PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1850953

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1850953

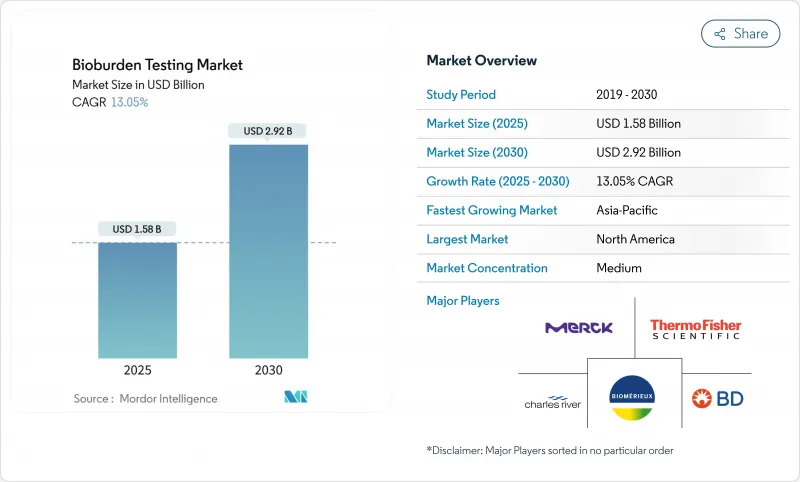

Bioburden Testing - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The bioburden testing market reached USD 1.58 billion in 2025 and is projected to climb to USD 2.92 billion by 2030, advancing at a 13.05% CAGR.

Demand accelerates as cell and gene therapy pipelines expand, single-use bioprocessing systems proliferate, and regulators intensify real-time sterility oversight. Manufacturers now favor automated, PCR-enabled instruments that shorten detection windows while pairing them with disposable consumables that curb cross-batch risks. Rapid enumeration technologies further strengthen the bioburden testing market by compressing sample-to-result timelines, a necessity for continuous manufacturing lines. Contract development and manufacturing organizations (CDMOs) deepen adoption as outsourcing grows, while persistent shortages of trained microbiologists spur interest in AI-assisted colony counting.

Global Bioburden Testing Market Trends and Insights

High Frequency of Product Recalls Driven by Rapid-Release Supply Chains

Recurring recalls underscore how speed-focused logistics can let contaminants slip through routine checks. FDA notices in 2024 for sulfamethoxazole/trimethoprim tablets and atovaquone suspensions illustrated the costly fallout of microbial lapses.Manufacturers now view preventive testing as cheaper than multi-month shutdowns and brand damage. Generic drug makers with tight margins feel this pressure most, which lifts routine sampling volumes and positions the bioburden testing market as an essential quality gate.

Stringent cGMP & ISO 13485 Audits for Sterility Compliance

The 2024 US Quality Management System Regulation aligned domestic rules with ISO 13485, raising the bar for documentation and real-time monitoring. PIC/S Annex 1 revisions require continuous oversight rather than periodic checks. When Sanofi's Massachusetts plant logged 20% rejected runs, regulators highlighted historic contamination rates, prompting peers to adopt automated alerts and audit-ready data trails. Such mandates expand instrument sales and software subscriptions across the bioburden testing market.

High Upfront Cost of Automated Enumeration Platforms

Systems such as Rapid Micro Biosystems' Growth Direct exceed USD 500,000, excluding validation outlays. Small generics plants struggle to amortize that spend, slowing instrument uptake despite clear efficiency gains. Financing hurdles are most acute in India, Indonesia, and parts of Africa where capital budgets remain tight.

Other drivers and restraints analyzed in the detailed report include:

- Shift Toward Single-Use Bioprocessing Equipment Boosting Test Volumes

- Rising Bioreactor Contamination Events in Cell & Gene Therapy Facilities

- Supply Bottlenecks for High-Purity Agar & Reagents

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Consumables posted the quickest revenue expansion, advancing at a 16.24% CAGR even though instruments still captured 63.76% of the bioburden testing market in 2024. Growth in single-use manufacturing pushes fresh culture media, filters, and rapid test kits into every production cycle, lifting volume demand. Automated identification instruments benefit from high-throughput cell and gene therapy pipelines that require swift, accurate readouts.

Disposable items now anchor contamination-prevention strategies because they eliminate cross-batch residue. Manufacturers intensify supplier audits to secure uninterrupted consumables flow, offsetting reagent bottlenecks. Meanwhile, AI-enabled imaging microscopes and PCR modules remain capital priorities for large plants aiming to reduce analyst touch time and boost data integrity across the bioburden testing market.

Plate count assays retained 39.45% of bioburden testing market share in 2024, yet rapid techniques are climbing at 14.23% CAGR on the back of real-time manufacturing needs. Flow cytometry and ATP bioluminescence deliver answers in hours, not days, aiding facilities that have adopted continuous lines.

Hybrid testing regimes now merge legacy culture plates for regulatory familiarity with fluorescence-based counts for speed. AI colony counters cut read time to 30 seconds while holding 95% accuracy. These efficiencies slash analyst bottlenecks and reinforce the bioburden testing market size outlook through 2030.

Bioburden Testing Market Report is Segmented by Product (Instruments [PCR Systems and More] and Consumables [Culture Media & Reagents and More]), Enumeration Method (Membrane Filtration, Plate Count Method, and More), Application (Raw Material Testing, In-Process Testing, and More), End User (Medical Device Manufacturers and More) and Geography (North America and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America led with 38.56% of global revenues in 2024 as FDA rule harmonization and a dense network of high-value biologics plants favored advanced detection investments. Canada and Mexico strengthen regional totals by upgrading facilities to US compliance levels, broadening customer bases for rapid enumeration suppliers.

Asia-Pacific is forecast to grow at 14.79% CAGR, propelled by China, India, South Korea, and Singapore. Rising GMP adherence and greater biologics capacity spark bulk orders for automated incubators, PCR kits, and disposable media packs. Public-private training initiatives aim to close microbiologist gaps, yet demand still outpaces talent supply across much of Southeast Asia, magnifying prospects for AI-assisted testing modules within the bioburden testing market.

Europe sustains expansion through strict Annex 1 enforcement that compels continuous facility monitoring. Germany, the United Kingdom, and France approve sizeable capital budgets for inline sensors and cloud data-management suites. Meanwhile, Middle East, Africa, and South America register incremental gains as generic-driven manufacturing hubs invest in basic plate-count capacity and gradually transition toward quicker molecular assays.

- Beckton Dickinson

- Sartorius

- Merck KGaA (MilliporeSigma)

- Thermo Fisher Scientific

- bioMerieux

- Rapid Micro Biosystems

- Danahar

- Solventum

- Hardy Diagnostics

- Mesa Laboratories

- Synbiosis (SDI)

- Microbiologics

- Don Whitley Scientific

- Lonza Group

- Advanced Instruments

- Cherwell Laboratories

- STERIS

- Hygiena

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 High Frequency Of Product Recalls Driven By Advent Of Rapid-Release Global Supply Chains

- 4.2.2 Stringent Cgmp & ISO 13485 Audits For Sterility Compliance

- 4.2.3 Shift Toward Single-Use Bioprocessing Equipment Boosting Test Volumes

- 4.2.4 Rising Bioreactor Contamination Events In Cell & Gene Therapy Facilities

- 4.2.5 Microbiome-Based Therapeutics Requiring Ultra-Low Detection Thresholds

- 4.2.6 Adoption Of Continuous Manufacturing Challenging Conventional Sampling Windows

- 4.3 Market Restraints

- 4.3.1 High Upfront Cost Of Automated Enumeration Platforms

- 4.3.2 Shortage Of Trained Microbiologists In Emerging Markets

- 4.3.3 False-Negative Risk In Rapid Sterility Assays Delaying Regulatory Acceptance

- 4.3.4 Supply Bottlenecks For High-Purity Agar & Reagents

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technology Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

5 Market Size and Growth Forecasts (Value-USD)

- 5.1 By Product

- 5.1.1 Instruments

- 5.1.1.1 Automated Microbial Identification Systems

- 5.1.1.2 Polymerase Chain Reaction (PCR) Systems

- 5.1.1.3 Microscopes

- 5.1.1.4 Other Instruments

- 5.1.2 Consumables

- 5.1.2.1 Culture Media & Reagents

- 5.1.2.2 Other Consumables

- 5.1.1 Instruments

- 5.2 By Enumeration Method

- 5.2.1 Membrane Filtration

- 5.2.2 Plate Count Method

- 5.2.3 Most Probable Number (MPN)

- 5.2.4 Rapid/Alternative Methods (flow-cytometry, ATP)

- 5.3 By Application

- 5.3.1 Raw-Material Testing

- 5.3.2 In-process (Bioprocess) Testing

- 5.3.3 Finished Medical-Device Testing

- 5.3.4 Equipment-Cleaning Validation

- 5.3.5 Environmental Monitoring Swabs & RODAC plates

- 5.4 By End-User

- 5.4.1 Pharmaceutical & Biopharmaceutical Manufacturers

- 5.4.2 Medical-Device Manufacturers

- 5.4.3 Contract Research & Manufacturing Organizations (CROs/CMOs)

- 5.4.4 Academic & Research Laboratories

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Spain

- 5.5.2.6 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 Japan

- 5.5.3.3 India

- 5.5.3.4 Australia

- 5.5.3.5 South Korea

- 5.5.3.6 Rest of Asia-Pacific

- 5.5.4 Middle East and Africa

- 5.5.4.1 GCC

- 5.5.4.2 South Africa

- 5.5.4.3 Rest of Middle East and Africa

- 5.5.5 South America

- 5.5.5.1 Brazil

- 5.5.5.2 Argentina

- 5.5.5.3 Rest of South America

- 5.5.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.3.1 Becton, Dickinson and Company (BD)

- 6.3.2 Sartorious AG

- 6.3.3 Merck KGaA (MilliporeSigma)

- 6.3.4 Thermo Fisher Scientific

- 6.3.5 bioMerieux SA

- 6.3.6 Rapid Micro Biosystems

- 6.3.7 Danahar

- 6.3.8 Solventum

- 6.3.9 Hardy Diagnostics

- 6.3.10 Mesa Laboratories

- 6.3.11 Synbiosis (SDI)

- 6.3.12 Microbiologics

- 6.3.13 Don Whitley Scientific

- 6.3.14 Lonza Group

- 6.3.15 Advanced Instruments

- 6.3.16 Cherwell Laboratories

- 6.3.17 STERIS

- 6.3.18 Hygiena

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment