PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1850955

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1850955

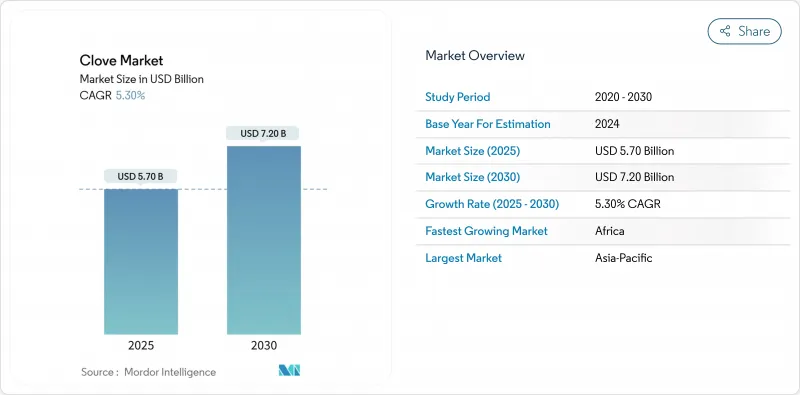

Clove - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Clove Market size is estimated at USD 5.7 billion in 2025 and is anticipated to reach USD 7.2 billion by 2030, at a CAGR of 5.3% during the forecast period.

Demand remains anchored in Indonesia's kretek-tobacco sector, yet wider adoption in food preservation, personal care, and drug discovery are widening revenue streams and reducing cyclic risk. Rising preference for natural preservatives in North America and Europe, combined with stricter limits on synthetic additives, is accelerating the uptake of clove essential oil in active packaging and convenience foods. Parallel investments in agro-rejuvenation across Madagascar and Tanzania are improving output quality, positioning Africa as a challenger in premium export niches. Meanwhile, blockchain-enabled traceability is carving a certified segment that can command a price in the European Union and Japan.

Global Clove Market Trends and Insights

Expanding Use as Natural Preservative and Essential Oil Source

Food manufacturers are reducing synthetic preservatives in favor of essential oils rich in antimicrobials. Clove oil, composed of 90% eugenol, has demonstrated efficacy against Shigella flexneri and Salmonella enterica, extending shelf life for meat, dairy, and baked goods. Active-packaging innovators embed clove actives into polymer films, adding safety without altering product flavor. Rising demand from clean-label product developers is pushing food-grade clove oil consumption upward, widening the revenue pool beyond the commodity spice trade.

Growth of Convenience-Food Spice Blends

Urban households in Europe, North America, and Asia increasingly purchase ready-to-use seasoning mixes that replicate restaurant flavors. These blends often combine cloves, cinnamon, and other warming spices, translating culinary heritage into easy pantry staples. Remote-work culture has lengthened home cooking occasions, and producers price blend formats at 35% above raw clove equivalents, improving per-unit returns. Product development teams thus seek stable clove supplies with consistent volatile oil profiles to maintain flavor precision.

Weather-Driven Price Volatility

Cyclones in Madagascar cut 2024 output. Similar drought episodes in Tanzania tighten regional supply, forcing spot buyers to renegotiate at elevated rates. Price unpredictability discourages long-term contracts for food processors and heightens the risk of substitution by synthetic eugenol or alternative spices.

Other drivers and restraints analyzed in the detailed report include:

- Blockchain Traceability Premiums for Certified Cloves

- Rising Demand from Indonesia's Kretek-Tobacco Industry

- Adulteration and Inconsistent Quality

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

The Clove Market Report is Segmented by Geography (North America, Europe, Asia-Pacific, and More). The Report Includes Production Analysis (Volume), Consumption Analysis (Value and Volume), Export Analysis (Value and Volume), Import Analysis (Value and Volume), and Price Trend Analysis. The Market Forecasts are Provided in Terms of Value (USD) and Volume (Metric Tons).

Geography Analysis

Asia-Pacific dominates the global clove market, with Indonesia accounting for over 70% of global production. Sri Lanka and China follow with production volumes of 5,722 and 1,320 metric tons, respectively, in recent harvests. Indonesia's market leadership stems from its position as both a major producer and consumer, with its domestic kretek cigarette industry consuming 85-90% of local production. The region has expanded into clove essential oil extraction, with Indonesia developing new processing facilities to increase raw material value. In 2023, Indonesia exported primarily to Saudi Arabia, India, Bangladesh, the United Arab Emirates, the United States, and Pakistan, with Saudi Arabia and India as the principal importers.

Africa represents the fastest-growing regional market, with a projected CAGR of 9% between 2025-2030, supported by investments in production capacity and processing infrastructure. Madagascar, Tanzania, and Comoros maintain significant production levels. The region benefits from replanting programs and government subsidies designed to renovate aging plantations and enhance yield quality. Tanzania's Morogoro Region produced about 2,000 metric tons of cloves in 2022, contributing substantially to national output through the Southern Agricultural Corridor of Tanzania (SAGCOT) initiative.

Europe maintains a substantial import market for cloves, with the Netherlands functioning as the main trade hub, followed by Germany, the UK, France, Spain, and Poland. Regional demand increases from the rising popularity of Asian cuisines and the increased use of specialized spice blends in convenience foods. European imports from developing countries grew by 2.5% annually between 2018 and 2022, reaching 3,500 metric tons in 2021, with Madagascar serving as a primary supplier to the Netherlands and Germany.

- Market Overview

- Market Drivers

- Market Restraints

- Value / Supply-Chain Analysis

- Regulatory Landscape

- Technological Outlook

- PESTEL Analysis

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising demand from Indonesia's kretek-tobacco industry

- 4.2.2 Expanding use as natural preservative and essential-oil source

- 4.2.3 Growth of convenience-food spice blends

- 4.2.4 Blockchain traceability premiums for certified cloves

- 4.2.5 Replanting subsidies in Madagascar and Tanzania

- 4.2.6 Pharmaceutical interest in eugenol-based actives

- 4.3 Market Restraints

- 4.3.1 Weather-driven price volatility

- 4.3.2 Adulteration and inconsistent quality

- 4.3.3 Stricter EU pesticide / aflatoxin limits

- 4.3.4 Synthetic eugenol substitutes

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 PESTEL Analysis

5 Market Size and Growth Forecasts (Value and Volume)

- 5.1 By Geography (Production Analysis (Volume), Consumption Analysis (Volume and Value), Import Analysis (Volume and Value), Export Analysis (Volume and Value), and Price Trend Analysis)

- 5.1.1 North America

- 5.1.1.1 United States

- 5.1.1.2 Canada

- 5.1.2 Europe

- 5.1.2.1 Germany

- 5.1.2.2 France

- 5.1.2.3 United Kingdom

- 5.1.2.4 Italy

- 5.1.2.5 Netherlands

- 5.1.2.6 Spain

- 5.1.3 Asia-Pacific

- 5.1.3.1 Indonesia

- 5.1.3.2 India

- 5.1.3.3 China

- 5.1.3.4 Sri Lanka

- 5.1.3.5 Vietnam

- 5.1.3.6 Malaysia

- 5.1.3.7 Singapore

- 5.1.4 South America

- 5.1.4.1 Brazil

- 5.1.4.2 Argentina

- 5.1.4.3 Chile

- 5.1.5 Middle East

- 5.1.5.1 Saudi Arabia

- 5.1.5.2 United Arab Emirates

- 5.1.6 Africa

- 5.1.6.1 Comoros

- 5.1.6.2 Kenya

- 5.1.6.3 Tanzania

- 5.1.6.4 Madagascar

- 5.1.1 North America

6 Market Opportunities and Future Outlook