PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1850983

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1850983

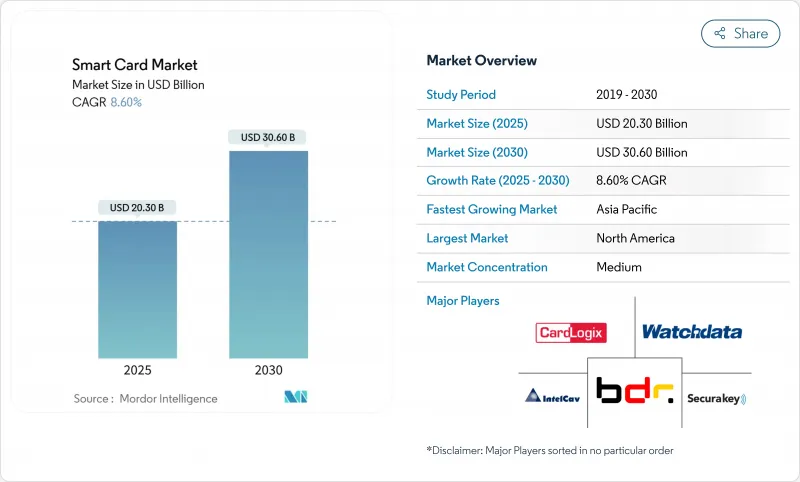

Smart Card - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The smart card market size stands at USD 20.3 billion in 2025 and is projected to reach USD 30.6 billion by 2030, advancing at an 8.6% CAGR through the forecast period.

Consistent migration to EMV, expanding national digital-identity programs, and rising demand for multi-application credentials continue to anchor growth. Contactless technology is now mainstream in retail payments, while dual-interface cards offer an incremental upgrade path for issuers that still maintain legacy contact-only estates. Secure elements on cards are witnessing rapid uptake as governments and enterprises converge physical and digital identity, a trend that creates adjacent opportunities in cybersecurity services. Regionally, Asia commands the largest installed base, yet the deepest expansion runway lies in Africa, where mobile-first payment ecosystems unlock card issuance at previously untapped customer tiers. Competitive intensity is moderate; tier-one manufacturers are consolidating share through sustainability-linked products and biometric innovations that create differentiation beyond price.

Global Smart Card Market Trends and Insights

Contactless EMV Migration in Emerging Asian Economies

Roll-out momentum accelerated in 2024 as Bangladesh and Nepal commissioned local EMV Level 3 test labs that shorten certification cycles and cut issuer costs. China saw a 37% annual rise in contactless transactions, while India logged 42% growth in issuance, figures that reflect the mainstreaming of tap-to-pay and underscore the addressable base for terminal upgrades. Banks frame contactless issuance as a retention lever in overcrowded retail markets, and merchants benefit from faster checkout speeds that lift throughput. With EMV-enabled cards already accounting for 70% of global issuance, Asian issuers are positioned to leapfrog directly to dual-interface portfolios. Near-term sales growth, therefore, skews toward secure microcontroller cards able to support value-added services such as transit ticketing and small-value offline payments.

EU & GCC National eID and Digital Health Card Roll-outs

Implementation of the EU Digital Identity Regulation in May 2024 obliges member states to provide physical and mobile credentials in parallel, sustaining demand for high-security polycarbonate cards. GCC countries follow a similar path as they modernize healthcare delivery and border-control frameworks. Polycarbonate inlays such as CoreLam are now deployed in 20+ national programs. Manufacturers gain from multi-year supply contracts that favor vertically integrated players capable of personalisation, key management, and secure applet loading. Because wallet adoption will take time, physical eID issuance remains a mandatory fallback, locking in baseline unit volumes during the transition period.

Rise of Tokenised Virtual Cards Reducing Physical Demand

Virtual card transactions are forecast to quadruple to more than 121 billion by 2027, while Mastercard targets 100% e-commerce tokenisation in Europe by 2030. The shift diverts issuer budgets toward digital engagements and shrinks replacement cycles for low-value debit portfolios. Physical cards remain essential for face-to-face acceptance and offline fallback, yet the share of wallet could tilt toward virtual instruments in mature markets, dampening unit growth.

Other drivers and restraints analyzed in the detailed report include:

- Pre-paid SIM Expansion Driving Secure Elements in Latin America

- EU eIDAS-2.0 digital wallet regulation adoption

- Secure MCU Supply-chain Volatility

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Contactless cards accounted for 54% of the smart card market size in 2024, reaffirming their status as the de facto form factor for everyday payments. Dual-interface issuance is rising at an 8.7% CAGR as issuers seek backward compatibility with legacy contact-only terminals without compromising tap-to-pay functionality. Innovations such as the EMV C-8 universal kernel reduce terminal certification complexity and catalyse acceptance expansion. In parallel, chipset improvements from Infineon shorten transaction time, improving user experience in high-throughput retail environments.

Issuer appetite for contact-only cards persists in government and defence, where a physical interface adds a security layer against relay attacks. Hybrid cards, embedding multiple technologies on a single substrate, satisfy niche enterprise requirements for logical and physical access convergence. The competitive narrative, therefore, shifts from mere interface type to value-added capabilities such as biometric match-on-card and post-issuance personalisation, themes that enable vendors to defend margins in the smart card market.

Microcontroller cards captured 62% of the smart card market share in 2024, reflecting their versatility across payments, telecom, and identity use cases. Secure element cards, however, are expanding at a 10.2% CAGR thanks to heightened cryptographic requirements in eID and digital-wallet ecosystems. The SECORA Pay Bio turnkey platform exemplifies how sensor integration and secure elements can be bundled to compress the bill-of-materials and time-to-market.

Memory-only cards remain relevant for mass transit and prepaid gift applications where cost sensitivity outweighs processing needs. Ultra-thin modules such as NXP's MOB10 unlock new passport applications by improving durability against bending stress. Overall, the product-mix shift toward secure elements benefits semiconductor suppliers with certified Common Criteria product lines, sustaining a technology-led competitive moat within the smart card market.

Smart Card Market Report is Segmented by Interface Type (Contact, Contact-Based, and More), Card Chip Type (Memory, Microcontroller, and More), Material (PVC, Polycarbonate, and More), Application (Payment and Banking, and More), End-User Vertical (BFSI, IT and Telecommunication, and More), and by Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia led the smart card market with 44% revenue share in 2024, anchored by rapid EMV penetration and national ID issuances. Contactless transactions in China rose 37% year-on-year despite coexistence with QR payment ecosystems. India logged 42% growth in contactless card issuance, though rural infrastructure gaps temper full-scale adoption. Japan, responding to a 30% spike in credit-card fraud, is piloting biometric payment cards and expects contactless payment value to reach USD 870 billion by 2028.

Europe holds second place by value. The eIDAS-2.0 mandate drives both physical and digital identity demand, while Nordic enterprises pioneer FIDO2 hardware keys. GDPR-linked complexity delays multi-country issuance platforms, nudging issuers toward domestically hosted personalization centres. Mastercard's commitment to full tokenisation by 2030 signals a gradual pivot to digital credentials, yet physical cards remain obligatory for offline verification and multi-channel access.

Africa is the fastest-growing region at a 9.3% CAGR. Mobile-money services processed transactions worth USD 1.68 trillion in 2024, catalysing demand for companion debit cards. South-African card payments will surpass USD 158 billion in 2025, while Egypt targets USD 104 billion in digital payments by 2030. Strategic alliances, such as Orange MEA and Mastercard, aim to digitize payments for 40 million users by 2025. North America emphasizes digital-fraud mitigation, South America benefits from SIM expansion, and Australia prioritizes tokenisation under its 2025-2028 security roadmap, visa.com.au.

- Thales Group (Gemalto)

- IDEMIA

- Giesecke and Devrient GmbH

- Infineon Technologies AG

- HID Global (Assa Abloy AB)

- NXP Semiconductors N.V.

- CPI Card Group Inc.

- Watchdata Technologies

- Bundesdruckerei GmbH

- Fingerprint Cards AB

- Samsung Electronics Co., Ltd.

- KONA I Co., Ltd.

- CardLogix Corporation

- IntelCav

- Secura Key

- Alioth LLC

- Eastcompeace Technology Co., Ltd.

- American Banknote Corporation (ABCorp)

- Paragon ID (ASK)

- Shenzhen Hengbao Co., Ltd.

- VALID S.A.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Contactless EMV Migration in Emerging Asian Economies

- 4.2.2 EU and GCC National eID and Digital Health Card Roll-outs

- 4.2.3 Pre-paid SIM Expansion Driving Secure Elements in LATAM

- 4.2.4 EU eIDAS-2.0 Digital Wallet Regulation Adoption

- 4.2.5 Sustainability-Driven Shift to Recycled and Bio-Plastic Cards

- 4.2.6 Biometric FIDO2 On-card Authentication Uptake in Nordics

- 4.3 Market Restraints

- 4.3.1 Rise of Tokenised Virtual Cards Reducing Physical Demand

- 4.3.2 Secure MCU Supply-Chain Volatility

- 4.3.3 GDPR-Driven Delays in Cross-border Issuance Platforms

- 4.3.4 Fraud Migration to CNP Channels Curtailing NA Card Upgrades

- 4.4 Supply Chain Analysis

- 4.5 Regulatory and Technological Outlook

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Bargaining Power of Suppliers

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitutes

- 4.6.5 Intensity of Competitive Rivalry

- 4.7 Vendor Positioning Analysis

- 4.8 Investment Analysis

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Interface Type

- 5.1.1 Contact

- 5.1.2 Contactless

- 5.1.3 Dual Interface

- 5.1.4 Hybrid

- 5.2 By Card Chip Type

- 5.2.1 Memory

- 5.2.2 Microcontroller

- 5.2.3 Secure Element/System-on-Card

- 5.3 By Material

- 5.3.1 PVC

- 5.3.2 Polycarbonate (PC)

- 5.3.3 ABS

- 5.3.4 PETG and Bio-based Plastics

- 5.3.5 Metal and Composite

- 5.4 By Function/Application

- 5.4.1 Payment and Banking

- 5.4.2 Identification and eID

- 5.4.3 Access Control and Physical Security

- 5.4.4 Telecom and SIM

- 5.4.5 Transportation Ticketing

- 5.4.6 Healthcare and Insurance

- 5.4.7 Retail and Loyalty

- 5.5 By End-user Industry

- 5.5.1 BFSI

- 5.5.2 IT and Telecommunications

- 5.5.3 Government and Public Sector

- 5.5.4 Transportation and Logistics

- 5.5.5 Healthcare

- 5.5.6 Retail and Hospitality

- 5.5.7 Education and Others

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Mexico

- 5.6.2 Europe

- 5.6.2.1 United Kingdom

- 5.6.2.2 Germany

- 5.6.2.3 France

- 5.6.2.4 Italy

- 5.6.2.5 Rest of Europe

- 5.6.3 Asia-Pacific

- 5.6.3.1 China

- 5.6.3.2 India

- 5.6.3.3 Japan

- 5.6.3.4 South Korea

- 5.6.3.5 Rest of Asia-Pacific

- 5.6.4 South America

- 5.6.4.1 Brazil

- 5.6.4.2 Argentina

- 5.6.4.3 Rest of South America

- 5.6.5 Middle East

- 5.6.5.1 GCC

- 5.6.5.2 Turkey

- 5.6.5.3 Rest of Middle East

- 5.6.6 Africa

- 5.6.6.1 South Africa

- 5.6.6.2 Nigeria

- 5.6.6.3 Kenya

- 5.6.6.4 Rest of Africa

- 5.6.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Vendor Positioning Analysis

- 6.5 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.5.1 Thales Group (Gemalto)

- 6.5.2 IDEMIA

- 6.5.3 Giesecke and Devrient GmbH

- 6.5.4 Infineon Technologies AG

- 6.5.5 HID Global (Assa Abloy AB)

- 6.5.6 NXP Semiconductors N.V.

- 6.5.7 CPI Card Group Inc.

- 6.5.8 Watchdata Technologies

- 6.5.9 Bundesdruckerei GmbH

- 6.5.10 Fingerprint Cards AB

- 6.5.11 Samsung Electronics Co., Ltd.

- 6.5.12 KONA I Co., Ltd.

- 6.5.13 CardLogix Corporation

- 6.5.14 IntelCav

- 6.5.15 Secura Key

- 6.5.16 Alioth LLC

- 6.5.17 Eastcompeace Technology Co., Ltd.

- 6.5.18 American Banknote Corporation (ABCorp)

- 6.5.19 Paragon ID (ASK)

- 6.5.20 Shenzhen Hengbao Co., Ltd.

- 6.5.21 VALID S.A.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment