PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1850965

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1850965

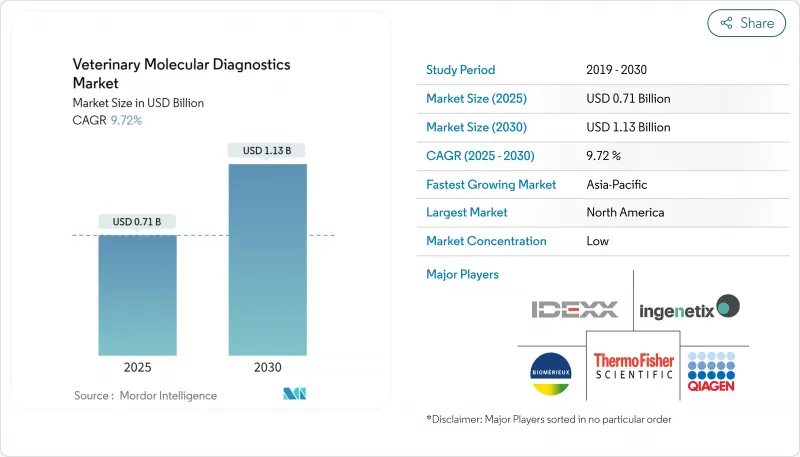

Veterinary Molecular Diagnostics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The veterinary molecular diagnostics market is valued at USD 1.67 billion in 2025 and is forecast to reach USD 2.55 billion by 2030, advancing at an 8.7% CAGR.

Adoption accelerates as veterinarians confront larger and more frequent outbreaks of high-consequence diseases, embrace precision medicine, and integrate artificial-intelligence tools into daily workflows. Portable nanopore sequencing, syndromic multiplex panels, and cloud-based analytics are shifting testing from reference laboratories toward point-of-care settings, widening access while shortening turnaround times. North American leadership continues, yet Asia Pacific records the fastest growth as companion-animal ownership and intensive livestock production expand. Competitive rivalry centers on technology breadth rather than price, with leading firms bundling instruments, consumables, software, and data services to lock in customers and capture recurring revenue.

Global Veterinary Molecular Diagnostics Market Trends and Insights

Rise in Prevalence of Animal Infectious Diseases

High-pathogenicity avian influenza H5N1 infected U.S. dairy cattle in 2024, pushing laboratories such as the University of Minnesota to process more than 115,000 samples by May 2025. Such surges spur demand for high-throughput PCR platforms that deliver hundreds of results per day and drive adoption of whole-genome sequencing to track viral evolution. Confirmed human H5N1 cases linked to cattle reinforce the One-Health imperative, making molecular diagnostics essential infrastructure for joint animal-human outbreak response. Investments in sequencing capacity therefore shift the veterinary molecular diagnostics market toward integrated, rapid and scalable solutions.

Growing Demand for Animal-Derived Proteins

Rising meat and dairy consumption in Asia Pacific is pushing producers to intensify biosecurity and select disease-resistant genetics. Livestock operators now deploy high-resolution melting assays to distinguish pathogen strains and apply genetic markers for superior feed conversion, cutting antibiotic usage while protecting welfare. This production-oriented testing sustains long-term sales of multiplex platforms capable of combining pathogen detection with genetic profiling inside a single workflow.

Lack of Skilled Veterinary Molecular Diagnosticians

Vacancy rates for laboratory technologists have reached 35%-40% in human health, with parallel gaps in veterinary practice. Rural veterinarians must often double as lab technicians, yet most veterinary curricula provide limited molecular-biology training. Staffing shortages slow installation of advanced platforms and limit the veterinary molecular diagnostics market in smaller clinics.

Other drivers and restraints analyzed in the detailed report include:

- Increasing Companion-Animal Ownership & Spend

- Adoption of Syndromic Multiplex Panels

- One-Health AMR Surveillance Funding Surge

- Portable Nanopore Sequencing Enters Field Use

- High Cost of Instruments & Consumables

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Kits and reagents produced 59.1% of 2024 revenues, anchoring a recurring business model that stabilizes cash flow for suppliers. Software and services, however, are expanding at an 11.9% CAGR as cloud analytics, AI interpretive modules, and subscription data portals become integral to laboratory operations. Leading vendors bundle consumables, instruments, and analytics, reinforcing switching barriers. The veterinary molecular diagnostics market size attributable to consumables is forecast to remain dominant through 2030, yet software will command increasing strategic importance for differentiation. Instrument margins tighten as miniaturization and open-platform designs lower entry barriers, illustrated by portable nanopore sequencers costing a fraction of legacy bench-top systems. As a result, manufacturers pivot toward integrated ecosystems that pair hardware with digital interpretation and lifetime kit revenue.

Infectious disease surveillance generated 69.7% of 2024 sales and remains the core of the veterinary molecular diagnostics market as laboratories manage avian influenza, African swine fever, and canine parvovirus. Syndromic panels shorten differential diagnosis and reduce empirical antibiotic use. Genetics applications, advancing at a 10.4% CAGR, reflect pet owners' desire for hereditary screening and breeders' focus on genomic selection. Liquid biopsies for oncology further widen clinical adoption. The veterinary molecular diagnostics market size for genetics is projected to accelerate as sequencing costs fall, enabling routine screening for both disease predisposition and performance traits.

The Veterinary Molecular Diagnostics Market is Segmented by Products (Instruments, Kits, and More), Applications (Infectious Diseases, Genetics, and More), Technology (PCR, Microarray, and More), Animal Type (Companion Animals and Livestock), End User (Veterinary Hospitals & Clinics, and More), and Geography (North America, Europe, Asia-Pacific, and More). The Market Sizes and Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America captured 41.6% revenue in 2024, underpinned by extensive veterinary infrastructure, generous pet-care spending, and USDA funding of USD 64.429 million for animal-health diagnostics in 2025. Federal fast-track pathways for new assays accelerate innovation, though rural skills shortages remain a bottleneck.

Europe maintains a substantial share thanks to strict antimicrobial stewardship rules. Regulation (EU) 2019/6 modernizes veterinary medicinal oversight and boosts demand for rapid resistance testing. Between 2018 and 2022, the region cut antimicrobial use in food animals by 28.3%, prompting farms to adopt molecular surveillance as a compliance tool.

Asia Pacific is the fastest-growing territory at an 11.1% CAGR. Middle-class pet ownership, mega-dairy expansion, and supportive policies such as the ASEAN Medical Device Directive spur uptake. Latin America and the Middle East & Africa record steady adoption, although currency volatility and limited laboratory networks temper growth. Portable diagnostic kits tailored for diverse species and climates show promise for accelerating penetration in these regions.

- Biochek

- bioMerieux

- Bioneer Corp.

- IDEXX

- Ingenetix

- Neogen Corp.

- Thermo Fisher Scientific

- Veterinary Molecular Diagnostics

- Biomedica Group

- Novacyt Group

- QIAGEN

- Virbac

- Zoetis

- Randox Laboratories

- Seegene

- BioNote Inc.

- LGC Group

- Abaxis (Zoetis)

- PathoSense NV

- Boehringer Ingelheim

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rise In Prevalence of Animal Infectious Diseases

- 4.2.2 Growing Demand for Animal-Derived Proteins

- 4.2.3 Increasing Companion-Animal Ownership & Spend

- 4.2.4 Adoption Of Syndromic Multiplex Panels

- 4.2.5 One-Health Amr Surveillance Funding Surge

- 4.2.6 Portable Nanopore Sequencing Enters Field Use

- 4.3 Market Restraints

- 4.3.1 Lack Of Skilled Veterinary Molecular Diagnosticians

- 4.3.2 High Cost of Instruments & Consumables

- 4.3.3 Limited Multi-Species Assay Validation Standards

- 4.3.4 Sample-Logistics Hurdles in Decentralised Networks

- 4.4 Supply Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value)

- 5.1 By Product

- 5.1.1 Instruments

- 5.1.2 Kits & Reagents

- 5.1.3 Software & Services

- 5.2 By Application

- 5.2.1 Infectious Diseases

- 5.2.2 Genetics

- 5.2.3 Other Applications

- 5.3 By Technology

- 5.3.1 PCR

- 5.3.2 Microarray

- 5.3.3 DNA Sequencing

- 5.4 By Animal Type

- 5.4.1 Companion Animals

- 5.4.2 Livestock

- 5.5 By End User

- 5.5.1 Veterinary Hospitals & Clinics

- 5.5.2 Reference Laboratories

- 5.5.3 Research Institutes

- 5.6 Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Mexico

- 5.6.2 Europe

- 5.6.2.1 Germany

- 5.6.2.2 United Kingdom

- 5.6.2.3 France

- 5.6.2.4 Italy

- 5.6.2.5 Spain

- 5.6.2.6 Rest of Europe

- 5.6.3 Asia Pacific

- 5.6.3.1 China

- 5.6.3.2 Japan

- 5.6.3.3 India

- 5.6.3.4 South Korea

- 5.6.3.5 Australia

- 5.6.3.6 Rest of Asia Pacific

- 5.6.4 Middle East and Africa

- 5.6.4.1 GCC

- 5.6.4.2 South Africa

- 5.6.4.3 Rest of Middle East and Africa

- 5.6.5 South America

- 5.6.5.1 Brazil

- 5.6.5.2 Argentina

- 5.6.5.3 Rest of South America

- 5.6.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.3.1 Biochek BV

- 6.3.2 bioMerieux SA

- 6.3.3 Bioneer Corp.

- 6.3.4 IDEXX Laboratories Inc.

- 6.3.5 Ingenetix GmbH

- 6.3.6 Neogen Corp.

- 6.3.7 Thermo Fisher Scientific Inc.

- 6.3.8 Veterinary Molecular Diagnostics Inc.

- 6.3.9 Biomedica Group

- 6.3.10 Novacyt Group

- 6.3.11 QIAGEN N.V.

- 6.3.12 Virbac

- 6.3.13 Zoetis Inc.

- 6.3.14 Randox Laboratories

- 6.3.15 Seegene Inc.

- 6.3.16 BioNote Inc.

- 6.3.17 LGC Group

- 6.3.18 Abaxis (Zoetis)

- 6.3.19 PathoSense NV

- 6.3.20 Boehringer Ingelheim Animal Health

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-need Assessment