panels to reduce mortality, illustrating emerging-market potential.

The Middle East and Africa region sees pilot rollouts of syndromic respiratory panels in tertiary centers, often backed by international aid. South America shows selective growth, with Brazil's leading oncology hospitals installing mass cytometers for immunotherapy monitoring. Across regions, differing regulatory clocks and infrastructure maturity dictate tailored go-to-market plans for multiplex assay vendors.

- Thermo Fisher Scientific

- DiaSorin

- Bio-Rad Laboratories

- Beckton Dickinson

- Illumina

- Merck

- QIAGEN

- Revvity

- Abcam

- biomerieux SA

- Hologic

- Seegene

- Promega

- Quansys Biosciences

- Standard BioTools (Fluidigm)

- Olink Holding AB

- Siemens Healthineers

- Abbott Laboratories

- Roche

- Danaher Corp.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increasing Adoption Of Precision-Personalized Medicine

- 4.2.2 Expanding Burden Of Chronic & Infectious Diseases

- 4.2.3 Distinct Advantages Over Singleplex Assays

- 4.2.4 Rise Of CRISPR-Powered Multiplex POC Panels

- 4.2.5 Clinical Deployment Of 40-Plus-Color Flow Cytometry

- 4.2.6 AI-Driven Assay Design & High-Dimensional Analytics

- 4.3 Market Restraints

- 4.3.1 High Capital Cost & Complex Workflows

- 4.3.2 Stringent Multi-Jurisdictional Regulatory Pathways

- 4.3.3 Shortage Of Bioinformatics Talent

- 4.3.4 Supply-Chain Volatility Of Rare Dyes & Beads

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technology Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

5 Market Size and Growth Forecasts (Value-USD)

- 5.1 By Type

- 5.1.1 Cell-based multiplex assays

- 5.1.2 Protein multiplex assays

- 5.1.3 Nucleic-acid multiplex assays

- 5.1.4 Bead-based immunoassays

- 5.2 By Technology

- 5.2.1 Multiplex real-time PCR

- 5.2.2 Flow cytometry

- 5.2.3 Bead-based xMAP/Luminex

- 5.2.4 Next-generation sequencing-based

- 5.2.5 Mass cytometry (CyTOF)

- 5.2.6 Microarray & others

- 5.3 By Application

- 5.3.1 Infectious disease diagnostics

- 5.3.2 Oncology & companion diagnostics

- 5.3.3 Autoimmune & allergy testing

- 5.3.4 Drug discovery & biomarker validation

- 5.3.5 Others

- 5.4 By End-User

- 5.4.1 Pharmaceutical & biopharmaceutical companies

- 5.4.2 Academic & research institutes

- 5.4.3 Contract research organizations

- 5.4.4 Hospitals & diagnostic laboratories

- 5.4.5 Others

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Spain

- 5.5.2.6 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 Japan

- 5.5.3.3 India

- 5.5.3.4 Australia

- 5.5.3.5 South Korea

- 5.5.3.6 Rest of Asia-Pacific

- 5.5.4 Middle East and Africa

- 5.5.4.1 GCC

- 5.5.4.2 South Africa

- 5.5.4.3 Rest of Middle East and Africa

- 5.5.5 South America

- 5.5.5.1 Brazil

- 5.5.5.2 Argentina

- 5.5.5.3 Rest of South America

- 5.5.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.3.1 Thermo Fisher Scientific

- 6.3.2 DiaSorin

- 6.3.3 Bio-Rad Laboratories

- 6.3.4 Becton Dickinson & Company

- 6.3.5 Illumina Inc.

- 6.3.6 Merck KGaA

- 6.3.7 Qiagen

- 6.3.8 Revvity

- 6.3.9 Abcam plc

- 6.3.10 biomerieux SA

- 6.3.11 Hologic Corporation

- 6.3.12 Seegene Inc.

- 6.3.13 Promega Corporation

- 6.3.14 Quansys Biosciences

- 6.3.15 Standard BioTools (Fluidigm)

- 6.3.16 Olink Holding AB

- 6.3.17 Siemens Healthineers

- 6.3.18 Abbott Laboratories

- 6.3.19 F. Hoffmann-La Roche Ltd

- 6.3.20 Danaher Corp.

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-need Assessment