PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1850970

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1850970

Satellite Antenna - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

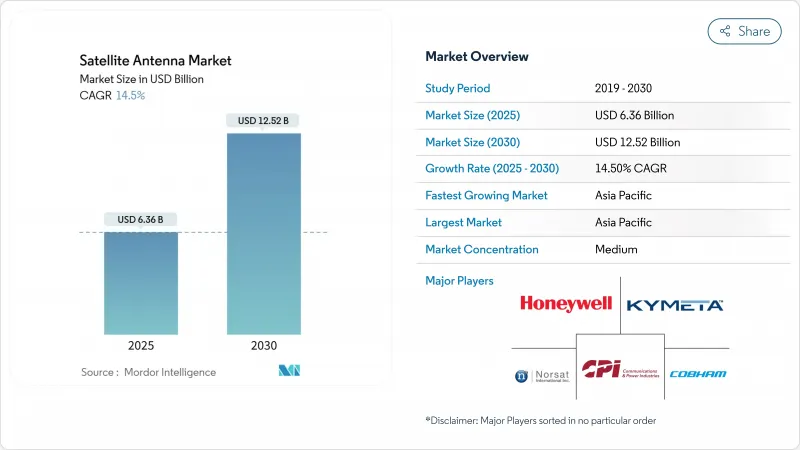

The satellite antenna market size stands at USD 6.36 billion in 2025 and is projected to reach USD 12.52 billion by 2030, reflecting a robust 14.5% CAGR.

Strong demand for high-throughput connectivity, the roll-out of multi-orbit constellations, and falling antenna production costs are accelerating adoption across commercial and defense domains. Software-defined beam steering, lighter composites, and highly integrated chipsets are improving performance while lowering lifetime ownership costs for operators. Growth is also being reinforced by strategic mergers that broaden product portfolios and by governments treating space infrastructure as a pillar of digital sovereignty. These converging factors keep the satellite antenna market on a double-digit growth path even as suppliers navigate regulatory and orbital-debris complexities.

Global Satellite Antenna Market Trends and Insights

Proliferation of LEO broadband constellations

Low Earth Orbit projects such as Starlink and OneWeb are rewriting link-budget assumptions, pushing operators to deploy electronically steered arrays that can track dozens of fast-moving satellites per minute. In September 2024, 411 constellations were registered, yet only 5% were fully launched, leaving extensive runway for antenna suppliers. Compact phased arrays now include integrated GNSS receivers and edge computing, letting terminals auto-switch beams across LEO, MEO, and GEO layers. Remote communities, maritime routes, and disaster-response teams are early beneficiaries. Because phased arrays eliminate mechanical parts, lifetime maintenance costs fall, reinforcing the economic case for large-scale roll-outs. Vendors able to mass-produce dual-orbit terminals at consumer-electronics price points will capture outsized value as the satellite antenna market broadens to handset-like volumes.

Rapid militarization of space (MilSATCOM)

Defense authorities see assured, jam-resistant links as mission-critical. The U.S. FY 2025 budget allocates USD 25.2 billion to space-based systems, triggering procurement of multi-band, directive antennas that operate in contested electromagnetic environments. Battle-proven requirements include side-lobe suppression, anti-spoofing, and dynamic beam hopping to mitigate interference. Parallel programs in Europe and Asia-Pacific further widen demand. Militaries also push for lighter terminals to fit small UAVs and dismounted soldiers, encouraging breakthroughs in GaN power amplifiers and conformal composites. Over the long term, secure optical cross-links will complement RF, but near-term spending remains anchored in advanced phased-array RF architectures, sustaining momentum for the satellite antenna market.

Ku/Ka-band rain fade in equatorial regions

Heavy rainfall events attenuate Ku and Ka signals by up to 20 dB, forcing operators to oversize link margins or revert to lower frequencies. Tropical micro-bursts in Indonesia and Brazil create unpredictable fades that undermine SLAs for enterprise and backhaul customers. Mitigation tactics include adaptive coding, site diversity, and dual-band terminals that fall back to C band during storms, yet these solutions raise capex and opex for service providers. Future climate variability adds uncertainty, making some telcos reluctant to commit to Ka-centric networks despite their capacity advantages. Consequently, adoption curves in equatorial belts may lag the global satellite antenna market trend.

Other drivers and restraints analyzed in the detailed report include:

- High-throughput satellite (HTS) payload adoption

- Commercial in-flight connectivity (IFC) boom

- Export-control bottlenecks on phased-array chipsets

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Ku Band accounted for 29% of the satellite antenna market in 2024, capitalizing on mature ground infrastructure and balanced rain-fade resilience. The segment continues to anchor broadcast and VSAT services, especially where regulatory clearances already exist. In contrast, Ka Band is scaling rapidly at a 15.2% CAGR, attracting broadband operators that seek lower cost per bit and flexible spot-beam architectures. This growth trajectory translates to an expanding satellite antenna market size for Ka terminals, underpinned by NASA's requirement to route 26 Tb/day on its upcoming Earth-observation constellation. C Band maintains relevance in cyclone-prone zones, while X Band remains a defense niche thanks to interference immunity. Emerging multi-band antennas blur traditional silos, permitting real-time frequency switching, a capability that uplifts overall system availability and widens supplier addressable revenue streams within the satellite antenna market.

Multi-beam flat-panel designs now facilitate simultaneous Ku and Ka connectivity, enabling operators to reverse traffic when rain fade hits. Suppliers integrating programmable RF front-ends can dynamically allocate power where needed, lifting spectral efficiency. These advances transform value propositions for mobile VSAT, cruise, and oil-and-gas platforms. As such, the satellite antenna market size for high-frequency terminals is forecast to double by 2030, though suppliers must embed weather-adaptive intelligence to unlock full demand across tropical geographies.

Parabolic reflectors held 38% share of the satellite antenna market size in 2024, favored for static gateways that prize high gain per dollar. Mechanical gimbals remain cost-effective for large cruise ships and teleport hubs. Yet flat-panel electronically steered arrays, expanding at an 18.4% CAGR, are redefining mobility use cases. Anokiwave-powered panels are now factory-calibrated, slashing installation time and supporting conformal fuselage mounting on narrow-body aircraft. Inflatable dishes under prototyping promise 20:1 packing efficiency, catering to launch-mass-sensitive small satellites.

Hybrid architectures blend small parabolic segments with phase-shifter sub-arrays, extracting the high-gain benefits of dishes and the agility of ESAs. Vendors exploring flexible dielectric materials can bend antennas around vehicle roofs, erasing aerodynamic drag penalties. Consequently, the addressable satellite antenna market widens to include personal vehicles, trains, and urban drone taxis, all of which require ultra-low-profile terminals. Reflector incumbents respond by embedding auto-pointing and health-monitoring firmware to protect installed bases, signaling a coexistence rather than outright displacement scenario through 2030.

The Satellite Antenna Market Report is Segmented by Frequency Band (C Band, X Band, Ku Band, and More), Antenna Type (Parabolic Reflector, Horn, FRP-Radome, and More), Application (Spaceborne, Airborne, and More), End-User (Commercial and Government and Defense), and Geography.

Geography Analysis

Asia Pacific records the quickest expansion, charting a 14.6% CAGR to 2030 as China, India, Japan, and South Korea scale multi-orbit systems and indigenous manufacturing. China's fifth Antarctic outpost, opened in February 2024, showcases dual-use satellite dishes that serve science and defense agendas. India's production-linked incentives, aligned with its "Make in India" drive, catalyze local fabrication of feed horns, radomes, and RFIC subsystems, lowering costs for regional operators. Japan's auto sector readies connected-car services using non-terrestrial backhaul, prompting suppliers to miniaturize antennas for rooftop integration.

North America remains the largest satellite antenna market thanks to deep aerospace supply chains, heavy defense spending, and entrepreneurial space ventures. The U.S. Space Force maintains the Satellite Control Network, operating 19 dishes at 75% utilization, with plans for 12 new high-capacity antennas starting 2025. Canada's Polar communications programs add demand for low-temperature-tolerant antennas. Mexico and other Latin peers leverage GEO gateways for internet-community Wi-Fi, although capex pressures curb near-term scale.

Europe holds robust share, reinforced by ESA technology demonstrators such as the shaped mesh reflector from the AMPER project that supports military and climate-monitoring missions. Germany and the UK fund sovereign teleports to secure data autonomy, while mobile network operators test backhaul-over-satellite in rural Scotland and Bavaria. Eastern European telcos adopt lease-to-own models to overcome currency volatility, a tactic that smooths order pipelines for antenna suppliers. The Middle East, buoyed by GCC sovereign wealth funds, backs GEO VHTS projects, and Saudi Arabia's roadmap foresees a trebling of national space revenues by 2030. South America trails but shows pockets of growth in Brazil, where oil-and-gas offshore connectivity mandates dual-redundant antennas. Collectively, these dynamics keep regional demand diversified within the satellite antenna market, insulating global revenue from macro shocks.

- Honeywell International Inc.

- CPI International Inc.

- Kymeta Corp.

- Norsat International Inc.

- Cobham SATCOM

- L3Harris Technologies Inc.

- Viasat Inc.

- Airbus Defence and Space

- Gilat Satellite Networks Ltd.

- Maxar Technologies

- Ball Aerospace

- Intellian Technologies

- Isotropic Systems (All.Space)

- Hanwha Phasor

- SES S.A. (O3b mPOWER User Terminals)

- Thales Alenia Space

- MT Mechatronics

- SatixFy Ltd.

- General Dynamics Mission Systems

- LEOcloud Inc.

- Hughes Network Systems

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Proliferation of LEO broadband constellations

- 4.2.2 Rapid militarization of space (MilSATCOM)

- 4.2.3 High?throughput satellite (HTS) payload adoption

- 4.2.4 Commercial in-flight connectivity (IFC) boom

- 4.2.5 ESA-based flat-panel cost curve deflation (UNDER-RADAR)

- 4.2.6 Lunar and cislunar mission communications demand (UNDER-RADAR)

- 4.3 Market Restraints

- 4.3.1 Ku-/Ka-band rain fade in equatorial regions

- 4.3.2 Export-control bottlenecks on phased-array chipsets

- 4.3.3 Mounting orbital-debris insurance premiums (UNDER-RADAR)

- 4.3.4 CAPEX crunch at emerging-market telcos (UNDER-RADAR)

- 4.4 Value Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Suppliers

- 4.7.3 Bargaining Power of Buyers

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Frequency Band

- 5.1.1 C Band

- 5.1.2 X Band

- 5.1.3 Ku Band

- 5.1.4 Ka Band

- 5.1.5 L/S Band

- 5.1.6 VHF/UHF Band

- 5.2 By Antenna Type

- 5.2.1 Parabolic Reflector

- 5.2.2 Flat-Panel (ESA/RSA)

- 5.2.3 Horn

- 5.2.4 Dielectric-Resonator

- 5.2.5 FRP-Radome

- 5.2.6 Metal-Stamp

- 5.3 By Application

- 5.3.1 Spaceborne

- 5.3.2 Airborne

- 5.3.3 Maritime

- 5.3.4 Land (Mobile and Fixed)

- 5.4 By End-User

- 5.4.1 Commercial

- 5.4.2 Government and Defense

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Argentina

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 France

- 5.5.3.4 Russia

- 5.5.3.5 Rest of Europe

- 5.5.4 APAC

- 5.5.4.1 China

- 5.5.4.2 Japan

- 5.5.4.3 India

- 5.5.4.4 South Korea

- 5.5.4.5 Rest of APAC

- 5.5.5 Middle East and Africa

- 5.5.5.1 GCC Countries

- 5.5.5.2 Turkey

- 5.5.5.3 South Africa

- 5.5.5.4 Rest of MEA

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Overview, Core Segments, Financials, Strategy, Market Rank)

- 6.4.1 Honeywell International Inc.

- 6.4.2 CPI International Inc.

- 6.4.3 Kymeta Corp.

- 6.4.4 Norsat International Inc.

- 6.4.5 Cobham SATCOM

- 6.4.6 L3Harris Technologies Inc.

- 6.4.7 Viasat Inc.

- 6.4.8 Airbus Defence and Space

- 6.4.9 Gilat Satellite Networks Ltd.

- 6.4.10 Maxar Technologies

- 6.4.11 Ball Aerospace

- 6.4.12 Intellian Technologies

- 6.4.13 Isotropic Systems (All.Space)

- 6.4.14 Hanwha Phasor

- 6.4.15 SES S.A. (O3b mPOWER User Terminals)

- 6.4.16 Thales Alenia Space

- 6.4.17 MT Mechatronics

- 6.4.18 SatixFy Ltd.

- 6.4.19 General Dynamics Mission Systems

- 6.4.20 LEOcloud Inc.

- 6.4.21 Hughes Network Systems

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment