PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1850960

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1850960

Dry Eye Disease - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

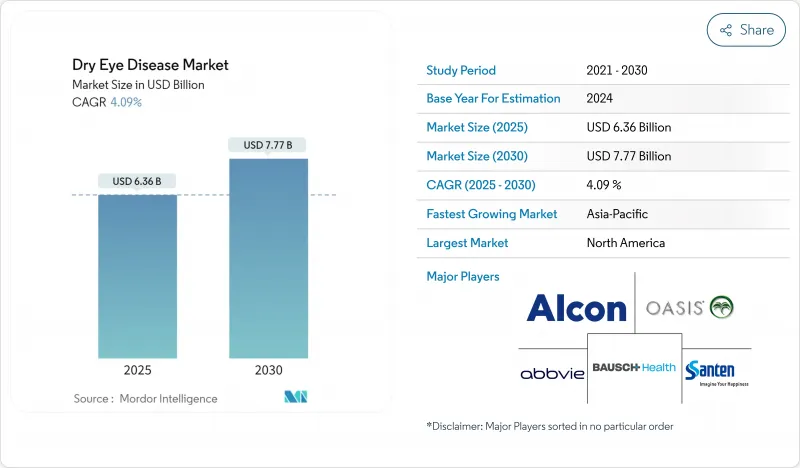

The dry eye disease treatment market is valued at USD 6.36 billion in 2025 and is forecast to reach USD 7.77 billion by 2030, reflecting a 4.09% CAGR over the period.

This trajectory is shaped by a structural pivot from over-the-counter lubricants toward prescription therapies aimed at inflammatory mechanisms. Prescription drugs are advancing because clinicians now prioritize disease-modifying regimens that address meibomian gland dysfunction, ocular surface inflammation, and tear-film instability. Heightened diagnosis rates, expanding tele-ophthalmology networks, and regulatory fast-tracking for mechanism-based therapies are enlarging the addressable patient pool. Online pharmacies are redefining access pathways and price transparency, while device-based interventions such as thermal pulsation systems and targeted energy platforms are broadening the treatment mix. Meanwhile, safety recalls of contaminated artificial tears have prompted stricter quality oversight, prompting manufacturers to rethink preservative systems and supply-chain traceability.

Global Dry Eye Disease Market Trends and Insights

Rising Global Prevalence of Dry Eye Disease Linked to Aging and Comorbidities

An aging population is reshaping the dry eye disease treatment market as people over 60 represent the fastest-growing demographic worldwide. More than 34 million Americans presently live with clinically significant dry eye, and prevalence is climbing in Europe and East Asia. Diabetes, autoimmune disorders, and hormonal shifts amplify risk, driving sustained demand for chronic-care regimens. Clinicians now apply multifactorial diagnostic protocols to stratify patients by tear-film deficiency, meibomian gland obstruction, and inflammatory status, which in turn guide targeted therapy selection. Recent peer-reviewed data underscore that managing inflammatory pathways improves long-term outcomes compared with symptomatic relief alone.

Escalating Screen-Time Across All Age Groups Increasing Ocular Surface Stress

Digital device use has lowered spontaneous blink rate by up to 60%, shortening tear-film breakup time and exposing the corneal surface to evaporation. Children, office workers, and gamers now report dry eye symptoms once confined to older adults. Product developers respond with preservative-free lubricants positioned for "digital eye strain" and by embedding blink-reminder software into tele-ophthalmology platforms. Companies have expanded marketing around afternoon dosage reinforcement to counter mid-day symptom spikes. As a result, demand is rising for combination regimens pairing artificial tears with lipid-layer stabilizers that sustain tear-film integrity during prolonged screen use.

Generic Competition Compressing Prices of Established Cyclosporine & Lubricant Brands

The patent cliff is eroding price premiums for flagship cyclosporine formulations, transferring volume toward lower-cost generics and private-label artificial tears that sell at discounts of 15-20%. Branded firms protect margins by releasing ready-to-use multidose preservative-free bottles and by bundling with meibography diagnostics. However, formulary committees increasingly favor less-expensive generics, limiting upside on unit growth. Manufacturers must balance investment in new mechanisms against shrinking cash flows from legacy portfolios.

Other drivers and restraints analyzed in the detailed report include:

- Adoption of Prescription Anti-inflammatory & Secretagogue Therapies Worldwide

- Favorable Regulatory Pathways & Fast-Track Approvals for Novel Tear Modulators

- Chronic Dosing Burden Leading to Poor Patient Adherence & Sub-optimal Outcomes

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

In 2024, over-the-counter artificial tears captured 39.5% of the dry eye disease treatment market size thanks to universal availability and self-selection at point of sale. Yet prescription drugs are accelerating with a 9.1% CAGR, propelled by robust evidence that chronic inflammation, not simple dehydration, underpins disease progression. New cyclosporine nanoemulsions, lifitegrast integrin antagonists, and TRPM8 agonists are displacing lubricant monotherapy as initial care pathways. Wider insurance coverage for prescription options in the United States, Germany, and Japan further catalyzes uptake, reinforcing a structural shift toward pharmacologic modulation of tear-film homeostasis.

The dry eye disease treatment industry also sees rising differentiation within prescription classes. High-concentration cyclosporine, enabled by stable oil-in-water carriers, delivers faster symptom relief and supports higher patient retention compared with earlier 0.05% emulsions. Secretagogues are opening new revenue streams by stimulating endogenous tear production through neurosensory reflexes, reducing dependence on frequent drop instillation. Although punctal plugs maintain a role for aqueous retention, their market share is plateauing amid competition from drug-eluting variants. Nutraceuticals containing omega-3 fatty acids and phytonutrients continue to gain clinical validation, positioning them as adjuncts rather than substitutes for prescription regimens.

Evaporative dry eye remains the dominant presentation, holding 53.0% of dry eye disease treatment market share in 2024. The meibomian gland dysfunction component fosters demand for lipid-layer stabilizers, heat-based gland expression devices, and microbiome-oriented therapies aimed at Demodex infestation. Research identifying hedgehog and EGFR pathways in gland stem-cell depletion has opened potential for regenerative treatments that could redefine long-term disease control.

Aqueous-deficient dry eye, though smaller, is predicted to expand at 7.9% CAGR through 2030 as diagnostic imaging distinguishes lacrimal gland hypo-secretion from evaporative components. In many cases, mixed-mechanism pathology drives clinicians to combine secretagogues with lipid-enhancing drops and thermal therapies, reinforcing demand for multi-mechanism solutions. Companies are exploring mitochondrial protection as a convergent strategy, given emerging data linking oxidative stress to both pathologies.

The Dry Eye Disease Market Report is Segmented by Product (OTC Artificial Tears, Prescription Drugs [Anti-Inflammatory, Secretagogues, and More] Punctal Plugs, and More), Disease Type (Evaporative Dry Eye, and More), Dosage Form (Eye Drops, Gels, and More), Distribution Channel (Hospital Pharmacies, Drug Stores and More), and Geography (North America, Europe, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America leads the dry eye disease treatment market, capturing 35.9% revenue in 2024 on the back of strong diagnosis rates, clinician adoption of imaging modalities, and comprehensive reimbursement for prescription drugs. The United States saw accelerated uptake of TRPM8 agonists immediately after FDA approval, reinforcing the region's role as a launchpad for novel mechanisms. Quality recalls of contaminated lubricants, however, have intensified regulatory scrutiny, prompting suppliers to upgrade production audits and distribution traceability.

Asia-Pacific is projected to grow fastest at a 7.7% CAGR through 2030, anchored by rising screen exposure among urban populations and progressive insurance expansion in China, South Korea, and Thailand. China alone reports dry eye disease in 20% of ophthalmic consultations, and forward-looking reimbursement reforms are poised to widen access to disease-modifying drugs. Japanese firms spearhead innovative delivery systems, including muco-adhesive microparticles and preservative-free multidose pumps, which are gaining attention in surrounding markets through regional licensing agreements.

Europe retains a sizable footprint in the dry eye disease treatment market, supported by universal healthcare frameworks and rapid aging demographics. Germany, France, and the United Kingdom together contribute a substantial portion of prescription volume, and EMA's acceptance of water-free ciclosporin 0.1% heralds broader adoption of next-generation formulations. Southern European countries with arid climates are witnessing heightened seasonal demand, stimulating cross-border distribution coordination. In the Middle East and Africa, climatic extremes and urban pollution intensify evaporative dry eye prevalence, encouraging multinational companies to pilot mobile clinic programs that pair diagnosis with onsite dispensing. South America, led by Brazil, is emerging as a growth pocket as private-sector health plans start to reimburse cyclosporine emulsions, paving the way for broader prescription uptake.

List of Companies Covered in this Report:

- Alcon

- Bausch Health

- Abbvie

- Santen Pharmaceuticals

- Johnson & Johnson Vision Care

- Novartis

- Viatris Inc. (Oyster Point Pharma)

- Kala Pharmaceuticals

- Sun Pharmaceuticals Industries

- Harrow Health (ImprimisRx)

- AFT Pharmaceuticals

- Horus Pharma

- Novaliq

- OASIS Medical Inc.

- Prestige Consumer Healthcare

- Sentiss Pharma

- VISUfarma B.V.

- Reckitt Benckiser Group plc (TheraTears)

- Scope Ophthalmics Ltd

- Dompe Farmaceutici

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising Global Prevalence of Dry Eye Disease Linked to Aging and Comorbidities

- 4.2.2 Escalating Screen-Time Across All Age Groups Increasing Ocular Surface Stress

- 4.2.3 Adoption of Prescription Anti-inflammatory & Secretagogue Therapies Worldwide

- 4.2.4 Favorable Regulatory Pathways & Fast-Track Approvals for Novel Tear Modulators

- 4.2.5 Direct-to-Consumer Awareness Campaigns and Tele-ophthalmology Expanding Diagnosis Rates

- 4.2.6 Growing Innovations in Treatment Options

- 4.3 Market Restraints

- 4.3.1 Generic Competition Compressing Prices of Established Cyclosporine & Lubricant Brands

- 4.3.2 Limited Long-term Efficacy & Safety Data for Emerging Devices and Biologics

- 4.3.3 Inadequate Insurance Coverage and High Out-of-Pocket Costs in Developing Regions

- 4.3.4 Chronic Dosing Burden Leading to Poor Patient Adherence & Sub-optimal Outcomes

- 4.4 Value Chain Analysis

- 4.5 Technological Outlook

- 4.6 Porter's Five Forces

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers/Consumers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value, USD)

- 5.1 By Product

- 5.1.1 Over-the-Counter (OTC) Artificial Tears & Lubricants

- 5.1.2 Prescription Drugs

- 5.1.2.1 Anti-inflammatory

- 5.1.2.2 Secretagogues

- 5.1.2.3 Other Prescription Therapies

- 5.1.3 Punctal Plugs

- 5.1.4 Nutraceuticals & Omega-3 Supplements

- 5.1.5 Autologous Serum & Blood-derived Tear Substitutes

- 5.2 By Disease Type

- 5.2.1 Evaporative Dry Eye

- 5.2.2 Aqueous-deficient Dry Eye

- 5.2.3 Mixed Mechanism

- 5.3 By Dosage Form

- 5.3.1 Eye Drops

- 5.3.2 Ointments & Gels

- 5.3.3 Others

- 5.4 By Distribution Channel

- 5.4.1 Hospital Pharmacies

- 5.4.2 Independent Pharmacies & Drug Stores

- 5.4.3 Online Pharmacies & E-commerce Portals

- 5.5 Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Spain

- 5.5.2.6 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 Japan

- 5.5.3.3 India

- 5.5.3.4 South Korea

- 5.5.3.5 Australia

- 5.5.3.6 Rest of Asia

- 5.5.4 Middle East and Africa

- 5.5.4.1 GCC

- 5.5.4.2 South Africa

- 5.5.4.3 Rest of Middle East and Africa

- 5.5.5 South America

- 5.5.5.1 Brazil

- 5.5.5.2 Argentina

- 5.5.5.3 Rest of South America

- 5.5.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global Level Overview, Market Level Overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products & Services, Recent Developments)

- 6.4.1 Alcon Inc.

- 6.4.2 Bausch Health Companies Inc.

- 6.4.3 AbbVie Inc. (Allergan)

- 6.4.4 Santen Pharmaceutical Co. Ltd

- 6.4.5 Johnson & Johnson Vision Care

- 6.4.6 Novartis AG

- 6.4.7 Viatris Inc. (Oyster Point Pharma)

- 6.4.8 Kala Pharmaceuticals

- 6.4.9 Sun Pharmaceutical Industries Ltd

- 6.4.10 Harrow Health (ImprimisRx)

- 6.4.11 AFT Pharmaceuticals

- 6.4.12 Horus Pharma

- 6.4.13 Novaliq GmbH

- 6.4.14 OASIS Medical Inc.

- 6.4.15 Prestige Consumer Healthcare

- 6.4.16 Sentiss Pharma Pvt. Ltd

- 6.4.17 VISUfarma B.V.

- 6.4.18 Reckitt Benckiser Group plc (TheraTears)

- 6.4.19 Scope Ophthalmics Ltd

- 6.4.20 Dompe Farmaceutici

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment