PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1850968

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1850968

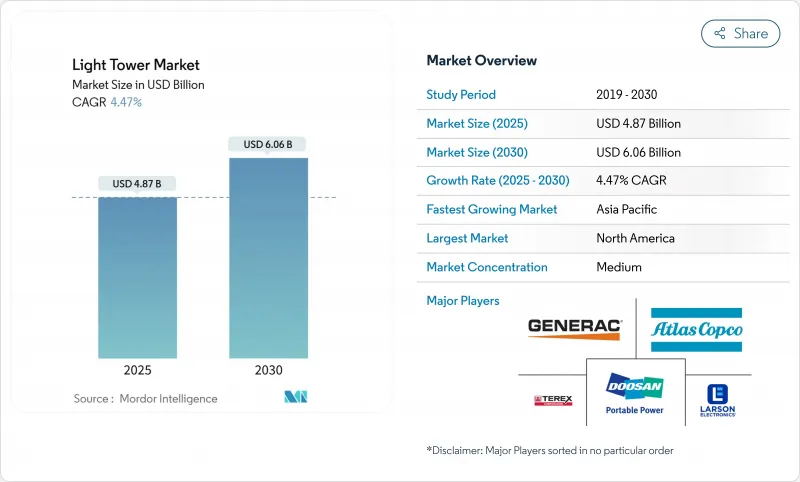

Light Tower - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The light tower market size stood at USD 4.87 billion in 2025 and is forecast to reach USD 6.06 billion by 2030, advancing at a 4.47% CAGR.

Demand resilience stems from the need for reliable, movable lighting across construction, mining, oil and gas, and emergency response sites. Contractors favor energy-efficient equipment, prompting a rapid migration toward LED units and a parallel push for hybrid power sources that cut fuel use and emissions. Rental providers are modernizing fleets to comply with Tier-4 and Stage V norms and to meet total-cost-of-ownership targets. Hydrogen fuel-cell prototypes and solar-hybrid systems widen the technology palette, while stricter environmental policies create headroom for premium designs focused on runtime, sound attenuation, and telematics.

Global Light Tower Market Trends and Insights

Booming 24 X 7 Infrastructure-Repair Programs in North America

Round-the-clock bridge, airport, and highway refurbishments create sustained demand for high-output towers able to operate for multiple shifts. The American Society of Civil Engineers lists a USD 9.1 trillion infrastructure gap that accelerates night-work schedules and heightens lighting requirements. Municipal budgets mirror this urgency; San Diego earmarked USD 451.37 million for streetlight upgrades across 2025-2029, signaling widespread procurement of portable units. Equipment spec sheets now highlight extended fuel tanks and telematics for up-time monitoring. Manufacturers respond with designs like Allmand's Maxi-Lite, featuring a 175-hour runtime, a specification that meets contractor requests for fewer refuels.

Rapid Shift Toward LED Retrofit in Rental Fleets across Europe

European rental houses compete on total operating cost, prompting fleet conversions from metal-halide to LED. Restrictions on noise and exhaust in dense urban zones speed the switch, as LED fixtures cut fuel burn and maintenance visits. Generac Mobile's GLT series now offers adjustable LED arrays and hybrid variants that meet strict municipal standards. Early adopters gain tender advantages when public contracts score sustainability criteria. The retrofit trend has also shifted residual-value calculations, with LED units achieving higher resale prices, a benefit reflected in rental rate structures that favor energy-efficient models.

High Initial CAPEX for Hydrogen-Fuel Towers

Fuel-cell units eliminate combustion emissions but cost three to four times more than conventional diesel models. Procurement departments focused on payback periods often defer purchases despite lifecycle savings. Limited refueling infrastructure confines deployments to pilot sites and high-profile events. As hydrogen hubs expand and stack prices fall, adoption barriers are expected to recede, yet near-term growth remains tempered by tight capital budgets and project bid pressures.

Other drivers and restraints analyzed in the detailed report include:

- Rising Deployment of Solar-Hybrid Towers at Remote Oil and Gas Pads in MENA

- Stringent Tier-4 and Stage V Emission Norms Fueling Hybrid-Powered Adoption

- Operational Downtime Due to Battery Drain in Cold Nordic Climates

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

LED towers retained 62% share of the light tower market in 2024 and continue growing at a 4.5% CAGR. Reduced wattage and bulb lifespans beyond 50,000 hours cut fuel burn and service intervals, making LED the default specification for rental bids that score on sustainability metrics. Bright white output improves worksite visibility, reducing accident rates and aligning with regulatory safety checklists. Construction contractors in urban Europe increasingly specify low-glare LED arrays to comply with noise and light-pollution ordinances.

Metal-halide systems persist in niche heavy-industrial applications where very high lumen output per fixture is prioritized over fuel use. Manufacturers respond with ruggedized housings and quick-strike lamps to shorten warm-up times. Product innovation extends across both formats; Atlas Copco's Hilight V4+ protects components under a molded canopy and fits 16 units per 13-m truck, showcasing how design efficiency supplements lighting performance. The coexistence of LED and metal-halide keeps component supply chains diversified yet tilts R&D budgets toward solid-state technologies.

Diesel-powered towers accounted for 70% of the light tower market share in 2024, benefiting from ubiquitous fueling infrastructure and field-proven reliability. Tier-4 engines with electronic management cut emissions and idle time, while automatic start-stop functions align runtime with real light demand, trimming fuel bills. These enhancements enable diesel units to remain competitive in remote or extreme environments where solar exposure or battery performance is uncertain.

Solar-hybrid designs post the highest 7.2% CAGR forecast. Integrated panels charge onboard batteries by day, allowing silent night operations, with small engines activating only under low-state-of-charge thresholds. Atlas Copco's HiLight BI+4 matches lithium-ion packs with a micro-diesel engine, cutting carbon dioxide output by more than half across a standard workweek. Hydrogen fuel-cell prototypes, like TCP Group's 500-unit fleet completed in 2025, promise zero-local-emission performance but remain cost-intensive. Direct grid-connected towers fill specialized roles in tunneling and large events where shore power exists, demonstrating the diversified technology mix inside the broader light tower market.

The Light Tower Market Report is Segmented by Type (LED Light Towers, and More), Power Source (Diesel Powered, Solar-Hybrid Powered, and More), Mast Height (Below 30 Ft, and More), Mobility (Mobile/Trailer-Mounted, and Skid/Fix-Mounted), Ownership Model (Rental/Leased, and Direct Purchase), End-User Industry (Construction, Oil and Gas, and More), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America led the light tower market with a 34% share in 2024. Infrastructure renewal mandates, stringent safety regulations, and frequent extreme-weather events sustain year-round demand. The American Society of Civil Engineers underscores the investment gap that drives night construction schedules. Manitoba's 2024/2025 strategy includes runway light upgrades to meet Transport Canada rules, highlighting aviation's contribution. Rental giants leverage digital platforms such as Total Control to optimize fleet allocation, enabling contractors to combine towers, generators, and pumps within unified dashboards.

Asia Pacific is the fastest-growing region at 5.3% CAGR, propelled by mega-mining activities, urban population growth, and expanding renewable-energy infrastructure. Australian projects necessitate high-mast towers to illuminate haul roads spanning several kilometers. Elsewhere, rapid urban expansion requires flexible trailer units for bridge, rail, and mixed-use developments. BloombergNEF estimates USD 89 trillion in energy investments are needed for net-zero by 2050, signaling long-term capital flows into grid and renewable installations that will require temporary lighting during build-out phases.

Europe remains a sizable market characterized by strict emission compliance and sophisticated rental penetration. LED and hybrid adoption rates exceed global averages due to urban environmental restrictions and carbon-pricing mechanisms. Government incentives for low-emission equipment increase the payback speed of next-generation towers. The Middle East and Africa register steady growth as oil, gas, and utility operators embrace solar-hybrid units for remote desert sites. South America's demand varies by commodity cycle; copper and iron ore mines in Chile and Brazil procure taller masts and robust chassis suited for mountainous terrain. Telecommunications fiber rollouts also spur equipment orders, as network installers require spot illumination for trenching and splice work after daylight.

- Atlas Copco AB

- Generac Power Systems Inc. (Generac Mobile)

- Terex Corp.

- Doosan Portable Power

- Wacker Neuson SE

- Trime S.r.l.

- Allmand Bros. Inc. (Briggs and Stratton)

- Larson Electronics LLC

- Wanco Inc.

- Xylem Inc. (Seltorque)

- J C Bamford Excavators Ltd.

- United Rentals Inc.

- BMI Group (Genergy)

- Lind Equipment Ltd.

- Colorado Standby

- Youngman Richardson and Co. Ltd.

- Westquip Diesel Sales Ltd.

- Inmesol Gensets SL

- Atlas Luminaires Inc.

- The Will-Burt Company

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Booming 24x7 Infrastructure-Repair Programs in North America

- 4.2.2 Rapid Shift Toward LED Retrofit in Rental Fleets across Europe

- 4.2.3 Rising Deployment of Solar-Hybrid Towers at Remote Oil and Gas Pads in MENA

- 4.2.4 Stringent Tier-4 and Stage V Emission Norms Fueling Hybrid-Powered Adoption

- 4.2.5 Mega-Mining Projects in Australia Accelerating High-Mast (Above 60 ft) Demand

- 4.2.6 Disaster-Relief Funding Surge Driving Mobile Towers in ASEAN

- 4.3 Market Restraints

- 4.3.1 High Initial CAPEX for Hydrogen-Fuel Towers

- 4.3.2 Operational Downtime Due to Battery-Drain in Cold Nordic Climates

- 4.3.3 Volatile Diesel Prices Distorting Rental Pricing Models

- 4.3.4 Complex Permitting for Temporary Lighting in EU Urban Zones

- 4.4 Industry Ecosystem Analysis

- 4.5 Technological Outlook

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Bargaining Power of Suppliers

- 4.6.2 Bargaining Power of Consumers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUES)

- 5.1 By Type

- 5.1.1 LED Light Towers

- 5.1.2 Metal-Halide Light Towers

- 5.2 By Power Source

- 5.2.1 Diesel Powered

- 5.2.2 Solar-Hybrid Powered

- 5.2.3 Hydrogen Fuel-Cell Powered

- 5.2.4 Direct Grid/Battery Powered

- 5.3 By Mast Height

- 5.3.1 Below 30 ft

- 5.3.2 30 - 60 ft

- 5.3.3 Above 60 ft

- 5.4 By Mobility

- 5.4.1 Mobile/Trailer-Mounted

- 5.4.2 Skid/Fix-Mounted

- 5.5 By Ownership Model

- 5.5.1 Rental/Leased

- 5.5.2 Direct Purchase

- 5.6 By End-user Industry

- 5.6.1 Construction

- 5.6.2 Oil and Gas

- 5.6.3 Mining

- 5.6.4 Industrial and Manufacturing

- 5.6.5 Infrastructure (Road, Rail, Airport, Ports)

- 5.6.6 Events, Sports and Entertainment

- 5.6.7 Military, Emergency and Disaster Relief

- 5.7 By Geography

- 5.7.1 North America

- 5.7.1.1 United States

- 5.7.1.2 Canada

- 5.7.1.3 Mexico

- 5.7.2 Europe

- 5.7.2.1 Germany

- 5.7.2.2 United Kingdom

- 5.7.2.3 France

- 5.7.2.4 Italy

- 5.7.2.5 Spain

- 5.7.2.6 Nordics (Denmark, Sweden, Norway, Finland)

- 5.7.2.7 Rest of Europe

- 5.7.3 Asia-Pacific

- 5.7.3.1 China

- 5.7.3.2 Japan

- 5.7.3.3 South Korea

- 5.7.3.4 India

- 5.7.3.5 Southeast Asia

- 5.7.3.6 Australia

- 5.7.3.7 Rest of Asia-Pacific

- 5.7.4 South America

- 5.7.4.1 Brazil

- 5.7.4.2 Argentina

- 5.7.4.3 Rest of South America

- 5.7.5 Middle East

- 5.7.5.1 Gulf Cooperation Council Countries

- 5.7.5.2 Turkey

- 5.7.5.3 Rest of Middle East

- 5.7.6 Africa

- 5.7.6.1 South Africa

- 5.7.6.2 Nigeria

- 5.7.6.3 Rest of Africa

- 5.7.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles {(includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)}

- 6.4.1 Atlas Copco AB

- 6.4.2 Generac Power Systems Inc. (Generac Mobile)

- 6.4.3 Terex Corp.

- 6.4.4 Doosan Portable Power

- 6.4.5 Wacker Neuson SE

- 6.4.6 Trime S.r.l.

- 6.4.7 Allmand Bros. Inc. (Briggs and Stratton)

- 6.4.8 Larson Electronics LLC

- 6.4.9 Wanco Inc.

- 6.4.10 Xylem Inc. (Seltorque)

- 6.4.11 J C Bamford Excavators Ltd.

- 6.4.12 United Rentals Inc.

- 6.4.13 BMI Group (Genergy)

- 6.4.14 Lind Equipment Ltd.

- 6.4.15 Colorado Standby

- 6.4.16 Youngman Richardson and Co. Ltd.

- 6.4.17 Westquip Diesel Sales Ltd.

- 6.4.18 Inmesol Gensets SL

- 6.4.19 Atlas Luminaires Inc.

- 6.4.20 The Will-Burt Company

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment